Markets Quiet in Anticipation: BoJ, Fed, and BoE Coupled with Key Economic Releases – Action Forex

The foreign exchange markets have commenced the week on a relatively quiet note, with major currency pairs and crosses adhering closely to Friday’s trading range. Commodity currencies have shown a modest edge, while European majors appear somewhat subdued. Yen and Dollar find themselves in an intermediate position, but overall market volatility remains notably low. Traders are poised for a week packed with significant events, including pivotal meetings by BoJ, Fed, and BoC, alongside critical data releases such as Eurozone CPI and US non-farm payrolls.

In equity markets, Japan’s Nikkei index is experiencing notable weakness, particularly with eyes on 30k mark in anticipation of BoJ’s decision. Chinese stocks, on the other hand, seem to have found some stability. Over the weekend, news that over 30 Chinese listed companies announced share buyback and purchase plans provided a degree of support. However, the resultant uplift in Shanghai’s SSE index remains somewhat muted. In the commodities sector, Gold is holding steady above 2000 level, with no immediate indications of a pullback. Similarly, Bitcoin is trading within a tight range, just below 35k mark.

Technically, CHF/JPY’s pull back from 168.39 appears to be gathering some momentum. Risk is now mildly on the downside for a take on 55 D EMA (now at 164.61). Sustained break there will argue that a medium term top was already formed, on bearish divergence condition in D MACD. In this case, deeper decline would be seen to 159.95 support, and possibly below. Eyes are now on how the CHF/JPY will respond to the upcoming BoJ policy decision, slated for tomorrow.

In Asia, at the time of writing, Nikkei is down -1.33%. Hong Kong HSI is down -0.28%. China Shanghai SSE is up 0.17%. Singapore Strait Times is up 0.16%.

Australian retails rose 0.9% mom, strong Sep in subdued 2023

Australia’s retail sales turnover registered a 0.9% mom growth in September to AUD 35.87B. This robust performance dwarfed the modest analyst expectations of a 0.3% mom growth. On an annual basis, sales turnover presented a rise of 2.0% yoy compared to the same month in the preceding year.

Speaking on the development, Ben Dorber, ABS head of retail statistics, elucidated, “The strong rise in September came from a diverse range of factors across the Retail industry.” He pinpointed the uncommonly warm onset of spring as a significant catalyst while technology and energy-conscious programs also had their roles.

However, while September’s figures paint a buoyant picture, Dorber pointed to a more restrained broader context.

“While the rise in September was the largest since January, subdued spending for most of 2023 means that underlying growth in Retail turnover remains historically low,” he said.

Adding weight to this perspective, he shared that “Retail turnover in trend terms is up only 1.5 per cent compared to September 2022 – the smallest trend growth over 12 months in the history of the series.”

BoJ, Fed, and BoE meetings aid key data tsunami

This week, the global financial markets are eagerly awaiting decisions and insights from three major central banks, coupled with a flurry of critical economic data set to be released.

Starting with BoJ on Tuesday, expectations are firmly set on maintaining current monetary policy, including -0.10% negative short-term rate target and yield curve control parameters. However, a significant focus will be on the bank’s new inflation projections in the quarterly Outlook for Economic Activity and Prices report. Market anticipations lean towards an upgraded fiscal 2024 core inflation forecast to 2% range.

Discussions around BoJ’s exit from its ultra-loose monetary policy have been rife, but such a move doesn’t seem imminent. A recent Reuters poll revealed that only 17 of 27 economists foresee BoJ ending its negative rate policy by the end of 2024, with the rest predicting “2025 or later”. Of those predicting a 2024 change, April is flagged by 10 economists as the likely timing for the end of negative rates.

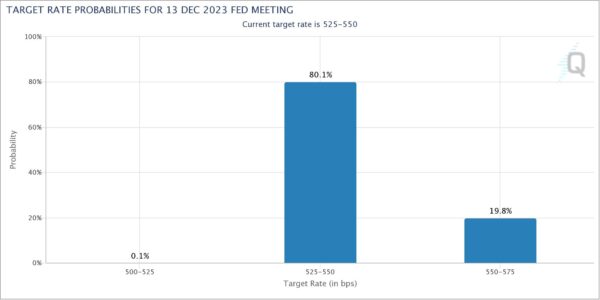

Shifting focus to Fed decision on Wednesday, it is widely anticipated that interest rates will remain unchanged at 5.25-5.50% for the second consecutive meeting. The likelihood of a surprise is minimal, as fed fund futures indicate a 99.9% chance of maintaining the current rate. However, the possibility of another rate hike in December remains a topic of debate. Currently, the probability of an additional 25bps hike is priced in at just 19.8% in fed funds futures.

Fed Chair Jerome Powell is expected to reinforce the commitment to combating inflation while maintaining vigilance. He may also reiterate the idea that higher treasury yields could reduce the need for further tightening. Beyond that, it’s unlikely for Powell to give more hints. For FOMC members, December decision would be heavily dependent on the new economic projections available by then.

Over at BoE on Thursday, the consensus is for interest rates to hold steady at 5.50%, despite September’s unexpectedly stable inflation rate of 6.7%. According to a Reuters poll, the majority of economists, 61 of 73, predict no rate change this time. However, given the tight 5-4 vote during the last decision to hold, any unexpected shifts in the upcoming economic projections could easily tilt the scales.

Apart from these central bank meetings, the economic calendar is packed with high-profile data releases, including US ISMs and Nonfarm Payrolls, Eurozone CPI flash and GDP, Swiss CPI, Canadian CPI, New Zealand employment, and Chinese PMIs. These data points, along with the central banks’ decisions and projections, will be crucial in shaping market sentiments and potentially ushering in new market trends.

USD/CAD Daily Outlook

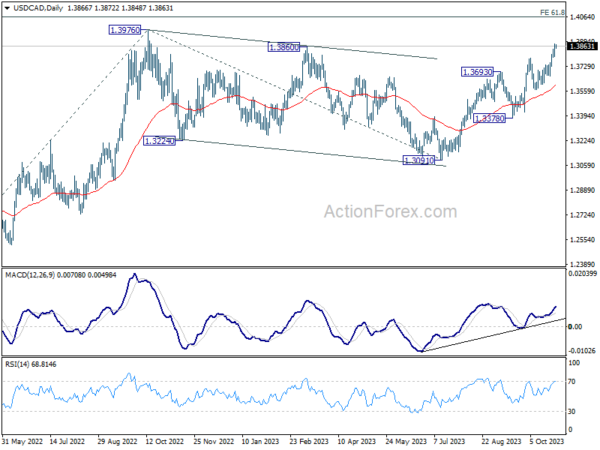

Daily Pivots: (S1) 1.3820; (P) 1.3850; (R1) 1.3905; More…

Intraday bias in USD/CAD remains on the upside at this point. Further rally should be seen to retest 1.3976. Decisive break there will resume larger up trend to 1.4064 projection level. On the downside, below 1.3794 minor support will turn intraday bias neutral and bring consolidations, before staging another rally.

In the bigger picture, corrective pattern from 1.3976 (2022 high) should have completed with three waves down to 1.3091. Decisive break of 1.3976 high will confirm resumption of up trend from 1.2005 (2021 low). Next target will be 61.8% projection of 1.2401 to 1.3976 from 1.3091 at 1.4064. This will now remain the favored case as long as 1.3568 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Retail Sales M/M Sep | 0.90% | 0.30% | 0.20% | 0.30% |

| 07:00 | EUR | Germany GDP Q/Q Q3 P | -0.20% | 0.00% | ||

| 08:00 | CHF | KOF Economic Barometer Oct | 95.6 | 95.9 | ||

| 09:30 | GBP | Mortgage Approvals (GBP) Sep | 44K | 45K | ||

| 09:30 | GBP | M4 Money Supply M/M Sep | 0.10% | 0.20% | ||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Oct | 93.3 | 93.3 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Oct | -9 | |||

| 10:00 | EUR | Eurozone Services Sentiment Oct | 4 | |||

| 10:00 | EUR | Eurozone Consumer Confidence Oct F | -17.9 | -17.9 | ||

| 13:00 | EUR | Germany CPI M/M Oct P | 0.20% | 0.30% | ||

| 13:00 | EUR | Germany CPI Y/Y Oct P | 4.00% | 4.50% |