Subdued Trading Continues as Markets Shrug US ADP Disappointment – Action Forex

Trading in the forex markets is subdued US session gets underway, with weaker-than-expected U.S. ADP private job data failing to stir significant movement in the Dollar. Despite the slowdown in job gains and pay growth, the job market remains robust. US futures are pointing to a flat open, and the 10-year yield is down slightly. Market focus is now shifting towards the upcoming US ISM Services data and BoC’s rate decision.

For the week, the Franc stands out as the strongest performer at this point, significantly outpacing other currencies. The second placed Japanese Yen is seeing some reversal of its gains from yesterday. New Zealand Dollar holds its position as the third strongest, in stark contrast to Canadian and Australian Dollars, which are among the weakest. Dollar, Euro, and Sterling are exhibiting mixed performances, with the Greenback trending slightly softer.

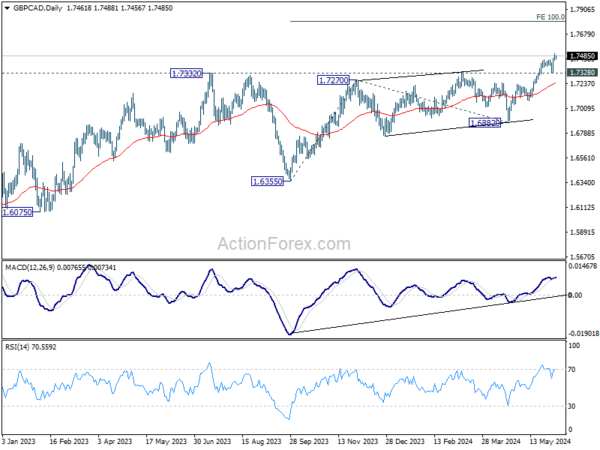

Technically, GBP/CAD’s up trend resumed this week and edged higher to 1.7504. While some volatility might be seen today, near term outlook will stay bullish as long as 1.7328 support holds. Current rise should continue to 100% projection of 1.6355 to 1.7270 from 1.6882 at 1.7797.

In Europe, at the time of writing, FTSE is up 0.50%. DAX Is up 1.15%. CAC is up 1.19%. UK 10-year yield is up 0.004 at 4.186. Germany 10-year yield is down -0.0153 at 2.521. Earlier in Asia, Nikkei fell -0.89%. Hong Kong HSI fell -0.10%. China Shanghai fell -0.83%. Singapore Strait Times fell -0.27%. Japan 10-year JGB yield fell -0.0323 to 1..005.

US ADP employment roses 152k, below expectation 175k

US ADP private employment grew 1252k in May, below expectation of 175k increase. By sector, goods-producing jobs rose 3k while services-providing jobs rose 149k. By establishment size, small companies lose -10k jobs. Medium companies added 79k while large companies added 98k.

Pay gains for job-stayers held steady for the third month at 5.0% yoy. Meanwhile, for job-changes, median change in annual pay was at 7.8% yoy.

“Job gains and pay growth are slowing going into the second half of the year,” said Nela Richardson, chief economist, ADP. “The labor market is solid, but we’re monitoring notable pockets of weakness tied to both producers and consumers.”

Eurozone PPI down -1.0% mom, -5.7% yoy in Apr

Eurozone PPI fell -1.0% mom in April, below expectation of -0.5% mom. Over the 12-month period, PPI fell -5.7% yoy. For the month, industrial producer prices increased by 0.3% for intermediate goods, 0.2% for capital goods, 0.2% for durable consumer goods, 0.1% for non-durable consumer goods. PPI decreased by -3.6% for energy.

EU PPI fell -0.1% mom, -5.5% yoy. The largest monthly decreases in industrial producer prices were recorded in France (-3.6%), Croatia (-1.9%) and Greece (-1.8%). The highest increases were observed in Denmark (+2.8%), Ireland (+0.8%) and Finland (+0.3%).

Eurozone PMI composite finalized at 52.2, a 12-month high

Eurozone PMI Services was finalized at 53.2 in May, slightly down from April’s 53.3. PMI Composite was finalized at 52.2, up from prior month’s 51.7, a 12-month high. Also, business confidence surged to 27-month high. Inflation rates cooled but remained above pre-pandemic averages.

A closer look at individual countries reveals varying levels of economic activity. Spain leads with a robust Composite PMI of 56.6, marking a 14-month high. Germany follows with a Composite PMI of 52.4 and hitting a 12-month peak. Conversely, Italy’s PMI dipped to a three-month low of 52.3, and France lagged with a Composite PMI of 48.9 and marking a two-month low.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, commented on the broader implications of these figures: “The spectre of recession is off the table.” He highlighted the crucial role of the service sector in driving this positive shift, noting, “In Germany, we can now talk of an upward trend, Italy’s business activity remains solid, and Spain has improved from an already strong position.” However, he also acknowledged the challenges facing France, which has seen a recent dip in economic performance.

UK PMI services finalized at 52.9, expansion slows, price pressures ease

The latest PMI data from the UK indicates a deceleration in the service sector for May, with the Services PMI dropping to 52.9 from April’s 55.0, marking the slowest growth rate since November. The Composite PMI, which aggregates both services and manufacturing, also experienced a downturn, finishing at 53.0 compared to 54.1 the previous month.

Joe Hayes, Principal Economist at S&P Global Market Intelligence, provided insights into the broader implications of these figures, stating that the PMI survey reflected a “reasonable rate of expansion” in the UK service sector. Coupled with data from the manufacturing sector, the PMIs collectively suggest an approximate GDP growth of around 0.3% for the second quarter.

A significant development from the PMI surveys is the moderation in price increases for UK services, which have risen at the slowest pace in over three years. This marks the third consecutive month of diminishing selling price inflation in the service sector, a trend that will likely be welcomed by BoE. According to Hayes, this trend suggests that “the trajectory of services prices is moving in the right direction,” potentially easing concerns about persistent inflationary pressures.

Japan’s nominal labor earnings rise 2.1% yoy, real wages still declining

Japan’s nominal labor cash earnings increased by 2.1% yoy in April, surpassing the expected 1.7% and marking the 28th consecutive month of growth. Excluding bonuses and nonscheduled payments, average wages climbed by 2.3% yoy. However, overtime and other allowances were down by -0.6% yoy.

Despite the rise in nominal wages, real wages fell by -0.7% yoy, continuing a 25-month streak of declines, the longest on record. Nonetheless, the rate of decline was smaller than the revised -2.1% yoy drop in March, as many major companies implemented salary increases during the latest spring annual wage negotiations.

Japan’s PMI composite hits highest since August 2023

Japan’s PMI Services index was finalized at 53.8 in May, slightly lower than April’s 54.3. Meanwhile, PMI Composite index rose to 52.6 from 52.3 in April, marking its highest level since August 2023 and staying above 50 neutral mark for the fifth consecutive month.

Trevor Balchin, Economics Director at S&P Global Market Intelligence, noted that the Japanese service sector’s “strong upturn was sustained,” with only slight easing in growth rates for activity and new work. New export business expanded the most since this metric was introduced in September 2014. Both the future activity and employment indices increased since April and were among the highest on record.

Balchin also highlighted that while costs continued to rise sharply, the strong demand for services led firms to be confident in raising prices. In May, average prices charged for services increased at the third-fastest rate on record, following only April 2014 and April 2024.

RBA’s Bullock discusses plan A and two backups amid inflation concerns

RBA Governor Michele Bullock addressed a senate panel today, emphasizing the importance of controlling inflation despite balanced risks. She underscored the necessity of bringing inflation back down to the target band, warning that if inflation doesn’t appear to be heading in the right direction, “we’ll have to take action.”

In her elaboration on the RBA’s rate-setting approach, Bullock described a “Plan A,” which involves a data-driven methodology, keeping all options open without committing to a specific course of action prematurely. That is, RBA does “not rule anything in or out.”

She also outlined two contingency “Plan Bs” depending on economic developments: one for persistently high inflation, and another for a significant economic downturn.

“If it turns out that inflation is starting to head higher again or it’s much stickier then we won’t hesitate to move and raise interest rates again,” Bullock declared. Conversely, she noted that a weaker-than-expected economy would prompt considerations for easing rates to mitigate deflationary pressures.

Australia’s Q1 GDP rises 0.1% qoq, lowest annual growth since late 2020

Australia’s GDP grew by 0.1% qoq in Q1, below the anticipated 0.2% growth. On a year-over-year basis, GDP increased by 1.1%.

Katherine Keenan, head of national accounts at ABS, remarked that GDP growth was weak in March, marking the lowest annual growth rate since December 2020. She also highlighted that GDP per capita fell for the fifth consecutive quarter, declining by -0.4% in March and -1.3% over the past year.

China’s Caixin PMI services rises to 54, highest level since July 2023

China’s Caixin PMI Services index jumped from 52.5 to 54.0 in May, exceeding expectations of 52.6. This marks the 17th consecutive month of expansion and the highest reading since July 2023. Similarly, PMI Composite rose from 52.8 to 54.1, indicating expansion for the 7th straight month and at the fastest pace in a year.

Wang Zhe, Senior Economist at Caixin Insight Group, noted that growth in supply and demand in both the manufacturing and services sectors picked up pace, with a particularly strong increase in services demand. He mentioned that exports in both sectors improved amid market optimism. Additionally, employment in the services industry shifted from a decline to an increase, driving the composite index into expansion for the first time in nine months.

GBP/USD Mid-Day Outlook

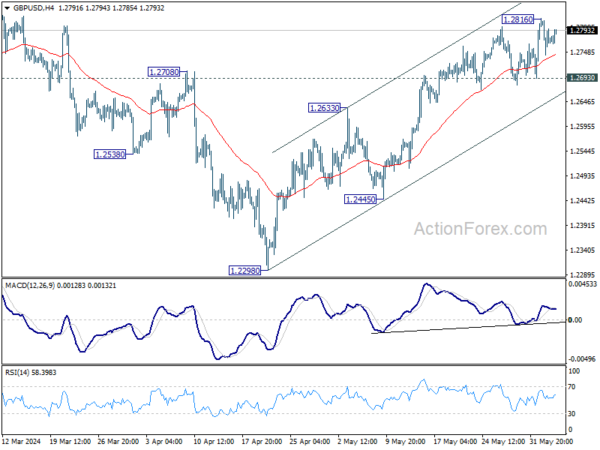

Daily Pivots: (S1) 1.2737; (P) 1.2777; (R1) 1.2810; More…..

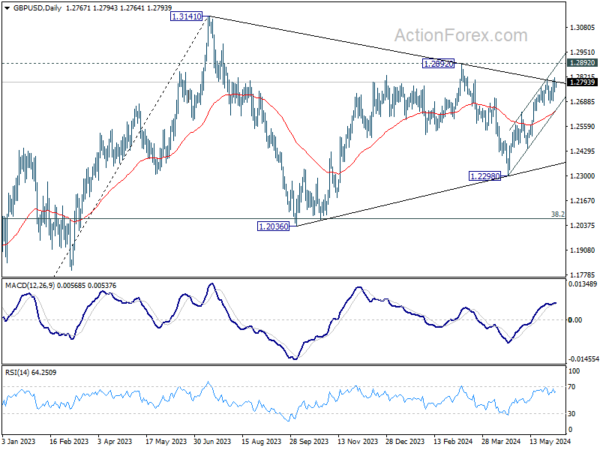

Range trading continues in GBP/USD and intraday bias stays neutral for the moment. Further rise is in favor as long as 1.2693 support holds. Above 1.2816 will resume the rally from 1.2298 to 1.2892 resistance next. On the downside, break of 1.2693 minor support will turn intraday bias to the downside for deeper pullback instead.

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern. Fall from 1.2892 is seen as the third leg which might have completed already. Break of 1.2892 resistance will argue that larger up trend from 1.0351(2022 low) is ready to resume through 1.3141. Meanwhile, break of 1.2445 support will extend the corrective pattern with another decline instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q1 | 5.10% | 2.80% | -7.80% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | 2.10% | 1.70% | 0.60% | 1.00% |

| 00:30 | JPY | Services PMI May F | 53.8 | 53.6 | 53.6 | |

| 01:30 | AUD | GDP Q/Q Q1 | 0.10% | 0.20% | 0.20% | 0.30% |

| 01:45 | CNY | Caixin Services PMI May | 54 | 52.6 | 52.5 | |

| 06:45 | EUR | France Industrial Output M/M Apr | 0.50% | 0.50% | -0.30% | |

| 07:45 | EUR | Italy Services PMI May | 54.2 | 54.5 | 54.3 | |

| 07:50 | EUR | France Services PMI May F | 49.3 | 49.4 | 49.4 | |

| 07:55 | EUR | Germany Services PMI May F | 54.2 | 53.9 | 53.9 | |

| 08:00 | EUR | Eurozone Services PMI May F | 53.2 | 53.3 | 53.3 | |

| 08:30 | GBP | Services PMI May F | 52.9 | 52.9 | 52.9 | |

| 09:00 | EUR | Eurozone PPI M/M Apr | -1.00% | -0.50% | -0.40% | -0.50% |

| 09:00 | EUR | Eurozone PPI Y/Y Apr | -5.70% | -5.10% | -7.80% | |

| 12:15 | USD | ADP Employment Change May | 152K | 175K | 192K | 188K |

| 12:30 | CAD | Labor Productivity Q/Q Q1 | -0.30% | 0.40% | 0.40% | |

| 13:45 | CAD | BoC Interest Rate Decision | 4.75% | 5.00% | ||

| 13:45 | USD | Services PMI May F | 54.8 | 54.8 | ||

| 14:00 | USD | ISM Services PMI May | 51 | 49.4 | ||

| 14:30 | USD | Crude Oil Inventories | -2.1M | -4.2M |