Risk-On Sentiment Regains Control as Data Downplays Severity of Tariff Shock – Action Forex

Global risk sentiment continued to improve last week, with major equity indices staging robust rallies as investor anxiety over the fallout from tariffs eased. The solid US non-farm payroll data was a key turning point, reassuring markets that the early economic impact of the trade shock was not as damaging as initially feared. Added to that, there were signs of progress on multiple trade negotiation fronts, including a potential thaw in US-China relations.

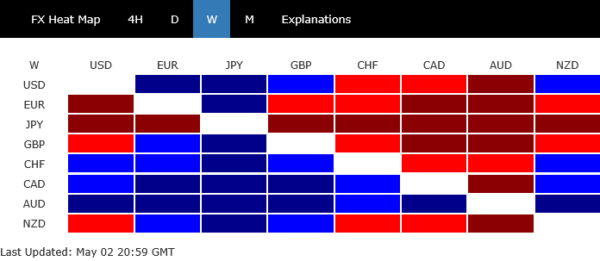

In the currency markets, Aussie was the top performer, buoyed not only by improving risk appetite but also by stronger-than-expected inflation data, which suggests the RBA’s easing path may remain gradual. Loonie followed as second benefiting from political stability after the Canadian elections. Swiss Franc ranked third.

On the other hand, Yen fell the most, under pressure from a dovish BoJ that downgraded its growth outlook. Euro was the second weakest performer, reversing some of its earlier strength despite a sharper-than-expected acceleration in core inflation. Sterling also lagged as third worst. Dollar and New Zealand Dollar ended the week in the middle of the pack.

US Stocks Erase April Losses as Payrolls Soothe Growth Fears, Fed Cut Odds Fall

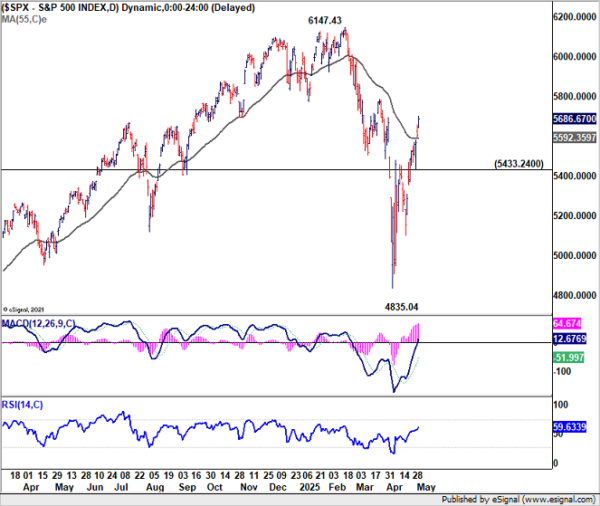

The US markets have decisively moved past the turmoil sparked by the reciprocal tariff announcements in April. Investor confidence has fully recovered, especially in equities with both S&P 500 and NASDAQ reversed all losses from April. S&P 500 even notched a remarkable nine consecutive days of gains, its longest winning streak since 2004. DOW is also on track to complete a full reversal.

Sentiment had wavered briefly after Q1 GDP showed an unexpected contraction. However, those concerns were largely alleviated by April’s non-farm payroll report, which showed solid job creation and stable unemployment. The data suggests that while trade disruptions remain a concern, the labor market is resilient and the broader economy is still on strong footing. This has helped markets conclude that the immediate economic damage from the tariff standoff is more modest than feared.

Looking ahead, the 90-day tariff truce, set to expire in early July, becomes the next major milestone for investors. There are tentative signs of progress on trade negotiations, including fresh signals from China that it may be open to returning to the table. While expectations for a zero-tariff outcome remain low, the fear of escalation to a worst-case scenario has clearly eased. Markets appear to be pricing in a more constructive path, even if slow-moving and politically complex.

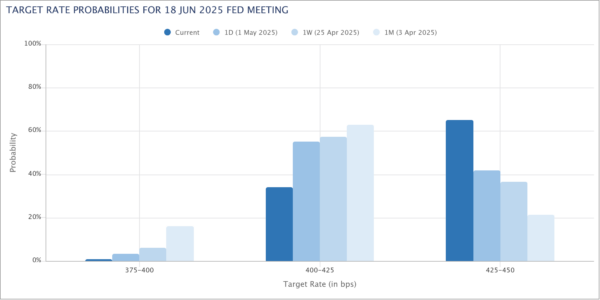

At the same time, expectations for Fed policy are undergoing a recalibration. With the labor market holding firm and inflation still persistent, the urgency for another rate cut has diminished. Fed fund futures are now pricing just a 35% chance of a cut in June — down sharply from 63% a week ago and nearly 80% at the start of April. Importantly, this moderation in rate cut bets is being absorbed without negative market reaction, signaling that investors are comfortable with Fed remaining on hold for longer.

Technically, S&P 500’s rally from the 4835.04 low is seen as the second leg in the medium-term pattern from 6147.43 record high. Further upside is favored in the near term as long as 5433.24 support holds. But significant resistance around 6147.43 to bring the third leg of the pattern.

In the bigger picture, the long term up trend remains intact. S&P 500 is well supported by long term rising channel, and managed to defend 4818.62 resistance turned support (2022 high).

An upside breakout is possible during the second half of the year. But that would depend on two key elements: the resolution of trade uncertainty and continued economic resilience.

If July’s truce deadline passes without escalation — or better yet, with concrete de-escalation — and economic data remains firm, then a new record would be on the horizon.

Yields Rise on Risk-On Flow, But Dollar Fails to Ride the Wave

US 10-year Treasury yield staged a rally rebound on Friday, in tandem with equities. Unlike previous yield spikes driven by capital flight, this surge appears rooted in a rotation out of safe-haven assets and into equities, as risk appetite returned.

Technically, 10-year yield’s pull back from 4.592 has likely completed with three waves down to 4.124. Break of 4.407 resistance will solidify this bullish case. Rise from 3.886 could then be resuming through 4.592 resistance to 100% projection of 3.886 to 4.592 from 4.124 at 4.830.

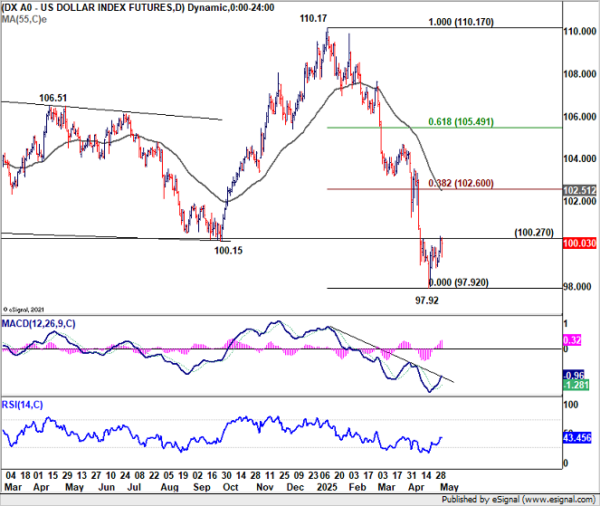

In contrast, Dollar has failed to capitalize on either yield strength or reduced recession anxiety. Expectations for Fed to keep interest rates elevated longer may provide some underlying support. But if risk sentiment continues to improve, demand for USD as a defensive play may continue to weaken, even as yield support holds.

Technically, firm break of 100.27 resistance in Dollar Index will bring stronger rebound back to 55 D EMA (now at 102.51). But strong resistance should be seen from 38.2% retracement of 110.17 to 97.92 at 102.60 to limit upside.

Bullish Case Continue to Build for AUD/JPY, with 94.94 Fibonacci Target in Insight

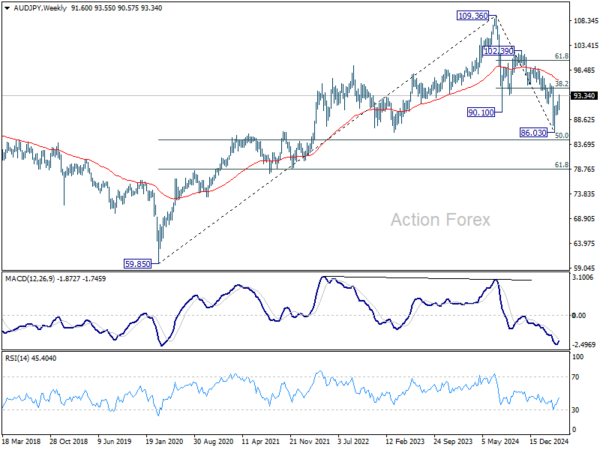

AUD/JPY ended last week as the top winner and gained 1.56%, on a potent mix of risk-on sentiment and changes in monetary policy outlooks.

Aussie’s strength was reinforced by Q1 inflation data from Australia. On the one hand, the trimmed mean CPI returned to RBA’s 2–3% target range for the first time since 2021, cementing expectations of a May rate cut. However, stronger than expected headline CPI reading, and renewed goods inflation pressures points to a cautious and gradual easing path, rather than an aggressive cycle.

In contrast, Yen suffered after BoJ left rates unchanged and sharply downgraded its growth forecast for fiscal 2025, slashing it by more than half. Additionally, core inflation projections were revised lower, raising the risk of falling short of the 2% target again. The downgrade has pushed back expectations of any near-term rate hikes. A June move now looks off the table.

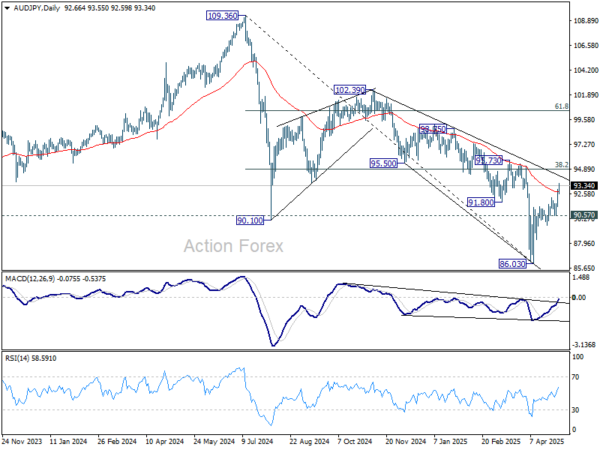

Technically, the developments continue to affirm the case that corrective fall from 109.36 (2024 high) has completed with three waves down to 86.03.

Further rally should be seen in the near term as long as 90.57 support holds, to 38.2% retracement of 109.36 to 86.03 at 94.94. Sustained break there will pave the way to 61.8% retracement at 100.44.

However, rejection by 94.94 fibonacci resistance, followed by break of 90.57 support, will dampen this bullish view and bring retest of 86.03.

EUR/USD Weekly Outlook

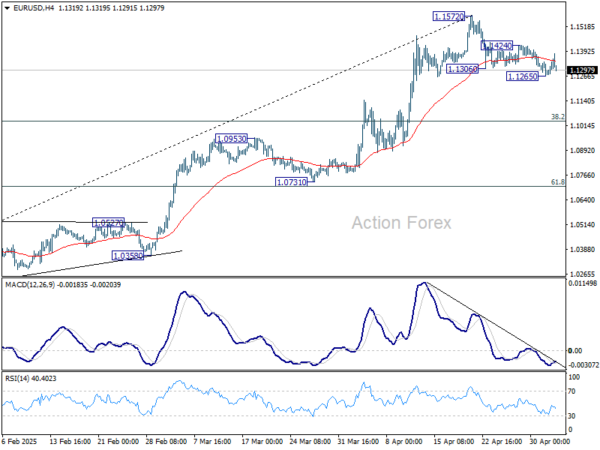

EUR/USD gyrated lower last week but recovered after hitting 1.1265. Initial bias remains neutral this week first. On the downside, below 1.1265 will resume the corrective fall from 1.1572 short term top. But downside should be contained by 38.2% retracement of 1.0176 to 1.1572 at 1.1039. On the upside, break of 1.1424 will suggest that the correction has completed and bring retest of 1.1572 high.

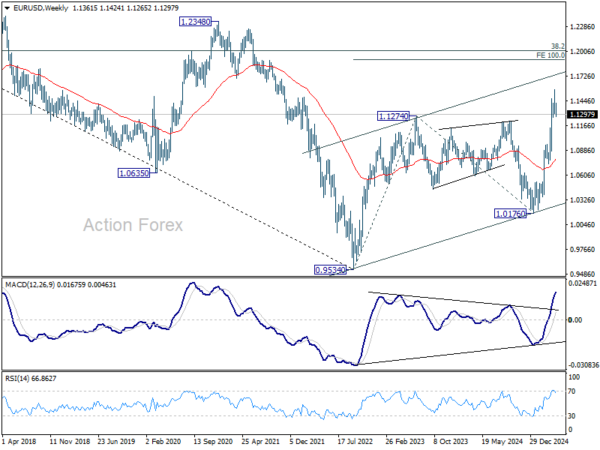

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will now remain the favored case as long as 55 W EMA (now at 1.0776) holds.

In the long term picture, the case of long term bullish reversal is building up. Sustained break of falling channel resistance (now at around 1.1300) will argue that the down trend from 1.6039 (2008 high) has completed at 0.9534. A medium term up trend should then follow even as a corrective move. Next target is 38.2% retracement of 1.6039 to 0.9534 at 1.2019.