Risk Sentiment Sours on US GDP Contraction, Recession Fears Mount – Action Forex

Risk sentiment soured as US session commenced after data showed the economy unexpectedly contracted in the first quarter. Although the decline was heavily influenced by a surge in imports, which mechanically subtract from GDP calculations, the result still serves as a stark reminder that economic momentum was already faltering even before the full impact of President Donald Trump’s reciprocal tariffs in April

The weak GDP print has reignited recession fears, and a downturn may have already begun. This narrative is also supported by poor ADP employment report. Attention now turns squarely to Friday’s non-farm payroll data. A meaningful uptick in the unemployment rate or significant weakness in job creation would ring alarm bells for the administration, investors, and Fed alike. W

In currency markets, the initial reaction has seen a mild shift toward Dollar, which is currently the strongest performer of the day, followed by the Loonie and Swiss Franc. On the other side, Yen, Sterling, and Kiwi are underperforming. However, these rankings remain fluid and may change quickly depending on how risk sentiment evolves in the coming sessions.

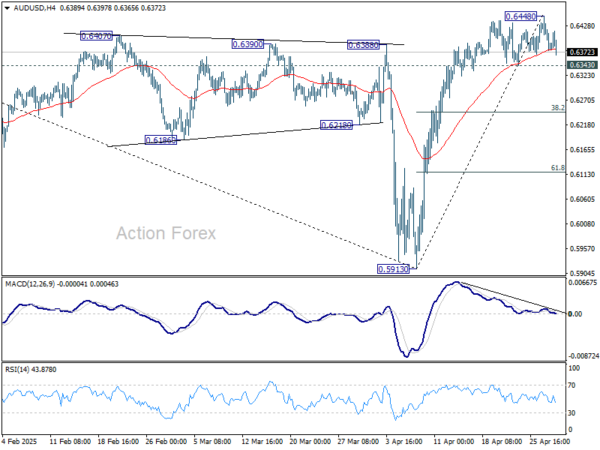

Technically, a focus is now on AUD/USD. Break of 0.6343 support, following broader risk aversion, will confirm short term topping at 0.6448. Deeper decline should then be seen to 38.2% retracement of 0.5913 to 0.6448 at 0.6244. Further break there will target 61.8% retracement at 0.6117.

In Europe, at the time of writing, FTSE is down -0.28%. DAX is down -0.37%. CAC is down -0.19%. UK 10-year yield is down -0.035 at 4.446. Germany 10-year yield is down -0.04 at 2.459. Earlier in Asia, Nikkei rose 0.57%. Hong Kong HSI rose 0.51%. China Shanghai SSE fell -0.23%. Singapore Strait Times rose 0.72%. Japan 10-year JGB yield closed flat at 1.315.

US GDP shrinks -0.3% annualized in Q1, price pressures building up

The US economy unexpectedly contracted in the Q1, with GDP shrinking at an annualized rate of -0.3%, marking the first decline since Q2 2022 and falling well short of expectations for modest 0.4% growth.

The surprise contraction was driven by a surge in imports and a pullback in government spending, which more than offset gains in investment, consumer spending, and exports.

Compounding the disappointing headline figure, inflation pressures showed renewed strength. The GDP price index jumped to 3.7% yoy, significantly above the 3.1% yoy forecast and accelerating from 2.3% yoy in Q4.

US ADP jobs rise just 62k in Apr, well below expectations

US ADP private sector employment rose by just 62k in April, sharply missing expectations of a 130k increase and marking a notable slowdown in hiring.

Gains were split between goods-producing industries, which added 26k jobs, and service-providing sectors, which contributed 34k. By establishment size, medium-sized firms led with 40k new jobs, while small and large businesses added 11k and 12k, respectively.

Pay trends were mixed. Job-stayers saw wage growth slow slightly to 4.5% yoy. Job-changers experienced an uptick in pay increases from 6.7% yoy to 6.9% yoy.

ADP Chief Economist Nela Richardson described the tone as one of “unease,” as employers balance strong economic signals against growing uncertainty tied to fiscal policy and consumer sentiment.

Canada’s GDP contracts -0.2% mom in Feb, weakness broad-based across sectors

Canada’s economy unexpectedly shrank by -0.2% mom in February, missing expectations of flat growth, as a broad-based downturn weighed on output.

Goods-producing sectors led the decline with a -0.6% mom drop, particularly from mining, quarrying, and oil and gas extraction, as well as construction.

Sservices sector also edged lower by -0.1% mom, dragged down by transportation, warehousing, and real estate

12 out of 20 industrial sectors posting declines.

Looking ahead, preliminary data suggests a modest rebound of 0.1% mom in March, led by gains in mining, retail trade, and transportation.

Eurozone GDP beats expectation of 0.4% qoq growth, EU up 0.3% qoq

Eurozone GDP expanded by 0.4% qoq in Q1, doubling market expectations of 0.2% and signaling a stronger-than-anticipated start to the year. Across the broader EU, GDP rose by 0.3% qoq.

On a year-on-year basis, seasonally adjusted GDP grew 1.2% in the Eurozone and 1.4% in the EU, matching growth rates from the previous quarter.

Ireland led the regional performance with a sharp 3.2% quarterly increase, followed by Spain and Lithuania with 0.6% growth. Hungary was the only member state to post a quarterly contraction, down -0.2%.

Swiss KOF falls to 97.1, outlook considerably subdued

The Swiss KOF Economic Barometer slumped to 97.1 in April, down sharply from 103.9 and well below the expected 102.0, marking its first drop below the medium-term average this year.

The KOF Swiss Economic Institute noted that the outlook for the Swiss economy is now “considerably subdued,” as broad-based weakness weighed on the indicator.

According to KOF, the sharp deterioration was primarily driven by a significant setback in manufacturing sentiment, with additional pressure seen across the hospitality and broader services sectors. Financial and insurance services were the only areas showing relative stability.

Australia’s trimmed mean CPI returns to RBA’s target band, services inflation eases further

Australia’s headline CPI was unchanged at 2.4% yoy in Q1, above expectations of a slight decline to 2.2% yoy. On a quarterly basis, CPI rose 0.9% qoq, also exceeding forecast of 0.8% qoq.

The closely watched trimmed mean CPI, a core inflation gauge, slowed from 3.3% yoy to 2.9% yoy , falling back within RBA’s 2–3% target range for the first time since 2021, in line with market expectations. However, the quarterly increase of 0.7% qoq was a touch higher than the anticipated 0.6% qoq.

Annual goods inflation accelerated from 0.8% yoy to 1.3% yoy, driven by a notable rebound in electricity prices. Services inflation eased from 4.3% yoy to 3.7% yoy, its lowest since mid-2022, amid broad-based moderation in rent and insurance costs.

NZ ANZ business confidence falls to 49.3, inflation expectations steady

New Zealand’s ANZ Business Confidence fell sharply in April, dropping from 57.5 to 49.3. The own activity outlook also edged lower from 48.6 to 47.7.

ANZ noted the decline may reflect growing apprehension over the global economic outlook, particularly uncertainty stemming from the escalating US-China trade war and broader policy unpredictability from the US administration.

Cost expectations three months ahead surged from 74.1 to 77.9, the highest level since September 2023. This contrasts with a slight dip in pricing intentions, which eased from 51.3 to 49.4. Inflation expectations one year out remained largely steady at 2.65%.

Japan’s industrial output slides -1.1% mom on auto weakness

Japan’s industrial production fell by -1.1% mom in March, significantly worse than the anticipated -0.7% mom decline.

According to the Ministry of Economy, Trade and Industry, the sharp drop was led by a -5.9% mom fall in motor vehicle output. Notably, regular passenger car production slipped -4.1% mom due to weaker export demand, while small vehicle output plunged -23.2% mom, reflecting disruptions in auto parts supply chains.

The slump in production comes against the backdrop of rising trade tensions, with US President Donald Trump imposing a 25% tariff on car and truck imports and a sweeping 24% tariff on all Japanese goods, later temporarily reduced to 10%.

Japanese manufacturers surveyed by METI project a recovery ahead, with output expected to rise 1.3% mom in April and 3.9% mom in May. But ministry officials remain cautious. “The environment surrounding production remains highly uncertain,” a METI representative warned, adding that manufacturers are clearly worried about the impact of US tariffs, though no changes to production plans have been formally announced yet.

Also released, retail sales rose 3.1% yoy in March, below expectations of 3.6%. Still, the result marks the 37th consecutive month of gains, indicating that domestic consumption has yet to show significant signs of stress.

China’s factory activity slumps on trade conflicts, optimism near record lows

China’s factory activity slumped sharply in April as official NBS Manufacturing PMI dropped from 50.5 to 49.0, its lowest level since December 2023 and below expectations of 49.9. Non-manufacturing PMI also weakened from 50.8 to 50.4.

The decline points to early signs of strain from escalating trade tensions, with NBS citing “sharp changes in the external environment” as a key driver.

Private-sector data painted a similarly cautious picture. Caixin Manufacturing PMI dropped to 50.4, its lowest in three months and just narrowly remaining in expansion.

Caixin’s Senior Economist Wang Zhe noted that while production and demand grew modestly, the pace has slowed and forward-looking optimism weakened significantly—plunging to the third-lowest level ever recorded. Trade-related uncertainty was a key concern for firms, weighing heavily on sentiment despite hopes for more policy support.

The April PMIs point to early-stage fallout from the China-US tariff standoff. Businesses are already reporting shrinking employment, delayed logistics, and inventory drawdowns. With both consumer and business confidence faltering, the government faces growing pressure to deploy stimulus measures. Unless domestic demand recovers and external risks subside, China’s economy could face more headwinds in Q2 and beyond.

EUR/USD Mid-Day Outlook

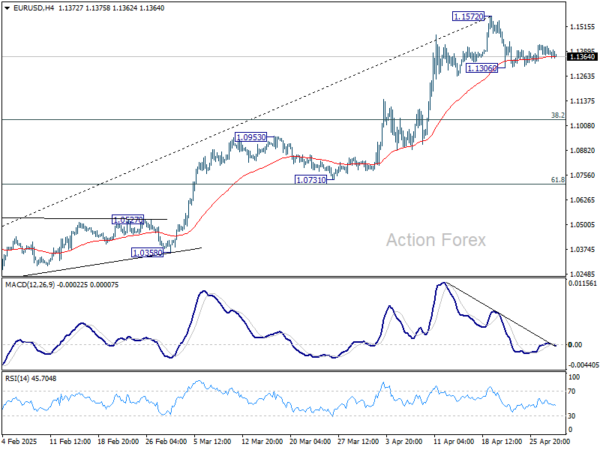

Daily Pivots: (S1) 1.1362; (P) 1.1394; (R1) 1.1418; More…

EUR/USD is still bounded in tight range and intraday bias stays neutral. On the downside, break of 1.1306 will extend the correction from 1.1572. But strong support should be seen from 38.2% retracement of 1.0176 to 1.1572 at 1.1039 to contain downside. On the upside, break of 1.1572 will resume larger up trend.

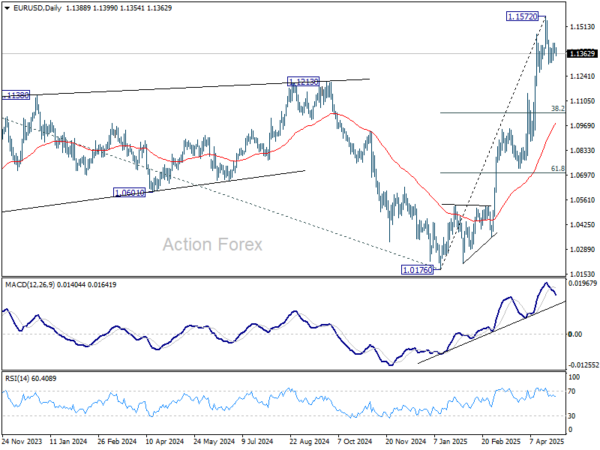

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will now remain the favored case as long as 55 W EMA (now at 1.0792) holds.