Dollar Rises on Fed Clarity, Oil Jumps on Rising Fears of Wider Middle East War – Action Forex

The financial markets gained much-needed clarity last week as strong US employment data aligned market expectations with Fed’s own monetary policy outlook. The possibility of a 50bps rate cut in November has now vanished, with traders anticipating two more standard 25bps cuts this year, matching Fed’s dot plot.

This development boosted Dollar, which ended the week as the strongest performing currency. Additionally, funds appeared to flow heavily from bonds into stock markets, driving up Treasury yields, and lifted DOW to new record close. The surge in 10-year yield was more than offset the typical “risk-on” sentiment’s negative effect on the greenback.

Canadian Dollar finished as the second strongest currency, largely driven by the significant rally in oil prices. Escalating tensions in the Middle East pose a serious threat to global oil supply, a wildcard that could influence not only the Loonie but also global inflation, monetary policy, and financial markets in the near term. Australian Dollar was the third strongest, although it seemed to lose some momentum towards the end of the week.

On the other end of the spectrum, Yen struggled as the weakest currency of the week. New Japanese Prime Minister Shigeru Ishiba’s dovish pivot on monetary policy, combined with a sharp rise in U.S. and European yields, pressured Yen further. New Zealand dollar also languished near the bottom, with firm expectations of a 50bps rate cut from RBNZ next. Swiss Franc also found itself among the weakest performers after the new SNB Chair, Martin Schlegel, clearly outlined a dovish stance.

Euro and Sterling settled in middle positions. The ECB’s unified stance on a October rate cut contrasted sharply with BoE’s internal division, with top officials offering conflicting views on the future of monetary policy.

Fed’s 50bps Cut Off the Table After Strong Jobs Data, Dollar and Yields Surge

The possibility of a 50bps rate cut by Fed in November has effectively been eliminated following the robust September non-farm payroll report. The earlier fears of a recession, fueled by a summer of weak employment data in the US, have dissipated too. Investors reacted positively to the strong jobs data, pushing the DOW to a record close. Funds flowed out of Treasury bonds, causing 10-year yield to rise sharply and break through a key near-term resistance level. Simultaneously, Dollar Index staged a strong rebound, surpassing a near-term resistance level and suggesting bullish trend reversal.

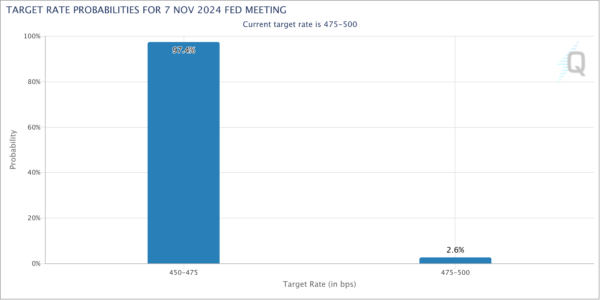

According to Fed funds futures, the market now assigns a 97.4% probability of a 25bps cut to 4.50-4.75% at the FOMC meeting on November 7. The remaining 2.6% probability is for no change in rates, rather than a 50bps cut.

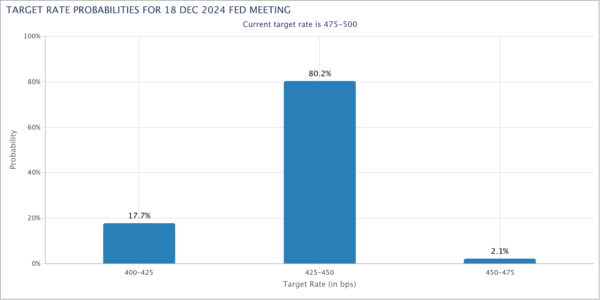

For the December meeting, futures indicate an 80.2% chance of another 25bps cut to 4.25-4.50%. This aligns the market’s base case with the Fed’s latest dot plot, which projected two more 25bps cuts by the end of the year.

Technically, DOW is holding on to 41859.73 support and maintains near term bullishness. Decisive break of 61.8% projection of 32327.20 to 39899.05 from 38000.96 will pave the way to 100% projection at 45562.81.

In the bigger picture, DOW is holding well above rising 55 W EMA (now at 38605.01) with W MACD trending up. Current up trend should target 100% projection of 18213.65 to 36952.65 from 28660.94 at 47399.94 in the medium term.

10-year yield’s strong break of 55 D EMA (now at 3.879) confirms short term bottoming at 3.603. Considering bullish convergence condition in D MACD, it’s also possible that whole corrective decline from 4.9978 has completed with three waves down to 3.603.

Immediate focus is now on the resistance zone between 55 W EMA (now at 4.074) and 38.2% retracement of 4.997 to 3.603 at 4.135. Decisive break there will affirm the mentioned bullish case, and target 61.8% retracement at 4.464 and above.

Also, from a “pure” technical point of view, the decline from 4.997 is clearly corrective, and has just missed 100% projection of 4.997 to 3.785 from 4.737 at 3.525. 10-year yield was comfortably supported above 3.253 cluster support (38.2% retracement of 0.398 to 4.997 at 3.240). That is, the up trend from 0.398 (2020 low) is not completed yet, and is probably setting itself up to resume through 4.997 high. It’s unsure what the fundamental driver of that would be, perhaps resurgence of inflation due to Middle East conflicts and rising oil prices. Well, maybe. That’s something we’d keep an eye on in the months ahead.

Dollar Index’s strong break of 55 D EMA (now at 102.00) confirms short term bottoming at 100.15, after defending 99.57 key support (2023 low). There are various interpretations of pattern from 99.57. But for now, the base case is that rise from 100.15 is another rising leg in the sideway pattern between 99.57/107.34. Thus, sustained break of 55 W EMA (Now at 103.50) will affirm this case, and bring stronger rally back to 106.13/107.43 resistance zone.

Oil Prices Jump Amid Widening Middle East Conflict, Fears of Iranian Supply Shock Grow

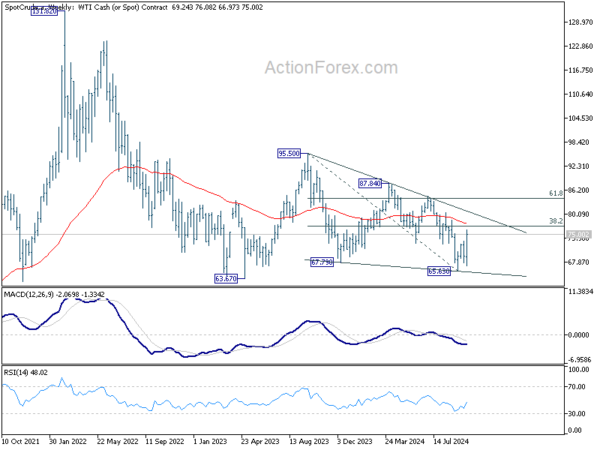

Oil prices surged last week, with WTI crude jumping 9%, marking its biggest weekly gain since March 2023. This sharp rise comes amid escalating tensions in the Middle East, where the threat of a full-scale regional conflict is rapidly increasing.

Beyond its ongoing operations against Hamas in Gaza, Israel is contending with Hezbollah in Lebanon, the Houthis in Yemen, and facing increasing hostilities involving Iran, which is widely regarded as the primary supporter of these groups.

The situation has rapidly evolved, and some analysts describe it as the most severe regional conflict since the Gulf War. As the conflict widens, the potential for a major disruption in global oil supplies looms larger.

The most immediate risk is an Israeli strike on Iran’s oil infrastructure, a scenario that could send shockwaves through the global oil market. On Thursday alone, oil prices spiked by 5% after President Joe Biden suggested that the US and Israel were in discussions about such a strike. With Iran producing nearly 4 million barrels of oil per day, or roughly 4% of the world’s total supply, any disruption to its output could have a significant impact on prices.

Goldman Sachs has warned that a reduction in Iranian oil production could push prices up by USD 20 per barrel. According to their estimates, if Iran were to lose 1 million barrels of daily output, sustained over time, oil prices could experience this sharp rise by next year. This prediction assumes that OPEC+ does not step in to mitigate the impact by increasing production.

However, the rally in oil prices has been “relatively” restrained by the expectation that OPEC+ might intervene to stabilize the market. The alliance holds significant spare capacity and could choose to boost production to mitigate the impact of any supply shortfalls. This potential response is currently acting as a cap on oil’s upward momentum.

Technically, the break of 100% projection of 65.63 to 73.23 from 66.97 at 73.57 is a sign of near term upside acceleration. Rise from 65.63 short term bottom could be developing into an impulsive move.

Immediate focus is now on the resistance zone between 55 W EMA (now at 77.73) and 38.2% retracement of 95.50 to 65.63 at 77.04. Decisive break there will argue that whole decline from 99.50 (2023 high) has completed with three waves down to 65.53. Further rally would then be seen to 61.8% retracement at 84.08, and possibly above.

ECB Consensus vs BoE Division; SNB’s Clarity vs BoJ’s Ambiguity

There are a couple of other developments to note. Firstly, the momentum for a 25bps ECB rate cut on October 17 has built up drastically in the past two weeks. Markedly souring PMI business surveys, the first below-2% inflation reading in more than three years now make it close to a done deal. The shift of the top hawk, Executive Board member Isabel Schnabel, from inflation to rising growth risks, is representative of a complete turn in the central bank, with unison among its officials.

On the other hand, BoE remains deeply divided. Governor Andrew Bailey highlighted that cost of living pressures have not been as persistent as the Bank previously feared. He noted that if positive inflation data continues, the BoE may adopt a “more activist” stance on reducing interest rates, which currently stand at 5%. But just a day later, Chief Economist Huw Pill urged “caution in” reducing monetary policy restrictions, emphasizing the need for a “gradual” approach to rate cuts. Pill warned against the risk of “cutting rates either too far or too fast.” The outcome of November’s MPC meeting remains highly uncertain, and it’s too earlier to have any realistic forecast before another round of inflation and growth data.

In Swiss, CPI unexpectedly slowed to just 0.8% in September, the lowest in more than three years. The downside surprise brings back the question of whether SNB will cut rates by 25bps or 50bps in December. There has been some reservations among analysts that with interest rate now at 1.00%, there is not much further down SNB could go. But the decidedly dovish new SNB Chair Martin Schlegel has cleared this question, as he “can’t rule out negative rate”.

In Japan, odds of another BoJ rate hike flip-flopped with the rhetoric of new Prime Minister Shigeru Ishiba. He somehow backed off from his hawkish stance, and said Japan is not in an environment to raise interest rate further. For now, the focus would probably be first on the upcoming snap election on October 27, to see how much support Ishiba is getting from the public.

Technically, EUR/GBP had a roller-coaster ride last week with contrasting comments from two of the most influential BoE figures. But after all, with rejection by 38.2% retracement of 0.8624 to 0.8309 at 0.8429, as well as the falling 55 D EMA, near term outlook remains bearish. The larger down trend is still in favor to extend to 0.8201 key support (2022 low).

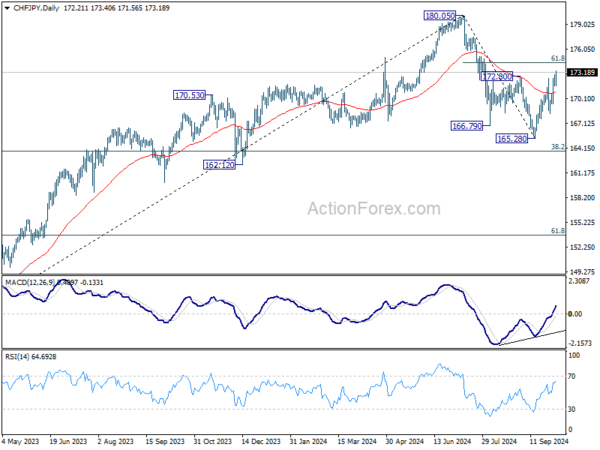

Yen’s rebound faltered with the U-turn of Ishiba and ended even lower than the weak Swiss Franc. The break of 172.80 resistance indicates that whole fall from 180.05 has completed at 165.28. Rebound from there is seen as the second leg of the corrective pattern from 180.05. Further rise is expected to 61.8% retracement of 180.05 to 165.28 at 174.40. Sustained break there will target a retest on 180.05 high.

EUR/USD Weekly Outlook

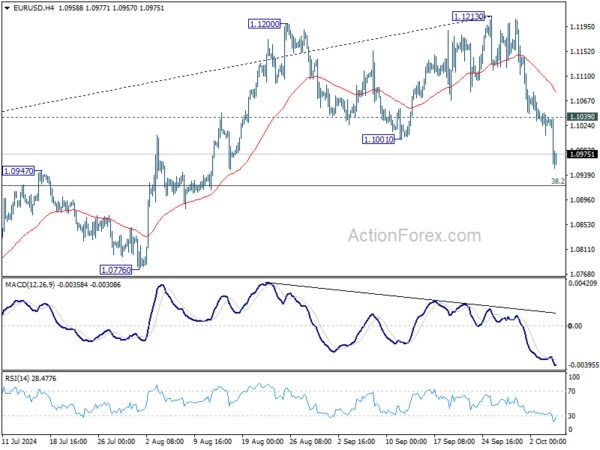

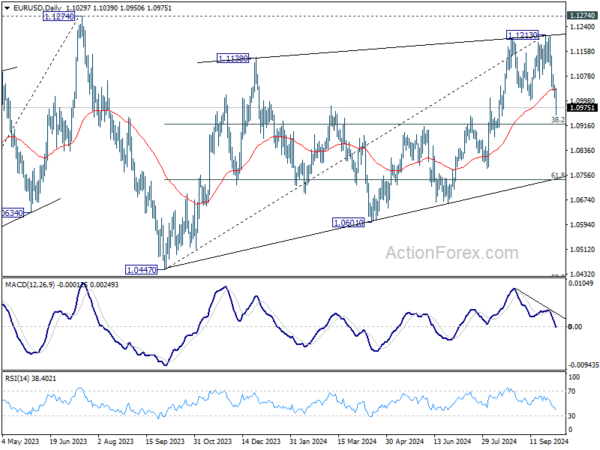

EUR/USD’s extended decline and strong break of 55 D EMA (now at 1.1031) last week suggest that the near term trend has reversed. Initial bias is now on the downside this week for 38.2% retracement of 1.0447 to 1.1213 at 1.0920. Sustained break there will argue that fall from 1.1213 is the third leg of the corrective pattern from 1.1274. In this case, deeper decline would be seen to 61.8% retracement at 1.0740 next. On the upside, above 1.1039 minor resistance will turn intraday bias neutral first.

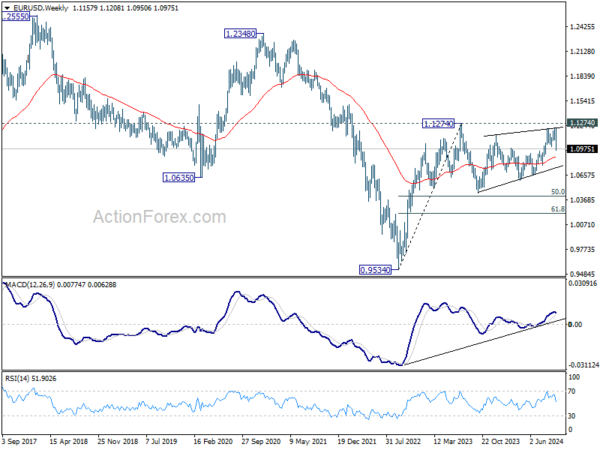

In the bigger picture, rejection by 1.1274 resistance (2023 high) suggests that corrective pattern from there (2023 high) is not completed yet. Instead, decline from 1.1213 might be another falling leg. Sustained break of 55 W EMA (now at 1.0877) will validate this case, and bring deeper fall towards 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404.

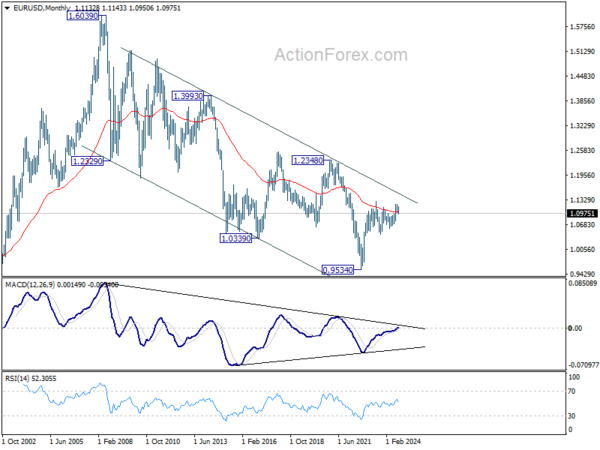

In the long term picture, a long term bottom is in place at 0.9534 (2022 low). But for now, EUR/USD is struggling to sustain above 55 M EMA (now at 1.1018). Outlook is neutral at best at this point.