Yen Plunges Amidst BoJ’s Speculations; Fresh Selling Seen in Sterling – Action Forex

Japanese Yen experienced a sharp fall today after reports emerged suggesting that BoJ is “leaning towards” maintaining its current yield curve control policy unchanged in the upcoming meeting next week. The development has come in the wake of Japanese inflation data for June, which showed a relatively unchanged yet high level. Notably, 10-year JGB yield is presently trading comfortably below 0.5%, eliminating any necessity even to adjust the yield cap. This has intensified the pressure on Yen, leading to a significant downward shift.

Meanwhile, Canadian Dollar lost ground after release of weaker-than-expected retail sales data. Sterling, which exhibited relative stability earlier today, faced fresh selling pressure in early US session. Despite these developments, Australian Dollar and New Zealand Dollar are currently underperforming even more, edging out only the beleaguered Yen. On the other end of the spectrum, Swiss Franc currently occupies the strongest position for the day, followed by Dollar and the Euro.

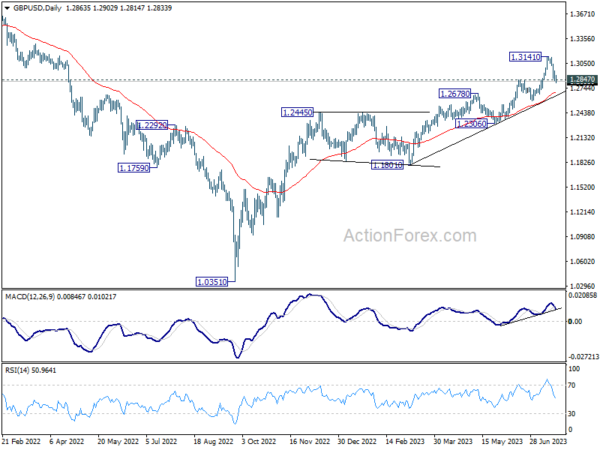

Technically, GBP/USD’s break of 1.2847 support argues that it’s already in correction to rise from 1.2306 at least. Deeper fall would be seen to 55 D EMA (now at 1.2692), or even below. Downside momentum in GBP/USD would be affected by whether EUR/GBP could power through 0.8717 support turned resistance to confirm bullish trend reversal.

In Europe, at the time of writing, FTSE is up 0.29%. DAX is down -0.33%. CAC is up 0.41%. Germany 10-year yield is down -0.0266 at 2.461. Earlier in Asia, Nikkei dropped -0.57%. Hong Kong HSI rose 0.78%. China Shanghai SSE dropped -0.06%. Singapore Strait Times rose 0.12%. Japan 10-year JGB yield rose 0.0063 to 0.466.

Canada retail sales rose 0.2% mom in May, missed expectations

Canada retail sales rose 0.2% mom to CAD 66.0B in May, below expectation of 0.5% mom. Sales increased in five of nine subsectors and were led by increases at motor vehicle and parts dealers (+0.8%) and food and beverage retailers (+1.0%).

Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were unchanged in May.

In volume terms, retail sales increased 0.1%.

UK retail sales volume rose 0.7% mom in Jun, sales value up 0.7% mom

UK retail sales volume rose 0.7% mom in June, well above expectation of 0.2% mom. Retail sales value also rose 0.7% mom. During the month, sales volumes increased across all the main sectors (food, non-food and non-store retailing) except automotive fuel.

Quarterly comparing with the three months to March, sales volume rose 0.4 in the three months to June. Sales value rose 1.7

Comparing with the same month a year ago, sales volume dropped -1.0% yoy. Sales value rose 4.3% yoy.

Japan CPI core ticked up to 3.3% yoy, CPI core-core edged down to 4.2% yoy

Japan’s Core CPI, which excludes food, matched expectations, ticked up from 3.2% yoy to 3.3% yoy in June. This marks the 15th month that the inflation reading has remained above BoJ’s 2% target.

Meanwhile, CPI core-core, which excludes both food and energy, dropped marginally from 4.3% yoy to 4.2% yoy, aligning with expectations. This slight decrease represents the index’s first slowdown since January 2022. Headline CPI edged higher from 3.2% yoy to 3.3% yoy, surpassing 3.2% yoy expectation.

Looking at some details, service prices slightly decelerated from 1.7% yoy to 1.6% yoy. Nevertheless, food prices remained robust, rising by 9.2% yoy. A significant increase was also observed in durable household goods, which rose by 6.7% yoy. Conversely, energy prices fell by -6.6% yoy.

These figures raises the probability of BoJ making an upward revision to its inflation outlook for the current fiscal year, with its two-day policy-setting meeting slated for next week. However, BOJ might still perceive the economy as being far from a virtuous cycle of higher wages, robust consumption, and further price hikes. As Governor Kazuo Ueda indicated earlier this week, if this assumption holds true, “our overall narrative on monetary policy remains unchanged.”

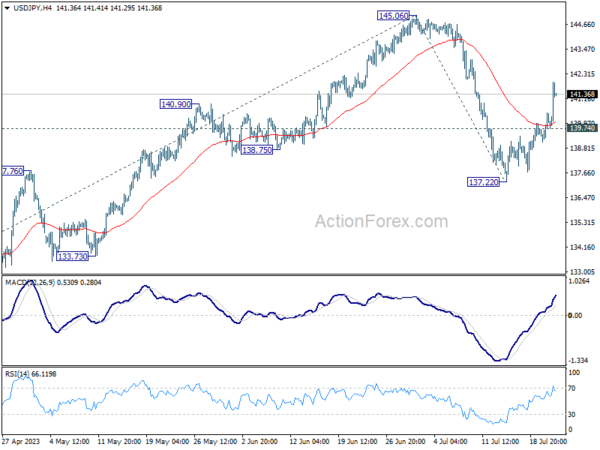

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 139.29; (P) 139.90; (R1) 140.67; More…

Intraday bias in USD/JPY stays on the upside at this point. Rise from 137.22 should extend to retest 145.05 high first. Firm break there will resume larger rise from 127.20 to 61.8% projection of 129.62 to 127.22 from 145.06 at 146.76 next. On the downside, below 139.74 minor support will bring retest of 137.22 instead.

In the bigger picture, overall price actions from 151.93 (2022 high) are views as a corrective pattern. Current development suggests that the second leg (the rise from 127.20) might not be over yet. But even in case of extended rise, strong resistance should be seen from 151.93 to limit upside. Meanwhile, break of 137.22 support should confirm the start of the third leg to 127.20 (2023 low) and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | GfK Consumer Confidence Jul | -30 | -26 | -24 | |

| 23:30 | JPY | National CPI Y/Y Jun | 3.30% | 3.20% | 3.20% | |

| 23:30 | JPY | National CPI Core Y/Y Jun | 3.30% | 3.30% | 3.20% | |

| 23:30 | JPY | National CPI Core-Core Y/Y Jun | 4.20% | 4.20% | 4.30% | |

| 06:00 | GBP | Retail Sales M/M Jun | 0.70% | 0.20% | 0.30% | 0.10% |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Jun | 17.7B | 20.7B | 19.2B | 15.8B |

| 12:30 | CAD | Retail Sales M/M May | 0.20% | 0.50% | 1.10% | 1.00% |

| 12:30 | CAD | Retail Sales ex Autos M/M May | 0.00% | 0.20% | 1.30% | 1.20% |

| 12:30 | CAD | New Housing Price Index M/M Jun | 0.10% | 0.00% | 0.10% |