State Bank of India Elliott Wave technical analysis [Video]

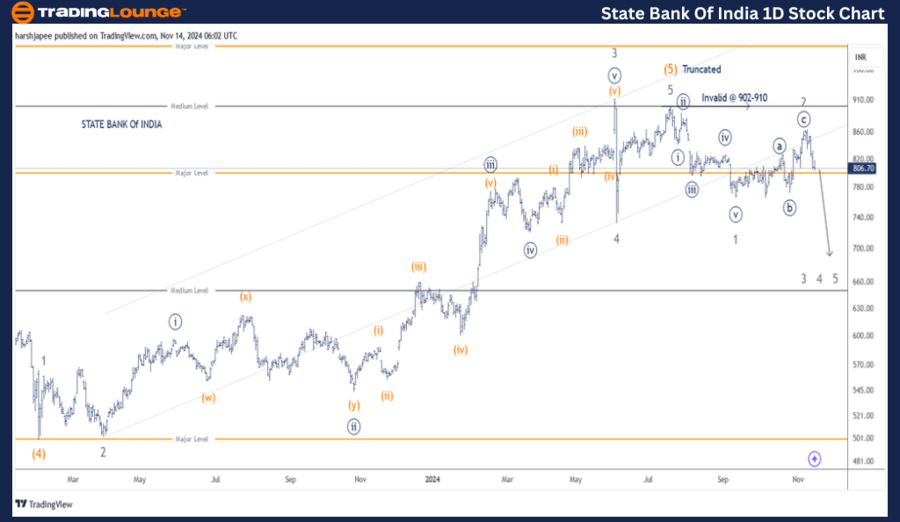

SBIN Elliott Wave technical analysis

Function: Counter Trend (Minor degree, Grey).

Mode: Motive.

Structure: Impulse within larger degree zigzag.

Position: Minor Wave 2.

Details: Minor Wave 2 Grey might have extended through 860 zone, If correct, expect Wave 3 to be underway soon.

Invalidation point: 910.

State Bank of India daily chart technical analysis and potential Elliott Wave counts

State Bank of India daily chart is indicating a potential trend reversal after hitting the 920 high; Intermediate Wave (5) Orange. The truncation has been followed by an impulse lower to 765 levels, Minor Wave 1 and a subsequent counter trend rally towards 860 high as Wave 2 termination.

If the above structure holds, bears are now back in control as Wave 3 begins to unfold. The bottom line for bearish structure is at 920 mark. Also note that a break below 730 will accelerate further. Alternatively, a push through 920 will confirm bulls are back in control.

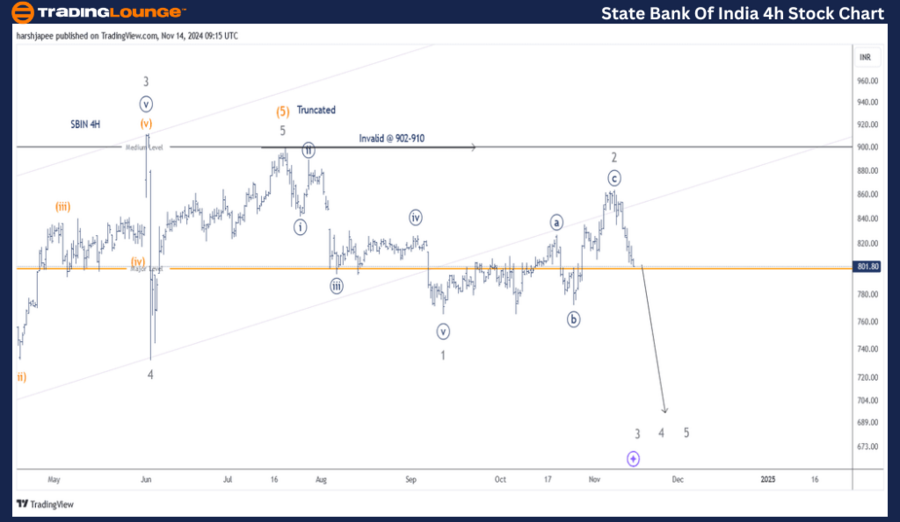

SBIN Elliott Wave technical analysis

Function: Counter Trend (Minor degree, Grey).

Mode: Motive.

Structure: Impulse within larger degree zigzag.

Position: Minor Wave 2.

Details: Minor Wave 2 Grey might have extended through 860 zone, If correct, expect Wave 3 to be underway soon. The stock trades around 803 at the time of writing as bears remain inclined to drag further.

Invalidation point: 910.

State Bank of India four-hour chart technical analysis and potential Elliott Wave counts

State Bank of India 4H chart highlights the wave structure post Minor Wave 4 termination around 730 mark on June 04, 2024. Kindly note that Minor Wave 5 has been proposed as a truncation, which terminated around 910 level.

Since then, there has been an impulse drop Minor Wave 1 Grey, followed by a corrective rally Minor Wave 2 Grey, terminating around 860 mark. If the above is correct, price action is now unfolding Minor Wave 3, which is projected way below the 700 mark.

Conclusion

State Bank of India is progressing lower within Wave 3 towards 700 mark, against 920 high.