Dollar Struggles, Gold Rally Stalls, Trade Uncertainty Caps Conviction – Action Forex

Global markets remain mixed, reflecting a cautious investor mood amid heightened trade uncertainty and a lack of clear directional drivers. US stocks closed modestly higher overnight, reversing losses from earlier in the session. Asian equities broadly followed the rebound, seemingly brushing off disappointing Chinese manufacturing data. The overall tone, however, remains indecisive, with no strong commitment to risk assets or safe havens.

In the currency markets, Dollar is recovering slightly after a brief selloff, but still stands as the week’s worst performer. Loonie and Aussie follow behind. Yen continues to lead on safe-haven demand. Kiwi and Euro are also holding firmer, with Sterling and Swiss Franc sitting mid-pack. The lack of clear directional bias reflects the broader market indecision, as traders await clarity on the outcome of key trade negotiations.

Underlying this market hesitation is persistent uncertainty surrounding global trade. According to a Reuters report, the Trump administration is pressing trading partners to submit their “best offers” by Wednesday, as it pushes to fast-track negotiations ahead of the July 9 expiry of the current 90-day reciprocal tariff truce. The US is requesting commitments on tariff and quota concessions, along with action plans on non-tariff barriers.

The draft communication from the US Trade Representative warns countries not to assume tariffs will be halted, even if court rulings go against the administration. The letter asserts that the White House intends to continue the tariff program under “other robust legal authorities” if necessary, signaling that tariffs remain a core policy tool in negotiations.

With legal and diplomatic fronts both in flux, traders are taking a wait-and-see approach. Until there is clarity on the direction of US trade policy—particularly with key partners like China and the EU—market participants are likely to stay sidelined. For now, short-term positioning continues to be dictated more by event risk management than conviction.

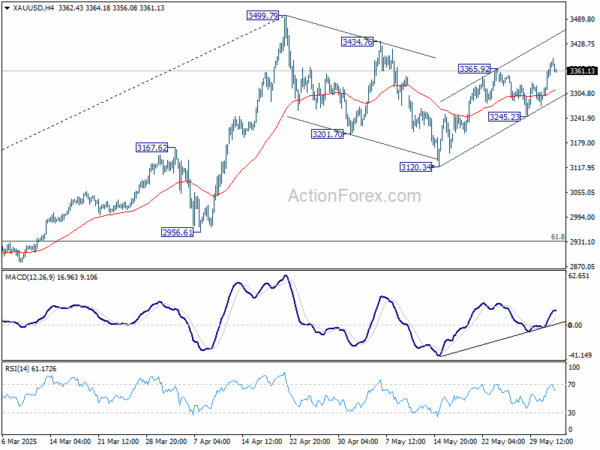

Technically, Gold’s rise from 3120.34 resumed by breaking through 3365.92 resistance. Further rally should be seen to retest 3499.79 high. but strong resistance could be seen there to limit upside on first attempt, to bring more sideway trading in the near term. Nevertheless, decisive break of 3499.79 will confirm larger up trend resumption.

In Asia, at the time of writing, Nikkei is up 0.07%. Hong Kong HSI is up 1.10%. China Shanghai SSE is up 0.36%. Singapore Strait Times is down -0.26%. Japan 10-year JGB yield is down -0.025 at 1.484. Overnight, DOW rose 0.08%. S&P 500 rose 0.41%. NASDAQ rose 0.67%. 10-year yield rose 0.046 to 4.462.

Looking ahead, Swiss CPI and Eurozone CPI flash are the main focuses in European session. US will release factory orders later in the day.

BoJ’s Ueda: Ready to hike if wage growth recovers from tariff drag

BoJ Governor Kazuo Ueda told parliament today that recently imposed U.S. tariffs could weigh on Japanese corporate sentiment, potentially impacting winter bonus payments and next year’s wage negotiations.

He acknowledged that wage growth may “slow somewhat” in the near term due to these external pressures. However, Ueda expressed confidence that wage momentum would eventually “re-accelerate”, helping to sustain a moderate growth in household consumption.

Looking ahead, Ueda reiterated the BoJ’s readiness to adjust its ultra-loose policy if the economy evolves in line with its projections. “If we’re convinced our forecast will materialize, we will adjust the degree of monetary support by raising interest rates,” he said.

However, he cautioned that uncertainty surrounding the economic outlook remains “extremely high.”

RBA’s Hunter: AUD’s recent resilience linked to global shift away from USD exposure

RBA Chief Economist Sarah Hunter addressed the unusual behavior of the Australian Dollar in recent months in a speech today. She highlighted that while initial moves were consistent with past risk-off episodes, the currency’s subsequent rebound against the US Dollar stood out as “more unusual”.

On a “trade-weighted” basis, AUD has remained broadly stable, even though it has appreciated against the greenback and the Chinese renminbi, while weakening against most other major currencies.

This divergence, Hunter explained, stems from “offsetting factors”. Global growth concerns have pressured the AUD against safe-haven and cyclical peers, while simultaneous outflows from US assets have weakened the US Dollar.

Hunter cautioned that it’s too soon to tell whether this trend will persist, but acknowledged that recent market behavior reflects shifting investor sentiment, particularly toward capital reallocation away from US assets. As a result, Australian Dollar’s relative resilience against USD may be underpinned by portfolio rebalancing and perceived relative economic stability.

Hunter noted that the trade-weighted index has reverted to “pre-shock values”, suggesting minimal net change in the foreign-currency value of Australian exports. However, the “relative move of capital” into Australia, at a time when the US is facing policy and tariff-related volatility, could offer some support to “domestic investment activity”, providing a cushion to the broader economy amid global uncertainties.

RBA Minutes: 25bps cut chosen for caution and predictability after debating hold and 50bps options

RBA’s May 20 meeting minutes revealed that policymakers weighed three policy options—holding rates, a 25bps cut, or a larger 50bps reduction—before ultimately opting for a modest 25bps cut to 3.85%.

The case for easing hinged on three key factors: sustained progress in bringing inflation back toward target without upside surprises, weakening global conditions and household consumption, and the view that a cut would be the “path of least regret” given the risk distribution.

While members discussed a 50bps reduction after deciding to ease, they found the case for a larger move unconvincing. Australian data at the time showed little evidence that trade-related global uncertainty was materially harming domestic activity. Furthermore, some scenarios might even result in upward pressure on inflation, prompting caution. The Board also assessed that it was “not yet time to move monetary policy to an expansionary stance”.

Ultimately, the Board judged that to move “cautiously and predictably” was more appropriate.

Caixin PMI manufacturing drops to 48.3, as China faces marked weakening at start of Q2

China’s manufacturing sector unexpectedly shrank in May, with Caixin PMI falling to 48.3 from 50.4, well below market expectations of 50.6. This marked the first contraction in eight months and the lowest reading since September 2022.

According to Caixin Insight’s Wang Zhe, both supply and demand weakened, with a particularly notable drag from overseas demand. Employment continued to contract, pricing pressures remained subdued, and logistics saw moderate delays. Although business optimism saw a marginal recovery, the broader picture points to intensifying headwinds.

The report highlights the fragile start to Q2, with Wang pointing to a “marked weakening” in key economic indicators and a “significantly intensified” level of downward pressure.

Fed’s Goolsbee warns against repeating ‘transitory’ mistake on tariff inflation

Chicago Fed President Austan Goolsbee said in a webcast overnight that tariffs typically lead to a one-time price increase rather than sustained inflation.

Drawing on textbook theory, he said a 10% tariff would create a 10% rise in prices for imported goods for “one year”, after which the inflationary effect dissipates. Such shocks are usually seen as “transitory” by central banks, Goolsbee explained.

However, he warned against underestimating potential risks, citing lessons from the pandemic-era supply chain disruptions. “We learned the last time around” not to dismiss inflation too quickly, Goolsbee said, referencing how persistent inflation caught the Fed off guard.

He added that scenarios combining rising prices and weakening labor markets, a stagflationary mix, present the most difficult challenge for monetary policy, as “there’s not an obvious playbook”.

USD/CHF Daily Outlook

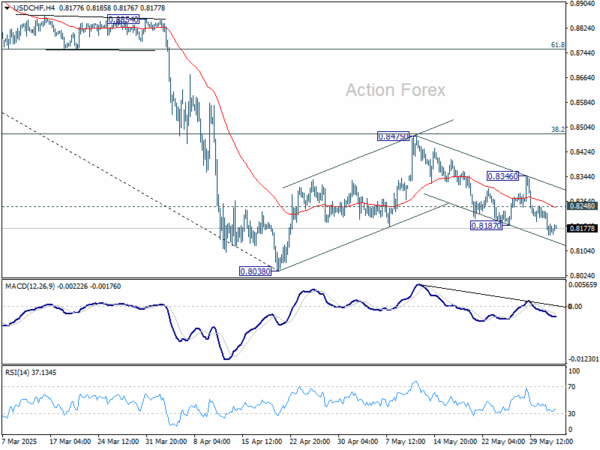

Daily Pivots: (S1) 0.8139; (P) 0.8189; (R1) 0.8222; More….

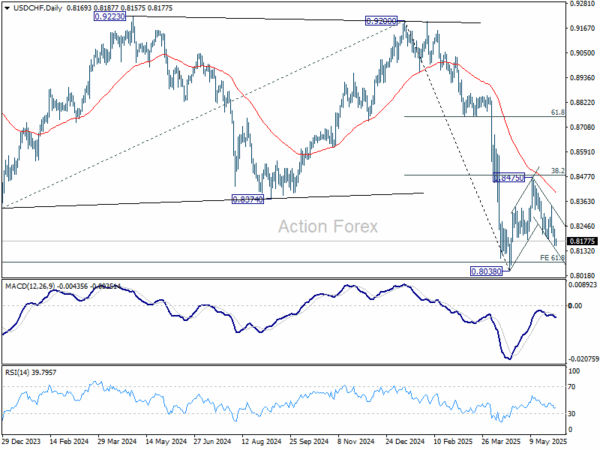

Intraday bias in USD/CHF stays on the downside as fall from 0.8475 is in progress for 0.8038 low. Strong support could be seen from there to bring rebound, on first attempt. On the upside, above 0.8248 minor resistance will turn intraday bias neutral first. However, decisive break of 0.8038 will confirm larger down trend resumption.

In the bigger picture, long term down trend from 1.0342 (2017 high) is still in progress and met 61.8% projection of 1.0146 (2022 high) to 0.8332 from 0.9200 at 0.8079 already. In any case, outlook will stay bearish as long as 55 W EMA (now at 0.8732) holds. Sustained break of 0.8079 will target 100% projection at 0.7382.