Mexican Peso trades higher in run up to Banxico meeting

- The Mexican Peso is edging higher ahead of the Banxico meeting on Thursday.

- Mexican April inflation data out on the same day could also cause volatility.

- Analysts at Trium Capital believe there is a higher chance of an interest-rate cut than markets are pricing in.

The Mexican Peso (MXN) fluctuates higher on Tuesday in the run up to a “super” Thursday for the Peso when key inflation data and the Bank of Mexico (Banxico) policy meeting decision are scheduled.

The positive market sentiment of the last few days, a factor benefiting the risk-sensitive Peso, finally unwinds with Asian stocks rounding out their session broadly lower.

On the geopolitical front, sentiment improves after Hamas agrees to a ceasefire with Israel but then quickly sours on the news Israeli units have moved into the Southern Gazan city of Rafah.

USD/MXN is trading at 16.85, EUR/MXN at 18.16 and GBP/MXN at 21.15, at the time of publication.

Mexican Peso trades with low volatility ahead of key events

The Mexican Peso trades slightly higher in key pairs ahead of Mexican April inflation data and the Banxico meeting on Thursday, with both events having the potential to cause volatility for MXN.

Both the headline and core inflation rates are scheduled for release on Thursday at 12:00 GMT. Headline Inflation is expected to show a higher 4.63% reading year-over-year but a slower 0.18% monthly rise.

The core inflation rate is forecast to decline to 4.40% YoY and 0.24% MoM.

If either comes out higher than expected, but especially core inflation – which is thought to be more accurate – the Mexican Peso could gain strength. Higher levels of inflation will force Banxico to keep interest rates at their current elevated levels for longer, and higher interest rates attract greater capital inflows.

Banxico meeting – a surprise cut?

The Banxico will hold its May policy meeting on Thursday at 19:00 GMT. Given the hawkish minutes of the March meeting, the bank’s commitment to a data-dependent approach and the relatively robust economic data of recent months, the consensus expectation is for Banxico to keep the policy rate unchanged at 11.0%.

According to Trium Capital, however, even if Banxico does not make an interest rate cut in May, it probably will soon after. The thrust of their argument is based on two key points. The first is that high interest rates are slowing down the GDP growth rate and economic activity in Mexico substantially.

“The case for cuts is supported by slowing economic activity. The monthly economic activity indicator surprised to the upside for February with 1.38% MoM compared to a 0.50% analyst expectation, but that comes after four consecutive negative prints since October,” says Javier Basabe, an analyst at Trium Capital.

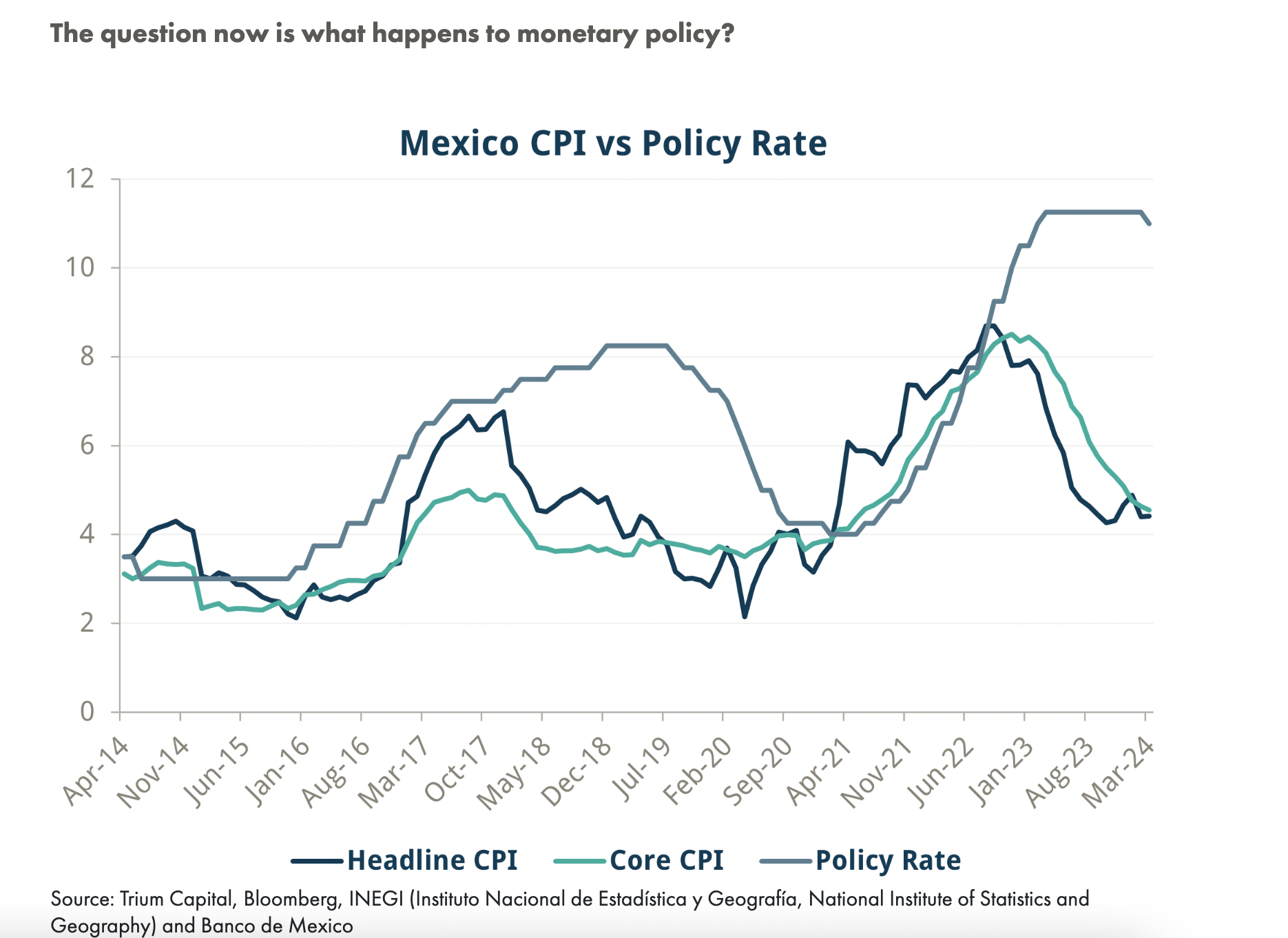

Secondly, the Consumer Price Index (CPI) over the long run has diverged so far away from the Banxico’s policy rate that this is increasing the likelihood of cuts. Additionally, it has pushed bond markets to extremes, making a mean reversion increasingly likely.

“In our opinion, the argument about the hawkish Banxico minutes is misplaced. Could it mean this is not the start of a cycle, and that rates might be held at the May meeting? Sure. Is it all that relevant? We would argue not. This growth slowdown is also happening with a record deficit and very high spending which is projected to be reduced next year, further dampening growth. If Banxico does keep rates on hold in May, there will still be more cuts to come,” says Basabe.

Technical Analysis: USD/MXN on the floor of short-term range

USD/MXN – the cost of one US Dollar in Mexican Pesos – creeps along the bottom of its short-term range. The pair has been oscillating between a floor at 16.86 and a ceiling at 17.40 since the April 19 highs.

USD/MXN 4-hour Chart

The short-term trend is sideways, and given the old trading maxim that the “trend is your friend”, this is expected to continue.

Despite several attempts to break below the range floor, bearish pressure was insufficient and prices recovered back inside the range.

There is an overall bearish backdrop, however, given that the medium and long-term trends are both down and these bigger currents influence the shorter-term perspective.

A rise back up within the range is expected that could take the USD/MXN up to the 50 Simple Moving Average (SMA) on the 4-hour chart at 17.06, followed by the lower high at 17.15. A clear break above the zone of resistance around 17.15-17.18 might see further gains up towards the range highs again.

A decisive breakout of the range – either below the floor at 16.86, or the ceiling at 17.40 – would change the directional bias of the pair.

A break below the floor could see further downside to a target at 16.50, followed by the April 9 low at 16.26.

On the other side, a break above the top would activate an upside target first at 17.67, piercing a long-term trendline and then possibly reaching a further target at around 18.15.

A decisive break would be one characterized by a longer-than-average green or red daily candlestick that pierces above or below the range high or low, and that closes near its high or low for the period; or three green/red candlesticks in a row that pierce above/below the respective levels.

Banxico FAQs

The Bank of Mexico, also known as Banxico, is the country’s central bank. Its mission is to preserve the value of Mexico’s currency, the Mexican Peso (MXN), and to set the monetary policy. To this end, its main objective is to maintain low and stable inflation within target levels – at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%.

The main tool of the Banxico to guide monetary policy is by setting interest rates. When inflation is above target, the bank will attempt to tame it by raising rates, making it more expensive for households and businesses to borrow money and thus cooling the economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN. The rate differential with the USD, or how the Banxico is expected to set interest rates compared with the US Federal Reserve (Fed), is a key factor.

Banxico meets eight times a year, and its monetary policy is greatly influenced by decisions of the US Federal Reserve (Fed). Therefore, the central bank’s decision-making committee usually gathers a week after the Fed. In doing so, Banxico reacts and sometimes anticipates monetary policy measures set by the Federal Reserve. For example, after the Covid-19 pandemic, before the Fed raised rates, Banxico did it first in an attempt to diminish the chances of a substantial depreciation of the Mexican Peso (MXN) and to prevent capital outflows that could destabilize the country.