Euro regains balance and challenges 1.0900

- Euro reverses part of the recent weakness against the US Dollar.

- Stocks in Europe maintain the upside pressure.

- EUR/USD bounces off multi-week lows near 1.0840.

- The USD Index (DXY) comes under pressure and revisits 103.20.

- Producer Prices in Germany surprised to the downside in July.

- Short-term Bills auctions will be the sole event across the pond on Monday.

The Euro (EUR) leaves behind part of the multi-day decline against the US Dollar (USD) on Monday, encouraging EUR/USD to pierce the key 1.0900 barrier and advance to two-day highs.

In the meantime, the Greenback extends the corrective knee-jerk after hitting new peaks in August near 103.70 on Friday. The Dollar’s weakness relegates the USD Index (DXY) to the 103.20 region despite the move higher in US yields early in the European trading hours.

Looking at the broader context of monetary policy, the discussion around the Federal Reserve’s stance of maintaining a tighter policy for an extended period seems to have been revived. This is in response to the resilience displayed by the US economy, despite some easing in the labour market and lower inflation readings in recent months.

Within the European Central Bank’s realm (ECB), internal disagreements among its Council members regarding the continuation of tightening measures after the summer period are causing renewed weakness for the Euro.

Moving forward, markets are expected to maintain a cautious approach in light of the Jackson Hole Symposium and Chairman Jerome Powell’s speech in the second half of the week.

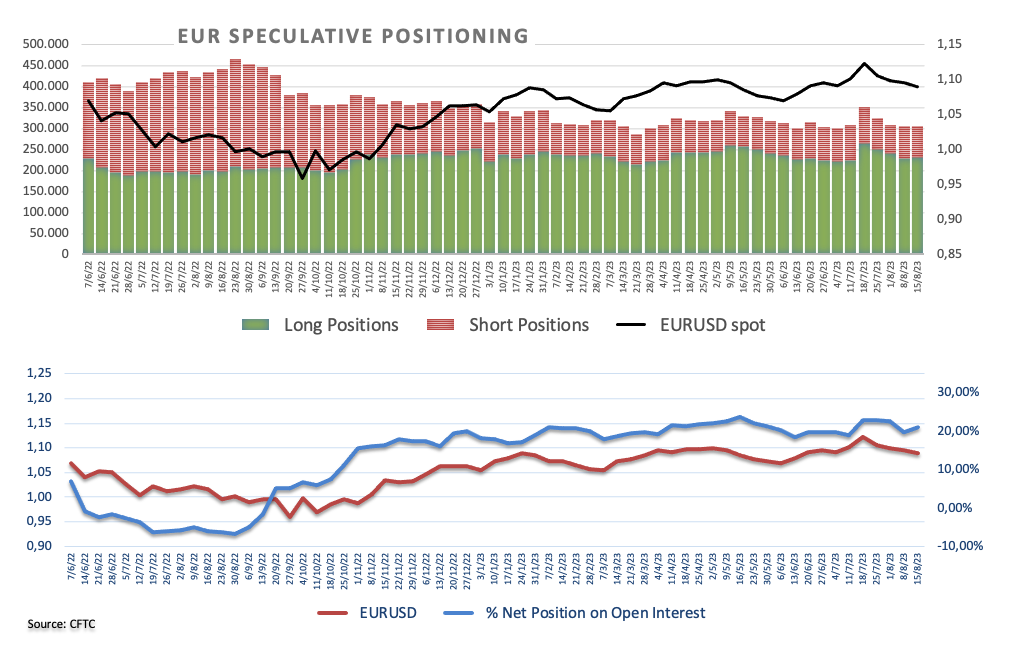

On another front, speculative net longs in the EUR climbed to two-week highs in the week ended August 15, according to the latest CFTC report.

Data-wise, Producer Prices in Germany contracted at a monthly 1.1% in July and 6.0% over the last twelve months. The period under scrutiny saw EUR/USD come under heavy pressure amidst the multi-week rally in the Greenback helped by stronger-than-expected results in the US docket.

Daily digest market movers: Euro picks up pace and trespasses 1.0900

- The EUR advances further north of 1.0900 against the USD.

- The PBoC reduced by 10 basis points the 1-Year Loan Prime Rate to 3.45%.

- Investors will closely follow the developments from the Jackson Hole event.

- US 10-year and 30-year yields resume the uptrend to multi-year highs.

- Fed’s tighter-for-longer narrative remains well in place.

- The Fed is likely to maintain rates at current levels until Q1 2024.

Technical Analysis: Euro now targets the 55-day SMA

EUR/USD manages to stage a decent rebound, with the immediate target at the 1.0900 barrier at the beginning of a new trading week. Despite the current bounce, the pair is still seen under pressure.

In case of further losses, EUR/USD could retest the August 18 low of 1.0844 ahead of the July 6 low of 1.0833. The breakdown of the latter exposes the significant 200-day SMA at 1.0792 ahead of the May 31 low of 1.0635. Deeper down, there are additional support levels at the March 15 low of 1.0516 and the 2023 low at 1.0481 seen on January 6.

Occasional bullish attempts, in the meantime, are expected to meet initial hurdle at the August 10 high at 1.1064 prior to the 1.1149 from July 27. If the pair clears the latter, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 registered on July 18. Once this region is surpassed, significant resistance levels become less prominent until the 2022 high at 1.1495, which is closely followed by the round level of 1.1500.

Furthermore, the positive outlook for EUR/USD remains valid as long as it remains above the important 200-day SMA.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region.

The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro.

QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.