Canadian Dollar Weakens on CPI; Dollar Firm After Retail Sales – Action Forex

Canadian Dollar trades broadly lower today while commodity currencies are generally soft. Canada’s CPI report reinforced the outlook of stable inflation hovering around target. BOC has likely completed its aggressive rate-cutting phase and pauses in policy easing are anticipated at some meetings next year. Nonetheless, the direction remains clear: further rate reductions are expected to move interest rates deeper into the neutral zone. Adding to the pressure, weaker Asian stock market performance overnight weighed on other commodity-linked currencies, Australian Dollar and New Zealand Dollar.

In contrast, Dollar is slightly firmer following stronger-than-expected US retail sales. The data underscores continued resilience in consumer spending, and together with a robust labor market, Fed is under no pressure to accelerate its rate-cutting cycle. Markets now widely expect tomorrow’s FOMC decision to reinforce a slower pace of easing for 2025, reflecting the central bank’s cautious stance.

Overall for the week so far, Sterling is currently strongest performer, supported by strong wage growth in today’s UK job market report. The pound now turns its focus to tomorrow’s UK CPI release and Thursday’s BoE rate decision for further cues. Meanwhile, New Zealand Dollar holds second place, followed by Euro. At the bottom, Canadian Dollar continues to struggle, joined by Swiss Franc and Australian Dollar. Yen and the greenback are mixed in the middle.

In Europe, at the time of writing, FTSE is down -0.69%. DAX is down -0.20%. DAX is up 0.11%. UK 10-year yield is up 0.055 at 4.500. Germany 10-year yield is down -0.024 at 2.225. Earlier in Asia, Nikkei fell -0.24%. Hong Kong HSI fell -0.48%. China Shanghai SSE fell -0.73%. Singapore Strait Times fell -0.55%. Japan 10-year JGB yield rose 0.0055 at 1.077.

US retail sales rises 0.7% mom in Nov, ex-auto sales up 0.2% mom

US retail sales climbed 0.7% mom to USD 724.6B in November, surpassing market expectations of 0.5% and highlighting robust consumer activity as the holiday shopping season gained momentum. However, the details reveal a mixed picture.

Excluding autos, sales grew by 0.2% mom, which was in line with expectations, reaching USD 583.9B. Meanwhile, sales excluding gasoline rose 0.7% mom to USD 673.1B. When excluding both autos and gasoline, sales also increased modestly by 0.2% mom to USD 532.4B, indicating steady but tempered spending patterns in core retail categories.

On a broader scale, total sales for the September through November period rose 2.9% yoy.

Canada’s CPI slows to 1.9% in Nov, with broad-based deceleration

Canada’s headline CPI slowed to 1.9% yoy in November, dipping below expectations of 2.0% yoy and down from 2.0% yoy in October. The deceleration was broad-based, with declines in travel tour prices and the mortgage interest cost index contributing significantly to the slower pace of inflation.

Excluding gasoline, the CPI rose 2.0% yoy, cooling from October’s 2.2% yoy. On a month-over-month basis, inflation was flat in November, following a 0.4% mom increase in the prior month.

While headline inflation eased, Canada’s core inflation measures sent mixed signals. CPI median increased slightly from 2.5% yoy to 2.6% yoy (above forecasts of 2.4% yoy). CPI trimmed climbed from 2.6% yoy to 2.7% yoy (also exceeding expectations of 2.5% yoy). However, CPI common, the measure often considered the most stable, declined from 2.2% yoy to 2.0% yoy, missing the anticipated 2.1% yoy.

ECB’s Rehn: EU can bolster negotiation stance with prepared countermeasures on US tariffs

Finland’s ECB Governing Council member Olli Rehn highlighted growing risks to Europe’s economic outlook with the uncertainty over trade policy as a key downside factor.

Rehn warned that Europe must be prepared to respond to potential trade conflicts with the US, emphasizing that while “negotiation is preferable,” EU’s position could be strengthened by demonstrating readiness to implement “countermeasures” against any US tariff threats.

Rehn also provided clarity on ECB’s monetary policy direction, stating it is now clearly leaning toward further easing. However, the “speed and scale of rate cuts” will remain data-dependent and decided at each meeting based on a thorough assessment of economic developments.

Eurozone goods exports rise 2.1% yoy in Oct, imports up 3.2% yoy

Eurozone goods exports rose 2.1% yoy to EUR 254.0B in October. Goods imports rose 3.2% yoy to EUR 247.2B. Trade balance stood at EUR 6.8B surplus. Intra-Eurozone trade rose 2.2% yoy to EUR 229.2B.

In seasonally adjusted term, exports fell -1.6% mom to EUR 232.5B. Imports rose 1.3% mom to EUR 226.5B. Trade surplus narrowed from EUR 12.6B in September to EUR 6.1B, versus expectation of EUR 11.9B. Intra-Eurozone trade fell -0.6% mom to EUR 213.5B.

ZEW sentiment surges on ECB rate cut optimism and German policy hope

The December ZEW Economic Sentiment survey delivered a notable improvement in outlook for both Germany and the Eurozone, driven by optimism surrounding interest rate cuts and policy shifts.

German ZEW Economic Sentiment index surged to 15.7 from 7.4, far exceeding expectations of 7.0. However, Current Situation Index continued to deteriorate, slipping further to -93.1 from -91.4, reflecting ongoing economic weakness in the near term.

Eurozone ZEW Economic Sentiment also showed a strong uptick, rising to 17.0 from 11.6. Yet, the Current Situation Index revealed a sharper decline, falling 11.2 points to -55.0.

ZEW President Achim Wambach attributed the improved sentiment to expectations of economic policies favoring private investment, particularly as Germany approaches snap elections.

Additionally, growing confidence in further ECB interest rate cuts next year has bolstered the outlook. Wambach noted that survey respondents remain unconcerned about inflation, suggesting the recent uptick is viewed as “a temporary phenomenon” and inflation rates are expected to stabilize or decline in 2025.

Germany Ifo business climate falls to 84.7, weakness becoming chronic

German Ifo Business Climate Index declined to 84.7 in December, missing expectations of 85.6 and falling from 85.7 in November. This drop highlights persistent economic challenges in Europe’s largest economy, with sentiment continuing to slide amid growing uncertainty. While Current Assessment Index surprised to the upside, rising to 85.1 (above forecasts of 84.0), Expectations Index fell sharply fro 87.0 to 84.4, undershooting the anticipated 87.5.

Sectoral data painted a concerning picture. Sentiment in manufacturing dropped further, from -22.0 to -24.8. Services sector weakened from -3.5 to -5.6. Trade saw a sharper decline from -26.6 to -29.5. Meanwhile, the only bright spot came from construction, where sentiment improved from -29.0 to -26.1, though it remains firmly in negative territory.

The Ifo Institute underscored the gravity of the situation, warning that “the weakness of the German economy has become chronic.”

UK job numbers decline, but wage growth remains elevated

UK labor market showed signs of softening in November, with payrolled employment falling by -35k or -0.1% mom to 30.4m. Meanwhile, median monthly pay growth slowed to 6.3% yoy, down sharply from 7.9% yoy in the prior month.

In the three months to October, employment rate edged up by 0.1% to 74.9%, while the unemployment rate also increased slightly to 4.3%, up by 0.1%. Economic inactivity rate fell by -0.2% to 21.7%, suggesting some progress in bringing inactive workers back into the labor force.

Wage growth remained robust overall, with average earnings excluding bonuses rising 5.2% yoy in the three months to October, up from 4.9% yoy in the previous month. Including bonuses, average earnings also grew by 5.2% yoy, accelerating from 4.4% yoy. This uptick in earnings may keep pressure on BoE, as policymakers balance moderating inflation with still-elevated wage growth.

Australia Westpac consumer sentiment falls as economic outlook worsens

Australian Westpac Consumer Sentiment Index declined -2.0% mom to 92.8 in December. The drop was driven by a sharp deterioration in economic expectations. The economic outlook, next 12 months sub-index fell -9.6% mom to 91.2, while the economic outlook, next 5 years dropped -7.9% to 95.9 mom, erasing nearly half of the gains from the past two months.

Westpac noted that while RBA has expressed growing confidence in inflation returning to its 2-3% target range, the latest sentiment data highlights lingering consumer uncertainty. Concerns about labor market slack and weak productivity growth continue to complicate the inflation outlook.

Looking ahead, RBA is expected to maintain its current policy stance at its February meeting, absent a significant downside surprise in inflation. Westpac anticipates the easing cycle will begin in May 2025, once clearer evidence of slowing inflation and stable labor conditions emerges.

USD/CAD Mid-Day Outlook

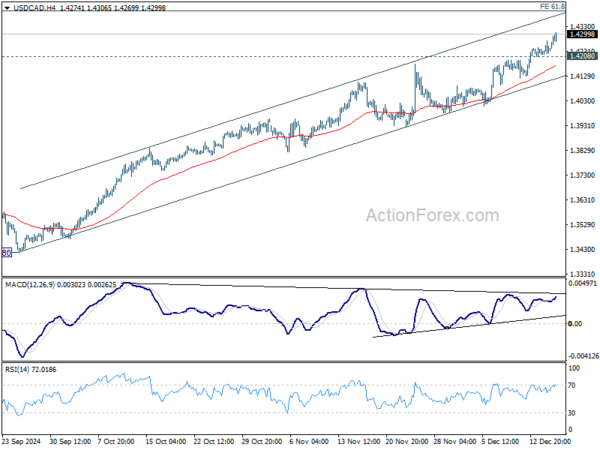

Daily Pivots: (S1) 1.4217; (P) 1.4244; (R1) 1.4272; More…

Canadian Dollar edged up slightly in early US session and intraday bias remains on the upside. Current up trend should target 1.4391 projection level. On the downside, break of 1.4208 minor support will turn intraday bias neutral again first, and bring deeper pull back to channel support (now at 1.4114). Considering bearish divergence conditio in 4H MACD, firm break of the channel support will indicate short term topping and bring deeper correction.

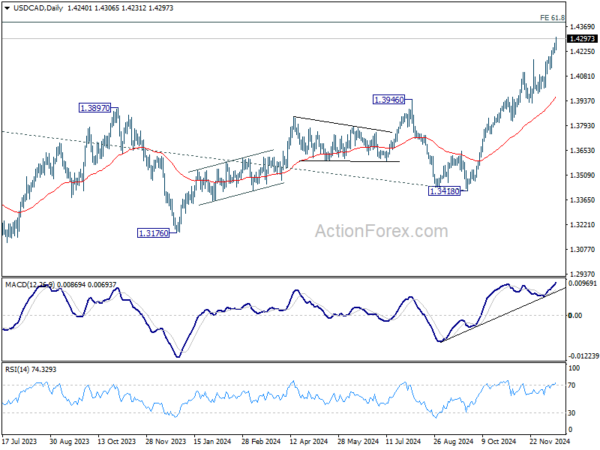

In the bigger picture, up trend from 1.2005 (2021) is in progress. Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3418 at 1.4391. Medium term outlook will remain bullish as long as 55 W EMA (now at 1.3706) holds, even in case of deep pullback.