USD/JPY recovers amid improving US consumer sentiment but easing inflation caps gains

- USD/JPY recovered some ground but remained in danger of losing its early gains due to the slowing pace of inflation in the United States.

- The pair saw a brief uplift as a report from the University of Michigan indicated improved Consumer Sentiment, posting a two-year high.

- Rising household inflation expectations and speculation on adjustments to Yield Curve Control put pressure on the Bank of Japan.

USD/JPY recovers some ground but remains at the brisk of erasing most of its earlier gains after data from the United States (US) continued to show inflation is decelerating. At the same time, an improvement in US consumer sentiment lifted the pair towards its daily high of 139.15 before reversing its curse. The USD/JPY is trading at 138.47 after hitting a daily low of 137.21, up 0.31%.

USD/JPY trims losses on upbeat US data but inflation data on the US warrants less Fed tightening needed

The USD/JPY jumped during the latest hour after a report from the University of Michigan (UoM) saw an improvement in Consumer Sentiment, which was expected to print 65.5 but came at 72.6m at a two-year high. Joanne Jsu, the UoM Surveys of Consumers Director, said, “The sharp rise in sentiment was largely attributable to the continued slowdown in inflation along with stability in labor markets.” Additional data showed that inflation expectations for one year were upward revised to 3.4% from 3.3% in June, while for a five-year period, they were 3.1%, up from 3%.

Other data the US Department of Labor revealed showed US Import and Export prices slowed down, falling below the estimates in annual and yearly figures for June. The report aligned with the recent inflation data on the consumer and producer side, with numbers justifying the case for the US Federal Reserve (Fed) to keep rates unchanged if they want to, as prices are accelerating towards the Fed’s 2% goal. Nevertheless, Fed policymakers stressed that the battle against inflation has not been won, suggesting further tightening is needed.

US Treasury bond yields are recovering some ground, as the 10-year Treasury note rate sits at 3.793%, up two basis points, a tailwind for the greenback. The US Dollar Index, a measure of the dollar’s performance against a basket of peers, stopped its drop at 99.809, gaining 0.03%.

On the Japanese front, a Bank of Japan (BoJ) survey showed that households’ inflation expectations had risen, keeping the BoJ pressured. Also, expectations of the BoJ tweaking its Yield Curve Control (YCC) have been the main driver behind the Japanese Yen (JPY) strong week against most G8 FX currencies.

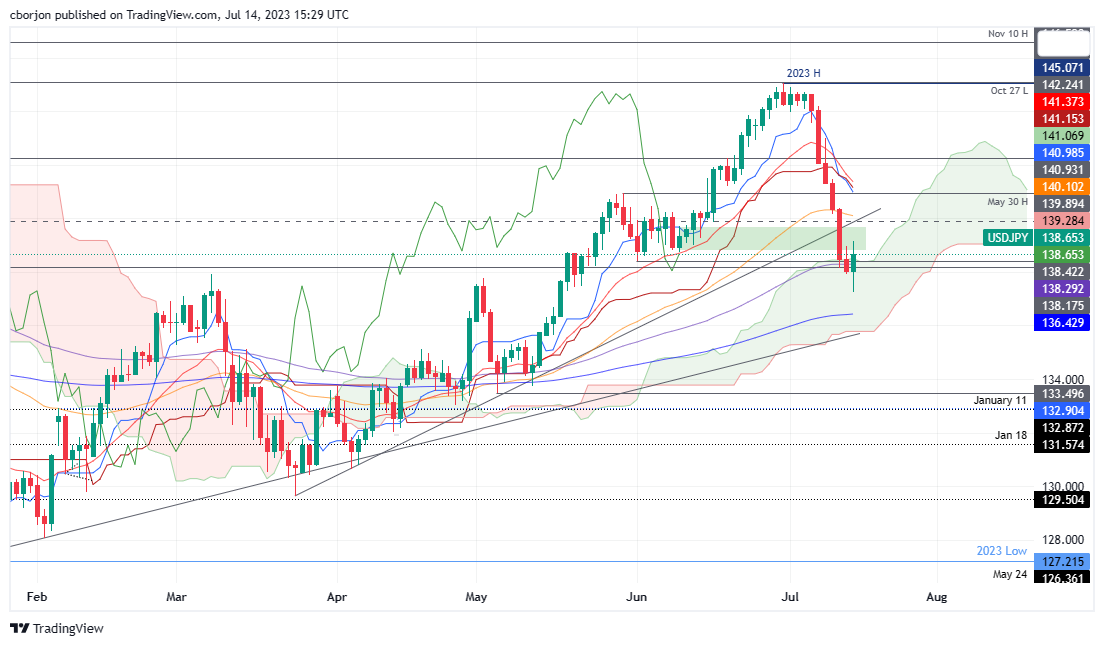

USD/JPY Price Analysis: Technical outlook

As of writing, the USD/JPY is struggling to decisively break the top of the Ichimoku Cloud (Kumo), which could pave the way for consolidation. USD/JPY’s sellers are eyeing the bottom of the Kumo at around 135.80/90, but the 200-day Exponential Moving Average (EMA) at 136.43 is expected to cushion the USD/JPY fall. On the upside, if USD/JPY buyers lift the pair past the top of the Kumo at around 138.50/60, it would exacerbate a challenge of the 139.00 psychological level.