Dollar and Euro Slide on Rate Cut Expectations, with US PCE and Eurozone CPI in Focus – Action Forex

Dollar and Euro are emerging as notable underperformers for the week, largely influenced by increasing market anticipation of interest rate cuts by Fed and ECB in the coming year, a sentiment that is also impacting treasury yields. In US, 10-year treasury yield, a key benchmark for market expectations, has dropped below 4.3% for the first time since September. This movement reflects the changing perceptions of investors, who are now factoring in a greater likelihood of a shift in Fed’s policy. Market probabilities indicate less than a 50% chance of a rate cut by Fed in March 2024, but expectations rise to nearly 80% for May. The release of today’s US PCE inflation data is eagerly awaited, as it could either confirm the market’s expectations or lead to adjustments in the outlook.

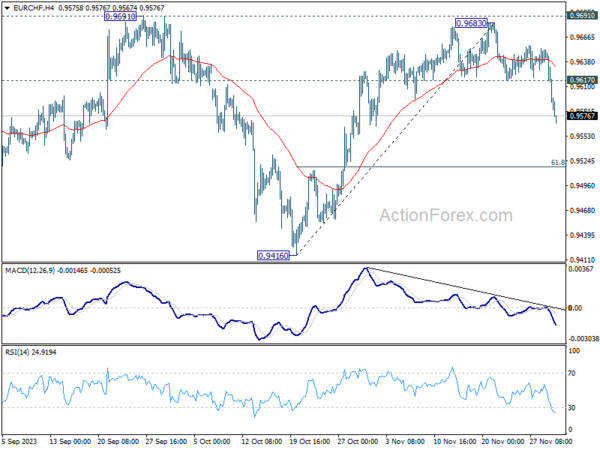

Similar trends are observed in Europe, where Germany’s 10-year bund yield has crossed below 2.5% mark for the first time since August. This is attributed to traders increasingly betting on faster ECB rate cuts in the next year. Current market forecasts suggest a 90% likelihood of an initial 25bps reduction in April, followed by a cumulative decrease of 105 bps throughout the year. Consequently, Euro has weakened significantly, particularly against Sterling and Swiss Franc, breaking through key near-term support levels. There is more downside prospect for Euro if today’s Eurozone CPI flash misses expectations.

Overall, Japanese Yen stands out as the strongest currency for the week, maintaining its firmness despite a mild retreat overnight. New Zealand Dollar follows as the second strongest, bolstered by RBNZ’s hawkish stance. In contrast, Australian Dollar is underperforming, influenced by negative PMI data from China, a key trading partner. Canadian Dollar’s performance is mixed but leans towards the softer side, similar to the Sterling. Upcoming Canadian GDP data may provide further direction for the Canadian currency.

Technical analysis of the EUR/CHF pair reveals significant developments. The pair’s extended decline from 0.9683 confirms a notable rejection at the 0.9691 structural resistance, diminishing the possibility of a larger bullish trend reversal. The trend now favors a more profound fall, possibly reaching the 61.8% retracement level of 0.9416 to 0.9683 at 0.9518. The market’s reaction to this level will be crucial in determining whether EUR/CHF is set to resume its downtrend from the January high of 1.0095.

In Asia, at the time of writing, Nikkei is up 0.18%. Hong Kong HSI is down -0.02%. China Shanghai SSE is up 0.04%. Singapore Strait Times is down -0.38%. Japan 10-year JGB yield is up 0.0079 at 0.689. Overnight, DOW rose 0.04%. S&P 500 fell -0.09%. NASDAQ fell -0.16%. 10-year yield fell sharply by -0.065 to 4.271.

BoJ’s Nakamura : More time needed before altering ultra-easy monetary stance

BoJ board member Toyoaki Nakamura, in a speech to business leaders today, emphasized that Japan has not yet reached a point where it can confidently assert that the sustained and stable achievement of BoJ’s 2% inflation target, along with corresponding wage growth, is within reach. He added that the current inflation in Japan is primarily driven by “cost-push factors”.

In light of this assessment, he said BoJ “must patiently maintain current monetary easing for the time being.” Some more time is needed before adjusting the policy.

Nevertheless, Nakamura expressed a positive outlook on Japan’s economy, describing it as recovering moderately. He also anticipates that this moderate recovery will be accompanied by increases in wages, which could play a crucial role in sustaining economic growth and achieving the inflation target.

Japan’s mixed economic signals: Industrial production up, retail sales growth slows

Japan’s economy presents a mixed picture based on the latest data for October 2023. Industrial production saw a notable increase, rising 1.0% mom, exceeding expectations of a 0.7% increase.

However, manufacturers surveyed by Japan’s Ministry of Economy, Trade and Industry have a mixed outlook. They expect industrial output to decrease by -0.3% mom in November but anticipate a significant climb of 3.2% mom in December. This forecast points to short-term fluctuations but overall optimism towards the year’s end.

In contrast to the industrial sector, retail sales figures were less encouraging. Retail sales in October rose by 4.2% yoy, falling short of the expected 5.9% yoy increase. Despite this slower growth, retail sales have continued to mark annual gains for 20 consecutive months.

However, a month-over-month analysis reveals a downturn, with retail sales falling by -1.6% in October from September, ending a three-month streak of gains.

China’s manufacturing PMI slips further to 49.4, indicating continued contraction

China’s NBS Manufacturing PMI slightly declined from 49.5 to 49.4 in November, marking the weakest reading since December 2022 and falling below market expectation of 49.6. This decline indicates that China’s manufacturing sector has been struggling to maintain consistent growth, having been in contraction for five consecutive months since April, briefly returning to expansion in September, and then slipping back into contraction in October.

NBS statistician Zhao Qinghe attributed this downturn to several factors, including “traditional off-season” effects in some manufacturing industries and “insufficient market demand”. This explanation points to both cyclical and demand-driven challenges impacting the manufacturing sector.

Within manufacturing PMI, there was a drop in new-orders subindex to 49.4 from 49.5, further reflecting the demand-side struggles. Additionally, new-export-orders subindex fell to 46.3, down from 46.8, indicating challenges in external markets and potentially reflecting global economic conditions.

PMI Non-Manufacturing also witnessed a decrease, moving from 50.6 to 50.2, which was below expected 51.1. However, within the non-manufacturing PMI, construction subindex showed an improvement, rising to 55 from 53.5. The official composite PMI, which combines both manufacturing and services, fell to 50.4 from 50.7.

NZ ANZ business confidence jumps to 30.8, but inflation concerns remain

ANZ Business Confidence in New Zealand saw a significant increase in November, reaching its highest level since March 2015, as it rose from 23.4 to 30.8. Additionally, Own Activity Outlook improved from 23.1 to 26.3.

ANZ’s analysis said the results support the idea of “soft landing” for New Zealand economy. However, ANZ points out that it’s still uncertain if this slowdown will be adequate to reduce inflation to target level quickly enough.

The survey also revealed varied trends across different economic indicators. Export intentions saw an uptick from 6.1 to 9.2, indicating stronger future export plans. Investment intentions also increased marginally from 3.8 to 4.5. In contrast, employment intentions experienced a slight decrease from 5.6 to 5.4, suggesting a small dip in hiring plans.

Notably, cost expectations showed a decrease from 76.0 to 73.9, which could signal easing cost pressures. Profit expectations reversed from a negative -5.6 to a positive 1.5, reflecting an improved outlook for business profitability.

The report presented a mixed view of inflation indicators. Inflation expectations continued their downward trajectory, moving from 4.94% to 4.79%. However, pricing intentions rose slightly from 46.3 to 46.8.

ANZ also commented on the market’s expectations for RBNZ’s OCR. They noted that while there is market anticipation for rate cuts, the current economic indicators, particularly some stalling in inflation measures and the overall robust level of activity, suggest that the RBNZ may not be inclined to lower rates soon.

Fed’s Beige Book: Activity slowdown, easing labor demand, moderating price pressures

The latest Fed’s Beige Book report indicates general slowdown in economic activity, with variations across different regions. Specifically, four districts reported “modest growth”, two districts experienced “flat to slightly down”, and six districts observed “slight declines” in activity.

This mixed picture reflects the diverse economic conditions across the country and points to a cautious economic outlook for the next six to twelve months, which is perceived to have “diminished” during the reporting period.

In terms of labor market dynamics, demand for labor “continued to ease”. Most districts reported either flat or modest increases in overall employment. Wage growth across most districts was characterized as “modest to moderate”. Notably, the report highlights “easing in wage pressures”, with several districts even reporting declines in starting wages. This trend could be a response to the overall economic slowdown and a signal of less competition for labor.

Regarding prices, the report notes a general moderation in price increases across districts, although prices remain at elevated levels. The expectation is for “moderate price increases to continue into next year”.

Fed’s Mester: Monetary policy well-positioned following discernible progress on inflation

Cleveland Fed President Loretta Mester, in her remarks at a conference overnight, acknowledged that while inflation remains above Fed’s 2% target, there has been “discernible progress” in controlling it, even as the “overall economy has remained relatively strong”.

Mester expressed confidence in the current stance of monetary policy, stating, “Monetary policy is in a good place for policymakers to assess incoming information on the economy and financial conditions.”

Highlighting the need for flexibility, Mester described the central bank’s rate policy as needing to be “nimble,” and she believes that “the current level of the funds rate positions us well to do that.”

Mester did not rule out the possibility of further rate hikes, emphasizing that the decision to increase rates further and the duration for which the rate target remains high “will depend importantly on whether the economy is evolving as expected, how the risks are changing, and the progress being made on our dual mandate goals of price stability and maximum employment.”

Looking ahead

Eurozone CPI flash will be the main focus in European session and unemployment rate will also be featured. Germany retail sales and unemployment, Swiss retail sales and KOF economic barometer will also be released.

Later in the day, US PCE inflation is the highlight, with jobless claims, Chicago PMI and pending home sales scheduled. Canada will also publish GDP data.

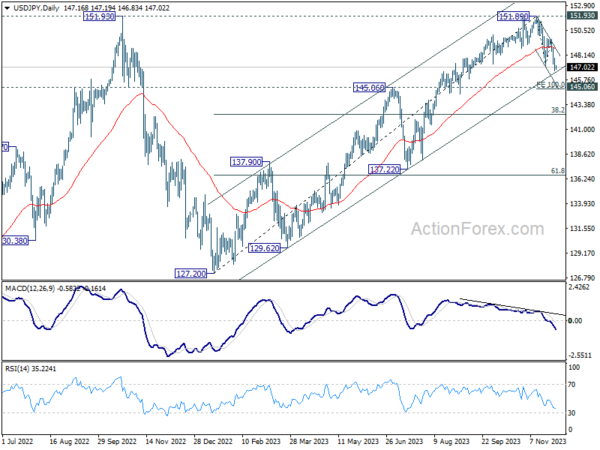

USD/JPY Daily Outlook

Daily Pivots: (S1) 146.63; (P) 147.27; (R1) 147.87; More…

USD/JPY is staying consolidation above 146.65 temporary low and intraday bias remains neutral. While another recovery cannot be ruled out, risk will stay on the downside as long as 55 4H EMA (now at 148.75) holds. Break of 146.65 will resume the fall from 151.89 to 100% projection of 151.89 to 147.14 from 149.66 at 144.91, which is close to 145.06 key resistance turned support.

In the bigger picture, rise from 127.20 (2023 low) is seen as the second leg of the pattern from 151.93 (2022 high). Decisive break of 145.06 resistance turned support will confirm that this second leg has completed, after rejection by 151.93. Deeper fall would be seen through 38.2% retracement of 127.20 to 151.89 at 142.45 to 61.8% retracement at 136.63. Nevertheless strong bounce from 145.06 will retain medium term bullishness for another test on 151.93 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Industrial Production M/M Oct P | 1.00% | 0.70% | 0.50% | |

| 23:50 | JPY | Retail Trade Y/Y Oct | 4.20% | 5.90% | 5.80% | 6.30% |

| 00:00 | NZD | ANZ Business Confidence Nov | 30.8 | 23.4 | ||

| 00:30 | AUD | Private Capital Expenditure Q3 | 0.60% | 1.00% | 2.80% | |

| 00:30 | AUD | Private Sector Credit M/M Oct | 0.30% | 0.40% | 0.50% | |

| 01:00 | CNY | NBS Manufacturing PMI Nov | 49.4 | 49.6 | 49.5 | |

| 01:00 | CNY | NBS Non-Manufacturing PMI Nov | 50.2 | 51.1 | 50.6 | |

| 05:00 | JPY | Housing Starts Y/Y Oct | -6.30% | -7.00% | -6.80% | |

| 07:00 | EUR | Germany Retail Sales M/M Oct | 0.50% | -0.80% | ||

| 07:30 | CHF | Real Retail Sales Y/Y Oct | 0.20% | -0.60% | ||

| 08:00 | CHF | KOF Economic Barometer Nov | 96.2 | 95.8 | ||

| 08:55 | EUR | Germany Unemployment Change Nov | 25K | 30K | ||

| 08:55 | EUR | Germany Unemployment Rate Nov | 5.80% | 5.80% | ||

| 09:00 | EUR | Italy Unemployment Oct | 7.40% | 7.40% | ||

| 10:00 | EUR | Eurozone Unemployment Rate Oct | 6.50% | 6.50% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Nov P | 3.80% | 2.90% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov P | 3.90% | 4.20% | ||

| 13:30 | CAD | GDP M/M Sep | 0.10% | 0.00% | ||

| 13:30 | USD | Personal Income M/M Oct | 0.20% | 0.30% | ||

| 13:30 | USD | Personal Spending Oct | 0.20% | 0.70% | ||

| 13:30 | USD | PCE Price Index M/M Oct | 0.10% | 0.40% | ||

| 13:30 | USD | PCE Price Index Y/Y Oct | 3.00% | 3.40% | ||

| 13:30 | USD | Core PCE Price Index M/M Oct | 0.20% | 0.30% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Oct | 3.50% | 3.70% | ||

| 13:30 | USD | Initial Jobless Claims (Nov 24) | 215K | 209K | ||

| 14:45 | USD | Chicago PMI Nov | 45.4 | 44 | ||

| 15:00 | USD | Pending Home Sales M/M Oct | -0.70% | 1.10% | ||

| 15:30 | USD | Natural Gas Storage | -8B | -7B |