Loonie Sinks Despite BoC’s Hawkish Hold, Aussie Rally Fizzles Out – Action Forex

Canadian Dollar encountered heavy headwinds after BoC made the anticipated decision to keep interest rates steady. The bank’s hawkish tone persisted, highlighting concerns over the sluggish pace of disinflation. However, the central bank also acknowledged emerging signs indicating that past rate hikes might be curbing economic activity.

Earlier in the day, Australian Dollar experienced a boost on the back of robust CPI data, prompting major financial institutions such as Commonwealth Bank of Australia and ANZ to change their tune regarding interest rate forecasts. Both banks now anticipate a 25 basis point rate hike come November.

Yet, the buoyancy of Aussie was short-lived, reverting to a mixed stance shortly thereafter. This change in sentiment is reflective of a broader realization in the markets: many major central banks, like BoC, are grappling with inflation rates that are more resilient than initially expected.

Presently, the market’s attention has pivoted back to rising treasury yields and a general inclination towards risk aversion. Commodity currencies, with Canadian Dollar at the forefront, are trailing behind as the day’s most underwhelming performers. This trend is mirrored by Aussie and Kiwi.

On the flip side, Dollar stands tall as the day’s top performer, trailed the Yen the Euro. Sterling and Swiss Franc, meanwhile, oscillate, reflecting a more ambivalent performance in the markets.

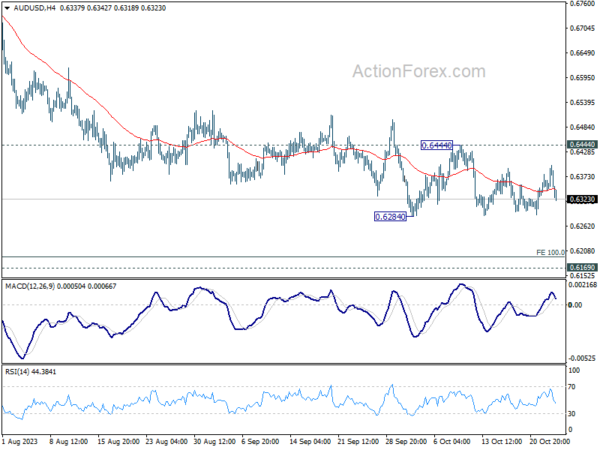

Technically, as AUD/USD’s earlier rebound falters, focus could be back on 0.6284 support in the near term. Decisive break there will resume the whole down trend from 0.7156 to 100% projection of 0.7156 to 0.6457 from 0.6894 at 0.6195, which is close to 0.6169 medium term support.

In Europe, at the time of writing, FTSE is down -0.22%. DAX is down -0.55%. CAC is down -0.45%. Germany 10-year yield is up 0.0590 at 2.886. Earlier in Asia, Nikkei rose 0.67%. Hong Kong HSI rose 0.55%. China Shanghai SSE rose 0.40%. Singapore Strait Times dropped -0.17%. Japan 10-year JGB yield rose 0.0065 to 0.861.

BoC stands pat, concerned on slow disinflation progress

BoC left overnight rate unchanged at 5.00% as widely expected. Bank Rate and deposit rate are held at 5.25% and 5.00% respectively. The Governing Council expressed concerns that “progress towards price stability is slow and inflationary risks have increased”. The central bank is “prepared to raise the policy rate further if needed”, maintaining hawkish bias.

Growth projections are revised notably lower for 2023 and 2024, but raised slightly for 2025. GDP growth is projected to be at 1.2% in 2023 (vs prior 1.8%), 0.9% in 2024 (vs prior 1.2%), and 2.5% in 2025 (vs prior 2.4%).

CPI inflation forecasts are revised higher through the projection horizon, at 3.9% in 2023 (vs prior 3.7%), 3.0% in 2024 (vs prior 2.5%), and 2.2% in 2025 (vs prior 2.1%).

German Ifo business climate rose to 86.9, seeing a silver lining

German Ifo Business Climate rose from 85.8 to 86.9 in October. Current Assessment Index rose from 88.7 to 89.2. Expectations Index rose from 83.1 to 84.7.

By sector, manufacturing rose from -16.2 to -15.9. Services rose from -4.9 to -1.5. Trade dropped from -25.0 to 27.2. Construction ticked up from -31.2 to -31.1.

Ifo said: “Managers were less pessimistic in their view of the coming months. Germany’s economy can see a silver lining ahead.”

Australia CPI slows to 5.4% yoy in Q3, but rises to 5.6% yoy in Sep

Australia’s CPI for Q3 registered a 1.2% qoq rise, exceeding expectation of 1.1% qoq and marking an acceleration from the previous quarter’s 0.8% qoq. Notably, some of the most pronounced price hikes were observed in automotive fuel (+7.2%), rents (+2.2%), new dwelling purchases by owner-occupiers (+1.3%), and electricity (+4.2%).

Over the twelve months, inflation saw a deceleration, with CPI moving from 6.0% yoy to 5.4% yoy in Q3. However, this figure surpassed the anticipated 5.3% yoy. It’s essential to note that this is the third consecutive quarter where the annual inflation rate has experienced a downturn, dropping from its high of 7.8% in Q4 2022.

The trimmed mean CPI, which excludes volatile items, recorded a 1.2% qoq increase again outpacing the forecasted 1.1% qoq and the previous quarter’s 1.0% qoq . When analyzing the annualized data, the trimmed mean CPI decelerated from 5.9% yoy to 5.2% yoy, surpassing the predicted 5.1% yoy.

Commenting on the latest figures, Michelle Marquardt, ABS head of price statistics, highlighted that “prices continued to rise for most goods and services.” However, she also noted a few sectors that registered price declines, notably child care, vegetables, and domestic holiday travel and accommodation.

Furthermore, the monthly CPI for September recorded acceleration from 5.2% yoy to 5.6% yoy , which was above the anticipated 5.4% yoy. Significant price surges in this period were identified in Housing (+7.2%), Transport (+9.4%), and Food and non-alcoholic beverages (+4.7%).

Reflecting on these trends, Marquardt stated, “This is the second consecutive rise in the annual movement up from 5.2% in August and 4.9% in July. While many industries’ price increases are slowing, automotive fuel has had large annual increases in the last two months, which has been driving the movement higher.”

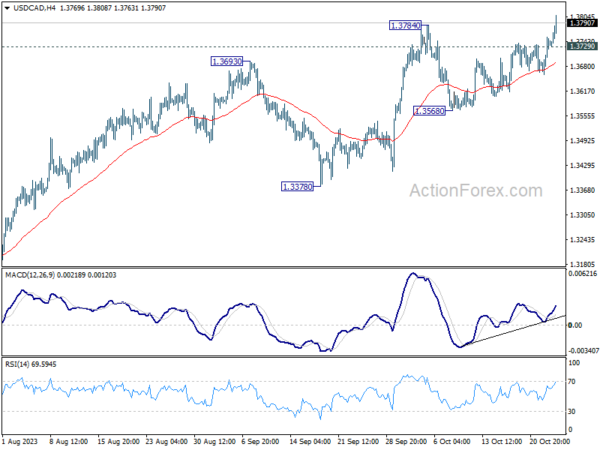

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.3660; (P) 1.3698; (R1) 1.3729; More…

USD/CAD’s solid break of 1.3784 resistance confirm resumption of the rally from 1.3091. Intraday bias is back on the upside for retesting 1.3976 high. Decisive break there will resume larger up trend. On the downside, below 1.3729 minor support will turn intraday bias neutral and bring consolidations. But near term outlook will remain bullish as long as 1.3568 support holds.

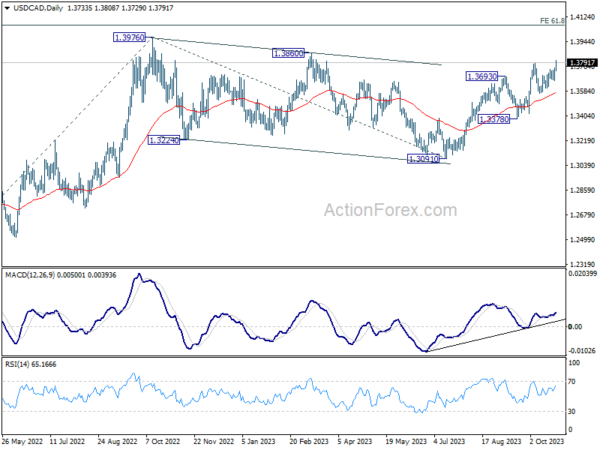

In the bigger picture, current development revives the case that corrective pattern from 1.3976 (2022 high) has completed with three waves down to 1.3091. Decisive break of 1.3976 high will confirm resumption of up trend from 1.2005 (2021 low). Next target will be 61.8% projection of 1.2401 to 1.3976 from 1.3091 at 1.4064. This will now remain the favored case as long as 1.3378 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Monthly CPI Y/Y Sep | 5.60% | 5.40% | 5.20% | |

| 00:30 | AUD | CPI Q/Q Q3 | 1.20% | 1.10% | 0.80% | |

| 00:30 | AUD | CPI Y/Y Q3 | 5.40% | 5.30% | 6.00% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q3 | 1.20% | 1.10% | 1.00% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q3 | 5.20% | 5.00% | 5.90% | |

| 08:00 | CHF | Credit Suisse Economic Expectations Oct | -37.8 | -27.6 | ||

| 08:00 | EUR | Germany IFO Business Climate Oct | 86.9 | 85.9 | 85.7 | 85.8 |

| 08:00 | EUR | Germany IFO Current Assessment Oct | 89.20 | 88.5 | 88.7 | |

| 08:00 | EUR | Germany IFO Expectations Oct | 84.7 | 83.3 | 82.9 | 83.1 |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Sep | -1.20% | -1.70% | -1.30% | |

| 14:00 | USD | New Home Sales Sep | 759K | 684K | 675K | |

| 14:00 | CAD | BoC Interest Rate Decision | 5.00% | 5.00% | 5.00% | |

| 14:30 | USD | Crude Oil Inventories | -0.5M | -4.5M | ||

| 15:00 | CAD | BoC Press Conference |