Forex Market Pauses Ahead of US Retail Sales, UK GDP – Action Forex

The forex market entered a phase of relative calm during Asian session today, with major currency pairs and crosses having limited movement. The Dollar softened slightly overnight with to retreat in US Treasury yields, but the losses have been minimal. The greenback found support from Fed Chair Jerome Powell’s comments that Fed is not in a hurry to cut interest rates. Market are now turning attention to upcoming US retail sales data, which will provide insights into consumer demand and could influence inflationary pressure.

Despite the modest pullback, Dollar remains the clear leader in currency performance for the week. Canadian Dollar holds a distant second place . The Swiss Franc also ranks among the stronger currencies. In contrast, Japanese Ten continues to underperform as the week’s worst performer. Political stability in Japan has not translated into currency strength. British pound is the second weakest, with investors awaiting UK’s GDP. Australian and New Zealand Dollars are tied as the third weakest currencies while Euro sits in the middle of the performance spectrum.

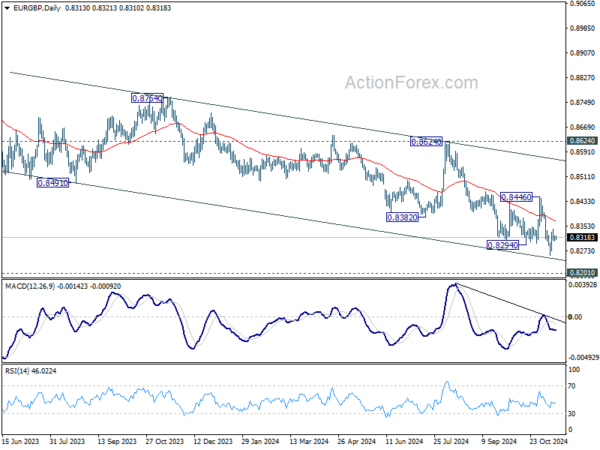

Technically, EUR/GBP is now in an interesting spot. It’s close to 0.8201 key long term support (2022 low). So even in case of another fall, downside potential might be limited. However, there is no clear buying momentum to push it through 0.8446 resistance to confirm short term bottom yet. Hence, in case of some volatility today, quick range trading strategy would be more appropriate.

In Asia, Nikkei rose 0.50%. Hong Kong HSI is up 0.37%. China Shanghai SSE is down -0.71%. Singapore Strait Times is up 0.12%. Japan 10-year JGB yield is up 0.0117 at 1.075. Overnight, DOW fell -0.47%. S&P 500 fell -0.60%. NASDAQ fell -0.64%. 10-year yield fell -0.033 to 4.418.

Fed’s Powell: Rate moving towards neutral, but no rush to cuts

Fed Chair Jerome Powell conveyed in a speech overnight that the central bank sees no immediate need to reduce interest rates quickly. He added that with an “appropriate recalibration” of monetary policy, Fed believes it can sustain economic growth and robust employment while guiding inflation back down to its 2% target in a sustainable manner.

He highlighted that the risks to achieving the Fed’s employment and inflation objectives are “roughly in balance,” and emphasized that policymakers remain “attentive to the risks to both sides.”

Powell noted that Fed is gradually moving policy toward a “more neutral setting”. However, he stressed that the path to reaching this neutral rate is “not preset.”.

Importantly, Powell remarked that “the economy is not sending any signals that we need to be in a hurry to lower rates.” The prevailing economic strength provides Fed with the ability to approach monetary decisions “carefully.”

Japan’s real GDP growth slows to 0.9% annualized, robust consumption but weak investment

Japan’s economy expanded by 0.2% qoq in Q3 2024, aligning with market expectations but indicating a slowdown from the previous quarter’s momentum. On an annualized basis, GDP grew by 0.9%, surpassing the anticipated 0.7%, yet decelerating from a downwardly revised 2.2% growth in Q2.

The second straight quarter of expansion was largely propelled by robust private consumption, which accounts for over half of the nation’s GDP. Private consumption increased by 0.9% qoq, up from revised 0.7% in the prior quarter, driven by solid demand for automobiles and the influence of wage increases. Despite persistent high inflation, consumers are channeling funds into spending as a result of wage gains.

However, the economy faces challenges as capital investment declined by -0.2% qoq after previous growth, reflecting the impact of a global economic slowdown on sectors like chipmaking equipment. Exports inched up by 0.4% qoq, indicating some resilience in external demand. In contrast, imports surged by 2.1% qoq, which negatively affected GDP by subtracting 0.4 percentage points from growth.

China’s industrial growth and investment lag, while retail sales outperform in Oct

China’s economic data for October showed a mixed performance, with retail sales surpassing expectations while industrial production and fixed asset investment slightly underperformed.

Industrial production grew by 5.3% yoy, just shy of the expected 5.4% yoy and holding steady from the prior month. Fixed asset investment also slowed, increasing by 3.4% ytd yoy compared to the forecasted 3.5%.

Real estate investment continued to struggle, declining by -10.3% from the previous year’s level over the January-October period, marking the sharpest annualized contraction since August 2021. This steeper drop reflects ongoing pressures in China’s real estate sector.

In contrast, retail sales surged 4.8% yoy, beating expectations of 3.8% yoy and accelerating from September’s 3.2% yoy. This stronger retail activity was largely driven by a week-long national holiday and an early start to the Singles’ Day shopping festival, which boosted consumer spending.

NZ BNZ manufacturing falls to 45.8, further contraction but new orders show signs of recovery

New Zealand’s BusinessNZ Performance of Manufacturing Index dropped from 47.0 to 45.8 in, marking its lowest point since July and extending the sector’s contraction for a 20th straight month. The reading underscores continued struggles in the manufacturing sector, despite recent RBNZ rate cuts.

A breakdown of the report reveals broad weakness across production and employment indicators, with production slipping from 47.9 to 44.5, and employment declining from 46.8 to 45.8. Deliveries also fell to 44.6 from 45.6, and finished stocks modestly increased to 47.4. However, new orders provided a rare bright spot, rising from 47.9 to 49.0, the highest level since May 2023.

Encouragingly, the proportion of negative comments from respondents fell to 53.5% in October, a marked improvement from the previous months, where negative sentiment had peaked at 76.3% in June.

BNZ’s Senior Economist Doug Steel noted, “Despite lower interest rates, the manufacturing sector continues to face significant headwinds. Recent business surveys show a sharp contrast between improved expectations for activity and weak current conditions.”

Looking ahead

UK will release GDP, production and trade balance in European session. Swiss will release PPI.

Later in the day, US retail sales will be the main focus. Empire state manufacturing, import prices, industrial production and business inventories will also be published. Canada will release manufacturing sales and wholesale sales.

USD/CAD Daily Outlook

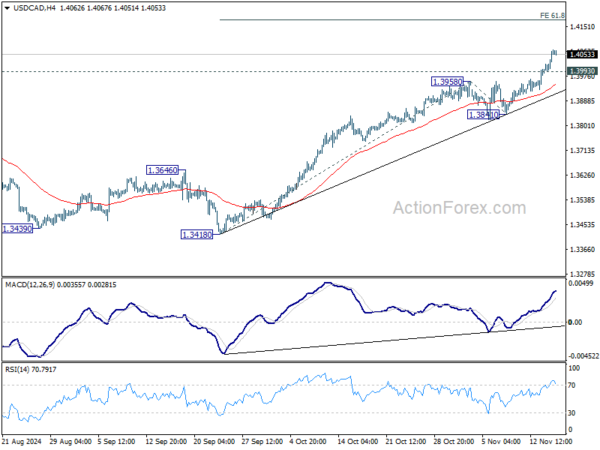

Daily Pivots: (S1) 1.4010; (P) 1.4038; (R1) 1.4087; More…

Intraday bias in USD/CAD remains on the upside for the moment. Current rally is part of the larger up trend. Next target is 61.8% projection of 1.3418 to 1.3958 from 1.3841 at 1.4175. On the downside, below 1.3993 minor support will turn intraday bias neutral and bring consolidations first. But outlook will stay bullish as long as 1.3841 support holds, in case of retreat.

In the bigger picture, up trend from 1.2005 (2021) is resuming with break of 1.3976 key resistance (2022 high). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3418 at 1.4391. Now, medium term outlook will remain bullish as long as 1.3418 support holds, even in case of deep pullback.