Dollar Weakens as Traders Boost Bets on 50bps Fed Cut – Action Forex

Traders continue to ramp up bets on a 50bps rate cut by Fed this Wednesday, with market odds now sitting at 65%. This increasing expectation is driving DOW futures higher, positioning the index for a potential new record high in the upcoming regular trading session. However, S&P 500 and NASDAQ are showing less momentum, struggling to match DOW’s rally for now.

In the currency markets, Dollar is facing renewed selling pressure, making it the worst performer today at this point. USD/JPY is currently testing the key psychological level of 140, and the greenback is under threat of retesting recent lows against the major European currencies even before the FOMC’s rate decision. Other currencies are showing mixed performance, with Yen displaying some tentative strength, while the Canadian Dollar remains on the weaker side.

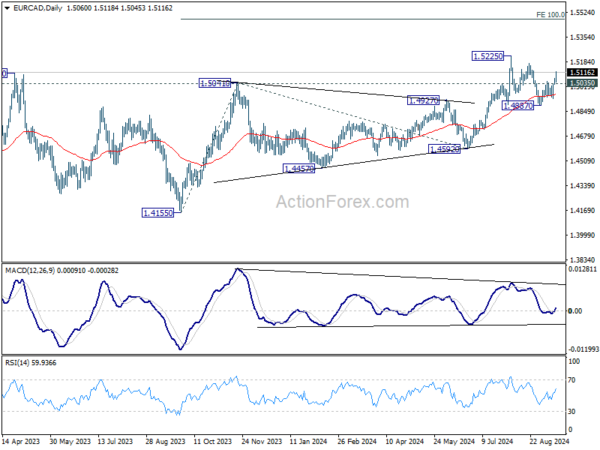

Technically, EUR/CAD’s rebound from 1.4887 accelerates higher today. The development affirms that case that correction from 1.5225 has already completed. Further rise is in favor as long as 1.5035 minor support holds. Retest of 1.5225 should be seen next. Firm break there will resume whole rise from 1.4155 to 100% projection of 1.4155 to 1.5041 from 1.4592 at 1.5478.

In Europe, at the time of writing, FTSE is down -0.05% DAX is down -0.31%. CAC is down -0.18%. UK 10-year yield is down -0.0055 at 3.762. Germany 10-year yield is down -0.021. Earlier in Asia, Japan and China were on holiday. Hong Kong HSI rose 0.31%. Singapore Strait Times rose 0.22%.

ECB’s Lane expects rapid inflation decline by 2025

ECB Chief Economist Philip Lane provided insight into the central bank’s inflation expectations in a speech today. In the near term, headline inflation is anticipated to fluctuate, with a temporary dip in September followed by a rebound later this year.

But more significantly, ECB projects a “rapid decline” in inflation over the next two years, from 2.6% in Q4 2024 to 2.0% in Q4 2025. Core inflation, which is primarily driven by services, is expected to follow a “even sharper” drop, falling from 2.9% at the end of this year to 2.1% by the same period in 2025.

The projections align with weaker economic growth and declining wage pressures, both of which are expected to accelerate the disinflationary process throughout 2025. Lane noted that this slowdown in wage growth is consistent with the recent data, reflecting the end of the “catch-up” dynamics seen in recent years. Additionally, the disinflation process will be supported by well-anchored forward-looking inflation expectations, with reduced price-price and price-wage dynamics compared to the higher inflation environment of 2023.

Looking forward, Lane emphasized that a “gradual approach” in reducing policy restrictiveness will be appropriate, provided the data aligns with ECB’s baseline projection. However, he cautioned that the central bank will “retain optionality” about the pace of adjustment, indicating flexibility depending on future economic developments.

ECB’s Kazimir: December almost surely the decision point for next rate cut

ECB Governing Council member Peter Kazimir expressed his cautious stance regarding future rate cuts, noting in a blog post that “We will almost surely need to wait until December for a clearer picture before making our next move.”

Kazimir also underscored the importance of receiving a “significant shift” or a “powerful signal” in the economic outlook to support backing another cut in October.

However, “the fact is that very little new information is in the pipeline” before October meeting, he added.

The Governing Council member argued that it is essential for the central bank to ensure incoming data aligns with projections, warning that acting too quickly could lead to regret if inflation has not been sustainably brought under control.

Eurozone goods exports rises 10.2% yoy in Jul, imports up 4.0% yoy

Eurozone goods exports rose 10.2% yoy to EUR 252.0B in July. Goods imports rose 4.0% yoy to EUR 230.8B. Trade balance showed a EUR 21.2B surplus. Intra-Eurozone trade rose 4.3% yoy to EUR 221.0B.

In seasonally adjusted term, Eurozone goods exports rose 0.8% mom to EUR 239.0B. Goods imports rose 1.6% mom to EUR 223.5B. Trade surplus narrowed from June’s EUR 17.0B to EUR 15.5B, smaller than expectation of EUR 20.3B. Intra-Eurozone trade rose 0.9% mom to EUR 21.4B.

NZIER downgrades New Zealand’s growth forecast to flat in 2025, recovery delayed

New Zealand’s economic outlook has been notably downgraded by the New Zealand Institute of Economic Research (NZIER), with projections pointing to zero GDP growth for fiscal 2025, a stark revision from the previous forecast of 0.6%.

Growth is expected to pick up modestly to 2.2% in 2026 and further to 2.8% in 2027, though these estimates are also lower than those given earlier in the year. The institute’s June forecast had previously anticipated 2.4% growth in 2025 and 3.0% in 2026, highlighting the extent of the shift in expectations.

Inflation estimates have similarly been revised downward. CPI is now expected to come in at 2.3% for 2024, down from the 2.6% forecast in June. For 2025, CPI is projected at 2.0%, revised from the earlier estimate of 2.1%, while the 2026 forecast remains unchanged at 2.1%.

NZIER pointed to concerning signals from its own Quarterly Survey of Business Opinion, which has shown a sharp drop in business confidence and in firms’ trading activity. This data suggests that the near-term outlook is particularly weak, with businesses expecting tougher conditions ahead. The slowdown is expected to persist through 2025, with lower interest rates forecasted to provide some support in stimulating a recovery beyond that.

NZ BNZ services ticks up to 45.5, longest contraction since GFC

New Zealand’s BusinessNZ Performance of Services Index edged up slightly in August, rising from 45.2 to 45.5, but still remains well below the long-term average of 53.2. The data shows that the service sector is continuing to struggle, with the index remaining in contraction for the sixth consecutive month, marking the longest period of decline since the global financial crisis.

Breaking down the numbers, activity/sales increased from 41.2 to 43.9, while employment also saw a slight rise from 47.0 to 43.9. However, new orders/business fell from 47.0 to 46.6, and stocks/inventories dropped from 45.3 to 44.6. Supplier deliveries improved marginally from 41.1 to 43.3.

The proportion of negative comments decreased to 60.8% in August, down from 67.0% in July and June. Despite the modest improvement, businesses continued to cite the high cost of living and challenging economic conditions as key concerns.

BNZ’s Senior Economist Doug Steel noted, “Smoothing through monthly volatility, the PSI’s 3-month average remains deep in contractionary territory at 43.9. The PSI has been in contraction for six consecutive months, which is the longest continuous period of decline since the GFC.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3109; (P) 1.3133; (R1) 1.3152; More…

GBP/USD’s rebound from 1.3000 extends higher today but stays below 1.3265 resistance. Intraday bias remains neutral first. On the upside, decisive break of 1.3265 will resume larger rally 1.3364 projection level next. On the downside, below, 1.3177 minor support will turn bias to the downside, to extend the correction from 1.3265 through 1.3000 support.

In the bigger picture, up trend from 1.0351 (2022 low) is in progress. Next target is 38.2% projection of 1.0351 to 1.3141 from 1.2298 at 1.3364. For now, outlook will stay bullish as long as 1.2664 support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Aug | 45.5 | 44.6 | 45.2 | |

| 23:01 | GBP | Rightmove House Price Index M/M Sep | 0.80% | -1.50% | ||

| 06:30 | CHF | Producer and Import Prices M/M Aug | 0.20% | 0.10% | 0.00% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Aug | -1.20% | -1.70% | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jul | 15.5B | 20.3B | 17.5B | 17.0B |

| 12:30 | CAD | Manufacturing Sales M/M Jul | 1.40% | 0.70% | -2.10% | |

| 12:30 | USD | Empire State Manufacturing Index Sep | 11.5 | -3.9 | -4.7 |