Canada Reverses Digital Tax to Save U.S. Trade Talks; Loonie Recovers Modestly – Action Forex

The forex market opened the week with low volatility and mixed Asian equities, but politically driven developments are keeping some G10 currencies in motion. Dollar is the weakest performer so far, with the Canadian Dollar also under pressure despite rebounding from weekend lows. Yen leads amid safe-haven inflows, while Kiwi and Aussie post modest gains.

Ottawa moved to de-escalate tensions with Washington by announcing a reversal of its digital services tax, originally set to take effect this week. The retroactive levy on American tech firms had prompted a sharp rebuke from US President Donald Trump, who vowed to halt all trade discussions with Canada. Reversing the tax was described by Canadian leadership as a strategic step to preserve the July 21 negotiation timeline and prevent retaliatory tariffs.

Canadian Prime Minister Mark Carney and Finance Minister Champagne framed the decision as a way to unlock progress on a new economic and security partnership. Markets welcomed the move, and the Loonie erased some of its losses, though sentiment remains fragile given the broader uncertainty heading into July’s tariff deadlines.

Meanwhile, the UK confirmed its partial trade agreement with the US has now come into force. British car exports will now face a reduced 10% tariff quota, and duties on aircraft parts have been removed. While the deal marks progress, the issue of steel and aluminum tariffs remains unresolved. UK officials reiterated their intent to push for 0% tariffs on core steel products under the agreed framework.

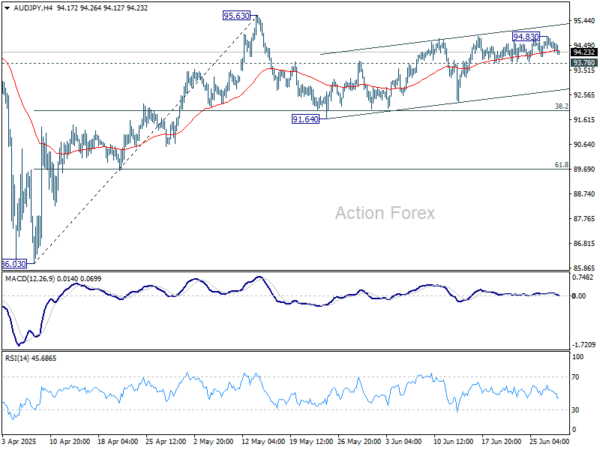

Technically, AUD/JPY’s choppy recovery from 91.64 might be close to completion, with further lot of momentum as seen in 4H MACD. Firm break of 93.78 support will suggest that corrective pattern from 95.63 short term top has started. Deeper fall should the be seen back to 94.64 support next.

In Asia, at the time of writing, Nikkei is up 0.79%. Hong Kong HSI is down -0.38%. China Shanghai SSE is up 0.38%. Singapore Strait Times is up 0.03%. Japan 10-year JGB yield is flat at 1.437.

Japan’s industrial production rises 0.5% mom in May, far below expectation

Japan’s May industrial output came in far below expectations, rising just 0.5% mom versus the anticipated 3.4% mom growth. Though production improved in key sectors such as machinery and autos, five categories—led by non-auto transport equipment—recorded declines.

Shipments rose 2.2% mom, while inventories fell -1.9% mom, offering some positive signals, but not enough to shift the ministry’s cautious tone.

METI maintained its assessment that output “fluctuates indecisively”. A poll of manufacturers showed expectations for a muted 0.3% mom rise in June and a -0.7% mom drop in July.

China’s PMI manufacturing rises to 49.7, small firms lag

China’s official NBS PMI Manufacturing rose slightly to 49.7 in June, up from 49.5 and matching expectations. While still in contraction for a third straight month, the improvement in production (51.0) and new orders (50.2) suggests some stabilization in activity. Large manufacturers led the gains, with their PMI rising to 51.2, but conditions for small enterprises deteriorated sharply, with a 2-point drop to 47.3.

The Non-Manufacturing PMI also inched up to 50.5 from 50.3, supported by a rebound in construction activity. The construction business activity index rose to 52.8, while services slipped marginally to 50.1. Composite PMI rose to 50.7 from 50.4, reinforcing the picture of a subdued recovery.

NZ ANZ business confidence jumps to 46.3, but growth headwinds persist

Business confidence in New Zealand improved notably in June, with the ANZ headline index rising from 36.6 to 46.3 and firms’ Own Activity Outlook climbing from 34.8 to 40.9. Inflation expectations held steady at 2.71%.

ANZ warned that the underlying environment remains difficult, citing ongoing cost pressures, tight margins, and a global backdrop that continues to “impeding risk-taking”. The bank highlighted that while the 0.8% qoq Q1 growth was solid, the outlook for Q2 appears “not looking nearly so positive. Despite stronger sentiment, actual business conditions and demand may remain under pressure in the months ahead.

ANZ continues to forecast more rate cuts from the RBNZ than the central bank currently projects, arguing that the recovery will likely fall short of policymakers’ expectations. Still, it acknowledged that the RBNZ appears inclined to move slowly, balancing inflation risks with a softening economic backdrop.

US NFP and ISM, Eurozone CPI and ECB accounts watched this week

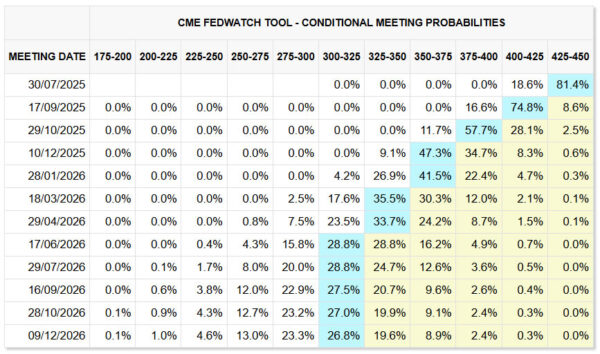

Markets will focus heavily on June’s US Non-Farm Payrolls report this week, which comes amid growing signs that Fed is willing to wait before resuming policy easing. Recent comments from Chair Jerome Powell and most other Fed officials suggest they still see the labor market as resilient, even as private-sector hiring has slowed. With tariffs set to lift inflation in the near term, policymakers appear content to wait while they assess how these effects filter into prices and activity.

Unless the NFP data is shockingly weak, it’s unlikely to shift the consensus that July is too soon for another rate cut. September remains the earliest realistic window. That said, any meaningful downside surprise would firm up expectations for a September move and potentially encourage traders to lean more aggressively into bets for a third cut this year. For now, futures price in a 56% chance of a triple-easing path.

Beyond payrolls, traders will dissect the ISM Manufacturing and Services PMIs for guidance on activity, labor and inflation pressures. The prices and employment sub-indices carry particular weight in the current environment.

In the Eurozone, investors will focus on the June flash CPI and ECB meeting accounts. The central question is whether ECB has already concluded its current easing cycle or still sees the need for one final adjustment. While market pricing reflects a bias for one more cut by September, the lack of consensus is evident. A recent Reuters poll found only 53% of economists expecting another move.

Markets will look to the meeting accounts for any signs that influential members like Chief Economist Philip Lane see further cut as necessary. A dovish tone could revive rate cut bets and weigh on the Euro, while confirmation that ECB views policy as broadly appropriate now could prompt repricing toward a hold.

Here are some highlights for the week:

- Monday: Japan industrial production; China NBS PMIs; Germany import prices, retail sales, CPI flash; UK Q1 GDP final; Swiss KOF economic barometer; US Chicago PMI.

- Tuesday: Japan Tankan survey, PMI manufacturing final, consumer confidence; China Caixin PMI manufacturing; Swiss retail sales, PMI manuacturing; Eurozone PMI manufacturing final, CPI flash; Germany unemployment; UK PMI manufacturing final; US ISM manufacturing.

- Wednesday: Japan monetary base; Australia retail sales; Eurozone unemployment rate; US ADP employment; Canada PMI manufacturing.

- Thursday: Australia goods trade balance; China Caixin PMI services; Swiss CPI; Eurozone PMI Services final, ECB meeting accouints; UK PMI Services final; Canada trade balance; US non-farm payrolls, jobless claims, trade balance, ISM services.

- Friday: Japan household spendig; Germany factory orders; France industrial production; Swiss unemployment rate; UK PMI construction; Eurozone PPI.

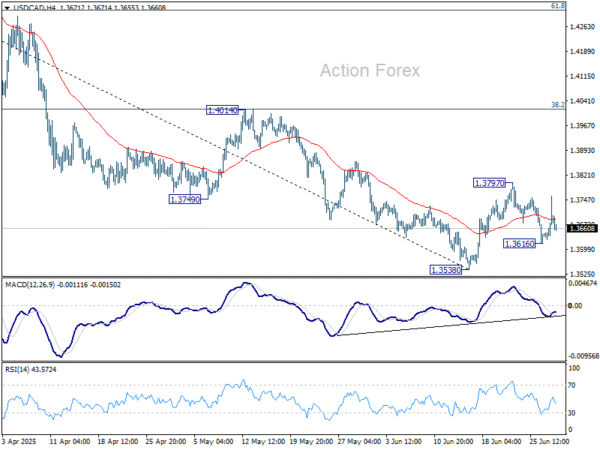

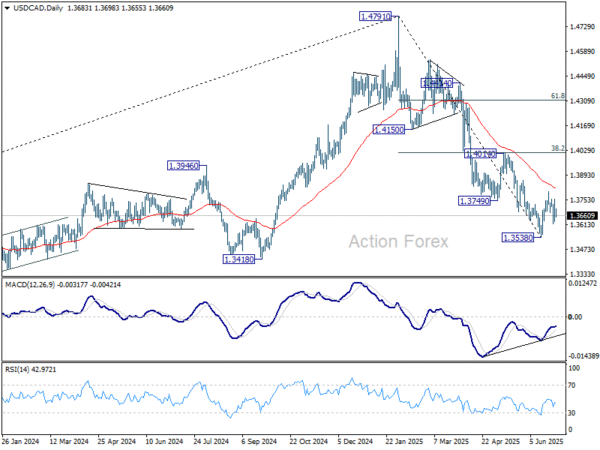

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3619; (P) 1.3689; (R1) 1.3750; More…

USD/CAD dips mildly today but stays in range of 1.3616/3797. Intraday bias remains neutral at this point. On the upside, break of 1.3797 will resume the rebound from 1.3538 short term bottom to 1.4014 cluster resistance (38.2% retracement of 1.4791 to 1.3538 at 1.4017). Nevertheless, below 1.3616 will bring retest of 1.3538 low.

In the bigger picture, price actions from 1.4791 medium term top could either be a correction to rise from 1.2005 (2021 low), or trend reversal. In either case, further decline is expected as long as 1.4014 resistance holds. Next target is 61.8% retracement of 1.2005 (2021 low) to 1.4791 at 1.3069.