EUR/JPY Price Analysis: Struggles at Tenkan-Sen and 158.00, as bears remain in charge

- EUR/JPY trades at 157.71, showing a minimal advance of 0.10% as the Asian session begins.

- The pair struggles to conquer the Tenkan-Sen line at 158.18, indicating a potential shift in momentum.

- Short-term technicals show a neutral bias with a slight tilt to the upside as the pair prints higher highs and higher lows.

As the Asian session begins, the EUR/JPY prints a minimal advance of 0.10% after traders failed to conquer the Tenkan-Sen line at 158.18, as the pair dropped below 158.00. At the time of writing, the cross-currency pair exchanges hands at 157.71, set to finish the week with losses.

EUR/JPY Price Analysis: Technical outlook

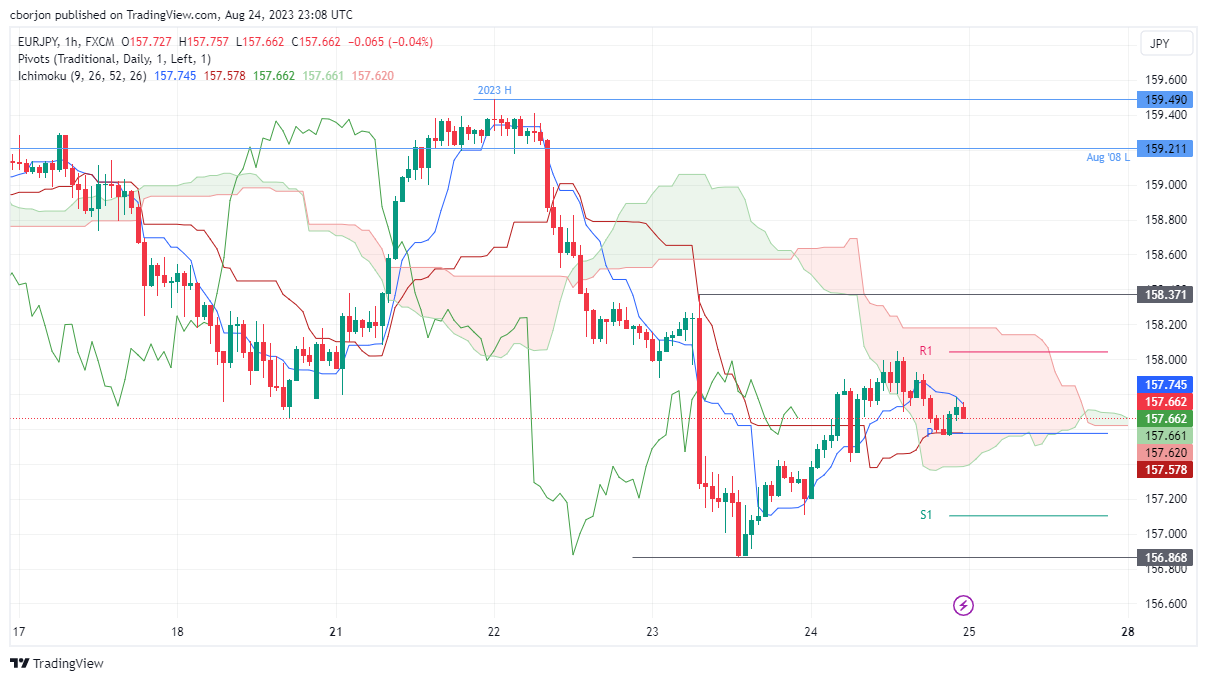

From a daily chart perspective, the EUR/JPY is still upward biased, but the recent dip below the Tenkan-Sen could pave the way to test lower prices. Next support emerges at the August 23 swing low of 156.87, followed by the top of the Ichimoku Cloud (Kumo) at 155.65/75. On the flip side, if buyers want to resume the uptrend, the pair must pierce the Tenkan-Sen at 158.18, so the cross could threaten to test the year-to-date (YTD) high at 159.49.

Short term, the EUR/JPY hourly chart portrays the pair as neutral biased, with risks seen slightly tilted to the upside, as the pair achieved two successive series of higher highs and higher lows. Nevertheless, buyers must lift the pair above the August 23 high of 158.37 to reinforce the upside bias.

On its way towards that level, the EUR/JPY must surpass the Tenkan Sen at 157.74, the R1 daily pivot point at 158.04, and the top of the Kumo at around 158.20. Conversely, if the cross drops below the confluence of the Kijun-Sen and the daily pivot point at 157.57, the pair would cre-test the weekly low of 156.86. But first, sellers must reclaim the bottom of the Kumo at 157.40, followed by the 157.00 figure.