Canadian Dollar Dives on CPI Surprise, Market Eyes Earlier BoC Rate Cut – Action Forex

Canadian Dollar falls sharply in early US session, triggered by an unexpected decline in Canada’s headline CPI and a more significant than anticipated slowdown in core inflation measures. This trend of disinflation is likely to reassure BoC that its efforts to curb inflation are bearing fruit, possibly at a quicker pace than initially projected. The fresh data has fueled market speculation that BoC might advance its timeline for rate cuts to the second quarter of the year, rather than in the third quarter.

Meanwhile, Yen is trading as the day’s weakest performer, facing steeper sell-off following BoJ’s landmark decision to hike interest rates for the first time in 17 years. The market’s reaction suggests a perception that, despite its symbolic significance, this rate hike could be a one-off event within the context of a broader overhaul of the monetary policy framework, rather than marking the beginning of a consistent tightening cycle. The Australian Dollar ranks as the second weakest, reflecting investor perception of a less hawkish statement from RBA than some had anticipated.

Conversely, Swiss Franc outperformed as the day’s strongest currency, followed closely by Dollar and then Euro. It’s important to note, however, that Franc’s rise is more indicative of a recovery from key support levels against Dollar, Euro, and Sterling, rather than a signal of intrinsic strength.

Technically, GBP/CHF retreated after hitting cluster projection zone at around 1.13 (61.8% projection of 1.0893 to 1.1182 from 1.1114 at 1.1293 and 100% projection of 1.0634 to 1.0893 from 1.1058 at 1.1317).

Considering persistent bearish divergence condition in 4H MACD, there is prospect for the cross to top at this level. Break of 1.1192 support will indicate that it has started a correction to the rally from 1.0634. Nevertheless, decisive break of this 1.13 resistance zone could prompt upside acceleration to next resistance level at 1.15.

With BoE and SNB rate decisions looming on Thursday, the direction of GBP/CHF will soon become clearer.

In Europe, at the time of writing, FTSE is down -0.18%. DAX is up 0.21%. CAC is up 0.46%. UK 10-year yield is down -0.0519 at 4.142. Germany 10-year yield is down -0.023 at 2.438. Earlier in Asia, Nikkei rose 0.66%. Hong Kong HSI fell -1.24%. China Shanghai SSE fell -0.72%. Singapore Strait Times rose 0.05%. Japan 10-year JGB yield fell -0.0315 to 0.732.

Canadian CPI cools to 2.8% yoy in Feb, below expectations

Canada’s CPI decelerated in February, registering an increase of 2.8% yoy, which fell short of anticipated 3.1% yoy. This slowdown from January’s 2.9% yoy offers a glimmer of relief as inflationary pressures show signs of easing. When gasoline prices are excluded, CPI was down from 3.2% yoy to 2.9% yoy. Gasoline prices themselves saw a modest uptick of 0.8% yoy, a notable recovery from -4.0% yoy decrease observed in the previous month.

The more specific measures of inflation, which provide a clearer view of underlying trends, also reflected a cooling trend. CPI median, a measure that provides a middle ground by excluding extreme fluctuations, slowed from 3.3% yoy to 3.1% yoy, coming in below the expected 3.3%. Similarly, CPI trimmed, which removes the most volatile components, decreased from 3.4% yoy to 3.2% yoy. Lastly, CPI common, often regarded as a core measure that tracks common price changes across categories, decelerated from 3.4% yoy to 3.1% yoy, again missing the forecast of 3.4%.

ECB’s de Guindos and de Cos eye June for rate cut

ECB Vice President Luis de Guindos emphasized the bank’s expectation of having “far more data” by June, which will be crucial for evaluating the appropriateness of a rate reduction.

De Guindos also noted the current market optimism for a “soft landing” and the continued decrease in inflation. However, he warned “there could be a different situation that leads to an abrupt adjustment.”

At the same event in Madrid, Governing Council member Pablo Hernandez de Cos conveyed a similar sentiment, suggesting that, based on current expectations and if macroeconomic and inflation forecasts hold, rate cuts could commence as early as June.

However, de Cos was careful to clarify that this projection does not constitute “explicit monetary policy guidance” but rather but rather “guidance that is conditioned by the evolution of data and how they can surprise us in one direction or another.”

German ZEW surges to 31.7 on ECB rate cut anticipation

German ZEW Economic Sentiment rose sharply from 19.9 to 31.7 in March , well above expectation of 21.0. Current Situation Index ticked up slightly from -81.7 to -80.5, below expectation of -80.0.

Eurozone ZEW Economic Sentiment rose from 25.0 to 33.5, above expectation of 25.4. Current Situation Index fell -1.4 pts to -54.8.

ZEW President Professor Achim Wambach highlighted the “significantly improving” economic expectations for Germany. A key factor contributing to this optimism appears to be the widespread anticipation of an interest rate cut by ECB “in the next six months”, as expected by over 80% of survey participants.

Additionally, Wambach pointed out that the German export sector stands to benefit from “increased economic expectations for China “and the anticipated depreciation of Dollar against Euro.

Despite these positive developments in sentiment, Wambach cautioned that the assessment of the current economic situation remains at a very low level. “This development somewhat diminishes the increased economic expectations,” he added.

Swiss SECO lowers 2024 inflation forecasts sharply to 1.5%, keeps growth at 1.1%

The Swiss Federal Expert Group on Business Cycles maintained its expectation for modest GDP growth at 1.1% for 2024, with improvement to 1.7% in 2025. Uunemployment rate is projected to remain stable at 2.3% in 2024 before rising to 2.5% in 2025. Notably, inflation forecast for 2024 has been revised sharply down to 1.5% from an earlier estimate of 1.9%, and is expected to slow to 1.1% in 2025.

The group also outlined risks to the Swiss economy, including geopolitical tensions in the Middle East and Ukraine, which could disrupt commodity markets. Prolonged period of restrictive international monetary policy may dampen global demand, impacting Switzerland’s recovery. Specific concerns were raised about Germany’s industrial slowdown and China’s economic cooling, which could affect Swiss foreign trade.

Conversely, there’s a possibility that the recovery could outpace expectations, especially if global inflation decreases faster than anticipated, boosting consumer purchasing power and leading to quicker monetary policy easing. This scenario would likely stimulate demand further.

BoJ ends YCC and negative rates as they have fulfilled their roles

In a landmark decision that marks a significant shift in Japan’s monetary policy, BoJ announced the termination of its Yield Curve Control framework and negative interest rate policy, signifying that these measures “have fulfilled their roles.”

This pivotal move is underpinned by BoJ’s assessment that a “virtuous cycle between wages and prices” has come in sight and that the long-standing 2% inflation target is on track to be “achieved in a sustainable and stable manner.”

Setting the overnight call rate to a range of 0-0.1%, the decision was reached with a majority vote of 7-2.

BoJ will continue its purchase of JGBs at “broadly the same amount as before,” ensuring a measure of stability in the bond market. This part of the decision was made with an 8-1 vote. Meanwhile, BoJ has pledged to “respond nimbly” in the event of a rapid rise in long-term interest rates

Additionally, BoJ has outlined plans to discontinue the purchase of ETFs and J-REITs, while the procurement of commercial paper and corporate bonds will be gradually reduced, aiming for discontinuation within approximately one year.

RBA stands pat, not ruling anything in or out

RBA has opted to maintain cash rate target unchanged at 4.35% today, aligning with broad market expectations. The central bank’s stance reflects a cautious approach, emphasizing the prevailing uncertainty in both the global and domestic economic environments. RBA’s declaration that the path of interest rates remains “uncertain” and that it is “not ruling anything in or out” underscores a flexible policy outlook, leaving the door open for rate adjustments in the future, including the possibility of further hikes.

On the inflation front, RBA acknowledges a moderating trend, consistent with its latest forecasts. This moderation is attributed primarily to slowdown in goods inflation. However, services inflation remains stubbornly high, and ism ode rating at a slower pace. Wages growth, a critical factor in the inflation equation, appears to have peaked.

Addressing the economic outlook, RBA paints a picture of significant uncertainty. Internationally, questions loom over China’s economic outlook and the broader impacts of geopolitical conflicts in Ukraine and the Middle East. Domestically, uncertainties pertain to the lag effects of monetary policy adjustments, firms’ pricing decisions, wages dynamics, and household consumption patterns.

USD/CAD Mid-Day Outlook

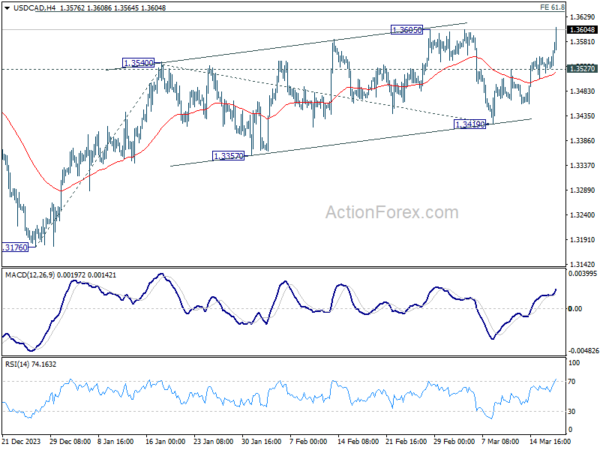

Daily Pivots: (S1) 1.3519; (P) 1.3536; (R1) 1.3550; More…

USD/CAD’s break of 1.3605 resistance suggests that whole rise from 1.3176 is resuming. Intraday bias is back on the upside for 61.8% projection of 1.3176 to 1.3540 from 1.3419 at 1.3644 first. Decisive break there could prompt upside acceleration to 100% projection at 1.3783 next. On the downside, below 1.3527 minor support will turn intraday bias neutral first. But outlook will stay bullish as long as 1.3419 support holds.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern only. In case of another fall, strong support should emerge above 1.2947 resistance turned support to bring rebound. Overall, larger up trend from 1.2005 (2021 low) is still expected to resume through 1.3976 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 03:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.35% | |

| 03:36 | JPY | BoJ Interest Rate Decision | 0.10% | 0.00% | -0.10% | |

| 04:30 | AUD | RBA Press Conference | ||||

| 04:30 | JPY | Industrial Production M/M Jan F | -6.70% | -7.50% | -7.50% | |

| 07:00 | CHF | Trade Balance (CHF) Feb | 3.66B | 3.50B | 4.74B | 4.70B |

| 08:00 | CHF | SECO Economic Forecasts | ||||

| 10:00 | EUR | Germany ZEW Economic Sentiment Mar | 31.7 | 21 | 19.9 | |

| 10:00 | EUR | Germany ZEW Current Situation Mar | -80.5 | -80 | -81.7 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Mar | 33.5 | 25.4 | 25 | |

| 12:30 | CAD | CPI M/M Feb | 0.30% | 0.60% | 0.00% | |

| 12:30 | CAD | CPI Y/Y Feb | 2.80% | 3.10% | 2.90% | |

| 12:30 | CAD | CPI Median Y/Y Feb | 3.10% | 3.30% | 3.30% | |

| 12:30 | CAD | CPI Trimmed Y/Y Feb | 3.20% | 3.40% | 3.40% | |

| 12:30 | CAD | CPI Common Y/Y Feb | 3.10% | 3.40% | 3.40% | |

| 12:30 | USD | Building Permits Feb | 1.52M | 1.50M | 1.47M | |

| 12:30 | USD | Housing Starts Feb | 1.52M | 1.43M | 1.33M |