GBP/JPY Price Analysis: Skyrockets and hits a daily high above 186.00

- GBP/JPY surges to 185.90, gaining more than 150 pips or 0.88%, as US economic data reduces the likelihood of Fed rate hikes.

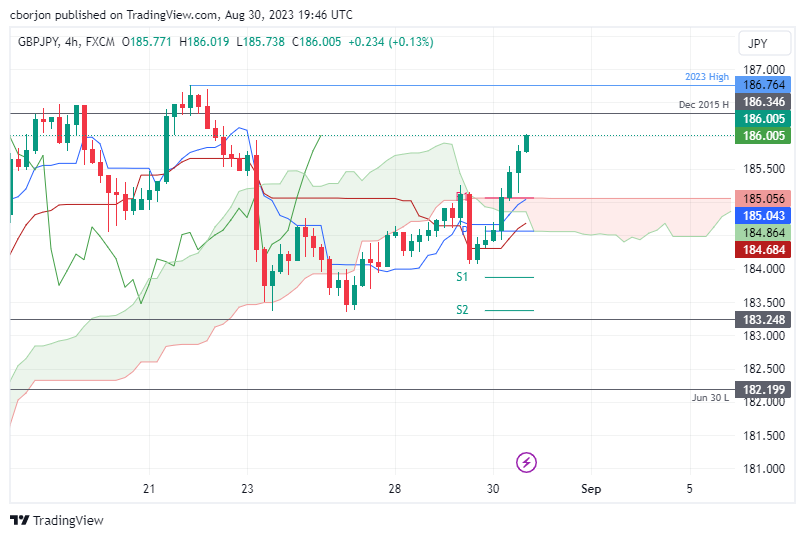

- Technical outlook shows the pair broke above the Tenkan-Sen line, targeting the 186.00 level and potentially the YTD high of 186.76.

- Short-term 4-hour chart indicates upward bias, with the first resistance at 186.00; downside support lies at 185.06, the confluence of the Tenkan-Sen and the top of the Kumo.

The GBP/JPY rallied sharply on Wednesday, gaining more than 150 pips or 0.88%, as market sentiment remains upbeat, following the release of US economic data that could deter the US central bank from hiking rates. The pair is trading at 185.90 after hitting a daily low of 184.31.

GBP/JPY Price Analysis: Technical outlook

On Wednesday, the GBP/JPY broke above the Tenkan-Sen line, opening the door for further upside, putting into play the 186.00 mark, followed by the year-to-date (YTD) high of 186.76. Conversely, a daily close below 186.00 could exacerbate a re-test of the Tenkan-Sen line at 185.05, followed by the current week’s low of 183.35.

Short-term, the GBP/JPY 4-hour chart portrays the pair as upward biased, and after cracking above the Ichimoku Cloud (Kumo), the cross is extending its gains. First resistance emerges at the 186.00 figure, followed by December’s 2015 high of 186.35, before testing the year-to-date (YTD) high of 186.76.

Contrarily, if GBP/JPY edges lower, the first support would emerge at 185.06, the confluence of the Tenkan-Sen and the top of the Kumo, followed by the Kijun-Sen line at 184.68.