Sterling Falters Post-UK Inflation Report, Dollar Sees Momentary Respite – Action Forex

Sterling emerged as the standout underperformer today, reacting notably to the latest CPI data from the UK. This data indicated a more rapid deceleration in both headline and core inflation rates than many had predicted. Such a shift in inflation dynamics is feeding into growing belief among market participants that BoE has reached the pinnacle of its interest rate hiking cycle.

Nevertheless, the sentiment towards the Pound is distinctly different from the US scenario, where Dollar witnessed a dramatic plunge following a similar inflation trend. In the case of Sterling, however, market response has been relatively muted, suggesting a more cautious recalibration of expectations rather than a drastic reassessment.

Euro is not far behind in terms of weakness, partly pressured by the resurgence in the Swiss Franc. Japanese Yen is also experiencing downward pressure, primarily due to Japan’s GDP contraction in the third quarter, which was much steeper than many analysts had anticipated.

In contrast, commodity-linked currencies such as Australian and New Zealand Dollars are maintaining their upward momentum, buoyed by strong risk-on sentiment that is evident across both Asian and European markets. Dollar, meanwhile, is displaying a mixed performance, having a breather after its steep decline earlier in the week, and shows little reaction to retail sales and PPI data.

Analyzing the performance over the week, Dollar continues to languish as the weakest among its peers, trailed by Japanese Yen, Canadian Dollar, and Swiss Franc. Australian Dollar stands out as the strongest, followed by New Zealand Dollar, Sterling, and the Euro.

Technically, CHF/JPY’s uptrend resumed this week by breaking through 168.39 resistance, and hits as high as 169.37 so far. Immediate focus is now on 38.2% projection of 140.21 to 166.57 from 159.95 at 170.01. Decisive break there could prompt further upside acceleration to 61.8% projection at 176.24.

In Europe, at the time of writing, FTSE is up 1.04%. DAX is up 0.68%. CAC is up 0.44%. Germany 10-year yield is up 0.0189 at 2.625. In Asia, Nikkei surged 2.52%. Hong Kong HSI rose 3.92%. China Shanghai SSE rose 0.55%. Singapore Strait Times rose 0.88%. Japan 10-year JGB yield dropped -0.0495 to 0.797.

US retail sales down -0.1% mom in Oct, ex-auto sales up 0.1% mom

US retail sales fell -0.1% mom to USD 705.0B in October, better than expectation of -0.3% mom. Ex-auto sales rose 0.1% mom to USD 570.9B, above expectation of -0.2% mom decline. Ex-gasoline sales fell -0.1% mom to 648.4B. Ex-auto and gasoline sales rose 0.1% mom to USD 514.3B.

Total sales for August through October period were up 3.1% from the same period a year ago.

US PPI down -0.5% mom in Oct, biggest fall since Apr 2020

US PPI for final demand fell -0.5% mom in October, below expectation of 0.1% mom rise. That’s also the largest monthly decline since April 2020. PPI goods fell -1.4% mom while PPI services was unchanged. For the 12 months period, PPI slowed from 2.2% yoy to 1.3% yoy, below expectation of 1.9% yoy.

PPI less foods, energy and trade services rose 0.1% mom, the fifth consecutive rise. For the 12 months period, PPI less goods, energy and trade services rose 2.9% yoy.

European Commission trims Eurozone growth forecasts for 2023 and 2024

In European Commission’s Autumn Economic Forecasts, 2023 GDP growth forecast has been lowered to 0.6%, a reduction from the earlier summer forecast of 0.8%. Outlook for 2024 is also tempered, with GDP growth projections scaled back to 1.2%, compared to previous 1.3%. However, there is an anticipation of pickup in growth to 1.6% in 2025.

In terms of inflation, 2023 forecast remains unchanged at 5.6%. However, there was an upward adjustment for 2024, with inflation rate now predicted to be 3.2%, higher than summer’s forecast of 2.9%. The Commission expects inflation to decelerate further in 2025, slowing to 2.2%.

Valdis Dombrovskis, Executive Vice-President of European Commission, expressed a cautiously optimistic view, stating, “Following very weak growth this year, we can expect growth to rebound modestly in 2024, helped by strong labour markets and continued easing of inflation.” He also highlighted the uncertain geopolitical context, particularly noting the recent conflict in the Middle East and its potential implications.

Paolo Gentiloni, Commissioner for Economy, echoed these sentiments. He pointed out that “Strong price pressures and the monetary tightening needed to contain them, as well as weak global demand, have taken their toll on households and businesses.”

Looking ahead, Gentiloni expects “a modest uptick in growth as inflation eases further and the labour market remains resilient.” He also acknowledged the limited immediate economic impact of the Middle East conflict, while cautioning about the heightened geopolitical tensions and the increased uncertainty and risks they pose for the future economic landscape.

Eurozone industrial production down -1.1% in Sep, EU down -0.9% mom

Eurozone industrial production fell -1.1% mom in September, worse than expectation of -0.9% mom. Production of durable consumer goods and non-durable consumer goods fell both by -2.1%, energy by -1.3% and intermediate goods by -0.3%, while production of capital goods grew by 0.3%.

EU industrial production fell -0.9% mom. Among Member States for which data are available, the largest monthly decreases were registered in Belgium (-3.2%), Portugal (-3.0%), Estonia and Ireland (both -2.9%). The highest increases were observed in Croatia (+4.3%), Slovenia (+4.1%) and Hungary (+1.3%).

Eurozone goods exports falls -9.3% yoy in Sep, imports down -23.9% yoy

Eurozone exports of goods fell -9.3% yoy to EUR 235.8B in September. Imports fell -23.9% yoy. As a result, a EUR 10.0B trade surplus was recorded. Intra-Eurozone trade fell -15.5% yoy to EUR 217.3B.

In seasonally adjusted term, Eurozone goods exports fell -0.5% mom to EUR 234.0B. Imports rose 0.3% mom to 224.8B. Trade surplus narrowed from August’s EUR 11.1B to EUR 9.2B, smaller than expectation of EUR 12.3B. Intra-Eurozone trade fell from August’s 215.8B to EUR 213.9B.

UK CPI eases significantly to 4.7% in Oct, another step to BoE’s target

UK CPI showed a marked slowdown in October, dipping below market expectations. The annual CPI rate decelerated from 6.7% yoy to 4.6% yoy , falling short of the anticipated 4.7% yoy. This decline reflects a broader trend of easing inflationary pressures, as evidenced by a flat monthly CPI rate of 0.0% mom, which was below the forecasted 0.2% mom.

Delving deeper, core CPI, which excludes volatile items such as energy, food, alcohol, and tobacco, mirrored this downtrend. It slowed from an annual rate of 6.1% yoy to 5.7% yoy, again undershooting the expected 5.8% yoy.

A notable aspect of the report was the significant drop in CPI goods annual rate, which plummeted from 6.2% yoy to 2.9% yoy. Meanwhile, services sector also saw a decline, albeit less pronounced, with CPI services annual rate reducing from 6.9% yoy to 6.6% yoy.

The most substantial downward pressure on the annual rates came from housing and household services sector. Notably, CPI annual rate in this category recorded its lowest level since record-keeping began in January 1950. Additionally, food and non-alcoholic beverages sector contributed to the downward trend, marking its lowest annual rate since June 2022.

Japan’s GDP down -0.5% qoq, -2.1% annualized in Q3

Japan’s GDP contracted -0.5% qoq in Q3, starkly underperformed market expectations of -0.1% qoq decline. On annualized basis, the situation appears even more drastic, with the economy shrinking by -2.1%, far exceeding anticipated -0.6% contraction, and being the worst since Q3 2021.

A critical factor in this downturn was a -0.6% decrease in business investment, marking a continuous decline for two consecutive quarters. This reduction was primarily influenced by reduced spending on semiconductor production equipment, reflecting broader challenges in global tech sector.

Additionally, private consumption, a key driver of economic activity, saw a marginal fall of -0.04%. This marks the second successive quarter of decline, with slump in vehicle sales significantly impacting consumer spending.

China’s industrial and retail growth surpass expectations, PBOC injects fresh funds

China’s industrial output and retail sales for October exceeded market expectations. Industrial production rose 4.6% yoy, surpassing forecasted 4.5% yoy, marking an improvement from September’s 4.5% yoy growth. Retail sales recorded a robust 7.6% yoy growth, significantly higher than anticipated 7.0% yoy and showing a considerable improvement from 5.5% yoy increase in September.

However, fixed asset investment experienced slower growth, rising only 2.9% ytd yoy, which was below the expected 3.1%. The real estate sector particularly faced challenges, with investment dropping by -9.3% ytd yoy, a deterioration compared to the previous period through September.

In a separate development, People’s Bank of China C) maintained the interest rate on CNY 1.45T worth of one-year medium-term lending facility loans at 2.50%, consistent with previous operations. As CNY 850B worth of MLF loans were set to expire this month, this move resulted in a net injection of CNY 600B of fresh funds into the banking system.

The central bank stated that this loan operation aimed to keep the banking system’s liquidity at a reasonably ample level, countering short-term factors such as tax payments and government bond issuances.

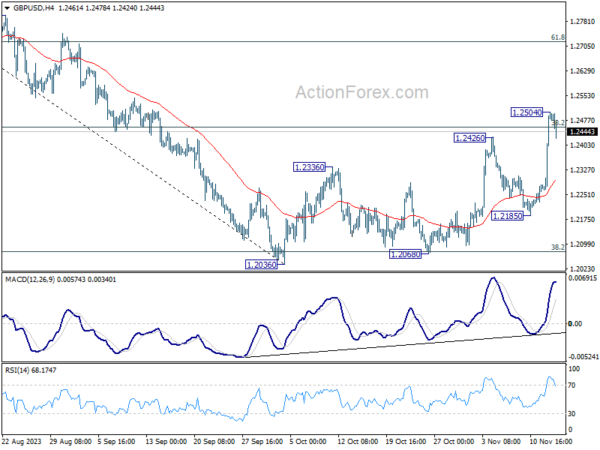

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2337; (P) 1.2421; (R1) 1.2583; More…

GBP/USD retreat slightly after edging higher to 1.2504 and intraday bias is turned neutral first. Some consolidations could be seen. But downside should be contained well above 1.2185 support to bring another rally. On the upside, break of 1.2504 will resume the whole rebound from 1.2036. Sustained trading above 38.2% retracement of 1.3141 to 1.2036 at 1.2458 will pave the way to 61.8% retracement at 1.2716.

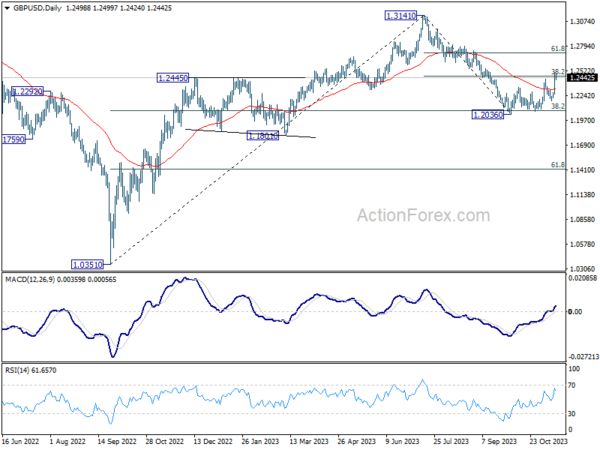

In the bigger picture, price actions from 1.3141 are seen as a corrective pattern to rise from 1.0351 (2022 low). Strong rebound from 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 will argue that current rise from 1.2036 is already the second leg. However, while further rally could be seen, upside should be limited by 1.3141 to bring the third leg of the pattern.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Wage Price Index Q/Q Q3 | 1.30% | 1.30% | 0.80% | 0.90% |

| 23:50 | JPY | GDP Q/Q Q3 P | -0.50% | -0.10% | 1.20% | |

| 23:50 | JPY | GDP Deflator Y/Y Q3 P | 5.10% | 4.80% | 3.50% | |

| 02:00 | CNY | Industrial Production Y/Y Oct | 4.60% | 4.50% | 4.50% | |

| 02:00 | CNY | Retail Sales Y/Y Oct | 7.60% | 7.00% | 5.50% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Oct | 2.90% | 3.10% | 3.10% | |

| 04:30 | JPY | Industrial Production M/M Sep F | 0.50% | 0.20% | 0.20% | |

| 07:00 | GBP | CPI M/M Oct | 0.00% | 0.20% | 0.50% | |

| 07:00 | GBP | CPI Y/Y Oct | 4.60% | 4.70% | 6.70% | |

| 07:00 | GBP | Core CPI Y/Y Oct | 5.70% | 5.80% | 6.10% | |

| 07:00 | GBP | RPI M/M Oct | -0.20% | 0.50% | ||

| 07:00 | GBP | RPI Y/Y Oct | 6.10% | 6.40% | 8.90% | |

| 07:00 | GBP | PPI Input M/M Oct | 0.40% | 0.10% | 0.40% | 0.60% |

| 07:00 | GBP | PPI Input Y/Y Oct | -2.60% | -2.60% | -2.10% | |

| 07:00 | GBP | PPI Output M/M Oct | 0.10% | 0.10% | 0.40% | 0.60% |

| 07:00 | GBP | PPI Output Y/Y Oct | -0.60% | -0.10% | 0.20% | |

| 07:00 | GBP | PPI Core Output M/M Oct | 0.10% | 0.00% | ||

| 07:00 | GBP | PPI Core Output Y/Y Oct | 0.20% | 0.70% | 0.80% | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Sep | 9.2B | 12.3B | 11.9B | 11.1B |

| 10:00 | EUR | Eurozone Industrial Production M/M Sep | -1.10% | -0.90% | 0.60% | |

| 13:30 | CAD | Manufacturing Sales M/M Sep | 0.40% | 0.80% | 0.70% | |

| 13:30 | CAD | Wholesale Sales M/M Sep | 0.40% | 1.40% | 2.30% | |

| 13:30 | USD | Empire State Manufacturing Index Nov | 9.1 | -2.6 | -4.6 | |

| 13:30 | USD | Retail Sales M/M Oct | -0.10% | -0.30% | 0.70% | 0.90% |

| 13:30 | USD | Retail Sales ex Autos M/M Oct | 0.10% | -0.20% | 0.60% | 0.80% |

| 13:30 | USD | PPI M/M Oct | -0.50% | 0.10% | 0.50% | 0.40% |

| 13:30 | USD | PPI Y/Y Oct | 1.30% | 1.90% | 2.20% | |

| 13:30 | USD | PPI Core M/M Oct | 0.00% | 0.20% | 0.30% | 0.20% |

| 13:30 | USD | PPI Core Y/Y Oct | 2.40% | 2.70% | 2.70% | |

| 15:00 | USD | Business Inventories Sep | 0.30% | 0.40% | ||

| 15:30 | USD | Crude Oil Inventories |