GBP/USD trades thin on Wednesday as markets wait for a push

- Pound Sterling stubbornly stuck to Wednesday’s opening range.

- A smattering of UK data sparked some volatility, but little movement.

- US Retail Sales and PPE figures in the barrel for Wednesday.

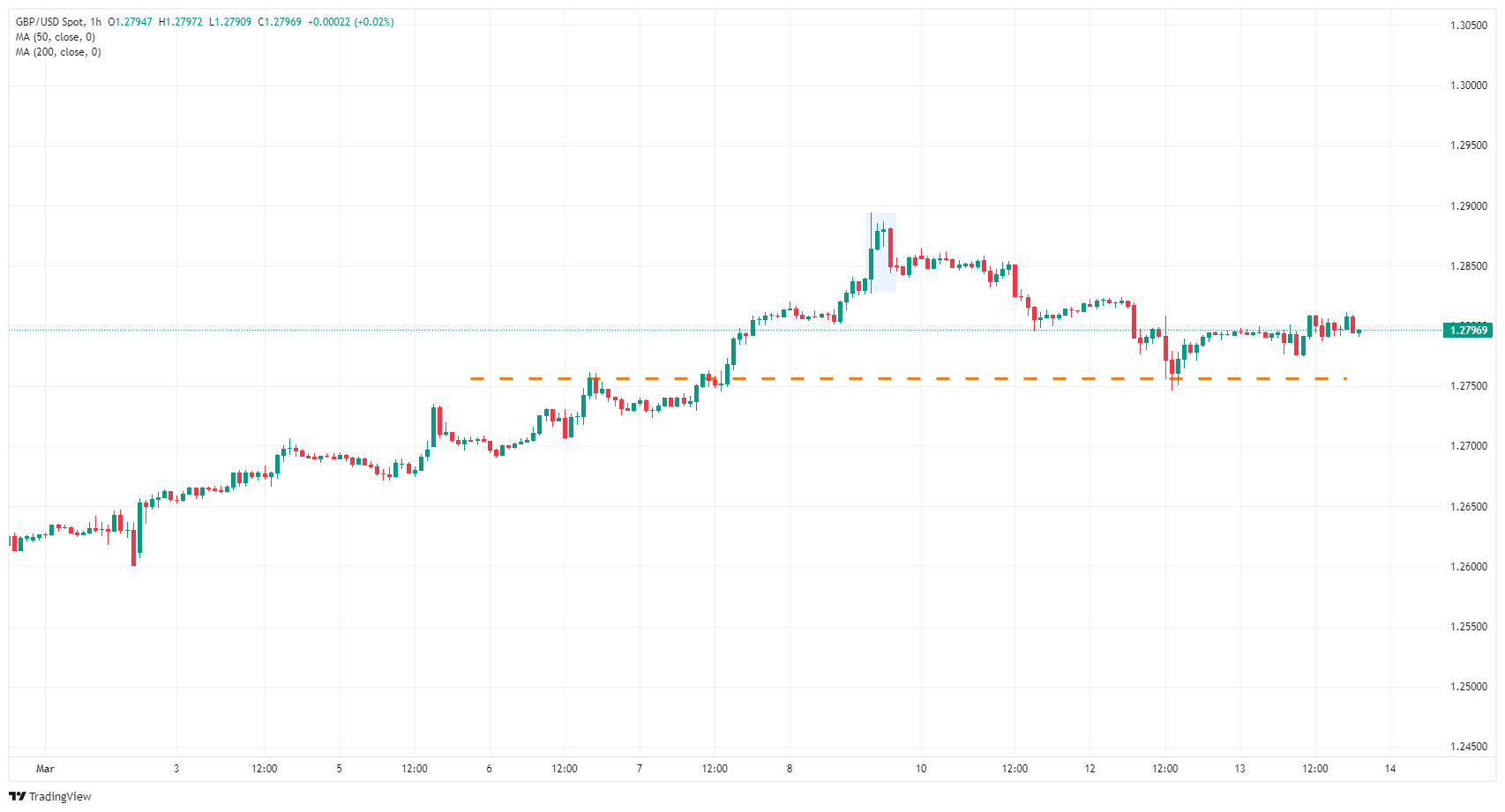

GBP/USD found some volatility on Wednesday, but overall directional momentum remains limited with the pair rangebound and pinned close to the day’s opening range near 1.2790. Technicals are struggling to push into either side of the 1.2800 handle in the midweek trading session, and investors are awaiting a spark in the data.

UK Industrial Production fell to -0.2% in January after December’s 0.6% print, missing the forecast flat print of 0.0%. UK MoM Manufacturing Production also declined, coming in at the expected 0.0% compared to the previous 0.8%. UK Gross Domestic Product (GDP) in January also met expectations, printing at 0.2% versus the previous -0.1%.

A thin showing for US data on Wednesday leaves investors waiting for Thursday’s Retail Sales and Producer Price Index (PPI) numbers. US Retail Sales are expected to rebound in February, with the median market forecast calling for a 0.8% print after January’s -0.8% decline. Meanwhile, February’s Core YoY PPI through February is expected to ease slightly, forecast to print at 1.9% compared to the previous 2.0%.

The trading week will wrap up with the University of Michigan’s Consumer Sentiment Index, which is broadly expected to hold steady at 76.9. Before that, mid-tier consumer inflation expectations from the UK will be seen early Friday during the London market session. At least read, UK consumers expected UK inflation to land somewhere around 3.3% for the following 12 months.

GBP/USD technical outlook

GBP/USD is cycling into the midweek, churning into the midrange as the pair grapples with an inflection point priced in just above 1.2750. Hourly candles have dropped a potential break of character just below the 1.2900 handle, and near-term action is set to consolidate until the stronger pattern emerges.

Daily candles are draining back into a heavy supply zone after a six-day bull run promptly ended this week, with the pair failing to capture to 1.2900. Consolidation plagues GBP/USD in the medium-term, and a bullish bounce from the 200-day Simple Moving Average (SMA) at 1.2590 is seeing limited topside momentum.