When Greed Turns to Fear

S&P 500 didn‘t bat an eyelid on weaker housing data, and why should it? Premium given 5,912 resistance is seeing quite some (buying) interest – the range narrowing, and price action getting further away from the 5,872 – 5,885 support. Greed, or even extreme greed knocking on the door?

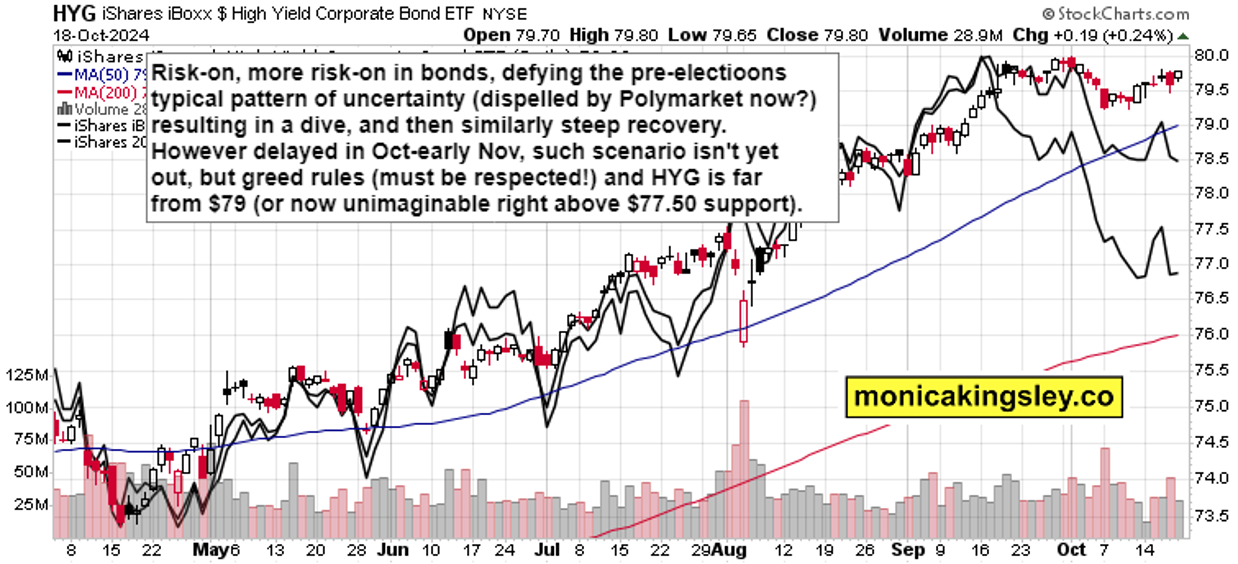

Sure, but high yields and decreasing rate cut odds are having powerful sectoral implications that I‘m discussing in the client section. While we‘re in the pre-elections uncertainty that oftentimes features a deep dive following similarly sharp recovery once that uncertainty is removed, the bond market charts that I‘m bringing you, show this thus far not really being the case. The nagging question featured though, remains – and I again answer it in the client section.

Valid questions to ask, is how overbought stocks are, on what time frames? Is greed or even borderline extreme greed a valid reason to look for the exit door, to get out? What can you apply from technical analysis – what to do when an oscillator such as RSI or Stochastics becomes overbought, does that mean trend reversal knocking on the door – or does the overall picture favor more juice to be squeezed from the lemon still?

That‘s what I‘m detailing further, looking at market breadth, sectoral performance and overall sentiment by retail and institutional traders. It‘s not for nothing that I‘m focusing on various predictive ratios and intermarket analysis. As for fundamentals, NFLX earnings have worked, and that‘s also what translates into swing and intraday successes rewarding clients in silver and gold as well – what a week and month.