Yen Robust on Strong Wage Growth Data, NFP to Determine Dollar’s Path – Action Forex

Japanese Yen continues to dominate as the strongest currency for the week, finding additional support from Japan’s unexpectedly robust wage growth data. However, its rally is currently pausing, with global financial markets redirecting their focus towards the impending US non-farm payroll data.

Dollar, currently ranking as the second strongest currency, faces a critical test with the release of the job data. Its ability to maintain this position is contingent on how the markets react to NFP. This anticipated reaction is multifaceted, encompassing not just individual financial instruments, but also the collective responses across various sectors, including stocks, bonds, and currencies. The interconnectedness of these financial markets would play a crucial role in Dollar’s performance post-data release.

European currencies are lagging in performance, with Sterling experiencing the most significant downturn, closely followed by Euro. Swiss Franc, while also soft, is faring slightly better than its European peers. Australian Dollar remains weak despite recovery in today’s trading. Meanwhile, Canadian and New Zealand Dollars are displaying mixed performance.

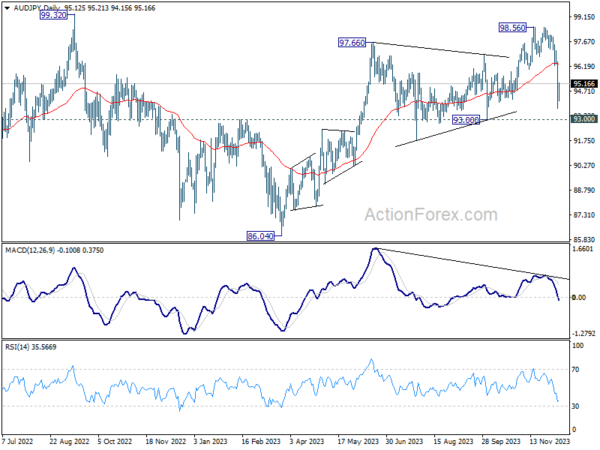

Technically, AUD/JPY recovered after diving to 93.70. Some consolidations could be seen first, but risk will stay on the downside as long as 55 D EMA (now at 96.28 holds). Rise from 86.04, as the second leg of the corrective pattern from 99.32, should have completed at 98.56. Break of 93.00 support will confirm that the third leg has starts, and target 86.04 support.

In Asia, at the time of writing, Nikkei is down -1.90%. Hong Kong HSI is up 0.10%. China Shanghai SSE is up 0.22%. Singapore Strait Times is up 1.02%. Japan 10-year JGB yield is up 0.0123 at 0.769. Overnight, DOW rose 0.17%. S&P 500 rose 0.80%. NASDAQ jumped 1.37%. 10-year yield rose 0.008 to 4.129.

US NFP in spotlight: A crucial test for soft-landing hypothesis

Today’s primary focus in the financial markets is US Non-Farm Payrolls report, which is keenly anticipated by investors assessing the “soft landing” scenario in the economy. The soft landing hypothesis implies that labor market is cooling sufficiently to reduce inflation and pave the way for Fed to start lowering interest rates next year, without posing a significant threat to the overall economy.

Non-Farm Payrolls report is expected to indicate that job growth reaccelerated to 190k in November, up from October’s 150k. Unemployment rate is projected to remain steady at 3.9%, and average hourly earnings are anticipated to show 0.3% mom increase.

Recent labor market data has shown signs of cooling. ISM Manufacturing Employment index dropped from 46.8 to 45.8, while ISM Services Employment index saw a slight improvement from 50.2 to 50.7. ADP Employment growth recorded 103k, nearly unchanged from the previous month’s 106k. The four-week moving average of initial jobless claims rose from 213k to 221k. Additionally, the latest JOLTs reported a drop in the ratio of job openings to number of unemployed workers to 1.34, the lowest since August 2021.

A “goldilocks” Non-Farm Payrolls report, signifying a balanced labor market condition, could reignite bull runs in the stock markets and subsequently exert renewed selling pressure on the Dollar. However, market reactions to deviations from this ideal scenario are difficult to predict.

Regarding the Dollar index, recovery from 102.46 was interrupted after reaching 104.23, largely due to the steep selloff in USD/JPY. For now, further rise is mildly in favor as long as 103.06 minor support holds, towards 55 D EMA (now at 103.54).

But the index could start to struggle above there, unless EUR/USD could extended its near term decline through 55 D EMA decisively, while USD/JPY could stabilize at 142.45 fibonacci support.

Japan’s nominal pay rises 1.5% yoy, but fail to keep pace with inflation, consumer spending drops

Japan’s nominal pay growth rose by 1.5% yoy, surpassing the expected 1.0% yoy increase. This marked the fastest rate of increase since June. Regular or base salaries contributed to this increase with a 1.4% yoy rise. However, overtime pay slightly decreased by -0.1% yoy. Special payments, a variable component of wages, saw a significant jump of 7.5% yoy.

However, the positive trend in nominal pay was offset by the continued decline in inflation-adjusted real wages, which fell for the 19th consecutive month, dropping by -2.3% yoy. A labor ministry official commented, “Price increases have outpaced wage growth.” This situation is exacerbated by the consumer inflation rate, which includes fresh food prices but excludes owner’s equivalent rent, re-accelerating to 3.9% after a brief two-month slowdown.

Alongside wage trends, household spending in Japan also experienced a downturn, decreasing by -2.5% yoy in October. This decline, while still significant, was less severe than the anticipated 3.0% yoy drop. The continued decrease in household spending, which has now extended to eight consecutive months, reflects ongoing challenges in the domestic consumption sector.

BoC’s Gravelle elaborates on holding interest rates steady amid balanced economy

In a speech overnight, BoC Deputy Governor Toni Gravelle said the decision to maintain policy interest rate at 5% this week was an effort to “balance the risks of over- and under-tightening.” BoC aims to avoid excessively slowing down the economy, while also alleviating the burden of high inflation on Canadians.

Gravelle observed that the Canadian economy “no longer looks to be in excess demand”, a shift that has contributed to reducing price pressures across a wide array of goods and services. He added said, “The economy is now roughly in balance.

He also emphasized that BoC is closely monitoring several key economic indicators, such as inflation expectations, wage growth, and corporate pricing behavior. These factors are crucial in determining whether inflation is on a consistent path towards the 2% target.

Despite the current state of balance in the economy, Gravelle stated, “Given the risks to the inflation outlook, we remain prepared to increase the policy rate further if needed.”

Elsewhere

Germany CPI final is the main feature in European session. Later in the day, US will release U of Michigan consumer sentiment after non-farm payrolls.

EUR/USD Daily Outlook

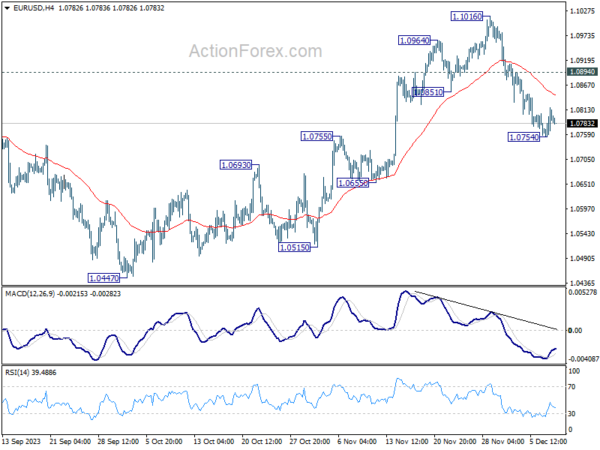

Daily Pivots: (S1) 1.0760; (P) 1.0788; (R1) 1.0822; More…

EUR/USD recovered after falling to 1.0754, and drew support from 55 D EMA (now at 1.0770). Intraday bias is turned neutral for consolidations. But another fall is in favor as long as 1.0894 minor resistance holds. Break of 1.0754 and sustained trading below 55 D EMA will pave the way to retest 1.0447 support. Nevertheless, break of 1.0894 will turn bias back to the upside for 1.1016 resistance instead.

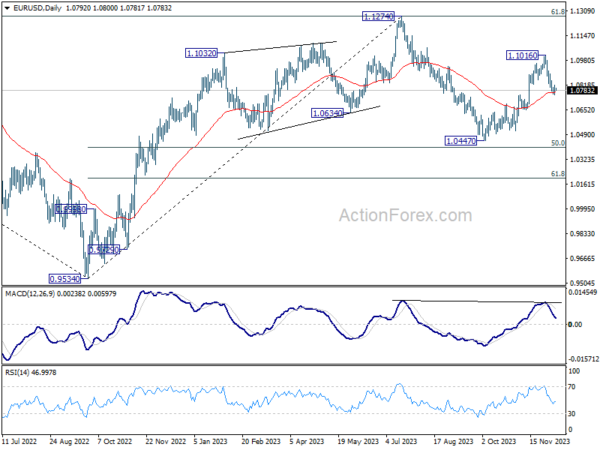

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is tentatively seen as the second leg. Hence while further rally could be seen, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 55 D EMA will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Manufacturing Sales Q3 | -2.80% | 0.20% | -0.80% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Oct | 1.50% | 1.00% | 1.20% | |

| 23:30 | JPY | Overall Household Spending Y/Y Oct | -2.50% | -3.00% | -2.80% | |

| 23:50 | JPY | Bank Lending Y/Y Nov | 2.80% | 2.80% | 2.80% | 2.70% |

| 23:50 | JPY | GDP Q/Q Q3 F | -0.70% | -0.50% | -0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q3 | 5.30% | 5.10% | 5.10% | |

| 23:50 | JPY | Current Account (JPY) Oct | 2.62T | 1.85T | 2.01T | |

| 05:00 | JPY | Eco Watchers Survey: Current Nov | 49.5 | 49.2 | 49.5 | |

| 07:00 | EUR | Germany CPI Y/Y Nov F | 3.20% | 3.20% | ||

| 07:00 | EUR | Germany CPI M/M Nov F | -0.40% | -0.40% | ||

| 09:30 | GBP | Consumer Inflation Expectations | 3.60% | |||

| 13:30 | CAD | Capacity Utilization Q3 | 81.40% | 81.40% | ||

| 13:30 | USD | Nonfarm Payrolls Nov | 190K | 150K | ||

| 13:30 | USD | Unemployment Rate Nov | 3.90% | 3.90% | ||

| 13:30 | USD | Average Hourly Earnings M/M Nov | 0.30% | 0.20% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Dec P | 61.7 | 61.3 |