Forex Consolidation, Metals Surge, US Retail Sales and PPI Eyed – Action Forex

Overall, the forex markets are still stuck in consolidative trading in Asian session, with expectations set for a subdued European session given the light economic calendar. However, anticipation builds for volatility spikes with releases of US retail sales and PPI later today. For now, Canadian Dollar is the stronger one for the week, followed by Euro and then Dollar. Yen is the weaker one, followed by Sterling and Kiwi. But overall, all major pairs and crosses are bounded inside last week’s range.

In contrast, the commodities market, particularly industrial metals, showcases more dynamic price actions. Copper spiked to its highest level in nearly a year, fueled by considerations of production cuts among Chinese smelters. Silver’s surge this week, driven by optimism surrounding the global economic recovery, contrasts with Gold’s current stagnation. After reaching a record high last week, Gold appears to be in a consolidation phase, taking a momentary pause in the long term uptrend.

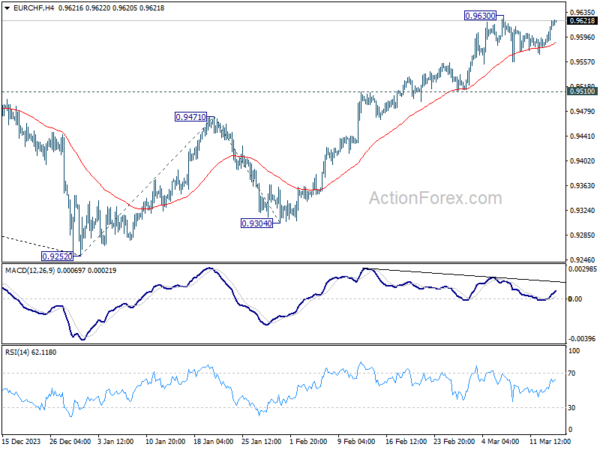

Technically, EUR/CHF might have finished the near term consolidation from 0.9630 after drawing support from 55 4H EMA. Immediate focus is now on 0.9630 resistance. Firm break there will resume whole rise from 0.9252 and target 161.8% projection of 0.9252 to 0.9471 from 0.9304 at 0.9658 next. The question is whether the upside breakout in EUR/CHF would be accompanied by break of 1.0980 resistance in EUR/USD or 0.8891 resistance in USD/CHF. This interplay between these three pairs merits close observation.

In Asia, at the time of writing, Nikkei is up 0.26%. Hong Kong HSI is down -0.78%. China Shanghai SSE is down -0.09%. Singapore Strait Times is up 0.71%. Japan 10-year JGB yield is up 0.014 at 0.775. Overnight, DOW rose 0.10%. S&P 500 fell -0.19%. NASDAQ fell -0.54%. 10-year yield rose 0.037 to 4.192.

Silver targeting key resistance zone at 26 as momentum picks up

While Gold’s rally stalled after hitting new record high last week, Silver is picking up momentum. Given that Silver has been clearly lagging Gold this year, there is room for Silver to catch up and outperform in Q2.

Fundamentally, both Gold and Silver as precious metal would benefit from policy loosening of major global central banks. But as additionally as an industrial metal, Silver could be benefited more with global growth and industrial demands pick up.

Yet, technically, Silver has to overcome key resistance level around 26 first. For now, near term outlook will stay bullish as long as 23.99 support holds. It’s possible that consolidation pattern from 26.12 has completed with three waves to 21.92 already.

Decisive break of 26.12 will confirm resumption of whole rise from 17.54 (2022 low). In this case, the near medium term target will be 61.8% projection of 17.54 to 26.12 from 21.92 at 27.22. Firm break there will pave the way for new record high above 30 later in the year.

Nevertheless, rejection by 25.91/26.12 resistance zone, or break of 23.99 support, will delay the bullish case and extend the consolidation from 26.12 with another falling leg instead.

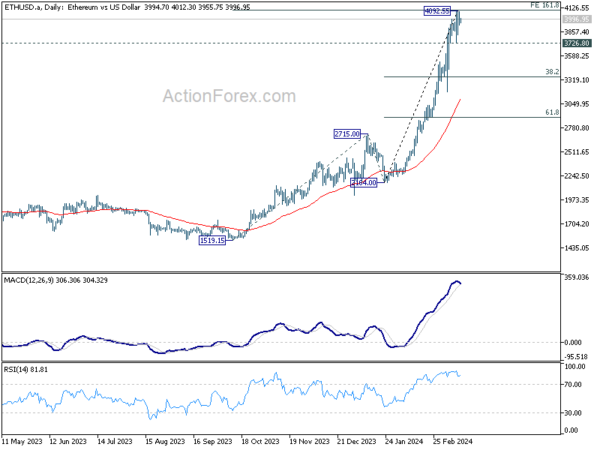

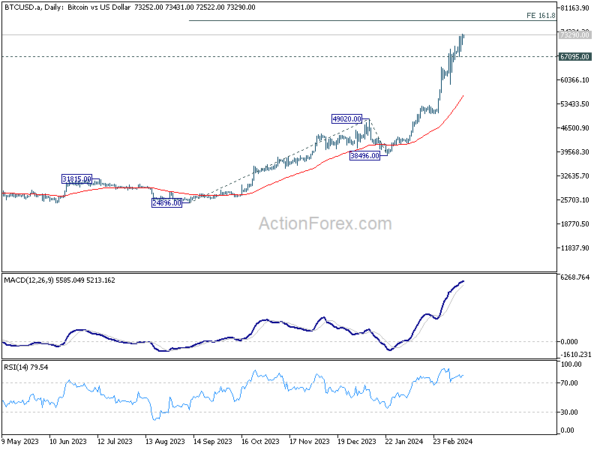

Ethereum’s momentum wanes, Bitcoin’s consolidation due soon

Ethereum’s rally appears to be losing momentum as seen in D MACD, after accelerating to as high as 4092.5. Overbought consolidation in D RSI is probably limiting it at 161.8% projection of 1519.1 to 2715.0 from 2164.0 at 4098.6. Break of 3726.8 support will confirm short term topping, and bring correction to 38.2% retracement of 2164.0 to 4092.5 at 3355.8, and then set the range for sideway consolidations.

As for Bitcoin, there might still be room to extend the record run, but upside potential is limited for the near term, as some consolidations should be due after the strong rally. Upside should be limited by 161.8% projection of 24896 to 49020 from 38496 at 77528. Meanwhile, break of 67095 support will indicate that a short term top is already formed, and deeper pull back could be seen next to start a consolidation phase.

Looking ahead

Swiss PPI is the only feature in Euroepan session. Later in the day, US will release retail sales, PPI and jobless claims. Canada will release manufacturing sales.

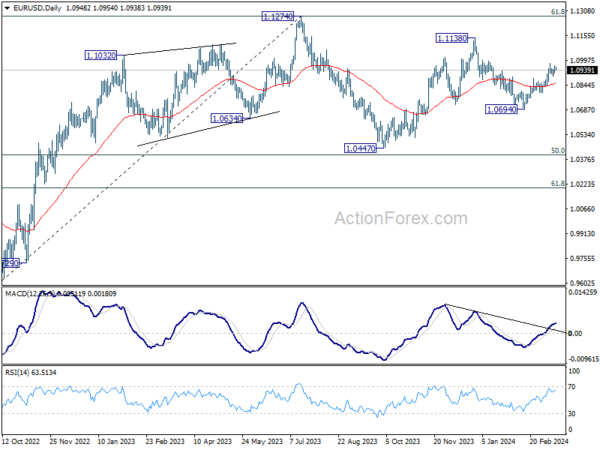

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0924; (P) 1.0944; (R1) 1.0968; More…

EUR/USD is still capped below 1.0980 resistance despite current recovery. Intraday bias remains neutral first. Further rise is in favor as long as 55 4H EMA (now at 1.0904) holds. Above 1.0980 will resume the rally from 1.0694 to retest 1.1138 high. However, sustained break of the EMA will turn bias to the downside for 1.0797 support instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | RICS Housing Price Balance Feb | -10% | -10% | -18% | |

| 07:30 | CHF | PPI M/M Feb | 0.20% | -0.50% | ||

| 07:30 | CHF | PPI Y/Y Feb | -2.30% | |||

| 12:30 | CAD | Manufacturing Sales M/M Jan | 0.30% | -0.70% | ||

| 12:30 | USD | Retail Sales M/M Feb | 0.50% | -0.80% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Feb | 0.40% | -0.60% | ||

| 12:30 | USD | PPI M/M Feb | 0.30% | 0.30% | ||

| 12:30 | USD | PPI Y/Y Feb | 1.10% | 0.90% | ||

| 12:30 | USD | PPI Core M/M Feb | 0.20% | 0.50% | ||

| 12:30 | USD | PPI Core Y/Y Feb | 2.00% | 2.00% | ||

| 12:30 | USD | Initial Jobless Claims (Mar 8) | 218K | 217K | ||

| 14:00 | USD | Business Inventories Jan | 0.30% | 0.40% | ||

| 14:30 | USD | Natural Gas Storage | -3B | -40B |