Dollar Rebounds on Strong Employment Cost Data, Euro Supported by GDP and CPI Core – Action Forex

Dollar’s rebound is picking up momentum in early US session, bolstered by latest Employment Cost Index which rose by 1.2% in Q3, marking the fastest pace since Q3 2022. This unexpected acceleration in employment costs adds to a series of economic data that suggests the US economy remains hotter than preferred. Especially, persistently elevated services inflation and tight labor market are holding back Fed’s plan for interest rate cuts. With this economic backdrop, Fed Chair Jerome Powell is expected to temper market expectations tomorrow about the feasibility of three rate cuts this year, reinforcing the notion that Fed would maintain a more cautious approach to monetary policy easing.

Meanwhile, Euro also recovers slightly today, spurred by stronger than anticipated Q1 GDP growth combined with slower-than-expected decline in April’s CPI core. While these developments are unlikely to disrupt ECB’s tentative plans for June rate cut. The scenario of continued economic momentum and slowing disinflation would diminish the urgency for aggressive rate cuts by ECB, supporting a strategy of two rate reductions by the end of Q3 and Q4, respectively.

In the broader currency markets, New Zealand Dollar and Australian Dollar are underperforming today. Yen is also weak, reversing gains from yesterday’s rebound. Dollar leads as the strongest, followed by Euro and the Sterling. Swiss Franc and Canadian Dollar are in the middle. Though, Canadian Dollar shows signs of further weakness following disappointing GDP data, and could slide further in the currency rankings.

Technically, NZD/USD’s recovery from 0.5851 could have completed at 0.5983 already. Break of 0.5919 minor support will affirm this case, and argue that larger fall from 06368 is ready to resume through 0.5851 low. Employment data from New Zealand in the upcoming Asian session could be a key catalyst in determining whether a downward breakout occurs

In Europe, at the time of writing, FTSE is up 0.44%. DAX is down -0.65%. CAC is down -0.34%. UK 10-year yield is up 0.047 at 4.349. Germany 10-year yield is up 0.055 at 2.589. Earlier in Asian, Nikkei rose 1.24%. Hong Kong HSI rose 0.09%. China Shanghai SSE fell -0.26%. Singapore Strait Times rose 0.32%. Japan 10-year JGB yield closed flat at 0.874.

Canada’s GDP grows 0.2% mom in Feb, vs exp. 0.3% mom

Canada’s GDP grew 0.2% mom in February, below expectation of 0.3% mom. Services-producing industries (+0.2%) led the growth for a second month in a row. Goods-producing industries aggregate was essentially unchanged. Overall, 12 of 20 sectors increased in the month.

Advance information indicates that real GDP was essentially unchanged in March. That suggests the economy expanded 0.6% in the first quarter of 2024.

Eurozone GDP rises 0.3% qoq in Q1, above exp 0.1% qoq

Eurozone GDP grew 0.3% qoq, 0.4% yoy in Q1, better than expectation of 0.1% qoq, 0.2% yoy. EU GDP grew 0.3% qoq, 0.5% yoy.

Among the Member States for which data are available, Ireland (+1.1%) recorded the highest increase compared to the previous quarter, followed by Latvia, Lithuania and Hungary (all +0.8%). Sweden (-0.1%) was the only Member State that recorded a decrease. The year on year growth rates were positive for nine countries and negative for four.

Eurozone CPI unchanged at 2.4% in Apr, core CPI down to 2.7%

Eurozone CPI was unchanged at 2.4% yoy in April, matched expectations. CPI core (energy, food, alcohol & tobacco) slowed from 2.9% yoy to 2.7% yoy, above expectation of 2.6% yoy.

Looking at the main components of euro area inflation, services is expected to have the highest annual rate in April (3.7%, compared with 4.0% in March), followed by food, alcohol & tobacco (2.8%, compared with 2.6% in March), non-energy industrial goods (0.9%, compared with 1.1% in March) and energy (-0.6%, compared with -1.8% in March).

ECB’s de Cos: Rate cut appropriate in June if inflation outlook maintained

ECB Governing Council member Pablo Hernandez de Cos highlighted that despite the positive trend in declining inflation rates, outlook is clouded by rising energy costs, persistent high inflation in the services sector, and ongoing geopolitical tensions.

He expected that inflation would continue to decrease in the upcoming quarters, albeit at a slower pace than previously observed due to certain upward base effects.

“The ECB’s governing council considers that if this inflation outlook is maintained, it would be appropriate to start reducing the current level of monetary policy tightening in June.”

Swiss KOF rises to 101.8, stable economy, no strong boost in sight

Swiss KOF Economic Barometer rose from 100.4 to 101.8 in April, slightly above expectation of 101.7. This rise positions the barometer in a range that is slightly above average, suggesting a stable yet unspectacular outlook for Switzerland’s economy.

According to the KOF Economic Institute, “The Swiss economic development is robust, but there is currently no strong boost in sight.”

Overall economic outlook appears to be improving across several key sectors including financial and insurance services, manufacturing, and private consumption. Conversely, outlook for construction and hospitality industries presents a less optimistic picture.

Japan’s industrial production rises 3.8% mom in Mar, more growth ahead

Japan’s industrial sector showed a robust rebound in March, with production rising by 3.8% mom, surpassing expectations of a 3.4% increase. This significant uptick represents a strong recovery from the previous month’s -0.6% yoy decline.

Production of machinery, including semiconductor manufacturing equipment, jumped by 11.6% mom, while output in electronic parts and devices saw 9.2% mom increase.

According to manufacturers surveyed by Japan’s Ministry of Industry, the up trend in industrial output is expected to continue, with projections of a 4.1% rise in April and a further 4.4% expansion in May.

Contrastingly, the retail sector did not fare as well. Retail sales in March increased by only 1.2% yoy, falling short of 2.2% yoy growth anticipated and marking a deceleration from February’s robust 4.7% yoy increase. On a month-on-month basis, retail sales contracted -1.2%, reversing the 1.7% gain observed in February.

Australia’s retail sales falls -0.4% mom in Mar amid cost of living pressures

Australia’s retail sales fell -0.4% mom in March, well below expectation of 0.2% mom.

Ben Dorber, ABS head of retail statistics, highlighted the impact of cost of living pressures on consumer behavior.

He further noted the stagnation in the sector, stating, “Underlying retail turnover has been flat for the past six months and was up only 0.8 percent compared to March 2023.”

This represents one of the weakest growth rates on record for this period, excluding the unique economic circumstances induced by the pandemic and the introduction of GST.

New Zealand ANZ business confidence plunges to 14.9 amid rising costs and weak demand

ANZ Business Confidence dropped notably from 22.9 to 14.9 in April. Own Activity Outlook similarly decreased from 22.5 to 14.3.

The survey highlighted escalating cost pressures as a primary concern for businesses. Cost expectations rose from 74.6 to 76.7, marking the highest level since last September. Conversely, wage expectations decreased from 80.5 to 75.5. Profit expectations also worsened, deepening from -3.8 to -9.8.

Pricing intentions, which indicate how businesses plan to adjust their selling prices, increased slightly from 45.1 to 46.9. Inflation expectations showed a marginal decrease from 3.80% to 3.76%.

ANZ analysts pointed to several factors contributing to this environment of cost-push inflation amidst weak demand. Rising oil prices due to escalating tensions in the Middle East, coupled with recent decline in New Zealand Dollar have increased the cost of imports significantly. Additionally, the recent increase in the minimum wage, effective from April 1, although smaller than previous years, has added another layer of cost for businesses.

China’s NBS PMI manufacturing falls to 50.4, Caixin rises to 51.4

China’s NBS PMI Manufacturing fell from 50.8 to 50.4 in April, matched expectations. NBS PMI Non-Manufacturing fell from 53.0 to 51.2, below expectation of 52.2. PMI Composite fell from 52.7 to 51.7.

The breakdown of the manufacturing PMI reveals challenges in solidifying demand, as the new orders subindex dropped to 51.1 from 53, and the new export orders fell to 50.6 from 51.3. Conversely, the production subindex showed modest improvement, rising to 52.9 from 52.2.

Senior NBS statistician Zhao Qinghe noted, “Though economic activities continued to expand, more manufacturers are facing higher costs.” He highlighted specific industries such as automobiles and electrical machinery, where domestic and foreign market demands are reportedly strengthening.

In contrast, Caixin PMI, which focuses more on smaller, private manufacturing firms, presented a more optimistic view. Caixin Manufacturing PMI rose to 51.4 from 51.1, surpassing expectations of 51.0.

According to Wang Zhe, senior economist at Caixin Insight Group, “the manufacturing sector continued to improve, with accelerated expansion in supply and demand, sweetened by exceptional performance in overseas demand.”

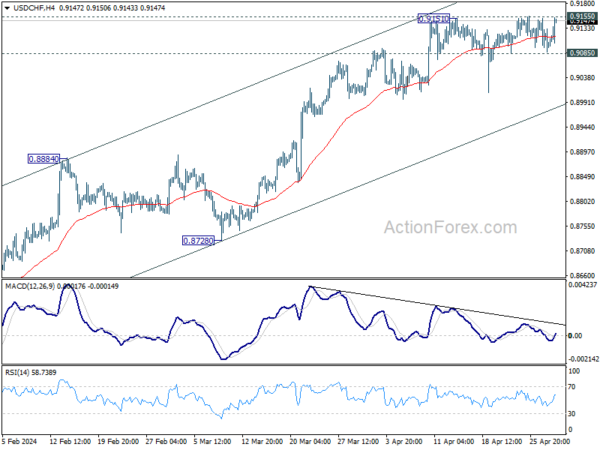

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9079; (P) 0.9116; (R1) 0.9143; More….

Intraday bias in USD/CHF remains neutral for the moment. On the upside, firm break of 0.9155 will resume the rally from 0.8332 and should target 0.9243 key resistance next. On the downside, break of 0.9085 will turn bias to the downside for deeper pullback.

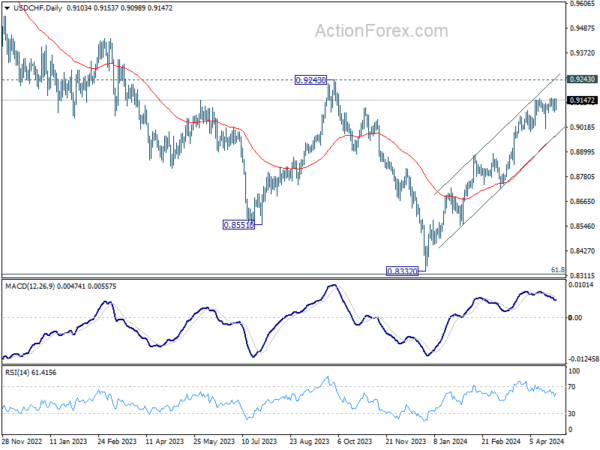

In the bigger picture, price actions from 0.8332 medium term bottom as tentatively seen as developing into a corrective pattern to the down trend from 1.0146 (2022 high). Further rise would be seen as long as 0.8884 resistance turned support holds. But upside should be limited by 0.9243 resistance, at least on first attempt. However, decisive break of 0.9243 will argue that the trend has already reversed and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Mar P | 3.80% | 3.40% | -0.60% | |

| 23:50 | JPY | Retail Trade Y/Y Mar | 1.20% | 2.20% | 4.70% | |

| 23:30 | JPY | Unemployment Rate Mar | 2.60% | 2.50% | 2.60% | |

| 01:00 | NZD | ANZ Business Confidence Apr | 14.9 | 22.9 | ||

| 01:30 | AUD | Retail Sales M/M Mar | -0.40% | 0.20% | 0.30% | |

| 01:30 | AUD | Private Sector Credit M/M Mar | 0.30% | 0.40% | 0.50% | |

| 01:30 | CNY | NBS Manufacturing PMI Apr | 50.4 | 50.4 | 50.8 | |

| 01:30 | CNY | NBS Non-Manufacturing PMI Apr | 51.2 | 52.2 | 53 | |

| 01:45 | CNY | Caixin Manufacturing PMI Apr | 51.4 | 51 | 51.1 | |

| 05:00 | JPY | Housing Starts Y/Y Mar | -12.80% | -7.60% | -8.20% | |

| 05:30 | EUR | France Consumer Spending M/M Mar | 0.40% | 0.10% | 0.00% | |

| 05:30 | EUR | France GDP Q/Q Q1 P | 0.20% | 0.20% | 0.10% | |

| 06:00 | EUR | Germany Import Price Index M/M Mar | 0.40% | 0.10% | -0.20% | |

| 06:00 | EUR | Germany Retail Sales M/M Mar | 1.80% | 1.30% | -1.90% | |

| 07:00 | CHF | KOF Leading Indicator Apr | 101.8 | 101.7 | 101.5 | 100.4 |

| 07:55 | EUR | Germany Unemployment Change Apr | 10K | 7K | 4K | |

| 07:55 | EUR | Germany Unemployment Rate Apr | 5.90% | 5.90% | 5.90% | |

| 08:00 | EUR | Italy GDP Q/Q Q1 P | 0.30% | 0.20% | 0.20% | |

| 08:00 | EUR | Germany GDP Q/Q Q1 P | 0.20% | 0.10% | -0.30% | |

| 08:30 | GBP | M4 Money Supply M/M Mar | 0.70% | 0.40% | 0.50% | 0.60% |

| 08:30 | GBP | Mortgage Approvals Mar | 61K | 61K | 60K | |

| 09:00 | EUR | Eurozone GDP Q/Q Q1 P | 0.30% | 0.10% | 0.00% | |

| 09:00 | EUR | Eurozone CPI Y/Y Apr P | 2.40% | 2.40% | 2.40% | |

| 09:00 | EUR | Eurozone CPI CoreY/Y Apr P | 2.70% | 2.60% | 2.90% | |

| 12:30 | CAD | GDP M/M Feb | 0.20% | 0.30% | 0.60% | 0.50% |

| 12:30 | USD | Employment Cost Index Q1 | 1.20% | 1.00% | 0.90% | |

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Feb | 7.30% | 6.70% | 6.60% | |

| 13:00 | USD | Housing Price Index M/M Feb | 1.20% | 0.10% | -0.10% | |

| 13:45 | USD | Chicago PMI Apr | 45.2 | 41.4 | ||

| 14:00 | USD | Consumer Confidence Apr | 104 | 104.7 |