Dow Jones slips from new peaks after soft sentiment surveys

- The Dow Jones found new all-time highs on Friday before trimming gains.

- US consumer sentiment took an unexpected hit in August.

- Consumers are beginning to sour on economic outcomes as tariff effects begin to crop up.

The Dow Jones Industrial Average (DJIA) surged to record highs early on Friday, touching chart territory north of 45,250 for the first time ever. However, tepid consumer sentiment data and a looming meeting between United States (US) President Donald Trump and Russian President Vladimir Putin are weighing on investor sentiment to wrap up the trading week.

The Dow Jones has tapped in a new all-time high of 45,277 but remains caught in congestion near the 45,000 major handle while rounding the corner into the closing bell. Fundamentals have driven most of the meaningful near-term price action as the Dow continues to drift higher following a technical bounce from the 50-day Exponential Moving Average (EMA) after chalking in the last swing low near 43,330. The 50-day EMA is now providing a technical floor near 43,885, ready to catch any short-term downturns.

Read more: Donald Trump lands in Alaska ahead of Putin meeting

US data hints at sustained tariff fallout

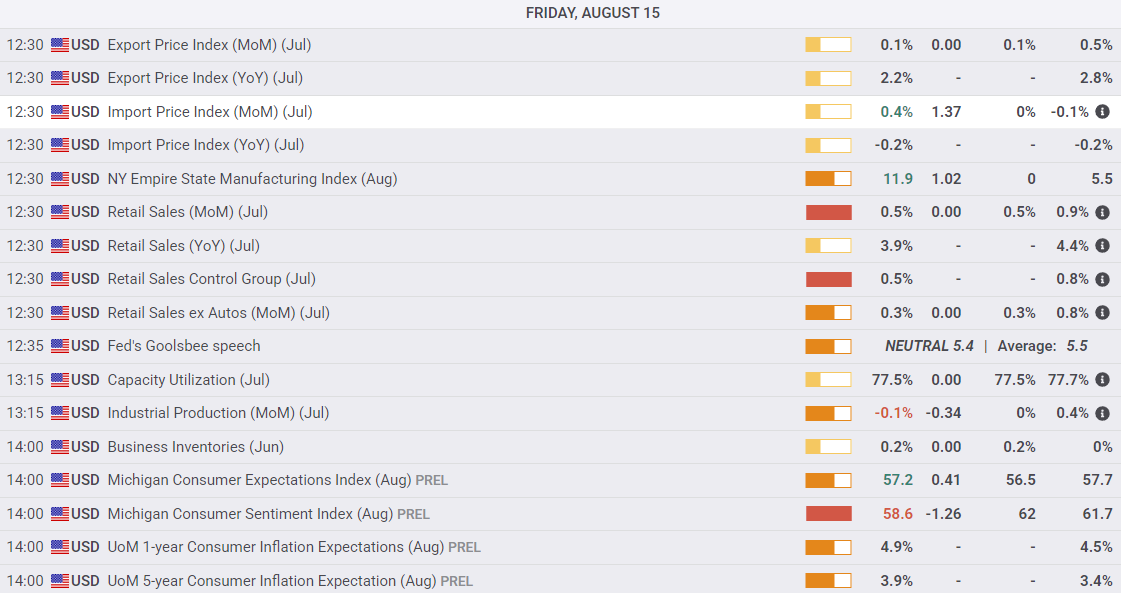

US Retail Sales for July came in broadly as expected, rising 0.5% MoM while June’s figure saw an upside revision to 0.9% MoM. While up is generally considered good, US Retail Sales data is nominal, meaning the economic indicator does not differentiate whether an extra dollar spent at the checkout is due to increased spending capacity or higher prices resulting from trade taxes.

The US Import Price Index rose 0.4% MoM in July, well above the flat 0.0% forecast and the previous month’s -0.1%. A rising Import Price Index implies that US importers are struggling to offset tariff costs with price discounting from exporters, a move that one would expect to occur if the US’s economic domination was forcing foreign businesses to absorb tariff costs. For that to hold true, importing costs would not only have to be falling, but they would also have to be falling globally and at a faster rate in the US than anywhere else. This overwhelmingly appears not to be happening.

August’s University of Michigan (UoM) Consumer Sentiment Index fell to 58.6. Median market forecasts expected a further improvement to 62.0, but consumer concerns over employment opportunities and future income constraints from rising prices proved calculator-wielding investors wrong. The current economic conditions segment of the UoM’s survey deteriorated to 60.8, with future expectations tumbling to 57.2.

12-month consumer inflation expectations also rose to 4.9% compared to 4.5% just a month ago, and the 5-year inflation outlook also accelerated to 4.9% from 4.5%. While consumer forecasts tend to undershoot the bad times and overestimate the good, consumers are feeling the bite from unexpected (for them) increases in the cost of big-ticket durable goods as trade taxes and import tariffs begin to leak through complex supply chains.

Read more stock news: The rumors were right about UnitedHealth Group stock

Dow Jones 5-minute chart

Dow Jones daily chart

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Last release:

Fri Aug 15, 2025 14:00 (Prel)

Frequency:

Monthly

Actual:

58.6

Consensus:

62

Previous:

61.7

Source:

University of Michigan