Risk-Off Sentiment Grips Markets Ahead of Key US Data Release – Action Forex

Yen staged a notable rebound today, joined by Dollar and Swiss Franc. In contrast, Australian Dollar is leading losses among commodity currencies. Risk-off mood appears to be taking hold, which is also evident in US futures, which point to a lower open as American markets return from the Labor Day holiday.

Market participants seem to be adopting a more cautious approach ahead of a series of key US economic data releases scheduled for this week, beginning with ISM manufacturing index today. Optimism had been building after Fed Chair Jerome Powell signaled that policy easing might be on the horizon. However, that optimism could quickly evaporate if the upcoming data disappoints, reigniting fears of recession.

Swiss Franc has found additional support against Euro, bolstered by stronger-than-expected Q2 GDP figures. However, its upside has been limited by a weaker-than-anticipated inflation reading for August. This mixed data leaves the door open for SNB’s decision later this month, with uncertainty over whether they will opt for a 25 or 50 basis point rate cut. Until then, EUR/CHF pair is likely to be influenced by broader risk sentiment.

Technically, with 0.9455 support turned resistance intact. EUR/CHF’s fall from 0.9579 is still in favor to continue. Break of 0.9351, and sustained trading below 61.8% retracement of 0.9209 to 0.9579 at 0.9350 will pave the way back to retest 0.9209 low.

In Europe, at the time of writing, FTSE is down -0.51%. DAX is down -0.29%. CAC is down -0.19%. UK 10-year yield is down -0.0445 at 3.989. Germany 10-year yield is down -0.021 at 2.322. Earlier in Asia, Nikkei fell -0.04%. Hong Kong HSI fell -0.23%. China Shanghai SSE fell -0.29%. Singapore Strait Times rose 0.50%. Japan 10-year JGB yield rose 0.0143 to 0.926.

Swiss GDP grows 0.7% qoq in Q2, above exp 0.6% qoq

Switzerland’s GDP grew by 0.7% qoq in Q2, exceeding expectations of 0.6% qoq and marking an improvement from Q1’s 0.5% qoq growth. When adjusted for sporting events, GDP still showed solid growth at 0.5% qoq, up from the previous quarter’s 0.3% qoq.

This stronger-than-expected performance was largely driven by significant expansion in the chemical and pharmaceutical industries, which played a key role in lifting the overall economic output. However, growth across other sectors was uneven, reflecting underlying weaknesses in domestic demand.

Swiss CPI slows to 1.1% yoy in Aug, vs exp 1.2% yoy

Swiss CPI was flat mom in August, below expectation of 0.1% mom rise. Core CPI (excluding fresh and seasonal products, energy and fuel) rose 0.1% mom. Domestic products prices was flat while imported products prices fell -0.1% mom.

For the 12-month people, CPI slowed from 1.3% yoy to 1.1% yoy, below expectation of 1.2% yoy. Core CPI was unchanged at.10% yoy. Domestic product prices was unchanged at 2.0% yoy. Imported price prices fell from -1.0% yoy to -1.9% yoy.

BoJ’s Ueda reaffirms commitment to further rate hikes if economic conditions allow

BoJ Governor Kazuo Ueda reiterated today that the central bank could continue raising interest rates if the economy and inflation develop as expected.

In a document presented to a government panel led by Prime Minister Fumio Kishida, Ueda highlighted that, despite the July rate hike, the economy are still solidly supported by current monetary policy, as rates are still significantly negative.

Additionally, members of the government panel, including business leader Masakazu Tokura, submitted a proposal urging careful management of macroeconomic policies, especially in light of the recent market turbulence. This highlights the importance of coordination between BOJ and the government to maintain economic stability as BoJ navigates its gradual shift towards higher interest rates.

NZIER expects Oct RBNZ rate cut, further easing hinges on demand recovery

The New Zealand Institute of Economic Research indicated today that it expects RBNZ to implement another interest rate cut during its October meeting. This follows RBNZ’s decision in August to bring forward its easing cycle in response to “deterioration in economic outlook.” However, NZIER notes that the pace of further easing remains highly uncertain, with a potential pause in November depending on how quickly demand recovers.

Weaker demand has become a significant concern for businesses, with 61% of firms identifying it as the primary constraint on their operations. This declining demand is also having an impact on the labor market, where there is now more slack as companies reduce hiring in response to the softer economic environment.

Looking ahead, NZIER forecasts GDP growth to remain subdued over the next year, contributing to further decline in inflation. The institute predicts that annual CPI inflation will fall back within RBNZ’s target band by the end of this year, which underpins its expectation for another Official OCR cut in October.

However, the uncertainty surrounding the economic recovery suggests that any further rate cuts after October will be closely tied to the extent of demand recovery, with the November meeting likely to be a key decision point.

New Zealand’s terms of trade improve in Q2 despite decline in export volumes

New Zealand’s terms of trade saw a solid improvement in the second quarter of 2024, rising by 2.0%. This increase was driven by a 5.2% rise in export prices, which outpaced the 3.1% increase in import prices. However, the value of exports decreased by -1.5% to NZD 16.6 billion, largely due to a -4.3% drop in export volumes, even as higher prices provided some support.

Dairy products played a significant role in the export dynamics, with prices rising by 8.0%. Despite this, dairy export volumes fell sharply by -10%, leading to an 8-.0% decline in the overall value of dairy exports. The meat sector, on the other hand, performed better, with prices rising by 7.3%, volumes increasing by 4.1%, and the total value of meat exports up by 6.5%.

On the import side, the total value rose by 4.0% to NZD 18.9B, supported by a 3.2% increase in import volumes. Petroleum and petroleum products were notable contributors, with prices up by 4.0%. However, petroleum volumes declined by -8.0%, leading to a -4.4% decrease in the overall value of these imports.

USD/JPY Mid-Day Outlook

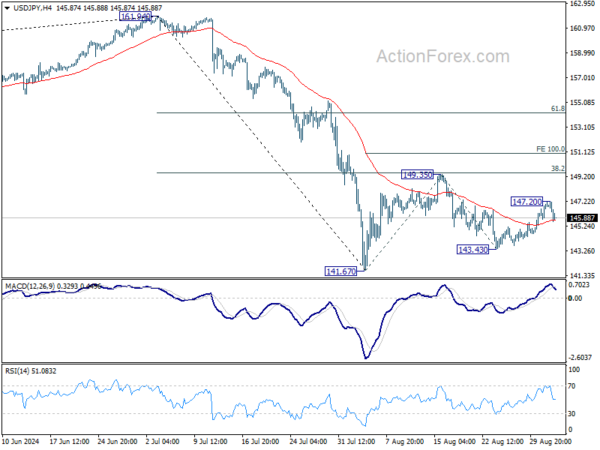

Daily Pivots: (S1) 146.08; (P) 146.62; (R1) 147.47; More…

Intraday bias in USD/JPY is turned neutral with current retreat. But further rise will remain in favor as long as 143.43 support holds. Above 147.20 will target 149.35 resistance first. Firm break there will resume the rebound from 141.67 to 100% projection of 141.67 to 149.35 from 143.43 at 151.11, as the second leg of the corrective pattern from 161.94 high. However, break of 143.43 will bring retest of 141.67 low instead.

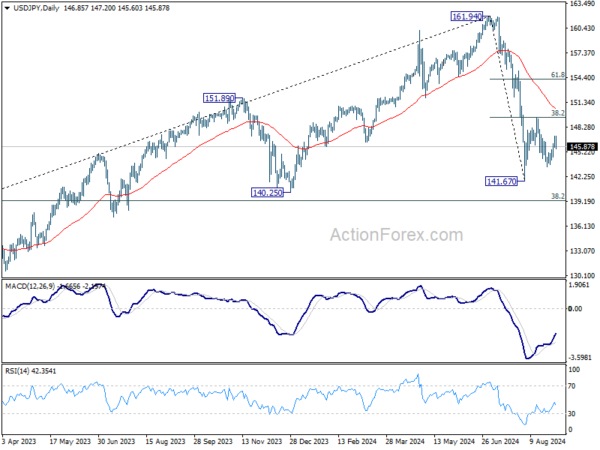

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. In any case, risk will stay on the downside as long as 55 W EMA (now at 149.47) holds. Nevertheless, firm break of 55 W EMA will suggest that the range for medium term corrective pattern is already set.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Terms of Trade Index Q2 | 2.00% | 2.60% | 5.10% | |

| 23:50 | JPY | Monetary Base Y/Y Aug | 0.60% | 0.60% | 1.00% | |

| 01:30 | AUD | Current Account (AUD) Q2 | -10.7B | -5.5B | -4.9B | -6.3B |

| 06:30 | CHF | CPI M/M Aug | 0.00% | 0.10% | -0.20% | |

| 06:30 | CHF | CPI Y/Y Aug | 1.10% | 1.20% | 1.30% | |

| 07:00 | CHF | GDP Q/Q Q2 | 0.70% | 0.60% | 0.50% | |

| 13:30 | CAD | Manufacturing PMI Aug | 47.8 | |||

| 13:45 | USD | Manufacturing PMI Aug F | 48 | 48 | ||

| 14:00 | USD | ISM Manufacturing PMI Aug | 47.8 | 46.8 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Aug | 52.5 | 52.9 | ||

| 14:00 | USD | ISM Manufacturing Employment Aug | 43.4 | |||

| 14:00 | USD | Construction Spending M/M Jul | 0.10% | -0.30% |