Dollar Rout Deepens; Gold Charges Toward 3500, or Even 4000? – Action Forex

The broad selloff in US assets resumed overnight as market confidence took another blow from escalating political pressure on Fed. Major US stock indexes ended the session deep in the red, while 10-year Treasury yields surged back above 4.4%. The Dollar Index also plunged to a fresh three-year low, continuing its dramatic collapse.

The key catalyst: another public attack by US President Donald Trump, who took to Truth Social to call Fed Chair Jerome Powell a “major loser” and demanded that interest rates be cut “NOW” to avoid a economic slowdown. Trump’s renewed rhetoric has intensified concerns about Fed’s independence at a time of high uncertainty due to his own tariff policies.

The central bank has so far resisted political pressure, and more Fed officials are set to speak today. Markets expect them to defend the institution’s autonomy and reaffirm their data-dependent approach. Given the current policy fog, particularly surrounding Trump’s shifting trade stance, officials are likely to emphasize the need for further clarity before making any policy adjustments.

Meanwhile, the 90-day truce on Trump’s “reciprocal tariffs” continues with little meaningful progress in negotiations. Even talks with Japan, one of America’s closest allies, remain stalled. Japanese Prime Minister Shigeru Ishiba stated on Monday that substance matters more than speed in any trade agreement. Additionally, Ishiba vowing not to concede on core issues such as car safety standards and agricultural access. Finance Minister Katsunobu Kato is expected to travel to Washington later this week for discussions with US Treasury Secretary Scott Bessent, with currency issues on the agenda.

Tensions with China continue to escalate. The Chinese Ministry of Commerce issued a sharp warning that Beijing will retaliate against any countries that cooperate with the US in ways that undermine China’s interests. China’s message reinforces the view that global trade friction is far from resolved, despite temporary pauses.

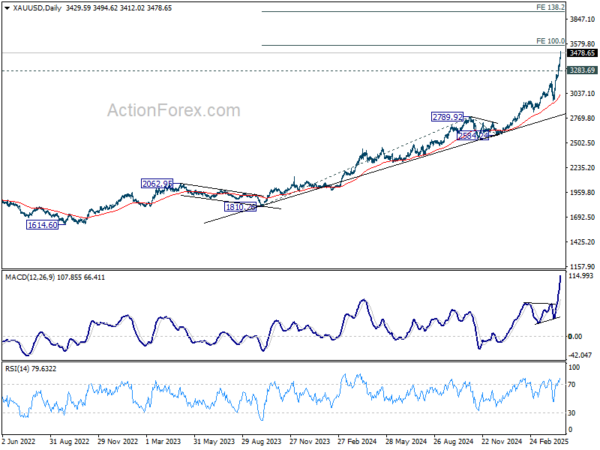

Against this backdrop, Gold continues to surge as investors flee to safety. The precious metal’s record-breaking rally shows no signs of slowing, with momentum firmly in upside acceleration.

Technically, further rise is expected as long as 3283.69 support holds. Next target is 100% projection of 1810.26 to 2789.92 from 2584.24 at 3563.90. Firm break there will pave the way to 138.2% projection at 3938.13, which is close to 4000 psychological level.

Overall in the currency markets, Dollar is currently the worst performer by a mild, followed by Loonie and then Sterling. Yen is the strongest one, followed by Kiwi and then Euro. Swiss Franc and Aussie are positioning in the middle.

In Asia, at the time of writing, Nikkei is down -0.07%. Hong Kong HSI is up 0.20%. China Shanghai SSE is up 0.38%. Singapore Strait Times is up 0.90%. Japan 10-year JGB yield is up 0.023 at 1.312. Overnight, DOW fell -2.48%. S&P 500 fell -2.36%. NASDAQ fell -2.55%. 10-year yield rose 0.072 to 4.405.

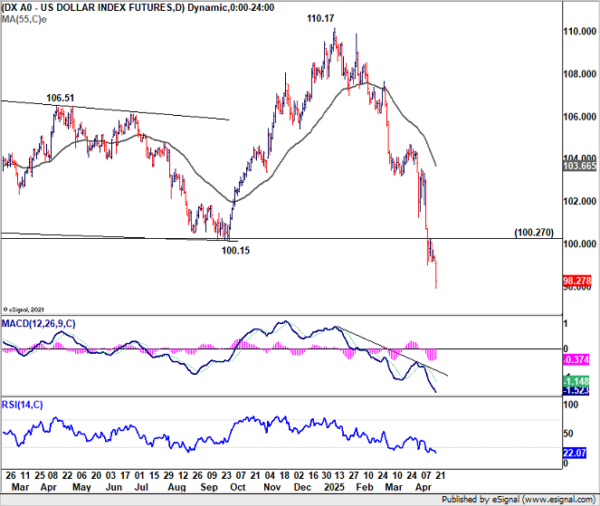

Dollar Index crashes to 3-year low; 95 support holds long-term fate

Dollar Index broke through an important support overnight as recent decline accelerated, and hit the lowest level in three years. The selloff reflects a deepening flight out of US assets, as confidence continues to erode. A major driver of the decline has been US President Donald Trump’s ongoing public attacks on Fed, which have increasingly undermined perceptions of central bank independence and rattled investor trust in US policy credibility.

Technically, the break of 99.57 (2023 low) confirms resumption of the downtrend from 114.77 (2022 high). Near term outlook will now stay bearish as long as 100.27 resistance holds. Next target is 100% projection of 114.77 to 99.57 from 110.17 at 94.97.

This support zone around 95 psychological level is especially significant, as it aligns with the long term rising channel support that dates back to 2011.

Decisive break of 95 ahead could firstly trigger further medium term downside acceleration. More importantly, that could also mark the end of the broader uptrend that began from 2008 low at 70.69.

Such a structural breakdown would open the door for sustained weakness with medium-term downside targets around the 89.20–90.00 range, with risk of entering a new secular downtrend in the years ahead.

New Zealand posts surprise NZD 970m trade surplus as exports surge 19%

New Zealand recorded stronger-than-expected trade surplus of NZD 970m in March, far exceeding forecasts of NZD 80m. The surprise was driven by a robust 19% yoy increase in goods exports, which rose by NZD 1.2B to NZD 7.6B. Imports also grew, up 12% yoy to NZD 6.6B.

Export performance was particularly strong across key trading partners. Shipments to China rose by NZD 371m (23% yoy), while exports to the US and the EU grew by 22% yoy and 51% yoy respectively. Exports to Japan also increased 11% yoy, although shipments to Australia dipped slightly, down -0.47% yoy.

On the import side, the largest increases came from the US, with a 48% yoy jump worth NZD 243m. This was followed by China and the EU, which posted 14% yoy and 19% yoy gains respectively. Imports from South Korea bucked the trend, falling -12% yoy.

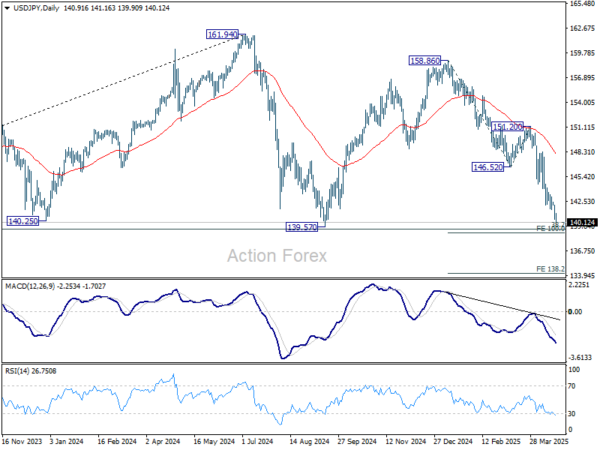

USD/JPY Daily Outlook

Daily Pivots: (S1) 140.18; (P) 141.16; (R1) 141.85; More…

Intraday bias in USD/JPY remains on the downside for the moment. Current fall from 158.86 is in progress for 139.57 support. Strong support could seen from 139.26 fibonacci level to bring rebound. On the upside, above 141.60 minor resistance will turn intraday bias neutral first. However, decisive break of 139.26 will carry larger bearish implications, and target 138.2% projection of 158.86 to 146.52 from 151.20 at 134.14.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low), with fall from 158.86 as the third leg. Strong support should be seen from 38.2% retracement of 102.58 to 161.94 at 139.26 to bring rebound. However, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.