Dollar Rallies as Core CPI Data Dims Hopes for Larger Fed Rate Cut – Action Forex

Dollar rises slightly across the board during early US session following release of key inflation data, which largely ruled out the possibility of 50bps rate cut at the upcoming FOMC meeting next week. While headline inflation in the US saw sharper-than-expected decline, falling to 2.6% year-on-year, core CPI remained stuck at 3.2%, signaling that disinflation efforts are stalling. The month-on-month rise in core CPI of 0.3%, coupled with 0.5% rise in shelter costs, is likely to keep Fed policymakers cautious as they assess the need for more aggressive easing.

The market’s reaction to the CPI report was immediate. US stock futures dropped notably, pointing to a lower market open, while the 10-year Treasury yield rebounded after dipping to a near 30-month low in the previous session. Investors seem to be digesting the likelihood that while inflation is cooling, the pace remains uneven, leaving the Fed with little room to justify a larger rate cut at this stage.

In the forex markets, Canadian Dollar is leading the charge, followed closely by Yen, though Dollar’s momentum suggests it may soon overtake both. On the opposite end, Swiss Franc is the worst performer of the day, followed by New Zealand Dollar. Sterling, meanwhile, is feeling the strain after disappointing UK GDP data, with Euro and Australian Dollar positioned in the middle of the pack.

Technically, USD/CHF is heading back to 0.8536 resistance as rebound from 0.8374 extends. Considering bullish convergence condition in 4H MACD, decisive break of 0.8536 should confirm short term bottoming, after defending 0.8332 key support (2023 low). In this case, stronger rise should be seen back to 0.8747 resistance to determine whether the pair is already in bullish reversal.

In Europe at the time of writing, FTSE is up 0.04%. DAX is up 0.41%. CAC is up 0.17%. UK 10-year yield is down -0.0156 at 3.802. Germany 10-year yield is up 0.013 at 2.143. Earlier in Asia, Nikkei fell -1.49%. Hong Kong HSI fell -0.73%. China Shanghai SSE fell -0.82%. Singapore Strait Times rose 0.53%. Japan 10-year JGB yield fell -0.0412 to 0.853.

US CPI slows to 2.5% yoy, core CPI unchanged at 3.2% yoy

US CPI rose 0.2% mom in August, matched expectations. However, core CPI rose 0.3% mom, above expectation of 0.2% mom. Shelter costs jumped 0.5% mom and was the main factor in the all items increase. Food index rose 0.1% mom while energy index fell -0.8% mom.

Over the 12-month period, CPI slowed from 2.9% yoy to 2.5% yoy, below expectation of 2.6% yoy. That’s also the lowest annual increase since February 2021. But core CPI was unchanged at 3.2% yoy, matched expectations. Energy index fell -4.0% yoy while food prices rose 2.1% yoy.

UK GDP stagnates in Jul with sharp production contraction

The UK economy showed no growth in July, marking a disappointing performance after also stagnating in June. The flat 0.0% mom reading fell short of expectations for 0.2% increase.

Breaking down the numbers, services sector—typically a key driver of UK growth—rose just 0.1% mom in July. Meanwhile, production sector saw a sharp contraction, declining by -0.8% mom. Construction activity also fell by -0.4% mom.

In the three months to July, UK GDP managed to post 0.5% growth compared to the previous three-month period ending in April, largely supported by the services sector, which grew by 0.6%. Construction performed relatively well, with a 1.2% expansion, marking its first positive three-month growth since September 2023. However, production remained weak, contracting by -0.1% over the same period.

NIESR expects 0.2% UK GDP growth in Q3, despite July stagnation

The National Institute of Economic and Social Research (NIESR) forecasts 0.2% GDP growth for the UK in Q3, driven by resilience in the services and construction sectors. This comes despite today’s data showing no growth in July, marking a weaker-than-expected start to the quarter.

Hailey Low, Associate Economist at NIESR, commented on the latest GDP figures, stating, “While today’s figures came in slightly weaker compared to the upbeat performance we have seen over the first half of the year, the strong start to 2024 will likely extend into the second half of the year.”

However, NIESR has noted signs of a slowdown in the final months of 2024. “High-frequency indicators are signaling a relative slowdown in momentum for the remainder of the year,” Low added. Attention is now focused on the government’s upcoming Autumn Statement, where policies aimed at sustaining long-term growth will be highly anticipated.

RBA’s Hunter anticipates slow cooling of Australia’s labor market

In a speech today, RBA Assistant Governor Sarah Hunter highlighted that while conditions in the Australian labor market have eased since late 2022, the market remains “tight relative to full employment.”

Looking ahead, Hunter expects labor demand to slow in comparison to labor supply, which should bring the market “into better balance” over the coming quarters. She noted that part of this adjustment is likely to come through a “decline in average hours” worked rather than sharp cuts to overall employment.

Employment growth is expected to persist but at a slower pace, lagging behind population growth. As a result, underutilization measures, including the unemployment rate, are projected to “continue rising gradually.” This rise is expected to stabilize once GDP growth returns to a level more consistent with Australia’s underlying economic trend.

Hunter’s comments underscore RBA’s outlook on the labor market, and the hawkish stance that it’s not nearing the start of rates reduction cycle yet.

BoJ’s Nakagawa signals more rate hikes if economic outlook met

In a speech today, BoJ board member Junko Nakagawa indicated that the central bank will raise interest rates further if the economic outlook aligns with their forecasts. Nevertheless, she also emphasized the need to carefully consider how such moves might impact the broader economy and price stability.

“Given real interest rates are currently very low, we will adjust the degree of monetary support, from the standpoint of sustainably and stably achieving our 2% inflation target, if our economic and price forecasts are met,” she noted.

Nakagawa acknowledged Japan’s tight labor market and rising import prices as upside risks to the inflation outlook. While affirming that Japan’s economic fundamentals remain strong, she highlighted the importance to “look back upon market developments” following July’s rate hike before making any further rate adjustments.

GBP/USD Mid-Day Outlook

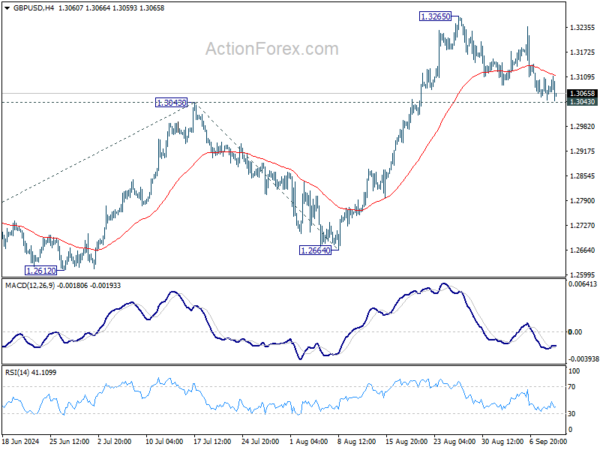

Daily Pivots: (S1) 1.3051; (P) 1.3079; (R1) 1.3109; More…

Intraday bias in GBP/USD stays neutral first with focus on 1.3043 resistance turned support. Strong rebound will maintain near term bullishness. Further break of 1.3265 will extend recent up trend to 100% projection of 1.2298 to 1.3043 from 1.2664 at 1.3409. However, firm break of 1.3043 will turn bias back to the downside for deeper pullback, to 55 D EMA (now at 1.2949) and possibly below.

In the bigger picture, up trend from 1.0351 (2022 low) is in progress. Next target is 38.2% projection of 1.0351 to 1.3141 from 1.2298 at 1.3364. For now, outlook will stay bullish as long as 1.2664 support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 06:00 | GBP | GDP M/M Jul | 0.00% | 0.20% | 0.00% | |

| 06:00 | GBP | Industrial Production M/M Jul | -0.80% | 0.30% | 0.80% | |

| 06:00 | GBP | Industrial Production Y/Y Jul | -1.20% | -0.20% | -1.40% | |

| 06:00 | GBP | Manufacturing Production M/M Jul | -1.00% | 0.20% | 1.10% | |

| 06:00 | GBP | Manufacturing Production Y/Y Jul | -1.30% | -0.10% | -1.50% | |

| 06:00 | GBP | Goods Trade Balance (GBP) Jul | -20.0B | -18.0B | -18.9B | |

| 12:30 | USD | CPI M/M Aug | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Y/Y Aug | 2.50% | 2.60% | 2.90% | |

| 12:30 | USD | CPI Core M/M Aug | 0.30% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Core Y/Y Aug | 3.20% | 3.20% | 3.20% | |

| 14:30 | USD | Crude Oil Inventories | 0.9M | -6.9M |