Hawkish BoJ Fuels Yen Surge, Dollar Awaits Crucial PCE Inflation Insights – Action Forex

Japanese Yen rallied broadly in Asian session, energized by hawkish remarks of a BoJ official. These remarks served as a potent reminder to the markets of two critical points: Firstly, BoJ is poised to hike interest rates, buoyed by positive developments in wage negotiations; secondly, while April is viewed as the more likely timing for this move, a March hike cannot not been entirely ruled out. This news initially led to a slight dip in Nikkei, though it managed to recover almost all of its losses by the afternoon, signaling a positive reception among investors to the anticipated policy tightening.

Elsewhere in the currency markets, Australian Dollar trading as the second-strongest performer of the day, partly supported by rebound in Chinese stock markets. However, this could be a temporary adjustment, as Aussie recovers from its post-CPI losses. Similarly, New Zealand Dollar is regaining some ground lost following RBNZ rate decision yesterday.

Conversely, Dollar is facing some downward pressure, with the market’s attention now turning to today’s PCE inflation data from US. This data could mirror the latest CPI figures, indicating a stall in the disinflation process. Fed fund futures are predicting a 65% chance of a June rate cut, but this forecast could shift based on today’s PCE inflation outcomes. Meanwhile, Euro is also on high alert, with Germany set to release its CPI data today and the broader Eurozone CPI data expected tomorrow.

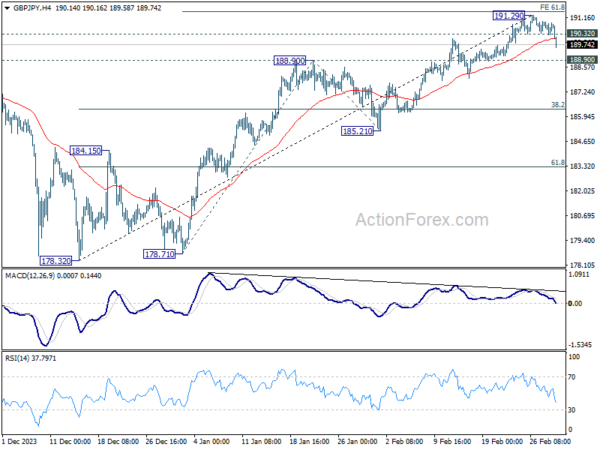

Technically, GBP/JPY should have made a short term top at 191.29 with today’s fall, after just missing 61.8% projection of 178.71 to 188.90 from 185.21 at 191.50. Considering bearish divergence condition in 4H MACD, it’s probably now corrective the whole five-wave rally from 178.32. Deeper decline should be seen to 188.90 resistance turned support first. Break will target 38.2% retracement of 178.32 to 191.29 at 186.33.

In Asia, at the time of writing, Nikkei is down -0.05%. Hong Kong HSI is down -0.02%. China Shanghai SSE is up 0.66%. Singapore Strait Times is up 0.19%. Japan 10-year JGB yield is up 0.029 at 0.726. Overnight, DOW fell -0.06%. S&P 500 fell -0.17%. NASDAQ fell -0.55%. 10-year yield fell -0.041 to 4.274.

BoJ’s Takata urges policy shift, time to exit ultra-accommodative stance

In a significant speech today, BoJ board member Hajime Takata emphasized the need for a “nimble and flexible response” to the nation’s monetary policy strategy, and called for the moves away from the current “extremely accommodative monetary policy”.

He outlined several measures for consideration, including exiting yield curve control, moving away from negative interest rates, and revising the BoJ’s commitment to expanding its monetary base until inflation consistently exceeds the 2% target.

Takata’s remarks come at a time when Japan appears to be on the cusp of meeting its long-sought-after inflation target of 2%. He noted, “While there are some economic uncertainties, I feel that we’re finally seeing prospects for achieving our 2% inflation target.”

Furthermore, Takata highlighted the positive momentum in spring wage negotiations, with many companies proposing wage hikes surpassing those of 2023. This trend towards higher wages, coupled with the corporate sector’s growing resilience to yield increases upon the exit of current monetary policies, underscores a strengthening economic foundation.

Japan faces steepest industrial decline in nearly four years, -7.5% mom drop in Jan

Japan’s industrial production faced a significant downturn in January, recording a -7.5% mom decline in production, marking the sharpest drop since May 2020. This downturn was slightly more severe than the anticipated -7.3% mom, with a widespread decrease across 14 of the 15 surveyed industries. Motor vehicles sector experienced the most substantial fall, plummeting by -17.8% mom, driven by declines in regular passenger cars and electrical drive systems.

Manufacturers remain somewhat optimistic, anticipating a rebound with of 4.8% in output for February and a further 2.0% rise in March, as surveyed by the Ministry of Economy, Trade and Industry. However, these forecasted gains are deemed insufficient by METI officials to fully counterbalance the steep January decline.

In contrast to the industrial sector’s struggles, Japan’s retail sales presented a brighter picture, rising 2.3% yoy in January, surpassing the expected 2.0% increase.

RBNZ’s Orr confident on bringing down inflation, highlights global risks

RBNZ to said in a conversation with Radio New Zealand that the central bank RBNZ’s very confident on returning inflation to target band of 1%-3% by the second half of 2024, with a goal to hit near 2% midpoint in 2025.

Highlighting the broader context, Orr pointed out that key risks to this positive outlook are mostly global. Domestic economy aligns with RBNZ’s expectations. Orr noted the current “subdued spending” and “declined” inflation levels as outcomes of the existing monetary policy settings and trade conditions.

Later in the day, Orr told a parliamentary committee the importance of “retaining a restrictive stance with the official cash rate,” as a pivotal factor for ensuring the forecasted return to target inflation levels.

NZ ANZ business confidence falls to 34.7, patchy economy

New Zealand ANZ Business Confidence fell from 36.6 to 34.7 in February. Own activity outlook rose from 25.6 to 29.5. Inflation expectations fell from 4.28% to 4.03%. Pricing intentions eased from 50% to 48%, continuing their sideways trend of recent months. Cost expectations fell from 75.6 to 73.5. Wages expectation fell from 81.4 to 78.9.

ANZ’s describes the economy as “patchy,” with visible “green shoots” in some sectors, yet acknowledges the “ongoing challenges” facing other segments. The survey does not imply the “economy is rolling over” or that “inflation has been beaten”.

Australia’s retail sales rises 1.1% mom in Jan, stagnates in trend terms

Australia’s retail sales rose 1.1% mom in January, below expectation of 1.7% mom. This increase marks a recovery from December’s significant -2.1% mom decline, where consumer spending retracted following the Black Friday sales rush in November.

According to Ben Dorber, ABS head of retail statistics, retail turnover has effectively returned to the levels observed in September 2023. Additionally, “retail turnover was unchanged in trend terms in January,” indicating that, despite the month’s positive performance, the broader trend reflects a period of stagnation in retail sales when considering the volatility of the past few months.

Fed’s Williams labels three rate cuts this year a reasonable starting point

In an event overnight, New York Fed President John Williams provided said the economy remains robust, with expectations for continued positive growth and a gradual decrease in inflation. His asserted that three rate cuts within the year could serve as a “reasonable starting point”.

Williams highlighted the significant decline in inflation over the past year and a half, emphasizing the “broad-based” reductions across various components of inflation measurements. Despite the positive trend, Williams candidly acknowledged “we still have a ways to go on the journey to sustained 2% inflation.”

Fed’s Collins methodical, forward-looking approach to rate cuts

Boston Fed President Susan Collins suggested that it may become “appropriate to begin easing policy later this year,” highlighting the importance of a “methodical, forward-looking approach” to gradually reduce rates.

Collins anticipated further inflation deceleration would might necessitate further slowdown in economic activity. However, she noted the “considerable uncertainty” surrounding the magnitude and timing of this slowdown. The path ahead, as Collins notes, is expected to be “bumpy,” as suggested by hotter-than-expected employment and price increase readings.

In this context, it will be important to focus on seeking “sustained, broadening signs” of progress towards its dual mandate goals, acknowledging that such progress may unfold unevenly. Collins cautions against setting overly stringent expectations for the data, indicating that “expecting all data to speak uniformly is too high a bar.”

ECB’s Nagel eyes next week’s economic projections as important policy milestone

Bundesbank President Joachim Nagel highlighted the critical need for “reliable data on wage developments” before commencing rate cuts. With ECB’s updated economic projections on the horizon next week, Nagel described the forthcoming report as an “important milestone”.

Nagel took a moment to reflect on the successes achieved through current policy in reducing inflation. However, he was quick to caution against complacency, emphasizing “we can’t make any mistakes in the final stretch of the journey.”

His warning against premature rate cuts was stark, labeling such a move as “fatal.” Nagel’s concern is that an ill-timed easing of monetary policy could lead to a resurgence of inflation, thereby damaging the ECB’s credibility and triggering financial market instability.

Looking ahead

European session will feature retail sales, CPI flash and unemployment from Germany, consumer spending and GDP revision from France, GDP and KOF economic barometer from Swiss, M4 money supply and mortgage approvals from UK.

Later in the day, Canada will release GDP. US will release personal income and spending, PCE inflation, jobless claims, Chicago PMI and pending home sales.

USD/JPY Daily Outlook

Daily Pivots: (S1) 150.43; (P) 150.64; (R1) 150.91; More…

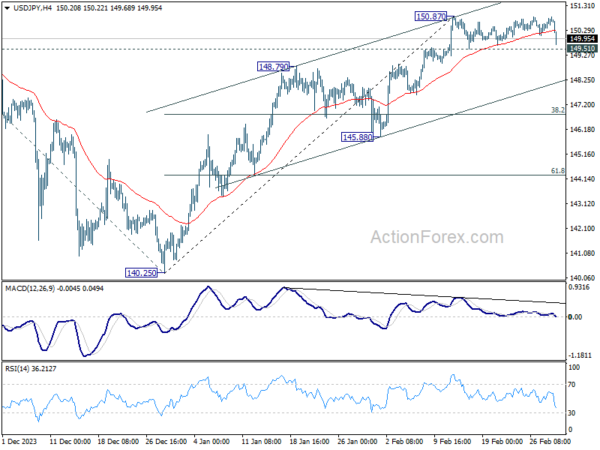

USD/JPY falls notably today but stays above 149.51 minor support. Intraday bias remains neutral first. Considering bearish divergence condition in 4H MACD, firm break of 149.51 should confirm short term topping at 150.87. Intraday bias will then be back on the downside for channel support (now at 148.04), even as a corrective move. On the upside, though, break of 150.87 will resume the rally from 140.25 to retest 151.89/93 key resistance zone.

In the bigger picture, rise from 140.25 is seen as resuming the trend from 127.20 (2023 low). Decisive break of 151.89/.93 resistance zone will confirm this bullish case and target 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. However, break of 148.79 resistance turned support will delay this bullish case, and extend the corrective pattern from 151.89 with another falling leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Jan P | -7.50% | -7.30% | 1.40% | |

| 23:50 | JPY | Retail Trade Y/Y Jan | 2.30% | 2.00% | 2.30% | |

| 00:00 | NZD | ANZ Business Confidence Feb | 34.7 | 36.6 | ||

| 00:30 | AUD | Retail Sales M/M Jan | 1.10% | 1.70% | -2.70% | -2.10% |

| 00:30 | AUD | Private Sector Credit M/M Jan | 0.40% | 0.40% | 0.40% | |

| 00:30 | AUD | Private Capital Expenditure Q4 | 0.80% | 0.40% | 0.60% | 0.30% |

| 05:00 | JPY | Housing Starts Y/Y Jan | -7.50% | -7.50% | -4.00% | |

| 07:00 | EUR | Germany Retail Sales M/M Jan | 0.50% | -1.60% | ||

| 07:45 | EUR | France GDP Q/Q Q4 | 0.00% | 0.00% | ||

| 08:00 | CHF | KOF Economic Barometer Feb | 102 | 101.5 | ||

| 08:00 | CHF | GDP Q/Q Q4 | 0.20% | 0.30% | ||

| 08:55 | EUR | Germany Unemployment Change Feb | 10K | -2K | ||

| 08:55 | EUR | Germany Unemployment Rate Feb | 5.80% | 5.80% | ||

| 09:30 | GBP | M4 Money Supply M/M Jan | 0.30% | 0.50% | ||

| 13:00 | EUR | Germany CPI M/M Feb P | 0.50% | 0.20% | ||

| 13:00 | EUR | Germany CPI Y/Y Feb P | 2.60% | 2.90% | ||

| 13:30 | CAD | GDP M/M Dec | 0.20% | 0.20% | ||

| 13:30 | USD | Personal Income M/M Jan | 0.50% | 0.30% | ||

| 13:30 | USD | Personal Spending Jan | 0.20% | 0.70% | ||

| 13:30 | USD | PCE Price Index M/M Jan | 0.30% | 0.20% | ||

| 13:30 | USD | PCE Price Index Y/Y Jan | 2.40% | 2.60% | ||

| 13:30 | USD | Core PCE Price Index M/M Jan | 0.40% | 0.20% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Jan | 2.80% | 2.90% | ||

| 13:30 | USD | Initial Jobless Claims (Feb 23) | 210K | 201K | ||

| 14:45 | USD | Chicago PMI Feb | 47.9 | 46 | ||

| 15:00 | USD | Pending Home Sales M/M Jan | 1.00% | 8.30% | ||

| 15:30 | USD | Natural Gas Storage | -86B | -60B |