Euro Rides High on Technicals, Yet Fundamental Proof Awaits – Action Forex

In a surprising twist, Euro experienced a significant surge overnight, powering through a short-term resistance level when matched up against Dollar. Euro in also a position to resume its long-term up trend versus Yen. he factors fuelling this surge, however, remain a subject of speculation. On one hand, recent economic indicators have been less than stellar, and there’s a strong expectation that ECB will keep interest rates unchanged this week.

One plausible explanation for Euro’s rally could be the dip in US benchmark yield, but with Germany’s yields also taking a dip, the exact impetus remains elusive. The question lingers: is this newfound Euro strength stemming from an underlying fundamental factor, or is it merely a corrective rebound after exhausting the pronounced selloff against Dollar and Swiss Franc?

Looking at the broader currency markets, Sterling closely tails Euro as the second-best performer for the week thus far, succeeded by Aussie and subsequently Kiwi. Contrarily, Dollar lags as this week’s weakest link, followed closely by Yen and Swiss Franc. The slackening of these traditionally safe-haven currencies might suggest a diminishing risk-off sentiment. Yet, this interpretation doesn’t seem to correlate with the ongoing stasis in stocks or the sustained resilience in Gold.

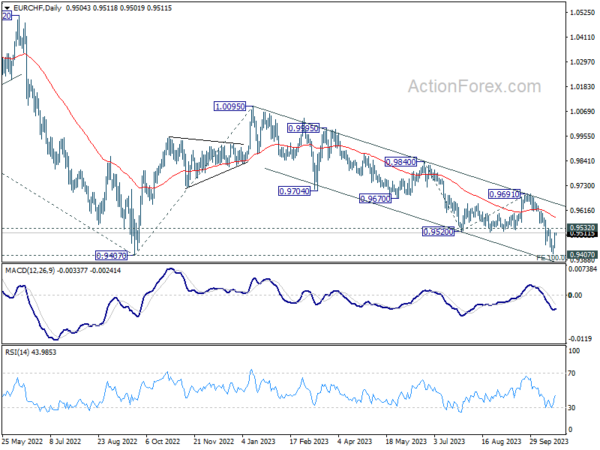

On the technical front, for the Euro to validate its newfound vigor, it would need to convincingly surpass the 0.9532 resistance against Swiss Franc, confirming short term bottoming. More critically, such a move would demonstrate a successful defense of the pivotal 0.9407 support level by EUR/CHF. An assertive advance through 0.9532 could potentially act as a tailwind, elevating Euro’s stance elsewhere. Conversely, if 0.9532 resistance stands firm, it could dampen short-term prospects for EUR/CHF, consequently restraining Euro’s surge against other currencies.

In Asia, at the time of writing, Nikkei is down -0.55%. Hong Kong HSI is down -0.87%. China Shanghai SSE is up 0.38%. Singapore Strait Times is up 0.45%. Japan 10-year JGB yield is down -0.0186 at 0.856. Overnight, DOW dropped -0.58%. S&P 500 dropped -0.17%. NASDAQ rose 0.27%. 10-year yield dropped -0.086 to 4.838.

Australia’s PMI composite dives to 47.3, slowdown amid sticky inflation

Australia’s economic indicators from October paint a worrisome picture, as PMI Manufacturing dipped to a six-month low at 48.0, down from 48.7. More significantly, PMI Services plunged to a 10-month trough, dropping from 51.8 to 47.6. PMI Composite, which combines both manufacturing and services, dropped to a concerning 21-month low of 47.3 from 51.5.

Weighing in on these figures, Warren Hogan, Chief Economic Advisor at Judo Bank, mentioned PMI output index reverting to cyclical lows around 47 after a brief rise above the neutral 50 mark in September. These PMI indicators resonate with the ongoing narrative that Australia’s economic momentum has decelerated in 2023, aligning with the anticipated gentle slowdown most economists had projected.

A silver lining, however, emerges from the employment index, which remains steadfastly above the 50-mark. Hogan interprets this as a sign that the deceleration in business activities hasn’t notably dampened hiring trends.

However, a significant area of concern highlighted by Hogan is the enduring nature of inflation pressures, which he refers to as “stickiness”. Both input and output price indexes remain elevated, not hinting at an imminent return of inflation to RBA’s target.

As RBA prepares for its board meeting, set to coincide with Melbourne Cup day, the latest PMI readings, especially concerning inflation, are unlikely to drastically influence the interest rate decision. Hogan articulated, “A strong case exists for a further modest upward adjustment to the Australian cash rate target, to ensure the economy remains on the so-called ‘narrow path’. If we are to avoid recession, Australia will need an extended period of below-trend growth to ensure inflation returns to target by 2025.”

Japan’s PMI manufacturing unchanged at 48.5, worst slump in eight months

October saw Japan’s PMI Manufacturing remain unchanged at 48.5, missing expectations of 48.9 and marking the fifth consecutive month showing deteriorating operating conditions. Additionally, PMI Services and PMI Composite displayed downturns, with the former dropping from 53.8 to 51.1 and the latter declining from 52.1 to a sub-50 figure of 49.9.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, noted that this is the first instance of a decline in business activity for the private sector since December 2022. The drop, albeit marginal, was primarily due to a more pronounced decrease in manufacturing output – the fastest rate seen in eight months. On the other hand, services activity did continue its expansion, albeit at its slowest pace for the year.

The overall sentiment among firms was not particularly encouraging either. They expressed the least optimism since the beginning of the year concerning future output, suggesting a tempered outlook for the immediate future. However, a silver lining in the employment sector, which saw a resurgence, particularly in the service sector.

On the pricing front, both manufacturing and service sectors experienced diminished cost pressures. This deceleration resulted in output prices within the private sector rising at their most muted pace since February 2022.

Bitcoin soars past 35k, ETF approval anticipation and geopolitical tensions fueling the surge

Bitcoin is experiencing a significant surge this week, effortlessly crossing its previous resistance at 31815 and making its mark beyond 35k. Notably, Bitcoin is now approaching a critical long-term fibonacci resistance near 36k. While it’s uncertain whether Bitcoin can clear this barrier on its first attempt, a definitive break past this resistance could lead to profound long-term bullish implications. Such a move might propel Bitcoin swiftly past 40k next.

A potential catalyst for this robust rally is the market’s anticipation of a spot BTC ETF approval. Despite last week’s false report, the consensus among market participants suggests that this approval could materialize within the upcoming three months, if not sooner. Another factor worth considering is the role of geopolitical tensions in influencing Bitcoin’s demand. As many in the investment community have come to regard Bitcoin as the “digital gold”, it’s plausible that some are turning to the cryptocurrency as an alternative safe haven amid global uncertainties.

From a technical standpoint, near term outlook will stay bullish as long as 30021 resistance turned support holds. The key resistance is 38.2% retracement of 68986 to 15452 at 35901. Sustained break there will argue that it’s already reversing, rather than correcting, the whole down trend from 68986 (2021 high). Next near term target will be 100% projection of 15452 to 31815 from 24896 at 41259.

Looking ahead

Germany Gfk consumer sentiment, Eurozone PMIs and UK PMIs will be the highlights for European session. Later in the day, Canada will publish new housing price index while US will also release PMIs.

EUR/USD Daily Outlook

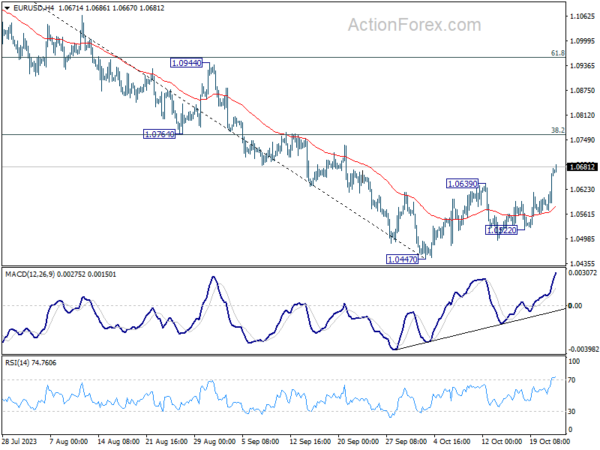

Daily Pivots: (S1) 1.0601; (P) 1.0640; (R1) 1.0707; More…

EUR/USD’s solid break of 1.0639 resistance short term bottoming at 1.0447, on bullish convergence condition in 4H MACD. Intraday bias is back on the upside for 1.0764 cluster resistance (38.2% retracement of 1.1274 to 1.0447 at 1.0763). Rejection by this level, followed by break of 1.0522 support, will retain near term bearishness for resuming the whole decline from 1.1274. However, sustained break of 1.0763/4 will pave the way to 61.8% retracement at 1.0958.

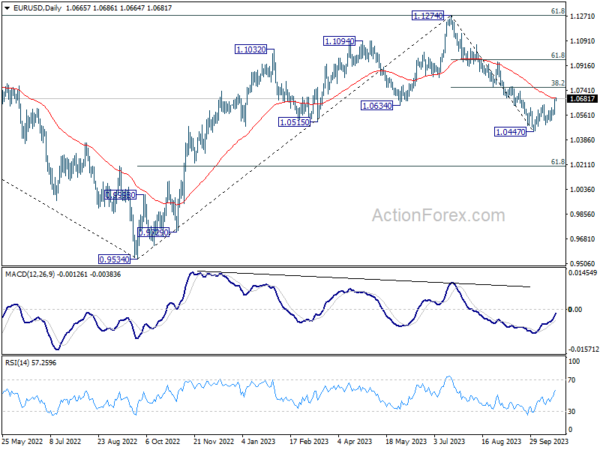

In the bigger picture, fall from 1.1274 medium term top could still be a correction to rise from 0.9534 (2022 low). But chance of a complete trend reversal is rising. In either case, current fall should target 61.8% retracement of 0.9534 to 1.1274 at 1.0199 next. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0684) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Oct P | 48 | 48.7 | ||

| 22:00 | AUD | Services PMI Oct P | 47.6 | 51.8 | ||

| 00:30 | JPY | Manufacturing PMI Oct P | 48.5 | 48.9 | 48.5 | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Nov | -27.3 | -26.5 | ||

| 06:00 | GBP | Claimant Count Change Sep | 2.3K | 0.9K | ||

| 06:00 | GBP | ILO Unemployment Rate 3M Aug | 4.30% | 4.30% | ||

| 07:15 | EUR | France Manufacturing PMI Oct P | 44.8 | 44.2 | ||

| 07:15 | EUR | France Services PMI Oct P | 44.6 | 44.4 | ||

| 07:30 | EUR | Germany Manufacturing PMI Oct P | 40.1 | 39.6 | ||

| 07:30 | EUR | Germany Services PMI Oct P | 50.1 | 50.3 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Oct P | 43.7 | 43.4 | ||

| 08:00 | EUR | Eurozone Services PMI Oct P | 48.7 | 48.7 | ||

| 08:30 | GBP | Manufacturing PMI Oct P | 45.2 | 44.3 | ||

| 08:30 | GBP | Services PMI Oct P | 49.5 | 49.3 | ||

| 12:30 | CAD | New Housing Price Index M/M Sep | 0.10% | 0.10% | ||

| 13:45 | USD | Manufacturing PMI Oct P | 49.5 | 49.8 | ||

| 13:45 | USD | Services PMI Oct P | 49.9 | 50.1 |