Gaza Strife Rattles Investor Confidence; Bitcoin Surpasses 30k Mark – Action Forex

Global stock markets continues to face turbulence today, with Asian indices wrapping up in the negative zone, European markets showcasing bearish sentiments, and US futures indicating a subdued opening. A heightened sense of caution permeates the investment community due to the intensifying conflict between Israel and Hamas in the Gaza strip, fueling concerns of possible escalation over the upcoming weekend. However, certain sectors like gold, oil, and treasuries seem to be pausing their rapid ascent, signaling a possible breather amidst the intense market volatility.

In the forex domain, Swiss Franc has managed to maintain its dominance as the week’s top performer, trailed by Euro and Australian Dollar. On the flip side, Kiwi, Yen, and Canadian are struggling. Retail sales data failed to catalyze sustained move for Loonie and Sterling. Amidst this, Dollar is locked in a standoff with the Yen, hovering precariously close to 150 mark.

On the cryptocurrency front, Bitcoin managed to push past 30k handle today, potentially driven in part by investors seeking alternative safe havens. From a short-term perspective, the crypto asset is likely to see further rise as long as 28071 support holds, aiming next for the 31815 peak. A broader overview suggests that the support at 24739 has held firm, leading to a moderately bullish medium-term outlook with the expectation that rise from 15452 could resume later in the stage.

In Europe, at the time of writing, FTSE is down -1.08%. DAX is down -1.30%. Hong Kong HSI is down -1.20%. Germany 10-year yield is down -0.0074 at 2.908. Earlier in Asia, Nikkei dropped -0.54%. Hong Kong HSI dropped -0.72%. China Shanghai SSE dropped -0.74%. Singapore Strait Times dropped -0.74%. Japan 10-year JGB yield dropped -0.0026 to 0.844.

Fed’s Bostic eyes late 2024 for possible rate cut, remains focused on curbing inflation

In an interview with CNBC, Atlanta Federal Reserve President Raphael Bostic emphasized that reigning in inflation remains a top priority, and the metric needs to approach the 2% mark before a rate cut can be seriously considered.

“Inflation is job one, we have to get that under control,” Bostic asserted. But rate cut is possible next year and “I would say late 2024”, he added.

“There’s still a lot of momentum in the economy. My outlook says that inflation is going to come down but it’s not going to like fall off a cliff,” he explained.

“It’ll be sort of a progression that’s going to take some time. And so we’re going to have to be cautious, we’re going to have to be patient, but we’re going to have to be resolute,” added Bostic.

In the context of a broader economic outlook, Bostic dismissed the possibility of a recession. He projected a slowdown in economic activity but remained optimistic about the economy’s resilience and the eventual return of inflation to the 2% target.

Canada retail sales fell -0.1% mom in Aug, sales volume down -0.7% mom

Canada retail sales fell -0.1% mom to CAD 66.1B in August, matched expectations. Sales were down in six of nine subsectors and were led by decreases at motor vehicle and parts dealers (-0.9%). Excluding gasoline stations, fuel, motor vehicles and parts, sales were down -0.3% mom. In volume terms, retail sales declined -0.7% mom.

Advance estimate suggests that sales were unchanged in September.

BoE’s Bailey anticipates marked decrease in October’s inflation figures

BoE Governor Andrew Bailey, in an interview with Belfast Telegraph, expressed that he “wasn’t surprised” by the latest inflation report released on Wednesday. This report showcased consumer prices having ascended by 6.7% compared to the previous year in September, mirroring the growth rate observed in August.

Bailey’s added the inflation rate was “not far off what we were expecting.” Even more reassuring was the slight dip in core inflation, a development he found “quite encouraging.”

He optimistically anticipates a “noticeable drop” in the headline inflation rate with the forthcoming October data. This anticipated decline can be attributed to the significant surge in energy prices last year, which will be excluded from the annual comparison.

However, Bailey warned, “Pay growth as measured is still well above anything that’s consistent with the target.”

UK retail sales volumes down -0.9% mom in Sep, value down -0.2% mom

UK retail sales volumes fell sharply by -0.9% mom in September, much worse than expectation of -0.4% mom. Sale volumes excluding automotive fuel dropped -1.0% mom.

Looking at some details, non-food stores sales volumes fell -1.9% mom. Non-store retailing sales volumes fell -2.2% mom. Foot stores sales volumes rose rose 0.2% mom. Automotive fuel sales volumes rose by 0.8% mom.

Looking at the quarterly picture, sales volumes fell by -0.8% in the three months to September when compared with the previous three months. Ex-fuel sales volumes fell -1.0%.

In value term, retail sales value dropped -0.2% mom. Sales value excluding automotive fuel fell -0.4% mom.

Japan’s core CPI slips below 3% mark to 2.8% yoy

Inflationary momentum in Japan showed signs of easing in September, with all-item CPI decelerating to 3.0% yoy, down from 3.2% yoy in the prior month. Core CPI, which strips out the volatile food prices, also showed a downtrend, registering at 2.8% yoy, a dip from 3.1% yoy. Furthermore, core-core CPI, which excludes both food and energy prices, declined marginally from 4.3% yoy to 4.2% yoy.

Remarkably, core inflation dipped below the 3% mark for the first time since August 2022. Nevertheless, it remains above BoJ’s 2% target, marking the 18th consecutive month of surpassing this benchmark.

The detailed breakdown of the data indicates that energy prices were a significant drag, plunging by -11.7% yoy. This downturn can be attributed to the government’s proactive measures to trim utility bills, resulting in double-digit falls in electricity and city gas prices. On the contrary, food prices remained on an upward swing, posting 8.8% yoy increase.

There are reports suggesting an upward revision in BoJ’s core CPI forecast for fiscal 2023. Sources familiar with the bank’s deliberations indicate a possible revision from 2.5% to nearly 3.0%. All eyes will now be on BoJ ‘s policy meeting scheduled for Oct 31, where a new outlook report is anticipated.

New Zealand’s exports down -18% yoy in Sep, China leads decline again

New Zealand’s trade balance for September reveals a deficit of NZD -2.3B, driven by a notable fall in goods exports of -18% yoy, bringing the total to NZD 4.9B. The decline in imports was also significant, dropping by -15% yoy to NZD 7.2B.

A striking feature of this downturn is the notable reduction in exports to China, marking a deviation from the consistent growth observed over the past decade. International trade manager Alasdair Allen noted, “Over the past decade, exports to China have been steadily increasing, with a flat period during COVID-19, but in recent months this has started to shift.”

Breaking down the export figures by country, China recorded a 20% yoy drop, equivalent to NZD 332 million, leading the downturn. Exports to Australia, US, EU, and Japan also experienced declines, calculated at -3.3%, -6.7%, -26%, and -12% yoy, respectively.

On the imports front, China once again played a significant role, with imports from the country decreasing by -17% yoy. Imports from EU and Australia also dropped by -1.5% yoy and -21% yoy respectively. Imports from South Korea contracted by -16% yoy. In contrast, imports from US saw a growth of 6.1% yoy.

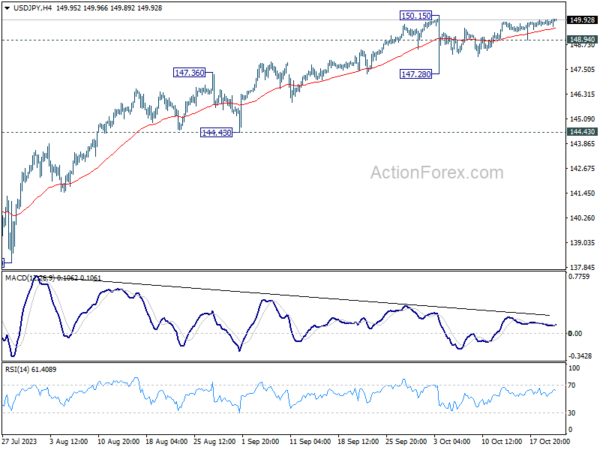

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 149.66; (P) 149.81; (R1) 149.96; More…

Intraday bias in USD/JPY stays neutral for the moment as range trading continues. On the downside, below 148.94 minor support will turn bias to the downside for another down leg towards 147.28. On the upside, firm break of 150.15 will resume larger up trend to test 151.93 high.

In the bigger picture, while rise from 127.20 is strong, it could still be seen as the second leg of the corrective pattern from 151.93 (2022 high). Rejection by 151.93, followed by sustained break of 145.06 resistance turned support will be the first sign that the third leg of the pattern has started. However, sustained break of 151.93 will confirm resumption of long term up trend.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Trade Balance (NZD) Sep | -2329M | -2291M | -2273M | |

| 23:01 | GBP | GfK Consumer Confidence Oct | -30 | -20 | -21 | |

| 23:30 | JPY | National CPI Y/Y Sep | 3.00% | 3.20% | ||

| 23:30 | JPY | National CPI ex-Fresh Food Y/Y Sep | 2.80% | 2.80% | 3.10% | |

| 23:30 | JPY | National CPI ex Food Energy Y/Y Sep | 4.20% | 4.30% | ||

| 06:00 | GBP | Retail Sales Y/Y Sep | -0.90% | -0.40% | 0.40% | |

| 06:00 | EUR | Germany PPI M/M Sep | -0.20% | 0.40% | 0.30% | |

| 06:00 | EUR | Germany PPI Y/Y Sep | -14.70% | -14.20% | -12.60% | |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) Sep | 13.5B | 17.7B | 10.8B | 10.6B |

| 12:30 | CAD | Retail Sales M/M Aug | -0.10% | -0.10% | 0.30% | |

| 12:30 | CAD | Retail Sales ex Autos M/M Aug | 0.10% | -0.10% | 1.00% |