Yen and Swiss Franc Climb as Ukraine War Intensifies on 1000th Day – Action Forex

The European session saw a significant shift toward risk aversion as geopolitical tensions escalated on the 1,000th day of Russia’s war in Ukraine. Investors sought refuge in major US and European treasuries, leading to a notable decline in yields. Safe-haven assets such as Gold, Swiss Franc, and Japanese Yen jumped. But the overall market response has remained relatively contained so far.

In a marked escalation of the conflict, Ukraine deployed US-supplied ATACMS missiles to strike Russian territory for the first time today. This action followed approval from US President Joe Biden, granted just this week, allowing Ukraine to utilize these medium-range missiles for such attacks. Ukrainian President Volodymyr Zelenskiy addressed parliament, stating that the war’s “decisive moments” are expected in the coming year. On the other hand, Russian President Vladimir Putin issued a warning by signing a revised doctrine that lowers the threshold for a nuclear strike. These developments have intensified geopolitical risks, prompting investors to adopt a cautious stance.

Meanwhile, Canadian Dollar rebounded during early US session, supported by inflation data that slightly exceeded expectations. While this upside surprise is unlikely to derail the BoC from another aggressive 50bps rate cut from the current 3.75% at its December meeting, it may prompt policymakers to consider a more measured pace as interest rates approach neutral levels.

Overall in currency markets, Japanese Yen is currently as the best performer of the day, followed by Swiss Franc and Canadian Dollar. British Pound lagged, making it the worst performer, with Euro and US Dollar also showing weakness. Australian and New Zealand Dollars positioned themselves in the middle of the performance spectrum.

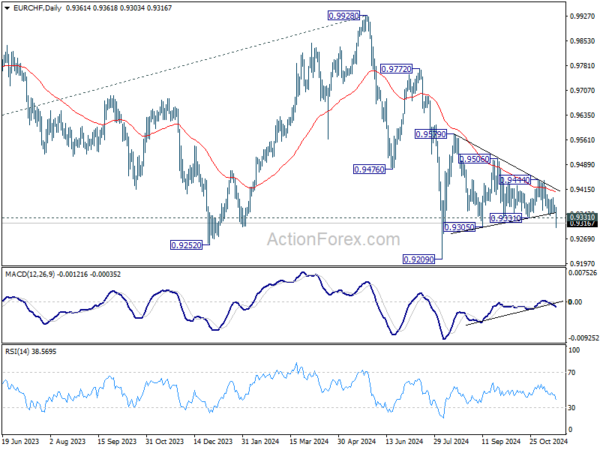

Technically, EUR/CHF is finally breaking out of the five-wave converging triangle pattern. The repeated rejection by 55 D EMA keeps outlook bearish. Break of 0.9305 low will probably bring resumption of larger down trend through 0.9209 low.

In Europe, at the time of writing, FTSE is down -0.41%. DAX is down -1.27%. CAC is down -1.36%. UK 10-year yield is down -0.052 to 4.418. Germany 10-year yield is down -0.059 at 2.316. Earlier in Asia, Nikkei rose 0.51%. Hong Kong HSI rose 0.44%. China Shanghai SSE rose 0.67%. Singapore Strait times rose 0.68%. Japan 10-year JGB yield fell -0.0113 to 1.065.

Canada’s CPI rebounds to 2% in Oct, services inflation slows to lowest since Jan 2022

Canada’s inflation accelerated in October, with the annual headline CPI rising to 2.0% yoy, slightly above expectations of 1.9% yoy and up from September’s 1.6% yoy. Slower decline in gasoline prices was a key driver, with prices falling -4.0% yoy compared to a sharper -10.7% yoy drop in September. Excluding gasoline, the all-items CPI maintained a steady rate of 2.2% yoy, consistent with August and September.

Goods prices saw a modest rebound, rising 0.1% yoy following -1.0% yoy decline in September. Services inflation moderated to 3.6% yoy, the smallest increase since January 2022. On a monthly basis, CPI rose by 0.4% mom, reversing a similar decline from the previous month.

Core inflation measures also exceeded expectations. CPI median increased from 2.3% yoy to 2.5% yoy, CPI trimmed rose from 2.4% yoy to 2.6% yoy, and CPI common ticked up from 2.1% yoy to 2.2% yoy. All three exceeded consensus forecasts.

BoE’s Bailey links tax rises to need for measured policy easing

BoE Governor Andrew Bailey highlighted in a parliamentary committee hearing today that the Labour government’s tax increases, outlined in the Autumn Budget, support the central bank’s gradual approach to easing monetary policy.

He explained, “There are different ways in which the increase in employer National Insurance Contributions announced in the Autumn Budget could play out in the economy.” This cautious approach, he said, will allow the Bank to observe how these fiscal changes interact with other inflation risks.

Bailey also cautioned about persistent wage pressures, with firms surveyed by the BoE expecting wage growth of 4% over the next year, even as the labor market shows early signs of loosening. He emphasized the importance of carefully monitoring these developments.

ECB’s Panetta calls for shift to neutral amid stagnant demand

Italian ECB Governing Council member Fabio Panetta emphasized today that restrictive monetary policies are “no longer necessary”, given inflation’s proximity to the target and sluggish domestic demand.

Panetta noted, “In the current phase, we should focus more on the sluggishness of the real economy,” highlighting the risk that a lack of recovery could drive inflation well below target, creating challenges for monetary policy to counteract.

He advocated for normalizing the ECB’s stance and moving toward a neutral or even “expansionary territory” if necessary, stressing, “We are probably a long way from the neutral rate.” Panetta also reminded that lowering rates below neutral at the bottom of a cycle aligns with standard policy frameworks historically followed by both ECB and Fed.

Separately, Estonian ECB Governing Council member Madis Muller shared that, “I wouldn’t ever want to say anything is a done deal,” but he expressed confidence that “we can again reduce interest rates in December.”

Eurozone CPI finalized at 2% in Oct, core CPI at 2.7%

Eurozone inflation was finalized at 2.0% yoy in October, a rise from September’s 1.7% yoy. Core CPI, excluding volatile components such as energy, food, alcohol, and tobacco, held steady at 2.7% yoy. Among contributors, services had the largest impact, adding +1.77 percentage points to the overall rate, followed by food, alcohol, and tobacco (+0.56 pp) and non-energy industrial goods (+0.13 pp). Energy, on the other hand, exerted downward pressure, subtracting -0.45 pp from the headline figure.

Inflation across the broader EU came in at 2.3% yoy, up slightly from September’s 2.1%. Member states showed a wide divergence in inflation rates. Slovenia recorded no inflation at 0.0%, while Lithuania and Ireland posted modest increases of 0.1%. At the other end of the spectrum, Romania led with the highest annual rate of 5.0%, followed by Belgium and Estonia at 4.5% each. Compared to September, inflation rose in 19 member states, remained stable in six, and declined in two.

RBA minutes highlight need for multiple good quarterly inflation reports before easing

In the minutes from the November meeting, RBA emphasized “minimal tolerance” for a prolonged period of high inflation, acknowledging the already “lengthy period” of elevated prices. They underscored the need to observe “more than one good quarterly inflation outcome” before concluding that a sustainable disinflation trend was underway.

Members discussed various scenarios that could challenge the forecasts, necessitating adjustments in policy.

One critical scenario revolved around weaker consumption. If consumption proved “persistently and materially weaker” than anticipated and threatened to significantly lower inflation, RBA suggested that a rate cut might be warranted. Conversely, stronger recovery in consumption could mean the current monetary stance would need to “remain in place for longer”.

The labor market also featured prominently in deliberations. Should employment conditions ease more sharply than expected, resulting in rapid disinflation, the Board acknowledged that looser monetary policy might become appropriate. On the other hand, if the economy’s supply capacity turned out to be “materially more limited” than assumed, a tighter stance could be required.

External risks were also assessed, including potential major shifts in US economic policy following the presidential election, uncertainty around the scope of China’s anticipated stimulus measures, and the broader implications of rising global government debt levels.

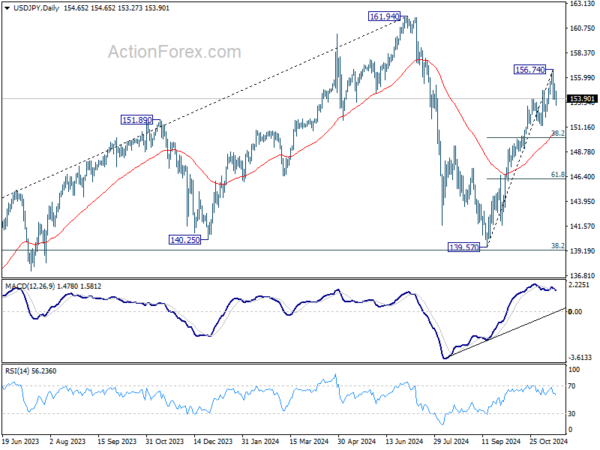

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 153.89; (P) 154.63; (R1) 155.41; More…

USD/JPY’s break of 153.87 resistance turned support and rising channel suggest short term topping at 156.74. Intraday is back on the downside for pull back to 151.27, and possibly below. But strong support should emerge at 38.2% retracement of 139.57 to 156.74 at 150.18 to contain downside. On the upside, above 155.35 minor resistance will bring retest of 156.74 high instead.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.