USD/CAD bounces after Tuesday’s softer-than-expected Canadian CPI inflation print

- USD/CAD saw early declines before getting bolstered by a weak Canadian CPI.

- Canadian CPI inflation fell to 2.9% from the previous 3.4% YoY.

- Wednesday’s FOMC Meeting Minutes in the barrel as investors focus on rates.

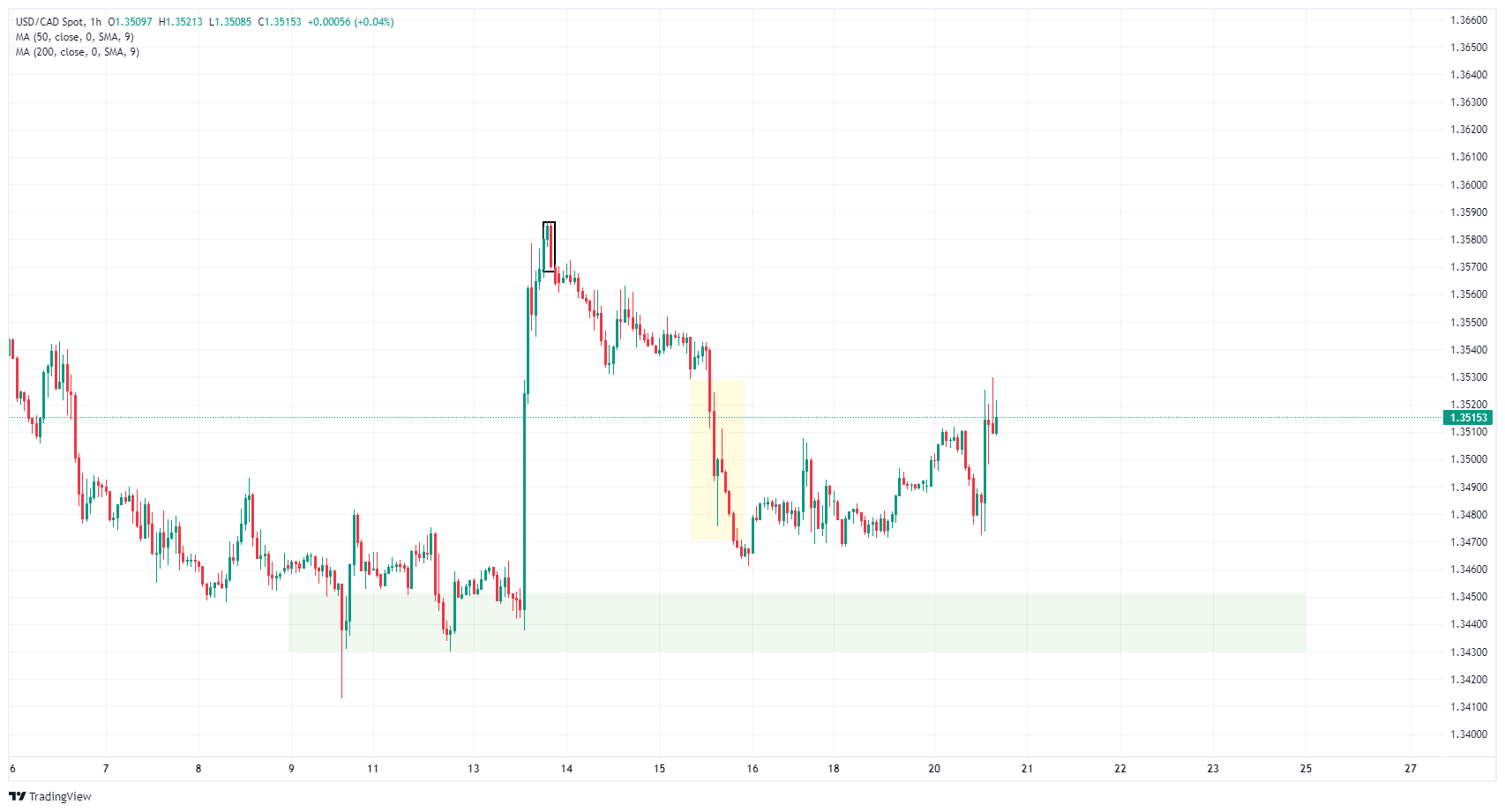

USD/CAD fell to a daily low of 1.3472 on Tuesday before rebounding into an intraday high of 1.3530 after Canadian Consumer Price Index (CPI) inflation fell faster than markets expected. A weaker-than-expected Canadian inflation print softened the Canadian Dollar (CAD) across the board.

Canadian Retail Sales figures are due Thursday, and markets will be pivoting to focus on the Federal Reserve (Fed) and the Federal Open Market Committee (FOMC). The FOMC’s latest Meeting Minutes will drop on Wednesday.

Daily digest market movers: USD/CAD grapples with 1.3500 after Canadian inflation recedes

- Canadian CPI inflation declined to 2.9% for the year ended January, well below the forecast tick down to 3.3% from the previous period’s 3.4%.

- January’s MoM Canadian CPI printed unexpectedly at 0.0% versus the forecasted rebound to 0.4% from the previous month’s -0.3%.

- The Bank of Canada’s (BOC) Consumer Price Index Core for the year through January also declined to 2.4% from 2.6%.

- Canada CPI inflation falls to 2.9% vs. 3.3% expected

- Investors will be focusing on the FOMC’s latest Meeting Minutes on Wednesday as traders hope for signs the Fed will move closer to rate cuts.

- According to the CME’s FedWatch Tool, money markets are giving a 60% chance of no rate cut in May and 80% odds of at least a 25 basis point cut in June.

- Markets are expecting Thursday’s Canadian Retail Sales to bounce in December.

- MoM Retail Sales are expected to print at 0.8% versus the previous -0.2%, while Retail Sales Excluding Automobiles is forecast to recover to 0.7% from -0.5%.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.40% | -0.47% | 0.10% | -0.46% | -0.28% | -0.52% | -0.30% | |

| EUR | 0.39% | -0.07% | 0.51% | -0.06% | 0.12% | -0.11% | 0.10% | |

| GBP | 0.47% | 0.08% | 0.59% | 0.00% | 0.19% | -0.04% | 0.17% | |

| CAD | -0.10% | -0.52% | -0.58% | -0.57% | -0.40% | -0.63% | -0.42% | |

| AUD | 0.47% | 0.07% | 0.00% | 0.57% | 0.18% | -0.05% | 0.17% | |

| JPY | 0.29% | -0.10% | -0.19% | 0.38% | -0.18% | -0.22% | -0.02% | |

| NZD | 0.51% | 0.11% | 0.04% | 0.63% | 0.06% | 0.23% | 0.22% | |

| CHF | 0.31% | -0.10% | -0.17% | 0.41% | -0.16% | 0.02% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: USD/CAD bounces on post-CPI CAD weakness

Tuesday’s climb into 1.3530 filled the Fair Value Gap (FVG) from 1.3530 to 1.3470, and the pair hangs in the midrange surrounding the 1.3500 handle. The nearest supply zone rests just below 1.3450 and represents a significant buy zone, while top-side pressure sees heavy selling around the Order Block (OB) near 1.3580.

Daily candlesticks remain caught in a significant congestion zone as bids consolidate near the 200-day Simple Moving Average (SMA). The pair is caught between December’s lows near 1.3177 and last November’s peak just shy of 1.3900.

USD/CAD hourly chart

USD/CAD daily chart

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.