China’s Rate Cut Meets Indifferent Markets, Canada CPI Takes Center Stage – Action Forex

The financial markets are rather calm in Asian session today, while major currency pairs and crosses largely engage in a phase of consolidation. This tranquility comes in the wake of China’s surprising decision to significantly lower its mortgage reference interest rate, a move designed to provide a much-needed boost to the struggling property sector and, by extension, the broader economy. Despite the potential implications of such a policy shift, reaction across the markets was relatively muted, with only the offshore Yuan registering slight gains.

Australian Dollar, in particular, remained indifferent to the news surrounding China’s development. Aussie is also similarly unresponsive to RBA’s hawkish minutes. Commodity currencies and Yen are currently leaning towards the softer side. On the other hand, Dollar shows signs of strengthening, trailed by Swiss Franc and Sterling, with Euro displaying mixed performance.

The focal point of the day shifts towards Canada, where January CPI data is eagerly awaited. This upcoming report is expected to reveal modest reduction in headline inflation to 3.3%, primarily driven by decreasing gasoline prices and softening in food price inflation. Despite this anticipated dip, core inflation figures—encompassing CPI median, trimmed, and common—are projected to remain elevated, hovering between 3.6% and 3.8%.

These figures suggest that BoC is unlikely to hasten towards an interest rate reduction. The central bank is likely to seek more pronounced and sustained decline in core inflation rates towards a sub-3% level before considering any easing of monetary policy. This scenario seems improbable to realize within the first quarter of the year.

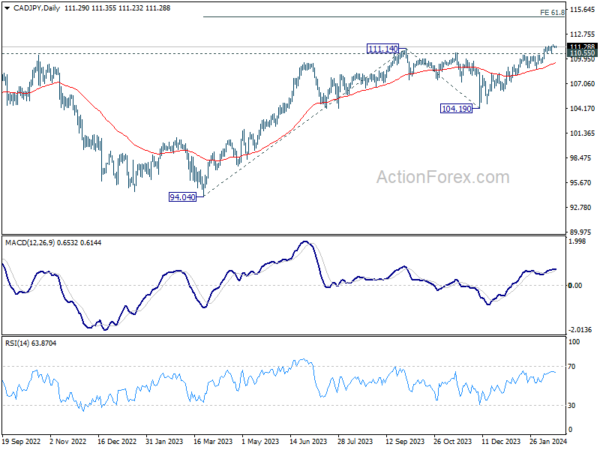

On the technical analysis front, CAD/JPY’s up trend is still in progress despite sluggish upside momentum. Further rally is expected as long as 110.55 support holds. Next target is 61.8% projection of 94.04 to 111.14 from 104.19 at 114.75. Break of 110.55 will bring retreat back to 55 D EMA (now at 109.49), before staging another rally.

In Asia, at the time of writing, Nikkei is down -0.25%. Hong Kong HSI is down -0.27%. China Shanghai SSE is up 0.02%. Singapore Strait Times is up 0.07%. Japan 10-year JGB yield is down -0.002 at 0.728.

RBA minutes: High costs of persistent inflation may necessitate additional rate hike

RBA minutes from the February 5-6 meeting revealed that the Board considered both an 25bps rate hike and maintaining the current rate. The choice to hold rates was influenced by a perceived reduction in the risk that inflation would fail to revert to the target range “within a reasonable timeframe.” However, the potential repercussions of inflation not normalizing as anticipated were deemed “potentially very high,” leaving the door open for future rate increases.

Central to the decision was the observation that moderation in inflation over preceding months had been “slightly larger than previously expected”. Global experiences had also provided “additional confidence” on the disinflation trend. Additionally, incoming data suggested “weaker than previously expected” labor market conditions and consumer spending.

The assessment of risks surrounding the economic outlook as “broadly balanced”. RBA emphasized the importance of remaining vigilant, opting to monitor evolving risks closely before making further policy adjustments. The acknowledgment of the high “costs” associated with inflation remaining above target for too long underscores the cautious stance, with members unanimously agreeing on the necessity to “not to rule out a further increase” in the cash rate target.

China announces historic reduction in benchmark mortgage rates, Yuan higher

In an effort to revitalize its beleaguered property sector and inject vitality into the broader national economy, China has taken larger than expected action by reducing a crucial reference rate for mortgage loans.

PBoC announced a significant cut in five-year loan prime rate to 3.95% from 4.20%. This move surpassed market expectations of a more modest reduction of 5 to 15 basis points. Notably, this adjustment also represents the largest cut in the five-year LPR since its inception in 2019 .

Conversely, one-year LPR, which serves as a barometer for market lending rates, was left unchanged at 3.45%. T

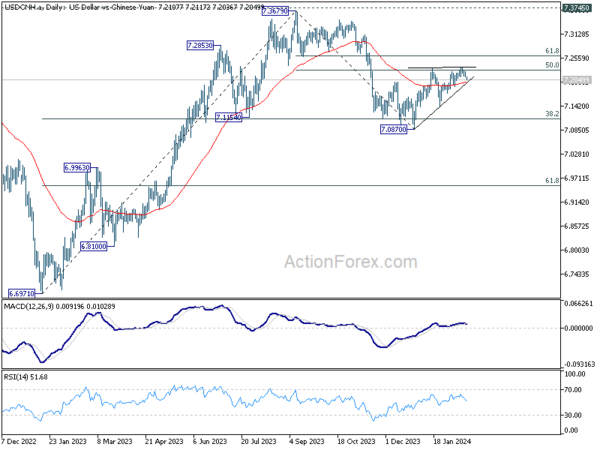

In the aftermath of this announcement, the offshore Chinese Yuan sees modest appreciation. Technically, focus will now on whether USD/CNH’s current fall would push it through 7.1885 support. If realized, that would bolster the case that corrective recovery from 7.0870 has completed with three waves up to 7.2334. That would set the stage for further decline back to retest 7.0870 low in the near term.

Looking ahead

Swiss trade balance and Eurozone current account will be released in European session. BoE’s monetary policy report hearings would be a major focus. Later in the data, Canada’s CPI data will take the spotlight.

USD/CAD Daily Outlook

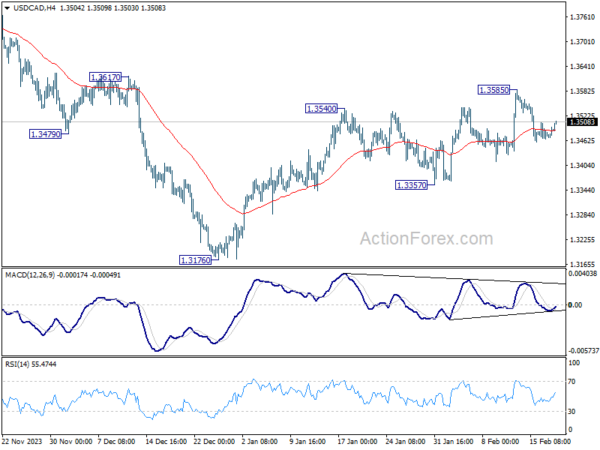

Daily Pivots: (S1) 1.3473; (P) 1.3485; (R1) 1.3503; More…

USD/CAD is still bounded in range below 1.3585 and intraday bias remains neutral. More consolidations could be seen, but further rally is expected as long as 1.3357 support holds. On the upside, firm break of 1.3585 will resume the rebound from 1.3176 for 1.3897 resistance.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern only. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Overall, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 01:15 | CNY | PBoC 1Y Loan Prime Rate | 3.45% | 3.45% | 3.45% | |

| 01:15 | CNY | PBoC 5Y Loan Prime Rate | 3.95% | 4.10% | 4.20% | |

| 07:00 | CHF | Trade Balance (CHF) Jan | 2.35B | 1.25B | ||

| 09:00 | EUR | Eurozone Current Account (EUR) Dec | 20.3B | 24.6B | ||

| 13:30 | CAD | CPI M/M Jan | 0.40% | -0.30% | ||

| 13:30 | CAD | CPI Y/Y Jan | 3.30% | 3.40% | ||

| 13:30 | CAD | CPI Median Y/Y Jan | 3.60% | 3.60% | ||

| 13:30 | CAD | CPI Trimmed Y/Y Jan | 3.60% | 3.70% | ||

| 13:30 | CAD | CPI Common Y/Y Jan | 3.80% | 3.90% |