Fed’s Moment of Truth: Will Markets Soar or Plunge After the Call? – Action Forex

The much-anticipated FOMC day has finally arrived, and the financial world is eagerly waiting to see if Fed will opt for a 25bps or a more assertive 50bps rate cut. With market expectations split nearly down the middle, and likely some internal divergence within FOMC itself, the outcome is poised to trigger significant market volatility across asset classes. The key question is whether US equities will soar to new records, or face a harsh selloff afterwards.

On the currency front, Dollar is trading slightly softer but remains largely range-bound against major rivals, as traders hold back ahead of Fed’s announcement. But, Japanese Yen and Canadian Dollar are struggling as the weaker performers. On the flip side, Australian and New Zealand Dollars are standing out with relative strength. If today’s announcement triggers risk-on sentiment, these two currencies could see further upside. European majors are mixed in the middle.

Another key event to monitor today is UK inflation data. While Although a downside surprise is unlikely to influence the BoE’s expected decision to pause rate cuts tomorrow, an unexpected upside in inflation could reignite doubts over whether BoE will indeed proceed with another cut in November, giving a boost to Sterling.

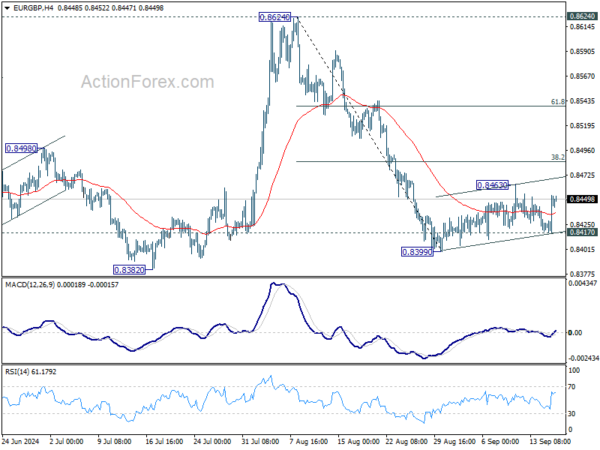

Technically, EUR/GBP is still stuck consolidation from 0.8399. While strong recovery cannot be ruled out, upside should be limited by 38.2% retracement of 0.8624 to 0.8399 at 0.8485. On the downside, break of 0.8417 minor support will argue that fall from 0.8624 is ready to resume through 0.8399 to 0.8382 support.

In Asia, at the time of writing, Nikkei is down -0.08%. Hong Kong is on holiday. China Shanghai SSE is down -0.05%. Singapore Strait Times is down -0.06%. Japan 10-year JGB yield is down -0.0065 at 0.824. Overnight, DOW fell -0.04%. S&P 500 rose 0.03%. NASDAQ rose 0.20%. 10-year yield rose 0.021 to 3.642.

Fed to cut 25 or 50? Stocks, bonds and Dollar await impact

FOMC’s upcoming decision on interest rates is shaping up to be one of the most anticipated in years, with markets still uncertain whether Fed will opt for a 25bps cut or go bolder with a 50bps reduction. As of now, futures markets are pricing in a 65% chance of a 50bps cut, while the remaining 35% lean toward the more traditional 25bps move. Despite this, many economists believe Fed will take a more measured approach, but the decision is likely to reveal a split within the FOMC, with intense debates expected between the hawks and doves on the committee.

Beyond the size of the rate cut, this meeting will offer much more insight into Fed’s thinking. Alongside the decision, markets are eagerly awaiting updates on future rate cut projections, revisions to the closely watched “dot plot,” and new economic forecasts. And together they will create a complex picture for traders to digest.

As for the broader markets, Dollar may likely follow overall risk sentiment, while the Japanese Yen will likely move in response to US Treasury yields.

The stock market is holding its breath after S&P 500 briefly touched a new intraday record before closing with only a slight gain of 0.03%. Technically, decisive break of 5669.67 will confirm up trend resumption. Next target for the rest of the year will be 61.8% projection 4103.78 to 5669.67 from 5119.26 at 6086.98. In case of a pullback, outlook will still be cautiously bullish as long as 5402.62 support holds.

In the bond market, 10-year yield’s down trend from 4.997 is still in progress for 100% projection of 4.997 to 3.785 from 4.737 at 3.525. Some support could be seen there to bring rebound, but outlook will stay bearish as long as 3.923 resistance holds. Decisive break of 3.525 will pave the way to next long term support level at 3.253.

Turning to currency markets, USD/JPY is now sitting close to a key long term fibonacci support, 38.2% retracement of 102.58 (2021 low) to 161.94 at 139.26. Break of 143.03 minor resistance should confirm short term bottoming, and bring stronger rebound back to 55 D EMA (now at 147.71).

However, decisive break 139.26 will suggest that deeper medium term correction is underway. Next near term target is 61.8% projection of 161.94 to 141.67 from 149.35 at 136.82. Next medium term target is 61.8% retracement at 125.25.

Japan’s exports rise for ninth month, but auto sector weighs on growth

Japan’s export growth continued in August, rising 5.6% yoy to JPY 8,442B, marking the ninth consecutive month of growth. However, this increase fell significantly short of market expectations of 10% yoy growth. The weaker export performance was largely driven by -9.9% yoy decline in auto exports.

In terms of regional performance, exports to the US fell -0.7% yoy, marking the first decline in nearly three years, with auto sales slumping -14.2% yoy. Exports to Europe also suffered, falling -8.1% yoy. In contrast, exports to China were a bright spot, rising by 5.2% yoy.

On the import side, Japan saw 2.3% yoy increase, reaching JPY 9,137B, but this was also far below the expected growth of 13.4% yoy. Despite this, the import figure was the second-largest on record for the month of August.

The country’s trade balance recorded a deficit of JPY -695B, remaining in the red for the second consecutive month.

In seasonally adjusted terms, both exports and imports declined on a month-over-month basis. Exports dropped -3.9% to JPY 8,759B, while imports fell -4.4% to JPY 9,354B. This left Japan with a seasonally adjusted trade deficit of JPY -596B.

BoC’s Rogers: Cooling inflation is “welcome news” but challenges remain

BoC Senior Deputy Governor Carolyn Rogers emphasized the importance of continued vigilance in combating inflation, even as cooling price pressures brought some relief.

Speaking at an event overnight, Rogers noted that while the recent decline in inflation to 2% is “welcome news,” it is still too early to declare victory. “There’s still work to do,” she stated, adding that policymakers need to “stick the landing” to ensure that inflation returns sustainably to target levels.

The comments come in yesterday’s data which showed that inflation had decelerated to BoC’s 2% target in August—the slowest pace since early 2021. The two key core inflation measures also eased, with the average annual pace falling to 2.35% from 2.55% in July.

Recently, there is growing focus on preventing a deep economic slowdown, while rising unemployment became critical concerns for policymakers. Rogers acknowledged the shift in risk perception, saying, “It’s not an absolute tilt to the downside risks, but definitely we’re in a period where the risks are more balanced.”

Looking ahead

UK CPI and PPI will be released in European session, then Eurozone CPI final. Later in the day, US will release building permits and housing starts. BoC will publish summary of deliberations. Then FOMC rate decision and press conference will follow.

AUD/USD Daily Report

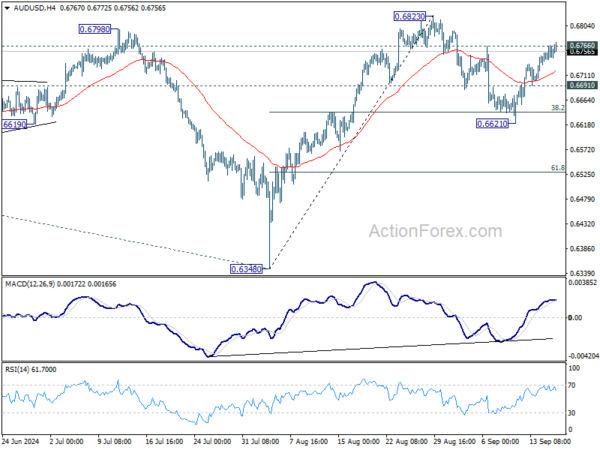

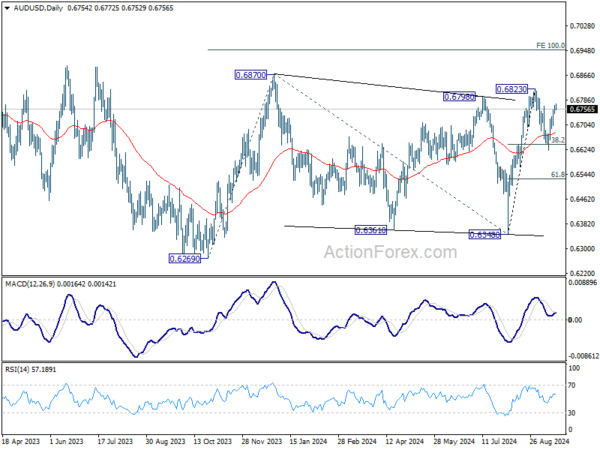

Daily Pivots: (S1) 0.6742; (P) 0.6755; (R1) 0.6770; More...

Intraday bias in AUD/USD stays neutral for the moment. On the upside, decisive break of 0.6766 resistance should confirm that corrective pullback from 0.6823 has completed at 0.6621 already. Intraday bias will be turned to the upside to resume the rally from 0.6348 through 0.6823, and then 6870 resistance. On the downside, however, below 0.6691 will turn bias back to the downside for 38.2% retracement of 0.6348 to 0.6823 again.

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 0.6798/6870 resistance zone will target 0.7156 resistance. In case of another fall, strong support should be seen from 0.6169/6361 to bring rebound.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Current Account (NZD) Q2 | -4.83B | -3.90B | -4.36B | -3.83B |

| 23:50 | JPY | Trade Balance (JPY) Aug | -0.60T | -0.97T | -0.76T | -0.68T |

| 23:50 | JPY | Machinery Orders M/M Jul | -0.10% | 0.40% | 2.10% | |

| 01:00 | AUD | Westpac Leading Index M/M Aug | -0.10% | -0.04% | ||

| 06:00 | GBP | CPI M/M Aug | 0.30% | -0.20% | ||

| 06:00 | GBP | CPI Y/Y Aug | 2.20% | 2.20% | ||

| 06:00 | GBP | Core CPI Y/Y Aug | 3.60% | 3.30% | ||

| 06:00 | GBP | RPI M/M Aug | 0.50% | 0.10% | ||

| 06:00 | GBP | RPI Y/Y Aug | 3.40% | 3.60% | ||

| 06:00 | GBP | PPI Input M/M Aug | -0.30% | -0.10% | ||

| 06:00 | GBP | PPI Input Y/Y Aug | -0.90% | 0.40% | ||

| 06:00 | GBP | PPI Output M/M Aug | 0.00% | 0.00% | ||

| 06:00 | GBP | PPI Output Y/Y Aug | 0.50% | 0.80% | ||

| 06:00 | GBP | PPI Core Output M/M Aug | 0.00% | |||

| 06:00 | GBP | PPI Core Output Y/Y Aug | 1.00% | |||

| 09:00 | EUR | Eurozone CPI Y/Y Aug F | 2.80% | 2.80% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug F | 2.20% | 2.20% | ||

| 12:30 | USD | Housing Starts Aug | 1.32M | 1.24M | ||

| 12:30 | USD | Building Permits Aug | 1.41M | 1.40M | ||

| 14:30 | USD | Crude Oil Inventories | -0.2M | 0.8M | ||

| 17:30 | CAD | BoC Summary of Deliberations | ||||

| 18:00 | USD | Fed Interest Rate Decision | 5.25% | 5.50% | ||

| 18:30 | USD | FOMC Press Conference |