Risk Sentiment Steadies as Dollar Softens, GBP/CAD Eyes UK and Canada Data – Action Forex

Risk sentiment appears to have stabilized heading into the weekend, despite stronger-than-expected US inflation data released overnight. The report didn’t cause any significant shifts in market expectations regarding Fed’s rate cuts. Stock markets also showed resilience, with major US indexes closing only slightly lower.

Dollar, however, has lost some momentum, turning softer against both Swiss Franc and Japanese Yen. Investors are now focused on comments from upcoming Fed officials, particularly on whether any will echo Atlanta Fed President Raphael Bostic’s openness to a potential pause in rate cuts at the November meeting.

For the week so far, Canadian Dollar is currently the weakest performer, followed by New Zealand Dollar and Australian Dollar. On the other hand, Swiss Franc is leading as the strongest currency, followed by Yen, and then Dollar. Euro and British Pound are stuck in the middle.

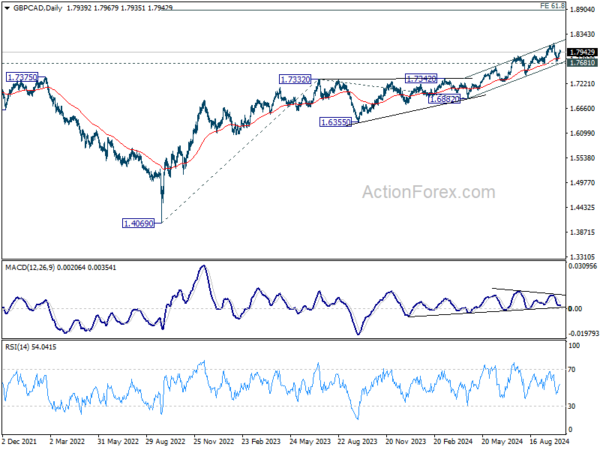

GBP/CAD is worth some attention today given that the UK will release GDP data while Canada will publish employment data. Technically, GBP/CAD’s up trend is still in healthy state, supported by the near term rising channel, as well as 55 D EMA. Further rally is expected as long as 1.7681 support holds. The rise from 1.4069 should target 61.8% projection of 1.4069 to 1.7332 from 1.6882 at 1.8899 in the medium term. The speed, however, will depends on how BoE’s and BoC’s policy paths diverge.

In Asia, at the time of writing, Nikkei is up 0.60%. Hong Kong is on holiday. China Shanghai SSE is down -1.73%. Singapore Strait Times is down -0.15%. Japan 10-year JGB yield is down -0.0101 at 0.949. Overnight, DOW fell -0.14%. S&P 500 fell -0.21%. NASDAQ fell -0.05%. 10-year yield rose 0.029 to 4.096.

Fed’s Bostic: Comfortable skipping a rate cut if data supports

Atlanta Fed President Raphael Bostic, in an interview with WSJ, indicated that he is open to pausing further rate cuts if economic data warrants it.

“I am totally comfortable with skipping a meeting if the data suggests that’s appropriate,” Bostic said.

His view aligns with the more conservative approach seen in Fed’s recent projections, where he has penciled in only one more quarter-point rate cut for the remainder of the year.

Bostic’s stance highlights a split among Fed officials regarding the future path of rate cuts. In the latest “dot plot” nine Fed members favor just one more 25bps cut this year, ten officials projected two such cuts.

Fed’s Williams expects gradual move toward neutral policy

New York Fed President John Williams signaled yesterday that monetary policy will continue to shift towards a more neutral stance in the coming months, aligning with ongoing progress toward price stability. He emphasized that while inflation remains above the 2% target, there has been clear movement in the right direction.

Williams noted, “Based on my current forecast for the economy, I expect that it will be appropriate to continue the process of moving the stance of monetary policy to a more neutral setting over time.” He reiterated that this approach will help preserve both the economy’s strength and the health of the labor market.

While acknowledging the work still needed to achieve price stability, he expressed optimism, stating, “The data paint a picture of an economy that has returned to balance.” Despite inflation remaining elevated, the message from Williams was one of cautious confidence, suggesting the Fed’s shift towards less restrictive policy will proceed gradually.

Fed’s Goolsbee expects more close calls ahead on rate decisions

Chicago Fed President Austan Goolsbee, in an interview with CNBC yesterday, highlighted the clear progress made in curbing inflation and cooling the labor market over the past 12 to 18 months.

“The overall trend… is clearly that inflation has come down a lot and the job market has cooled to a level which is around where we think full employment is,” Goolsbee stated.

Looking ahead, he noted there is broad consensus among policymakers that interest rates will need to drop a “fair amount” over the period.

However, in the near-term, Goolsbee expects more “close call” meetings for FOMC as members navigate through sometimes conflicting economic data.

SNB’s Martin: Negative rates a possibility, but not on immediate agenda

SNB Vice Chair Antoine Martin indicated that the central bank may consider lowering interest rates, potentially even taking them into negative territory, as a tool to support the economy.

Speaking at an event overnight, Martin said “with inflation being reasonably low in Switzerland and with an economy that could grow faster, that tends in the direction of a lower policy rate,”

He further remarked that negative rates, although not imminent, remain a useful tool in the central bank’s arsenal, stating, “There are imaginable scenarios where this is a tool that we would use because it’s a particularly useful tool.”

“But we’re not today in a situation that this is something that we’re considering,” Martin added.

New Zealand BNZ PMI rises to 46.9, but stays in contraction for 19th month

New Zealand’s BusinessNZ Performance of Manufacturing Index rose slightly from 46.1 to 46.9 in September, marking the third consecutive month of improvement. Despite this, the sector remains in contraction for the 19th straight month, with the index still well below the long-term average of 52.6.

Catherine Beard, Director of Advocacy at BusinessNZ, highlighted that while it’s positive to see the highest PMI result since April, the sector faces a “long and slow road” to recovery.

The components painted a mixed picture: production improved from 46.6 to 48.0, while employment dipped slightly from 46.8 to 46.6. New orders also inched higher from 47.3 to 47.8, but deliveries fell further from 45.8 to 45.6.

Negative sentiment among respondents is gradually improving, with 63.5% expressing pessimism in September, down from 64.2% in August and significantly lower than the 76.3% seen in June. The main concerns continue to revolve around weak demand, with many businesses citing a lack of orders and sales as key issues.

Looking ahead

UK data will take center stage in European session, with monthly GDP, production and trade balance featured. Swiss will release SECO consumer climate while Germany will publish CPI final.

Later in the day, main focus is on Canada employment and US PPI. US will also release U of Michigan consumer sentiment.

USD/CHF Daily Outlook

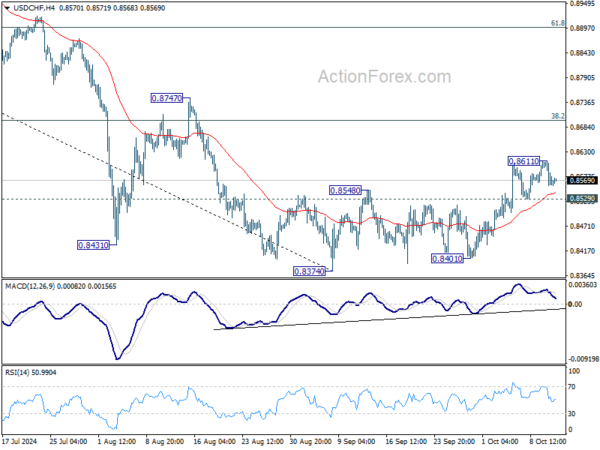

Daily Pivots: (S1) 0.8542; (P) 0.8578; (R1) 0.8597; More…

Intraday bias in USD/CHF is turned neutral first with current retreat. On the upside, above 0.8611 will resume the rebound from 0.8374 to 38.2% retracement of 0.9223 to 0.8374 at 0.8698. Sustained break there will argue that fall from 0.9223 has completed after defending 0.8332 low. However, firm break of 0.8529 minor support will turn bias back to the downside for retesting 0.8374/8401 support zone instead.

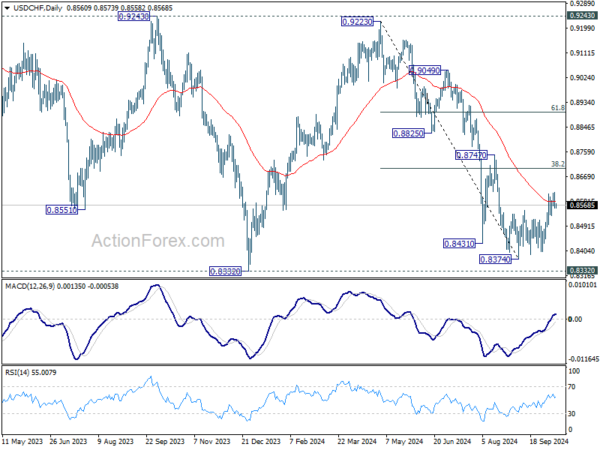

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with fall from 0.9223 as the second leg. Strong support could be seen from 0.8332 to bring rebound. Yet, overall outlook will continue to stay bearish as long as 0.9243 resistance holds. Firm break of 0.8332, however, will resume larger down trend from 1.0146 (2022 high).