Yen Rebound Gains Momentum, NZD Gains on RBNZ’s Moderated Easing Outlook – Action Forex

Kiwi rebounded broadly during Asian session, supported by a less dovish-than-expected rate cut from RBNZ. While the 50bps reduction to 4.25% had been widely anticipated, RBNZ’s updated forecasts, which suggest a slower pace of easing in 2025, surprised markets. The central bank projects the OCR to reach 3.50% by the end of next year, a level slightly higher than many had anticipated. This has divided analysts over the February rate decision, with ANZ expecting a 25bps cut while Westpac holds firm on a 50bps reduction. Regardless of the outcome, the moderated easing trajectory has bolstered Kiwi against its peers.

Yen also extended its rally, gaining strength across the board as its rebound against Dollar and European currencies gained momentum. While US Treasury yields showed some overnight recovery, they have struggled to generate sustained upward movement. 10-year yield is just testing critical technical support, reflecting hesitation among bond buyers. Hopes remain that Treasury Secretary nominee Scott Bessent might instill fiscal discipline in the Trump administration, at least for now.

For the week so far, Yen is currently the strongest performer, followed by Swiss Franc, both benefiting from falling US and European yields. Euro has clawed back some ground after earlier losses, placing third. On the weaker side, Loonie continues to lag, weighed down by uncertainty surrounding Trump’s tariff threats. Aussie and Dollar round out the bottom three, with Kiwi and Sterling holding middle positions.

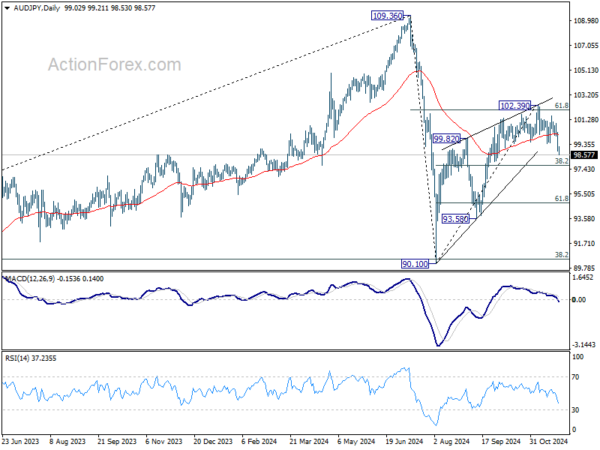

Following up on yesterday’s comment on AUD/JPY, fall from 102.39 extends lower today, on both Aussie’s weakness and Yen’s strength. Further decline is now in favor as long as 55 D EMA (now at 100.08) holds. Decisive break of 38.2% retracement of 90.10 to 102.39 at 97.69 should indicate that corrective rebound from 90.10 has completed with three waves up to 102.39. In this bearish case, deeper fall should be seen to 61.8% retracement at 94.79 and below.

In Asia, at the time of writing, Nikkei is down -1.04%. Hong Kong HSI is up 0.44%. China Shanghai SSE is up 0.37%. Singapore Strait Times is down -0.23%. Japan 10-year JGB yield is up 0.0024 at 1.073. Overnight, DOW rose 0.28%. S&P 500 rose 0.57%. NASDAQ rose 0.63%. 10-year yield rose 0.037 to 4.302.

FOMC minutes highlight gradual approach to policy easing amid uncertainty

The minutes from the FOMC November meeting revealed that if economic data aligns with expectations, it would likely be appropriate to “move gradually” toward a neutral policy stance over time. However, they stressed that decisions were “not on a preset course” and would depend on the state of the economy and risks to the outlook.

The committee acknowledged the volatility of recent economic data, highlighting the importance of focusing on “underlying economic trends” rather than reacting to short-term fluctuations. Most participants assessed risks to employment and inflation goals as “roughly in balance.”

Participants discussed the delicate balance required in easing policy, weighing the risks of moving “too quickly,” which could hinder inflation progress, against those of moving “too slowly,” which could weaken economic activity and employment.

Some members suggested that a “pause” in policy easing might be warranted if inflation remained “elevated”, while others argued for “accelerating” easing if labor market or economic conditions deteriorate.

Uncertainty over the “neutral” interest rate also played a significant role in shaping the committee’s deliberations. Many participants believed this uncertainty made it prudent to reduce policy restraint “gradually,” ensuring flexibility in responding to future developments.

RBNZ cuts rates by 50bps; projections indicate slower easing ahead

RBNZ delivered a widely expected 50bps cut to its Official Cash Rate, bringing it down to 4.25%. The central bank maintained easing bias, stating that if economic conditions align with projections, “the Committee expects to be able to lower the OCR further early next year.”

Governor Adrian Orr did not rule out another large cut in February during the post-meeting press conference. But RBNZ now forecasts the cash rate will drop to around 3.5% by the end of 2024, signaling smaller moves or pauses to assess the impact of prior easing.

On the economic front, RBNZ expects -0.2% contraction in Q3 2024, followed by recovery to 0.3% growth in Q4. Growth is anticipated to strengthen to a steady 0.6% quarterly rate through 2025 and 2026. “Economic growth is expected to recover during 2025, as lower interest rates encourage investment and other spending,” the central bank noted. .

Inflation is projected to slow from 2.2% currently to 2% by early 2025, but RBNZ forecasts show it picking up again and remaining between 2.0% and 2.5% through early 2027.

Australian CPI steady at 2.1% in Oct, underlying inflation shows mixed trends

Australia’s monthly CPI was unchanged at 2.1% yoy in October, below expectations of a rise to 2.5% yoy. This marks the lowest annual inflation rate since July 2021.

Core inflation metrics presented mixed signals, with CPI excluding volatile items and holiday travel slowing from 2.7% yoy to 2.4% yoy. However, trimmed mean CPI, a preferred gauge of underlying inflation, rose from 3.2% yoy to 3.5% yoy, signaling persistent inflationary pressures in certain sectors.

At the group level, notable price increases were observed in Food and non-alcoholic beverages (+3.3%), Recreation and culture (+4.3%), and Alcohol and tobacco (+6.0%). These were partly offset by a sharp decline in Transport prices, which fell -2.8%, driven by lower fuel costs.

Michelle Marquardt, head of prices statistics at the Australian Bureau of Statistics, noted that “the falls in electricity and fuel had a significant impact on the annual CPI measure this month.” She highlighted the value of core inflation measures, such as the trimmed mean, in offering deeper insights into inflation trends amid significant price fluctuations.

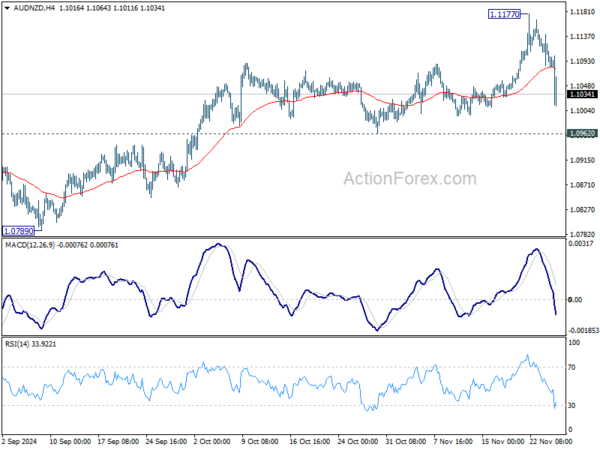

AUD/NZD dives but no bearish reversal yet

AUD/NZD plunged in the Asian session, driven by contrasting developments in Australia and New Zealand. However, it is too early to declare a bearish trend reversal for the cross, with near-term sideways consolidation likely.

In Australia, RBA received some relief as headline inflation in October did not reaccelerate as feared. While the trimmed mean CPI showed underlying inflation pressures remain strong, declines in CPI excluding volatile items and holiday travel offered some hope. The data keeps the possibility of a February rate cut alive, albeit with low odds.

Meanwhile, in New Zealand, RBNZ’s 50bps rate cut aligned with expectations, but its projected easing path disappointed dovish expectations. RBNZ now forecasts the OCR to drop to 3.50% by the end of 2025, implying only 75bps of further cuts from the current 4.25%. This signals that RBNZ could slow its pace of rate cuts to 25bps steps as early as February, provided the economy stabilizes.

Technically, a short term top should be in place at 1.1177 in AUD/NZD with today’s steep fall. However, outlook will remain mildly bullish as long as 1.0962 support holds. Some consolidations is now expected between 1.0962/1.1177 before resuming the choppy rally from 1.0567.

Looking ahead

Germany Gfk consumer confidence and Swiss UBS economic expectations will be released in European session. Later in the day, US will release GDP revision, durable goods orders, goods trade balance, personal income and spending, Chicago PMI, and jobless claims.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 161.17; (P) 161.64; (R1) 162.30; More….

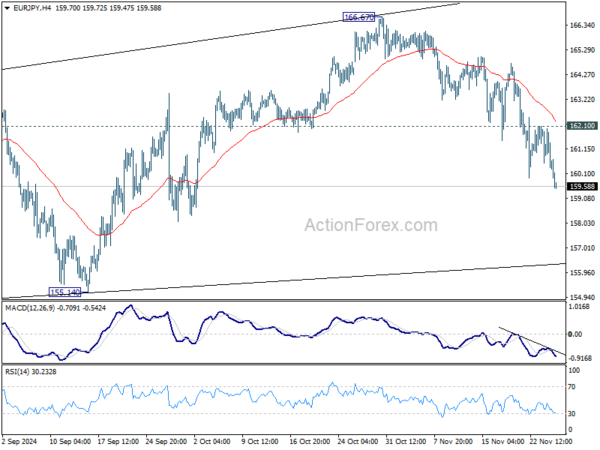

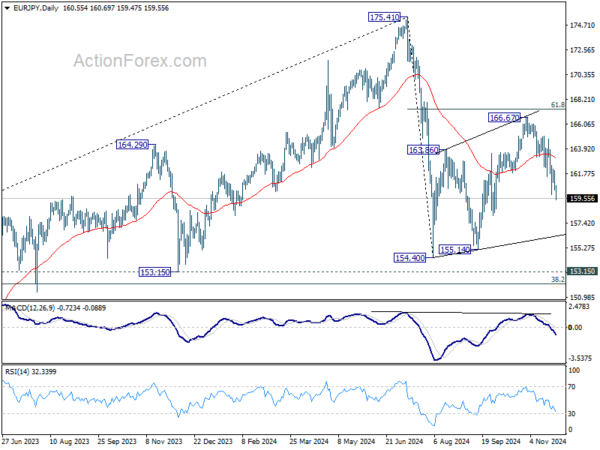

EUR/JPY’s fall from 166.67 continues today and intraday bias stays on the downside. As noted before, corrective rebound from 154.40 could have completed with three waves up to 166.67. Deeper decline would be seen to 155.14 support next. On the upside, above 162.10 resistance will turn intraday bias neutral again first.

In the bigger picture, price actions from 175.41 are seen as correction to rally from 114.42 (2020 low). The range of consolidation should have been set between 38.2% retracement of 114.42 to 175.41 at 152.11 and 175.41 high. However, decisive break of 152.11 would argue that deeper correction is underway.