Investor Sentiment Wavers Despite DOW’s Highs, Loonie Pressured Ahead of CPI – Action Forex

Investor sentiment is currently mixed, reflecting the heightened uncertainty surrounding this week’s crucial Fed meeting. While DOW surged to a fresh record high overnight, and S&P 500 edged closer to its historical peak too, the tech-heavy NASDAQ struggled, ending the session in negative territory. The mixed performance extended to Asia, where Nikkei fell sharply in its first session after a long weekend, contrasting with the rally in Hong Kong’s stock market.

In currency markets, Yen’s strength faded quickly after a brief rally on Monday. The steep appreciation since July has raised concerns within Japan, with Finance Minister Shunichi Suzuki stating today that “rapid fluctuations in exchange rates are not desirable.” He also pledged to monitor the rising Yen’s impact on the economy closely and to take appropriate action if necessary.

Canadian Dollar, meanwhile, is underperforming, lagging behind its peers in the face of Dollar’s broad-based weakness. It is currently the weakest performer in the currency market this week. Traders are eyeing today’s Canadian inflation report, which could provide direction for the Loonie. The data will be critical for assessing the BoC’s next move, especially after dovish comments from BoC Governor Tiff Macklem, who recently hinted that the central bank might be open to a more aggressive policy easing if economic conditions warrant it.

Overall, Australian Dollar has been the standout performer this week so far. Sterling is also holding up well, with investors eyeing Thursday’s BoE rate decision. At the other end of the spectrum, Loonie and Dollar are lagging, but the broader picture remains fluid. Most currency pairs are still trading within familiar ranges, leaving the door open for sudden shifts based on upcoming events.

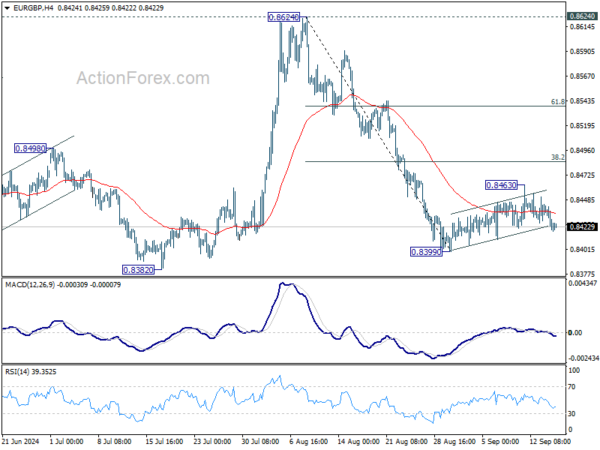

Technically, one of the focuses now is whether EUR/GBP’s corrective recovery from 0.8399 has already completed at 0.8463. Break of 0.8399 could prompt downside acceleration through 0.8382 low to resume the medium term down trend. If realized, that could give GBP/USD an extra lift through 1.3265 resistance with upside acceleration.

In Asia, at the time of writing, Nikkei is down -1.82%. Hong Kong HSI is up 1.42%. China Shanghai SSE is down 0.48%. Singapore Strait Times is up 0.55%. Overnight, DOW rose 0.55%. S&P 500 rose 0.13%. NASDAQ fell -0.52%. 10-year yield fell -0.029 to 3.621.

Canadian CPI in focus after as BoC’s Macklem signals potential for faster rate cuts

Canadian inflation data is set to take center stage today, particularly after dovish signals from BoC Governor Tiff Macklem hinted at the potential for accelerated monetary easing should the economy weaken further. Progress in disinflation could provide the BoC with more leeway to shift toward a more aggressive policy stance.

Headline CPI is forecasted to decelerate from 2.5% yoy in July to 2.1% yoy in August, edging just above BoC’s 2% target. If realized, this would mark the lowest inflation rate since March 2021. While the bulk of the inflation slowdown is attributed to falling gasoline prices, core inflation metrics are expected to reflect improvement too, with the three-month annualized growth rate projected to ease from July’s 2.6% yoy.

In a recent Financial Times interview, Macklem voiced growing concerns about the labor market’s softening and the impact of lower crude oil prices on the broader economy. He emphasized that as inflation approaches target levels, the “risk management calculus changes,” and the focus shifts toward downside risks.

BoC’s current forecast anticipates 2% economic growth in 2024 and 2.1% in 2025. However, Macklem acknowledged that if these growth projections falter, “it could be appropriate to move faster [on] interest rates.”

Presently, economists expect BoC to cut rates by 25bps at every meeting through mid-2025, bringing the policy rate down to 2.50%. However, weaker economic data could prompt a faster pace of cuts or even a lower terminal rate.

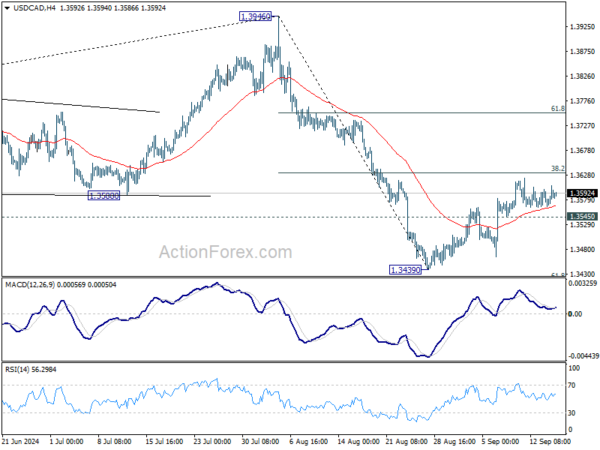

Technically, Canadian Dollar has been sluggish to rally against the greenback even though the latter has been pressured across the board on speculation of a 50bps rate cut by Fed this week. Decisive break of 38.2% retracement of 1.3946 to 1.3439 at 1.3633 in USD/CAD could argue that the decline from 1.3946 has completed. Stronger rally would then be seen to 61.8% retracement at 1.3752 and above.

ECB’s Kazaks: Rate cuts not over, could fall to 2.5% by mid-2025

ECB Governing Council member Martins Kazaks indicated that after two rate cuts this year, “this is not the final destination.” Borrowing costs remain “pretty restrictive”, and “these rates will continue to go down,” he added.

Kazaks noted that the speed of these rate cuts will largely depend on the path of services inflation and the broader outlook for Europe’s struggling economy.

“If we look at what financial markets expect — and I don’t have any serious reason not to agree with them — then by the middle of next year, rates are expected at 2.5%,” he added.

Looking ahead

German ZEW economic sentiment is the main focus in European session. Later in the day, Canada will release housing starts and CPI. US will publish retail sales, industrial production, business inventories and NAHB housing index.

USD/JPY Daily Outlook

Daily Pivots: (S1) 139.82; (P) 140.37; (R1) 141.17; More…

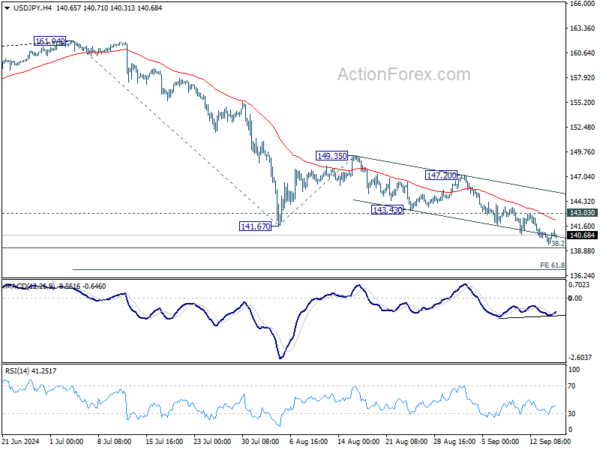

Intraday bias in USD/JPY is turned neutral first as it recovered just ahead of key 139.26 fibonacci level. Considering bullish convergence condition in 4H MACD, break of 143.03 resistance will indicate short term bottoming and turn bias back to the upside for rebound towards 147.20. However, decisive break of 139.26 would carry larger bearish implications, and target 61.8% projection of 161.94 to 141.67 from 149.35 at 136.82.

In the bigger picture, fall from 161.94 medium term top is seen as correcting whole up trend from 102.58 (2021 low). Strong support could be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to contain downside, at least on first attempt. But in any case, risk will stay on the downside as long as 149.35 resistance holds. Sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 04:30 | JPY | Tertiary Industry Index M/M Jul | 1.00% | -1.30% | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Sep | 18.6 | 19.2 | ||

| 09:00 | EUR | Germany ZEW Current Situation Sep | -77.3 | |||

| 09:00 | EUR | Germany ZEW Economic Sentiment Sep | 17.6 | 17.9 | ||

| 12:15 | CAD | Housing Starts Y/Y Aug | 246K | 280K | ||

| 12:30 | CAD | CPI M/M Aug | 0.20% | 0.40% | ||

| 12:30 | CAD | CPI Y/Y Aug | 2.20% | 2.50% | ||

| 12:30 | CAD | CPI Median Y/Y Aug | 2.30% | 2.40% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Aug | 2.50% | 2.70% | ||

| 12:30 | CAD | CPI Common Y/Y Aug | 2.20% | 2.20% | ||

| 12:30 | USD | Retail Sales M/M Aug | -0.10% | 1.00% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Aug | 0.20% | 0.40% | ||

| 13:15 | USD | Industrial Production M/M Aug | 0.20% | -0.60% | ||

| 13:15 | USD | Capacity Utilization Aug | 77.90% | 77.80% | ||

| 14:00 | USD | Business Inventories Jul | 0.40% | 0.30% | ||

| 14:00 | USD | NAHB Housing Market Index Sep | 42 | 39 |