Yen Recovers Slightly on Japan’s Inflation and Verbal Intervention, But Dollar Remains Unstoppable – Action Forex

Yen, which has been one of the weakest currencies this week, showed a modest recovery during today’s Asian session. The rebound came on the back of stronger-than-expected inflation data and renewed verbal intervention from Japan’s Finance Ministry. November’s inflation figures revealed a sharp reacceleration, driven by significant increases in energy prices and rice prices. Despite this, the slight uptick in core-core CPI was insufficient to push BoJ into immediate action. Expectations remain for a possible rate hike in January, with future moves contingent on developments in domestic wage growth and the trade policies of the incoming US administration.

Japanese Finance Minister Katsunobu Kato reiterated the usual warning against “one-sided or rapid” currency movements, emphasizing that exchange rates should reflect economic fundamentals. He pledged to take “appropriate action” to address excessive volatility. However, these remarks had a limited market impact given the dominance of Dollar, which surged after Fed’s hawkish hold and the strong rally in US Treasury yields. In particular, 10-year yield has broken through 4.5% resistance level, now setting sights on 5.0% mark. This momentum keeps USD/JPY on track toward the critical 160 level.

In weekly rankings, Dollar remains the clear leader, driven by Fed expectations and rising yields. Swiss Franc holds a distant second, followed by the British Pound, which remains relatively resilient against others despite the selloff after BoE rate decision.

Meanwhile, New Zealand Dollar is the week’s worst performer, weighed down by poor GDP data showing significant economic contraction. Yen is the second weakest, pressured by both a lack of BoJ action and strong US and European yields. Australian Dollar rounds out the bottom three, while Euro and Canadian Dollar are positioned in the middle. Though market dynamics on the bottom side of the spectrum could still shift in the final trading sessions.

Technically, it should be emphasized that EUR/USD is still holding above 1.0330 near term support after all the volatility so far. Sellers appear not too committed yet. Because of this, even with a breach of 1.0330, some support could be seen from 61.8% projection of 1.0936 to 10330 from 1.0629 at 1.0254 to contain downside. EUR/USD would need to break through 1.0254 decisively to confirm that Dollar’s underlying strength is to sustain.

Looking ahead, US personal income and spending, as well as PCE inflation data are the main focuses for the rest of the day. Canada retail sales will be watched too.

UK retail sales edge up 0.2% mom, below 0.4% mom expectations

UK retail sales volumes rose by 0.2% mom in November, falling short of expectations for a 0.4% increase. This modest gain partly recovered the -0.7% mom decline recorded in October. Growth in supermarkets and non-food stores provided support, but this was partially offset by weaker performance from clothing retailers.

On an annual basis, sales volumes increased by 0.5% over the year to November. However, volumes remain -1.6% below their pre-pandemic levels from February 2020.

Looking at the broader trend, retail sales volumes rose by 0.3% in the three months to November compared with the prior three-month period. Compared to the same period last year, volumes were up by 1.9%, suggesting some resilience despite ongoing economic uncertainties.

Japan’s core CPI reaccelerates to 2.7%, driven by energy and rice

Japan’s core CPI (excluding food) rose to 2.7% yoy in November, marking the first reacceleration in three months and exceeding market expectations of 2.6% yoy. Core inflation has remained above the BoJ’s 2% target since April 2022, highlighting persistent price pressures. This increase was attributed to reduced government subsidies for utility bills and a sharp rise in rice prices.

Energy prices surged 6.0% yoy, up from October’s 2.3% yoy gain. Within this category, electricity prices jumped 9.9% yoy, and city gas costs climbed 6.4% yoy. Meanwhile, rice prices soared by a staggering 63.6% yoy, the steepest increase since 1971, driven by last year’s unusually hot summer that disrupted production.

Core-core CPI (excluding food and energy) ticked up from 2.3% yoy to 2.4% yoy, while headline CPI rose to 2.9% from October’s 2.3%. Service prices, a key indicator for BOJ as they often reflect wage dynamics, increased 1.5% yoy, unchanged from the prior month.

NZ’s exports rises 9.1% yoy in Nov, imports up 3.9% yoy

New Zealand’s trade data for November showed a significant improvement, with goods exports rising 9.1% yoy to NZD 6.5B, while goods imports increased by a more modest 3.9% yoy to NZD 6.9B. The resulting trade deficit of NZD -437m was much smaller than the expected NZD -1951m.

Exports saw notable gains across key markets. Shipments to China increased 6.3% yoy, adding NZD 106m, while exports to Australia climbed 8.4% yoy (NZD 62m) and to the US by 12% yoy (NZD 85m). Exports to the EU surged the most, rising 27% yoy (NZD 74m), with shipments to Japan also showing strength at 7.2% yoy (NZD 19m).

On the import side, data was more mixed. Imports from China edged down -1.7% yoy (NZD -29m) and from the EU fell sharply by -16% yoy (NZD -163m). Similarly, imports from South Korea dropped -12% yoy (NZD -61m ). However, imports from Australia rose 14% yoy (NZD 101m) and from the US increased 7.2% yoy (NZD 41 m).

USD/JPY Daily Outlook

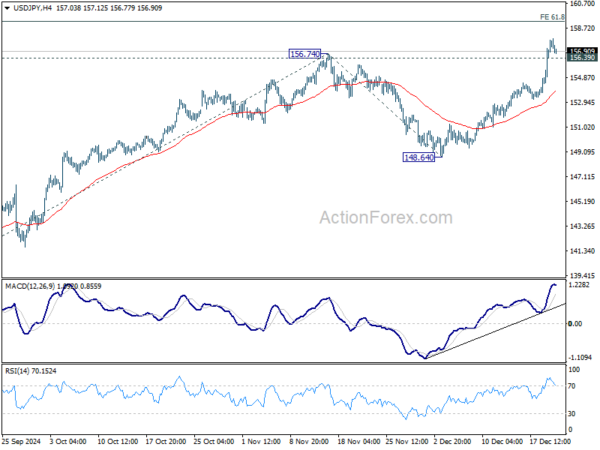

Daily Pivots: (S1) 155.31; (P) 156.56; (R1) 158.68; More…

Intraday bias in USD/JPY remains on the upside for now despite current mild retreat. Current rally is part of the whole rise from 139.57, and should target 61.8% projection of 139.57 to 156.74 from 148.64 at 159.25 next. On the downside, below 156.39 minor support will turn intraday bias neutral again first. But outlook will stay bullish as long as 153.15 support holds, in case of retreat.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.