Sterling Slides on Poor UK GDP, While Dollar Struggles Under Trade Uncertainty – Action Forex

Sterling came under renewed pressure at the start of European session, triggered by a deeper-than-expected contraction in UK GDP for April. Services sector, the economy’s dominant component, posted its first monthly decline since October. Nine out of 14 services subsectors registered falls, pointing to broad-based weakness. It’s a disappointing start to Q2 and follows weaker-than-expected labor data earlier in the week.

The string of soft UK economic releases is likely to reinforce BoE’s case for policy easing. Market expectations for a rate cut in August are now firming, with investors betting that the BoE will continue its gradual loosening cycle. While the central bank has maintained a cautious stance thus far, the data flow increasingly supports action sooner rather than later, especially if core inflation continues to moderate alongside cooling wages and tepid output growth.

Meanwhile, Dollar remains the worst-performing major currency this week, despite receiving a brief reprieve from a strong 10-year Treasury auction on Wednesday. Market attention is now on today’s 30-year auction, which could provide further clues about investor confidence in US fiscal stability. A solid reception would help calm nerves around rising debt issuance.

However, the broader macro backdrop, particularly trade uncertainty, continues to weigh heavily on the greenback. Hopes that this week’s US-China talks would deliver material de-escalation were dashed after no tariffs were rolled back as part of the so-called framework deal. Instead, the absence of concrete outcomes, coupled with hints that the US may further delay its self-imposed 90-day tariff review deadline, has left markets in limbo.

Testifying before Congress, US Treasury Secretary Scott Bessent struck a more conciliatory tone, suggesting that Washington may extend the negotiation window with key trading partners—including the EU—if they are seen to be acting in “good faith”. While this may avert immediate tariff escalation, it also signals that trade talks could drag on well into the second half of the year. That lack of resolution is weighing on sentiment and feeding into a mild risk-off tone across markets.

In terms of weekly currency performance, Euro is the clear outperformer, while Yen and Swiss Franc are also benefiting from safe-haven flows. At the other end of the spectrum, Dollar leads the laggards, followed by the Aussie and Sterling. The Loonie and Kiwi are trading more neutrally. Overall, markets are showing a tilt toward risk aversion.

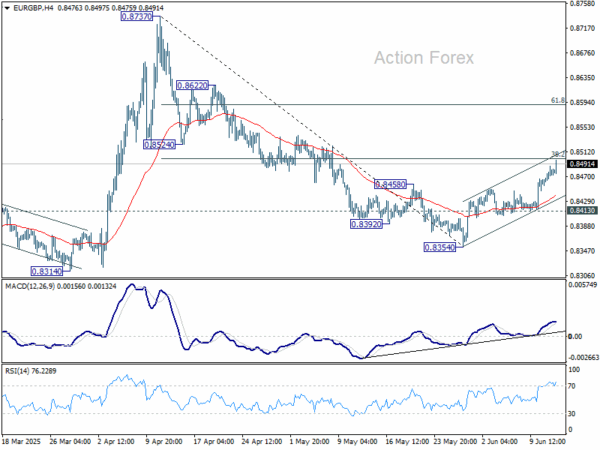

Technically, an immediate focus is now on 38.2% retracement of 0.8737 to 0.8354 at 0.8500. in EUR/GBP. Decisive break there will suggest that fall from 0.8737 has completed at 0.8354. Even as a corrective bounce, rise from there would target 61.8% retracement at 0.8591.

In Asia, Nikkei closed down -0.65%. Hong Kong HSI is down -0.89%. China Shanghai SSE is up 0.03%. Singapore Strait Times is up 0.21%. Japan 10-year JGB yield fell -0.002 to 1.458. Overnight, DOW closed down -0.00%. S&P 500 fell -0.27%. NASDAQ fell -0.50%. 10-year yield fell sharply by -0.062 to 4.412.

UK GDP contracts -0.3% mom in April, as services drag

The UK economy contracted -0.3% mom in April, a sharper decline than the expected -0.1%. The main drag came from the services sector, which fell -0.4% mom and contributed most to the monthly GDP drop. Production also shrank -0.6% mom. In contrast, construction provided a rare bright spot, rising 0.9% mom, though not enough to offset broader weakness.

Despite the poor April print, the broader picture remains more constructive. GDP expanded 0.7% in the three months to April compared to the prior three-month period, with services up 0.6%, production up 1.1%, and construction up 0.5%.

Japanese business confidence sours amid tariff fears and profit warnings

Business sentiment in Japan deteriorated sharply in Q2, with the Ministry of Finance’s survey revealing a broad-based loss of confidence across industries.

The overall index for large firms slipped into negative territory at -1.09, down from Q1’s modest 2.0. Large manufacturers saw sentiment weaken further from -2.4 to -4.8, while large non-manufacturers experienced a steep drop from 5.2 to -5.7, suggesting that economic uncertainty is spreading beyond export-heavy sectors.

The survey also highlighted a growing sense of earnings pessimism. Large manufacturers now expect recurring profits to decline -1.2% in the fiscal year ending March 2026, a downgrade from the -0.6% fall seen in the previous survey. Particularly alarming is the auto sector’s outlook, with automakers and parts suppliers projecting a severe -19.8% drop in profits.

This highlights the mounting concern over the impact of steep US tariffs, which threaten to hit Japan’s flagship export industry hard and weigh on broader economic momentum.

EUR/USD Daily Outlook

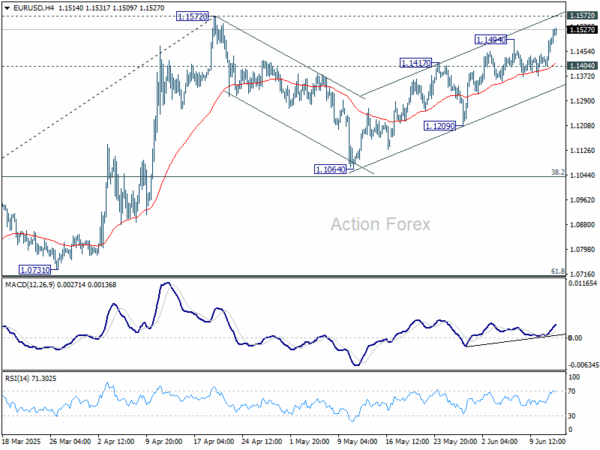

Daily Pivots: (S1) 1.1429; (P) 1.1465; (R1) 1.1524; More…

EUR/USD’s rise from 1.1064 resumed by breaking through 1.1494 and intraday bias is back on the upside for 1.1572 high. Strong resistance could be seen there to bring another fall, to extend the near term consolidation pattern. Firm break of 1.1404 support will turn intraday bias back to the downside for 1.1209 first. However, decisive break of 1.1572 will resume whole rise from 1.0176.

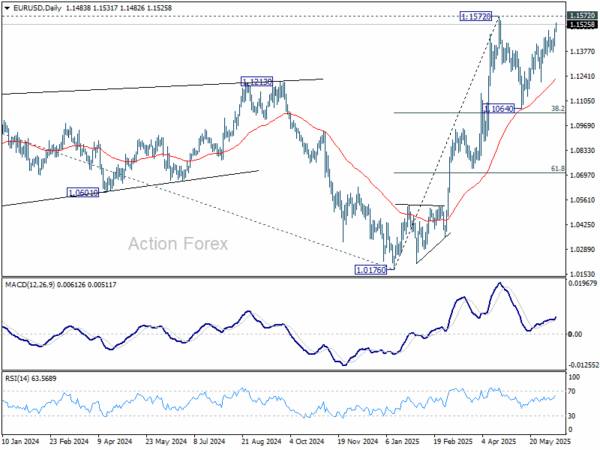

In the bigger picture, rise from 0.9534 long term bottom could be correcting the multi-decade downtrend or the start of a long term up trend. In either case, further rise should be seen to 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916. This will now remain the favored case as long as 55 W EMA (now at 1.0894) holds.