Euro looks offered and slips back below 1.1200

- Euro faces some downside pressure and challenges 1.1200 against the US Dollar.

- Stocks in Europe en route to a positive closing on Wednesday.

- EUR/USD appears so far supported just below 1.1200

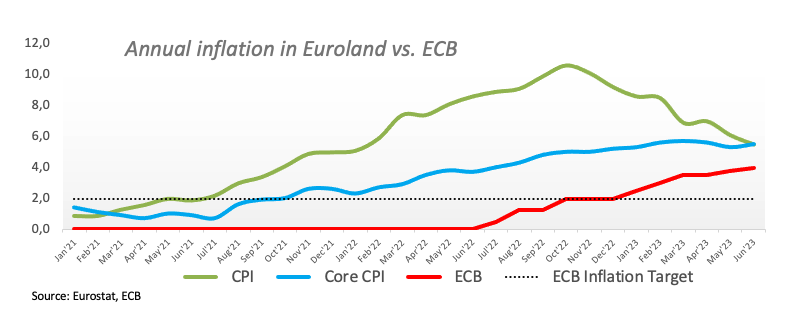

- Eurozone CPI rose 5.5% YoY in June, Core CPI rose 5.5% YoY.

- US housing data surprised to the downside in June.

The Euro (EUR) now faces some selling pressure amidst a quite steady rebound in US Dollar (USD), forcing EUR/USD to give away some ground and retreat to the area below the 1.1200 yardstick amidst an overall risk-off market environment.

The strengthening dollar, as evidenced by the Dollar Index (DXY) retaking the 100.00 level to hit multi-day highs around 100.30, favours the pair’s renewed offered bias on Wednesday.

This comes alongside falling US bond yields across the board and new lows for German bund yields, suggesting rising demand for safe havens.

Looking ahead, though the Fed is perceived as nearing the end of its tightening cycle, the broad view of another 25 basis points (bps) interest-rate hike in July could keep the dollar supported.

Meanwhile, a rate increase by the European Central Bank (ECB) later this month is widely anticipated, but ECB officials have sounded less hawkish recently on the prospects of additional hikes beyond summer, hinting more consensus may be needed for that.

Data-wise in the region, the Eurozone final inflation data for June showed headline inflation at 5.5% YoY and core inflation at 5.5% YoY.

In the US, Mortgage Applications rose 1.1% in the week to July 14, while Housing Starts contracted 8.0% MoM in June (1.434M units) and Building Permits shrank 3.7% MoM in the same period (1.44M units).

Daily digest market movers: Euro could have embarked on a technical correction

- The EUR piereces the 1.1200 mark against the USD.

- Eurozone Final CPI and Core CPI rose 5.5% in the year to June.

- The USD Index picks up pace and surpasses the 100.00 hurdle.

- Speculation that the Fed’s July hike could be the last one runs high.

- US, German yields keep the downside well in place for yet another session.

- Traders see the BoE’s interest rate peaking below 6%.

- UK inflation loses traction in June.

Technical Analysis: Euro faces initial support at 1.1000

The pair printed a new 2023 high at 1.1275 on July 18. Once this level is cleared, there are no resistance levels of significance until the 2022 peak of 1.1495 recorded on February 10.

On the downside, the 1.1000 region emerges as a psychological support seconded by provisional support at the 55-day and 100-day SMAs at 1.0893 and 1.0871, respectively, ahead of the July 6 low of 1.0833. The breakdown of this region should meet the next contention area at the key 200-day SMA at 1.0674 prior to the May 31 low of 1.0635. South from here emerges the March 15 low of 1.0516 before the 2023 low of 1.0481 on January 6.

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

However, the current pair’s overbought condition, as per the daily Relative Strength Index (RSI) near 75, carries the potential to spark a technical correction in the short-term horizon.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.