Gold Price Analysis: XAU/USD could be on the retreat into the Fed next week

- Gold price is on the back foot as we head into key US events.

- Gold price is below the counter trendline and the prior day’s closing price.

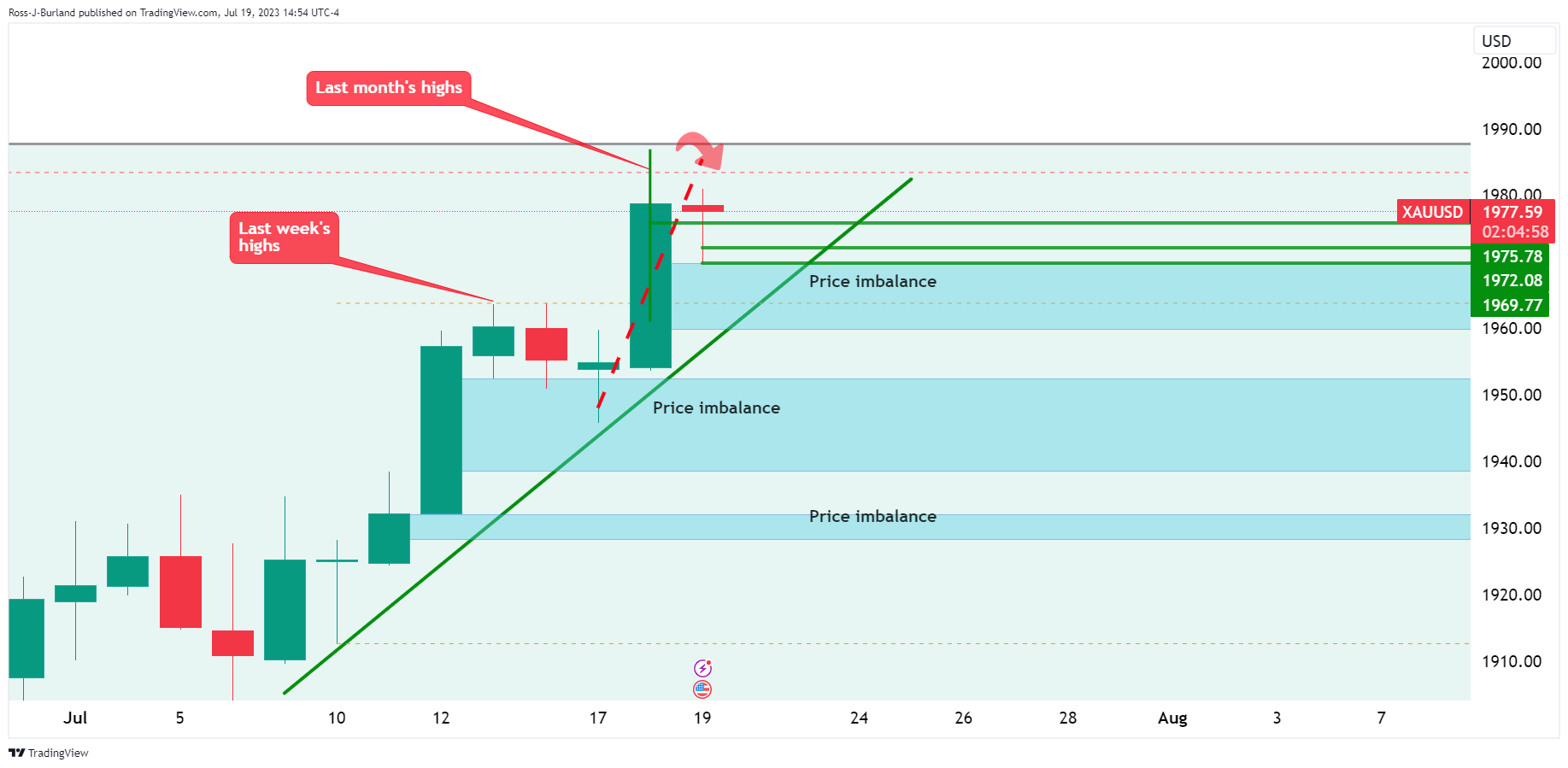

The Gold price has started to show signs of deceleration on the bid as we head towards the Federal Reserve meeting next week and ahead of US JOLTS. At the time of writing, Gold price is trading at $1,978.05 and has been stuck between a range of $1,969.77 and $1,980.89 on the day.

Data is crucial at this juncture and on Tuesday, Retail Sales re-ignited hopes that the US Federal Reserve may soon hit pause on its interest rate hiking cycle. As said, traders will also keep a tab on weekly jobless claims data due on Thursday. Employment growth has slowed modestly even as initial claims have increased. ”Overall, the labor market remains fairly strong and JOLTS job openings near 10 mln suggest firms are still having difficulty finding workers,” analysts at Brown Brothers Harriman argued.

Ahead of the data and the Federal Reserve next week, the US Dollar climbed, making Gold prices more expensive for international buyers, with the DXY index last seen up 0.35 points to 100.27. Treasury yields have also narrowed, bullish for the Gold price since it offers no interest. The US two-year note was last seen paying 4.751%, down 1.3 basis points, while the yield on the 10-year note was down 4.3 basis points to 3.747%.

Investors could modestly add to upside flow north of $1,985 should jobs data continue to show weakness. Technically, the Gold price is lower and headed towards daily trendline support and last week’s highs in a long squeeze:

Gold price technical analysis

Those daily charts are showing the Gold price in deceleration and we wait to see if we get a bearish close for the day.

The 4-hour chart is showing the bulls putting up a fight.

The 15-min chart shows that the bears are in control given the break of structure and staying below the prior day’s closing price. However, there will be stops above and this could be food for the next move lower. For the time being, were are still front side of the bearish and counter-trendlines.