Aussie Gains Ground, Overcoming PMI Weakness on China’s Rate Cut Boost – Action Forex

Australian Dollar managed to climb modestly in a quiet Asian trading session today, despite underwhelming PMI data from Australia. With Japan on holiday, the session saw limited movement, but risk-on sentiment helped offset some of the negative impact from the weak data. In contrast, Yen and Swiss Franc extended their recent declines. Overall, the markets are still riding on the tailwind of last week’s Fed rate cut.

China’s central bank also played a role in boosting sentiment. In a surprising move, the People’s Bank of China cut its 14-day repo rate by 10bps, catching many off guard after it had opted not to cut longer-term rates just last Friday. The real focus, however, is on tomorrow’s scheduled press conference by China’s top three financial regulators, raising hopes that more comprehensive and substantial stimulus measures may be on the horizon.

Looking ahead to the rest of the day, attention will shift to PMI releases from the Eurozone, the UK, and the US. These figures will provide more clarity on the health of major economies and could set the tone for broader market moves. In addition, focus is also turning to the upcoming RBA and SNB rate decisions later in the week.

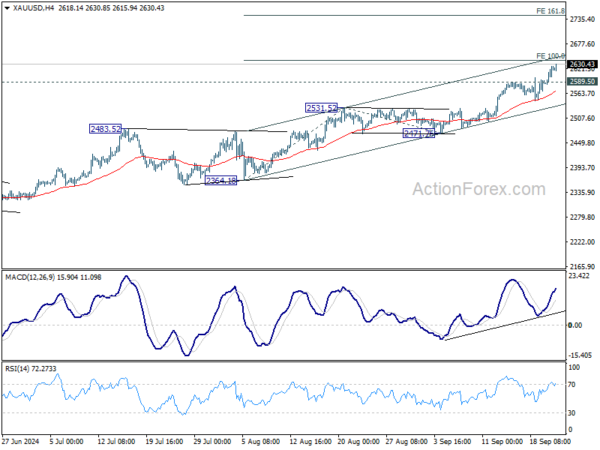

Technically, Gold’s record run continues today and further rally is expected for 100% projection of 2364.18 to 2531.52 from 2471.76 at 2639.10. Some resistance might be see there to limit upside on first attempt. Break of 2589.50 resistance turn support will bring consolidations first. However, decisive break of 2639.10 could trigger upside acceleration to 161.8% projection at 2742.51 next.

In Asia, Japan is on holiday. Hong Kong HSI is up 0.82%. China Shanghai SSE is up 0.74%. Singapore Strait Times is up 0.58%.

Australian PMI manufacturing hits 52-month low, composite in contraction

Australia’s economic activity continued to slow in September, with the Judo Bank Manufacturing PMI dropping to 46.7, its lowest in 52 months, down from 48.5 in August. The Services PMI also declined, slipping to 50.6 from 52.5, while the Composite PMI fell back into contraction, down from 51.7 to 49.8, marking an 8-month low.

Matthew De Pasquale, Economist at Judo Bank, noted that the recent PMI weakness suggests households are saving more of the government stimulus than anticipated. He added that “the economy is gradually bringing supply and demand into balance,” supporting the case for maintaining the current cash rate rather than hiking it later this year.

Employment growth also showed signs of slowing, with the employment index barely in expansion at 50.8. Additionally, output price index, which tracks businesses raising consumer prices, hit its lowest level since January 2021. Although input prices dropped, they remain above pre-pandemic averages, signaling lingering inflationary pressures.

New Zealand’s exports fell -0.1% yoy in Aug, imports down -1.0% yoy

New Zealand’s goods trade balance posted deficit of NZD -2.2B, substantially larger than the expected deficit of NZD -155m. This widening gap is attributed to a slight decrease in both goods exports and imports. Goods exports fell by NZD -6.1m, or 0.1% yoy, to NZD 5.0B, while goods imports decreased by NZD -70m, or -1.0% yoy, to NZD 7.2B.

The decline in exports was primarily due to weaker trade with China, New Zealand’s largest trading partner. Exports to China fell by NZD -195m, or 16% yoy. In contrast, exports to other key markets saw gains. Shipments to Japan jumped by 39% yoy, while exports to the US and the EU rose by 3.1% yoy and 5.9% yoy, respectively.

On the import side, China, the EU, and Australia all saw notable declines in the value of goods imported by New Zealand, with China down -6.4% yoy, the EU down -8.2% yoy, and Australia down -12% yoy. However, imports from the US and South Korea surged. Goods from the US increased by NZD 154m (24% yoy), and imports from South Korea were up by a substantial NZD 185m (39% yoy).

RBA to hold steady, SNB faces a critical decision

Two major central banks prepare to make the monetary policy decisions this week. RBA is stay pat while SNB is anticipated to continue its policy easing cycle. But as the latter is facing pressure to weaken the Franc, there is potential of a more aggressive reduction. Meanwhile, markets are also gearing up for some global PMIs, along with key economic data from the US, Canada, and Japan.

RBA is widely expected to keep its interest rate unchanged at 4.35% this week. While the central bank has not ruled out further rate hikes, the general consensus among economists is that the next move will be a reduction. However, there is no clear agreement on the timing of this anticipated rate cut.

The country’s major banks offer differing views on when the first rate cut will take place. The Commonwealth Bank, which was earlier predicting a November cut, has now revised its forecast to December due to recent strength in employment growth. Westpac and ANZ both anticipate a cut in February 2025. NAB is the most cautious, projecting a cut in May next year. This split among the big four banks highlights the uncertainty regarding the RBA’s next steps.

This week’s monthly CPI report from Australia may provide some short-term relief to RBA, with inflation expected to drop notably from 3.5% to 2.8% in August. However, the more critical figure will be the quarterly CPI data, due on October 30.

RBA’s November meeting, with both the quarterly CPI and fresh economic projections available, is seen as a much more pivotal moment. By then, the central bank will have a clearer view of whether inflation is moderating enough to justify a rate cut in early 2025.

On the other hand, SNB is anticipated to cut interest rates this week, but the magnitude of the reduction is getting uncertain.

While Swiss Franc’s appreciation has eased since August, it remains at historically high levels, weighing heavily on Switzerland’s export-dependent economy. Outgoing SNB Chair Thomas Jordan has also been vocal about the negative impact of Franc’s strength. Swiss exporters have increasingly called on the central bank to intervene more aggressively, adding urgency to the SNB’s decision-making.

The base case scenario is still that SNB will opt for a 25bps rate cut, bringing the policy rate down to 1.00% this week, with another 25bps reduction expected in December. However, given the economic pressure and the need to weaken the Franc, some economists believe there is a substantial chance SNB could front-load its monetary easing with a larger, 50bps cut at this meeting.

On the data front, the spotlight will be on PMI data from major economies at the start of the week. Particular attention is on Eurozone and Germany, as the German economy is grappling with a significant recession risk, and any further weakening in its PMI figures could solidify these concerns. In the US, several key economic reports are set to capture market attention, including consumer confidence, durable goods orders, and the closely-watched PCE inflation data. Additionally, Canada’s GDP data and Tokyo CPI from Japan are on the radar too.

Here are some highlights for the week:

- Monday: New Zealand trade balance; Australia PMIs; Eurozone PMIs; UK PMIs; Canada new housing price index; US PMIs.

- Tuesday: Japan PMIs; RBA rate decision; Germany Ifo business climate; US house price index, consumer confidence.

- Wednesday: Japan corporate service price index; Australia monthly CPI; Swiss KOF economic barometer; US new home sales.

- Thursday: BoJ minutes; Germany Gfk consumer sentiment; Swiss SNB rate decision; Eurozone M3, ECB monthly bulletin; US GDP final, jobless claims, durable goods orders, pending home sales.

- Friday: Japan Tokyo CPI; France consumer spending; Germany unemployment; Canada GDP; US goods trade balance, personal income and spending and PCE inflation.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6363; (P) 1.6396; (R1) 1.6435; More…

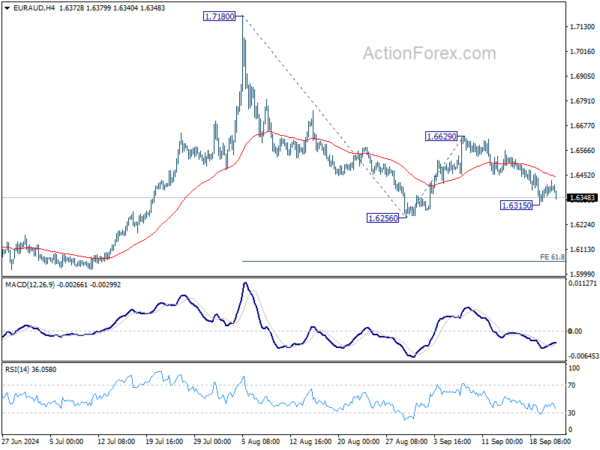

EUR/AUD dips notably after recovery was capped below 55 4H EMA, but stays above 1.6315 temporary low. Intraday bias stays neutral first. While consolidation from 1.6315 might extend, risk will continue to stay on the downside as long as 1.6629 resistance holds. Below 1.6315 will bring retest of 1.6256. Firm break there will resume whole decline from 1.7180 and target 61.8% projection of 1.7180 to 1.6256 from 1.6629 at 1.6058.

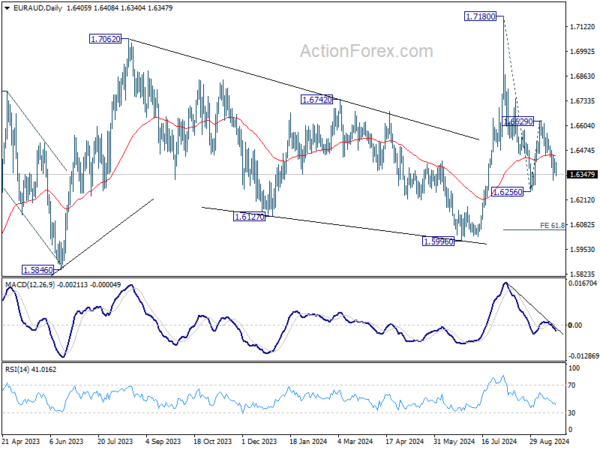

In the bigger picture, outlook is mixed up by the deeper than expected fall from 1.7180. Yet as long as 1.5996 support holds, up trend from 1.4281 (2022 low) is still in favor to resume at a later stage. Firm break of 1.7180 will pave the way to 61.8% projection of 1.4281 to 1.7062 from 1.5996 at 1.7715.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Aug | -2203M | -155M | -963M | -1016M |

| 23:00 | AUD | Manufacturing PMI Sep P | 46.7 | 48.5 | ||

| 23:00 | AUD | Services PMI Sep P | 50.6 | 52.5 | ||

| 07:15 | EUR | France Manufacturing PMI Sep P | 44.3 | 43.9 | ||

| 07:15 | EUR | France Services PMI Sep P | 53 | 55 | ||

| 07:30 | EUR | Germany Manufacturing PMI Sep P | 42.4 | 42.4 | ||

| 07:30 | EUR | Germany Services PMI Sep P | 51.1 | 51.2 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Sep P | 45.7 | 45.8 | ||

| 08:00 | EUR | Eurozone Services PMI Sep P | 52.3 | 52.9 | ||

| 08:30 | GBP | Manufacturing PMI Sep P | 52.3 | 52.5 | ||

| 08:30 | GBP | Services PMI Sep P | 53.5 | 53.7 | ||

| 12:30 | CAD | New Housing Price Index M/M Aug | 0.10% | 0.20% | ||

| 13:45 | USD | Manufacturing PMI Sep P | 48.6 | 47.9 | ||

| 13:45 | USD | Services PMI Sep P | 55.3 | 55.7 |