Dollar Weakens after Mixed Data, Traders Turn Cautious – Action Forex

Dollar weakens broadly weakening in the early US session following the release of a batch of economic data. Durable goods orders presented a mixed bag. Concurrently, continuing claims for unemployment benefits rose to their highest level in more than two-and-a-half years. Despite these indicators, there is no immediate cause for alarm.

Instead, traders, observing the Dollar’s inability to extend its near-term rally against Euro, appear to be lightening up their positions ahead of the upcoming PCE inflation data tomorrow and the end of the first half. Adding to the cautious sentiment is the upcoming French parliamentary election on Sunday, which is contributing to market jitters. The potential political shake-up in France could have significant implications for the Eurozone, prompting traders to adopt a wait-and-see approach.

In the broader currency market, Swiss Franc and Canadian Dollar are following the greenback as the next weakest currencies for the day. New Zealand Dollar reversed its earlier losses to become the strongest currency. Euro and the Australian Dollar are also showing strength, while British Pound and Japanese Yen are mixed in performance. Despite heightened verbal intervention by Japanese officials, Yen remains hesitant to stage a meaningful rebound.

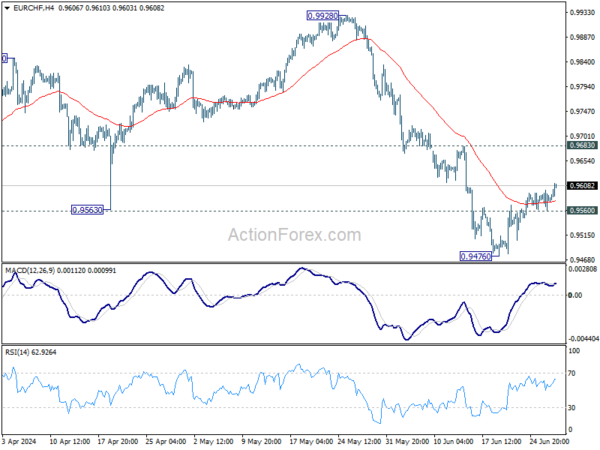

A key pair to monitor is EUR/CHF as the French election looms. While recovery from 0.9476 might extend, near term outlook will continue to stay bearish as long as 0.9683 resistance holds. Break of 0.9560 minor support will now argue that the recovery has already completed. Retest of 0.9476 should be seen next, and break there will resume the decline from 0.9928.

In Europe, at the time of writing, FTSE is down -0.09%. DAX is up 0.24%. CAC is down -0.60%. UK 10-year yield is down -0.0079 at 4.131. Germany 10-year yield is up 0.008 at 2.461. Earlier in Asia, Nikkei fell -0.82%. Hong Kong HSI fell -2.06%. China Shanghai SSE fell -0.90%. Singapore Strait Times rose 0.35%. Japan 10-year JGB yield rose 0.0491 to 1.074.

US durable goods orders rise 0.1% mom, ex-transport orders down -0.1% mom

US durable goods orders rose 0.1% mom to USD 283.1B in May, above expectation of -0.1% mom. Ex-transport orders fell -0.1% mom to 187.7B, below expectation of 0.1% mom. Ex-defense orders fell -0.2% mom to USD 266.1B. Transportation equipment rose 0.6% mom to USD 95.4B.

US initial jobless claims falls to 233k, vs exp 230k

US initial jobless claims fell -6k to 233k in the week ending June 22, slightly above expectation of 230k. Four-week moving average of initial claims rose 3k to 236k.

Continuing claims rose 18k to 1839k in the week ending June 15, highest since November 27, 2021. Four-week moving average of continuing claims rose 12k to 1816k, highest since December 4, 2021.

ECB’s Kazimir anticipates single additional rate cut in 2024

ECB Governing Council member Peter Kazimir suggested today that “we could expect one more interest-rate cut this year.” He underscored his continued concern over the “significant risk of rising inflation,” driven primarily by wage growth.

Kazimir reiterated his opposition to an interest-rate adjustment at upcoming July meeting. Instead, he advocated for policymakers to wait until the next round of quarterly economic projections before making any decisions.

“It’s appropriate to wait for the September forecast,” Kazimir stated. “Those are the right moments to make the correct decisions.”

Eurozone economic sentiment falls slightly to 95.9, EU ticks down to 96.4

Eurozone Economic Sentiment Indicator ticked down from 96.1 to 95.9 in June. Employment Expectation Indicator fell from 101.3 to 99.7. Economic Uncertainty Indicator fell from 18.5 to 18.0.

Eurozone industry confidence fell from -9.9 to -10.1. Services confidence fell from 6.8 to 6.5. Consumer confidence improved slightly from -14.3 to -14.0. Retail trade confidence fell from -6.8 to -7.8. Construction confidence fell from -6.2 to -7.0.

EU ESI fell from 96.6 to 96.4. EEI fell from 101.2 to 100.4. EUI fell from 17.9 to 17.3. For the largest EU economies, the ESI improved markedly for Spain (+1.1) and more moderately for the Netherlands (+0.5), while it deteriorated for France (-0.7) and Italy (-0.7). The ESI remained broadly stable for Germany (-0.2) and Poland (-0.1).

RBA’s Hauser cautions against policy decisions based on single data point

In an event today, RBA Deputy Governor Andrew Hauser emphasized the need for comprehensive analysis before making policy decisions, stating, “it would be a bad mistake to set policy on the basis of one number and we don’t intend to do that.”

This comment comes in the wake of Australia’s May CPI release earlier this week, which showed an unexpected acceleration to 4%, leading money markets to price in a 50-50 chance of another 25bps rate hike in August.

Hauser highlighted the importance of considering the broader economic context, noting that the monthly consumer price indicator provides only partial information.

He stressed, “there’s a whole series of data coming out between now and when we meet in August.”

NZ ANZ business confidence falls to 6.1, inflation pressure eases further

New Zealand ANZ Business Confidence fell from 11.2 to 6.1 in June. Despite this decrease in overall confidence, there was a slight improvement in the own activity outlook, from 11.8 to 12.2.

Cost expectations decreased from 72.6 to 69.2, while pricing intentions dropped significantly from 41.6 to 35.3, signaling easing price pressure in the business environment. Furthermore, inflation expectations continued their steady descent, moving from 3.59% to 3.46%.

ANZ noted that “the economy is clearly weak, as the RBNZ intended.” More importantly, there appears to be “renewed meaningful progress on bringing inflation pressures down.” This fosters optimism that RBNZ might be able to lower the Official Cash Rate considerably earlier than the currently projected August next year.

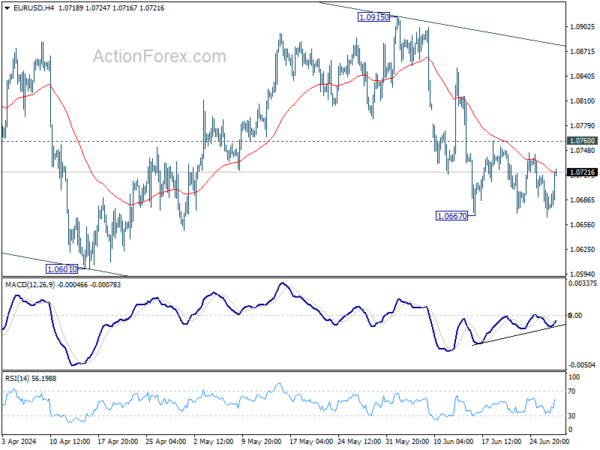

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0658; (P) 1.0688; (R1) 1.0710; More….

EUR/USD recovered after breaching 1.0667 briefly and intraday bias remains neutral. Outlook stays outlook stays bearish with 1.0760 resistance intact. Decline from 1.0915 is seen as another leg in the larger corrective pattern. Firm break of 1.0667 will target 1.0601 and below. However, decisive break of 1.0760 will turn intraday bias back to the upside for stronger rebound.

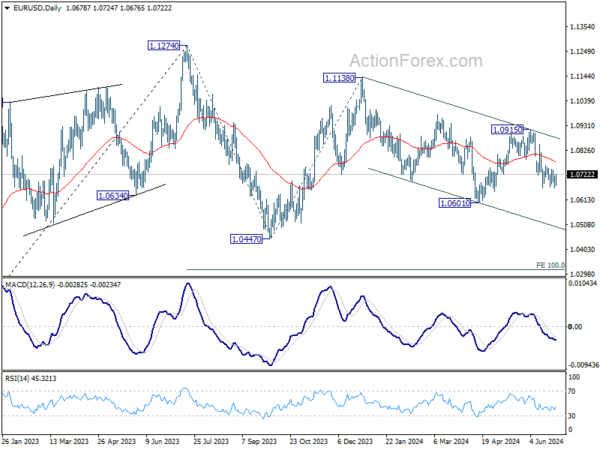

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still in progress. Break of 1.0601 will target 1.0447 support and possibly further to 100% projection of 1.1274 to 1.0447 from 1.1138 at 1.0311. For now, this will remain the favored case as long as 1.0915 resistance holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y May | 3.00% | 2.00% | 2.40% | 2.00% |

| 01:00 | AUD | Consumer Inflation Expectations Jun | 4.40% | 4.10% | ||

| 01:00 | NZD | ANZ Business Confidence Jun | 6.1 | 11.2 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y May | 1.60% | 1.60% | 1.30% | |

| 09:00 | EUR | Eurozone Economic Sentiment Jun | 95.9 | 96.3 | 96 | |

| 09:00 | EUR | Eurozone Industrial Confidence Jun | -10.1 | -9.6 | -9.9 | |

| 09:00 | EUR | Eurozone Services Sentiment Jun | 6.5 | 6.4 | 6.5 | |

| 09:00 | EUR | Eurozone Consumer Confidence Jun F | -14 | -14 | -14 | |

| 12:30 | USD | Initial Jobless Claims (Jun 21) | 233K | 230K | 238K | |

| 12:30 | USD | Durable Goods Orders May | 0.10% | -0.10% | 0.60% | |

| 12:30 | USD | Durable Goods Orders ex Transport May | -0.10% | 0.10% | 0.40% | |

| 12:30 | USD | Goods Trade Balance (USD) May P | -100.6B | -96.0B | -99.4B | |

| 12:30 | USD | Wholesale Inventories May P | 0.60% | 0.20% | 0.10% | |

| 12:30 | USD | GDP Annualized Q1 F | 1.40% | 1.30% | 1.30% | |

| 12:30 | USD | GDP Price Index Q1 F | 3.10% | 3.00% | 3.00% | |

| 14:00 | USD | Pending Home Sales M/M May | 0.60% | -7.70% | ||

| 14:30 | USD | Natural Gas Storage | 53B | 71B |