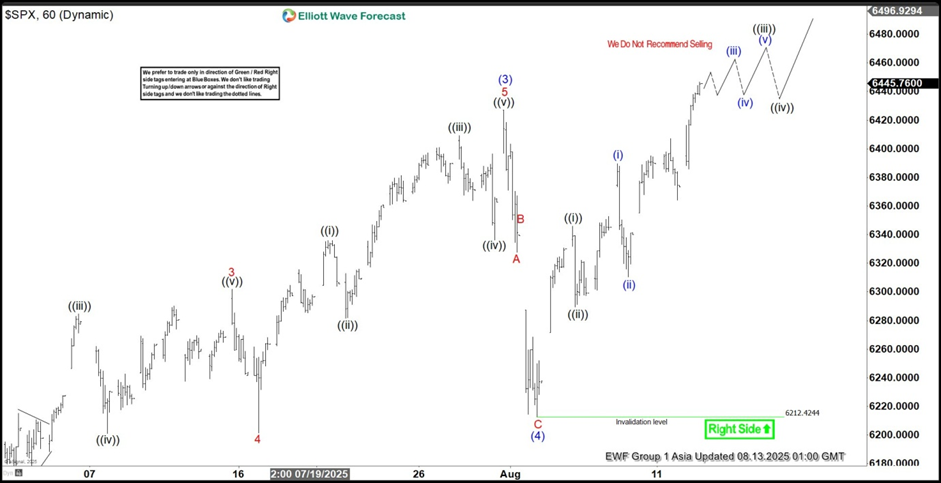

Elliott Wave forecast: S&P 500 (SPX) targets 6639 in final Wave (5)

The Elliott Wave cycle, initiated at the April 7, 2025 low, is progressing as an impulse structure, driving the Index upward. Wave (1) reached a high of 5267.47, followed by a wave (2) pullback to 4910.42. The Index then surged in wave (3) to 6427.02, as depicted in the one-hour chart. A corrective wave (4) concluded at 6212.42, structured as a zigzag. Within this correction, wave A dropped to 6327.6, wave B climbed to 6339.89, and wave C finalized the decline at 6212.4, completing wave (4) in the higher degree.

The Index has since advanced in wave (5), breaking above the wave (3) peak of 6427.02, confirming the next upward move. This wave (5) is unfolding as a lower-degree impulse. From the wave (4) low, wave 1 hit 6346, and wave 2 corrected to 6289.37. The Index then nested higher, with wave ((i)) reaching 6389.7 and wave ((ii)) retracing to 6310.32. In the short term, anticipate a few more highs to complete wave 1 of (5). A pullback should follow to adjust the cycle from the August 2, 2025 low. As long as the 6212.4 pivot remains intact, the Index should continue climbing.