Markets Hold Breath as US-China Trade Talks Resume – Action Forex

The cautious optimism in Asia failed to spill into European markets, as investors turned cautious ahead of today’s US-China trade talks in London. While no one expects a sweeping resolution to the broader trade conflict, hopes are centered on incremental progress—particularly around rare earths.

Kevin Hassett, Director of the US National Economic Council, struck a pragmatic tone in his remarks today, emphasizing the goal of securing tangible commitments from China on resuming critical mineral exports. Hassett stated that the meeting’s purpose was to verify China’s seriousness, aiming for “a short meeting with a big, strong handshake.” He added that a mutual agreement could result in immediate easing of US export controls, clearing the path for further negotiations.

Meanwhile, parallel trade efforts are underway between the US and Japan. Japan’s top trade envoy, Ryosei Akazawa, is reportedly planning his fourth US trip in as many weeks to engage in a sixth round of ministerial talks. While the discussions are said to be progressing, Akazawa conceded that the two sides have yet to reach a consensus. The urgency is growing ahead of the upcoming G7 summit in Canada, where a leaders’ meeting between the US and Japan may be on the agenda.

In currency markets, Kiwi is leading gains today, followed by Aussie and Japanese Yen. On the other end, Swiss Franc is the weakest performer, trailed by Dollar and Euro. Sterling and Loonie are mixed in the middle.

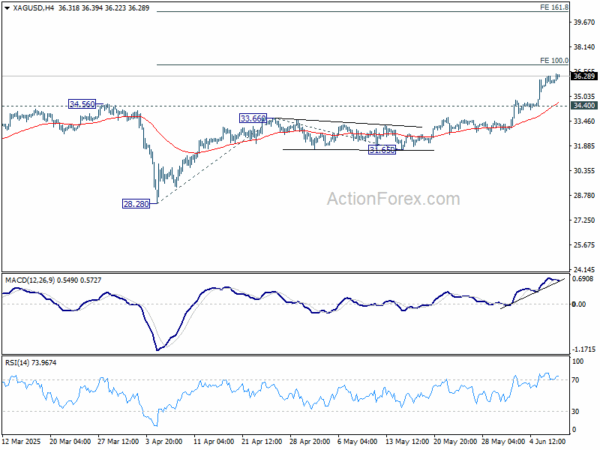

On the metals front, a divergence is forming between Gold and Silver. Gold is continuing its retreat, while Silver remains on a firm upward path. Technically, further rise in Silver is expected as long as 34.40 support holds, with focus on 100% projection of 28.28 to 33.66 from 31.65 at 37.03. Decisive break there could prompt further acceleration to 161.8% projection at 40.35.

In Europe, at the time of writing, FTSE is down -0.24%. DAX is down -0.77% CAC is down -0.35%. UK 10-year yield is up 0.013 at 4.666. Germany 10-year yield is up 0.01 at 2.589. Earlier in Asia, Nikkei rose 0.92%. Hong Kong HSI rose 1.63%. China Shanghai SSE rose 0.43%. FTSE rose 0.05%. Japan 10-year JGB yield rose 0.019 to 1.479.

ECB Kazimir: Likely at end of cuts, eyes summer data for fine-tuning

Slovak ECB Governing Council member Peter Kazimir signaled a possible end to the current easing cycle, writing in an opinion piece today that “we’re nearly done with, if not already at the end of, the easing cycle.”

While acknowledging the potential for weaker-than-expected economic growth in the eurozone, Kazimir emphasized the importance of staying focused on inflation to, which he warned could surprise to the upside.

Looking ahead, Kazimir stressed the need for flexibility, noting that “incoming data throughout the summer will provide a clearer picture and guide our decisions on whether further fine-tuning is needed.”

China’s CPI falls -0.1% yoy in May, negative for fourth month

China’s headline CPI stayed in negative territory for the fourth consecutive month in May, coming in at -0.1% yoy, slightly better than the expected -0.2% yoy.

The persistent softness in overall inflation was largely driven by a sharp -6.1% yoy decline in energy prices, which alone shaved off nearly half a percentage point from the annual CPI reading.

On a monthly basis, CPI fell -0.2% mom, with energy again dragging down the figure through a -1.7% mom decline.

In contrast, core inflation, which strips out food and energy prices, rose to 0.6% yoy, the highest level since January.

Producer price pressures continue to weaken further, with PPI dropping to -3.3% yoy from -2.7% yoy previously, marking the deepest contraction in nearly two years. Wholesale prices have now been stuck in deflation since October 2022.

China’s trade surplus widens to USD 103.2B in May, US exports slump -34.5% yoy

China’s trade surplus widened to USD 103.2B in May, exceeding expectations of USD 101.3, even as headline export and import figures undershot forecasts. Exports rose 4.8% yoy, just shy of the 5.0% yoy consensus. Imports fell -3.4% yoy, a sharper drop than the anticipated -0.9% yoy.

Exports to the US plunged -34.5% yoy, highlighting the entrenched trade tensions despite Washington’s partial tariff rollback in April. However, the impact was cushioned by robust growth in exports to ASEAN (15% yoy), the European Union (12% yoy), and Africa (33% yoy).

EUR/USD Mid-Day Outlook

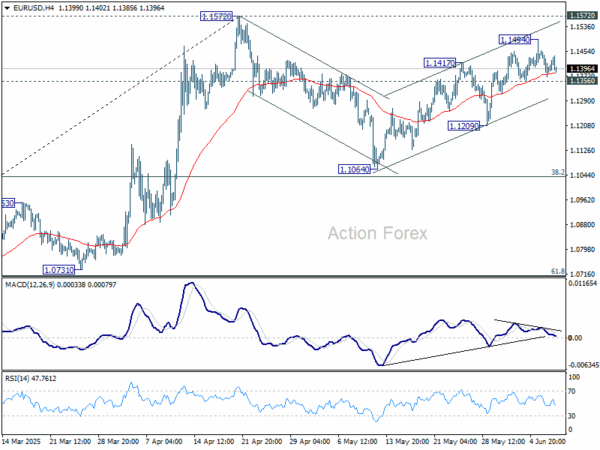

Daily Pivots: (S1) 1.1359; (P) 1.1409; (R1) 1.1445; More…

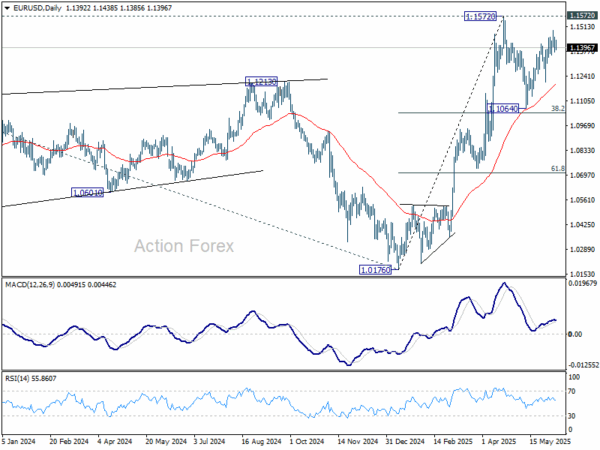

No change in EUR/USD’s outlook and intraday bias stays neutral. Price actions from 1.1572 are seen as a corrective pattern to rally from 1.0716. While rebound from 1.1064 might extend, strong resistance should emerge from 1.1572 to limit upside. On the downside, break of 1.1356 support will argue that the correction is already in the third leg, and target 1.1209 support for confirmation.

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will now remain the favored case as long as 55 W EMA (now at 1.0894) holds.