Too labored bottoming

S&P 500 did not see convincing buying following the opening bell in the least – no surprise to clients, I had been bearish ever since the intraday update issued for them during Powell conference latter minutes. Also the macro reasons given for the slide presented earlier yesterday, offered my view on which price action scenario is to unfold in S&P 500.

During the regular session, I updated the views with gold and silver performance ahead, revisiting the weekend video that was followed up with all the answers to the raised question – shared with clients.

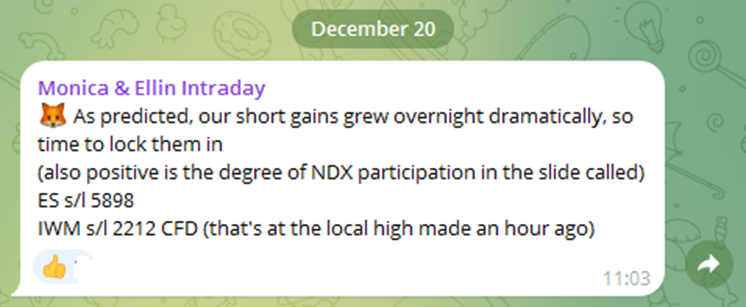

The prognosis got confirmed in the following hours, starting with equities. So what‘s going on in our channel? Smashing ES and IWM short gains of well over 110pts together in the two indices delivered amid continuous tightening of protective stop-loss so as to lock in gains. Clients just benefit most from combining the swing analyses and calls with the intraday ones – they can act as per their circumstances and trading style – this kind of a steep downtrend offered better exit management than the prices shown below.

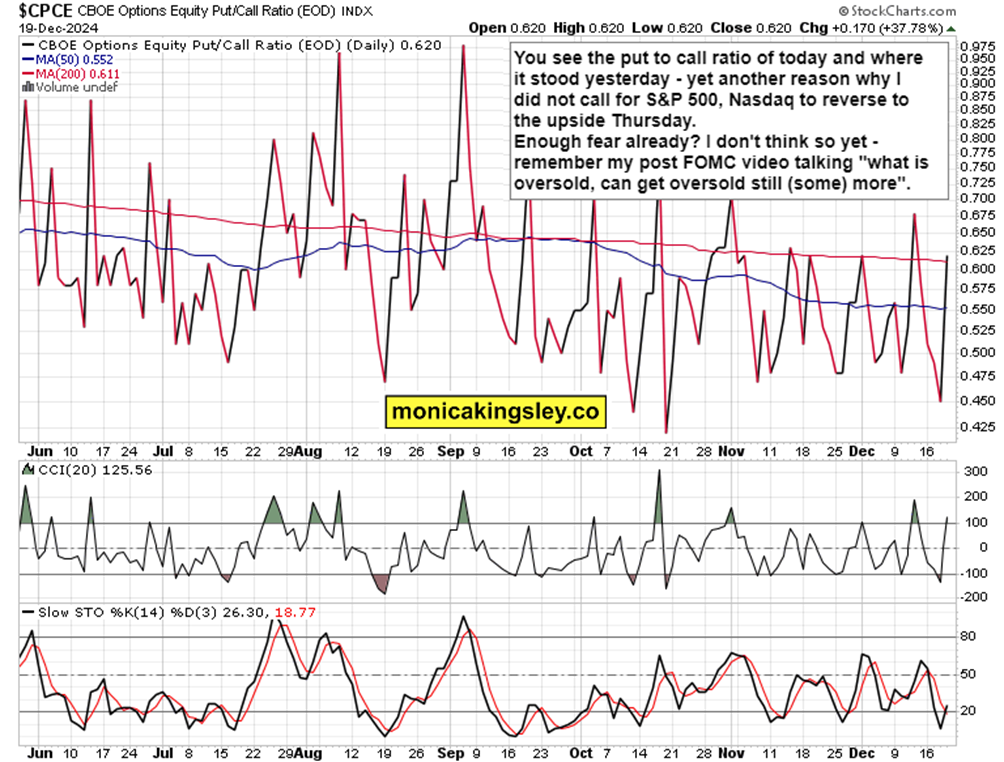

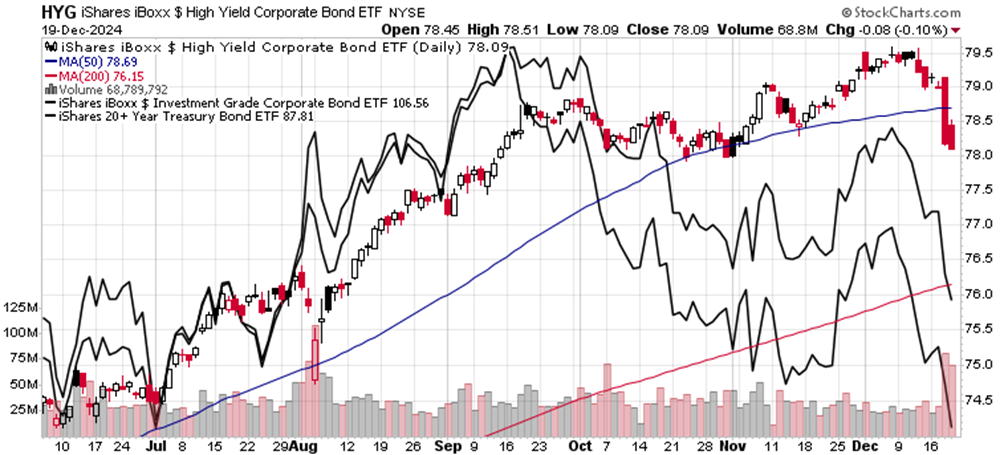

Now, the question is when are we to see some kind of a V-shaped recovery? The following put to call ratio and yields chart will hint at that – forget not it‘s triple witching today.

Core PCE price index isn‘t going to be a game changer, but the way it came in at 0.1% only, will provide some relief to risk assets (some, that‘s the key word) – the late in the tooth disinflation process will be getting shown to move to the next chapter, the sticky inflation / second wave starting – that‘s not a good sign for rate cutting, meaning market yields are to keep the steady grind higher.

Enjoy today‘s reprieve and have a great pre-Christmas weekend!