Euro and Sterling Fall on Weak PMI Data – Action Forex

Euro fell notably today, along with decline in Eurozone government bond yields, following weaker-than-expected PMI data. Political instability in France is negatively impacting business activity, while Germany’s economic recovery has lost momentum. At the same time, surge in Germany’s services inflation pressures suggests that ECB is unlikely to implement back-to-back rate cuts in July. The key question now is whether the results of France’s snap election, scheduled for June 30 to July 7, will provide positive outcomes for investors and businesses, improving market sentiment.

Sterling also weakened after the release of lower-than-expected Services PMI data. Despite the upcoming general election on July 4, UK faces relatively lower political risk, with Labour expected to win by a landslide according to various polls. This has not provided enough support to Sterling, which continues to struggle alongside other European majors. Meanwhile, Swiss Franc is the weakest among the three major European currencies today, extending its pullback following SNB’s rate cut, but with relatively weak momentum.

In contrast, New Zealand and Australian Dollars are the strongest performers of the day. US Dollar follows as the third strongest, benefiting from falling European yields. Japanese Yen is mixed, having recovered much of its earlier losses except against the greenback. Canadian Dollar is also trading in the middle after the release of retail sales data.

In Europe at the time of writing, FTSE is down -0.57%. DAX is down -0.47%. CAC is down -0.49%. UK 10-year yield is up 0.005 at 4.062. Germany 10-year yield is down -0.051 at 2.382. Earlier in Asia, Nikkei fell -0.09%. Hong Kong HSI fell -1.67%. China Shanghai SSE fell -0.24%. Singapore Strait Times rose 0.18%. Japan 10-year JGB yield rose 0.0215 to 0.977.

Canada’s retail sales rises 0.7% mom in Apr, but falls -0.6% mom in May

Canada’s retail sales rose 0.7% mom to CAD 66.8B in April, matched expectations. Sales were up in seven of nine subsectors and were led by increases at gasoline stations and fuel vendors as well as food and beverage retailers.

Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were up 1.4%

Advanced estimate suggests that sales fell -0.6% mom in May.

Eurozone PMI manufacturing falls to 45.6, services down to 52.6

Eurozone’s PMI data for June revealed significant declines, with Manufacturing PMI falling from 47.3 to 45.6, below the expected 45.6. Services PMI also dropped from 53.2 to 52.6, missing the forecast of 53.5. Consequently, Composite PMI decreased from 52.2 to 48.0.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that the preliminary HCOB Flash Eurozone Composite Output Index indicates a slight downgrade in GDP growth for Q2, though it still suggests positive growth of 0.2% compared to Q1.

ECB’s June rate cut may be justified by easing price pressures in the service sector, he added. However, the PMI data do not support another rate cut in July. In Germany, service providers increased their prices more sharply than in May. Additionally, the manufacturing sector, which faced deflation in output charges for 14 months, saw input prices rise in June for the first time since February 2023.

He also noted that orsening conditions in France’s services and manufacturing sectors may be tied to recent European Parliament election results and President Macron’s announcement of snap elections on June 30. This uncertainty has likely led many companies to pause new investments and orders, contributing to the economic downturn in the Eurozone.

German PMI Manfacturing fell from 45.4 to 43.4. PMI Services fell from 54.2 to 53.5. PMI Composite fell from 52.4 to 50.6. French PMI Manufacturing fell from 46.4 to 45.3. PMI Services fell from 49.3 to 48.8. PMI Composite fell from 48.9 to 48.2.

UK economic growth slows as services PMI hits 7-month low

UK’s PMI data for June presents a mixed picture. Manufacturing PMI slightly increased from 51.2 to 51.4, surpassing the expectation of 51.0 and marking a 23-month high. However, Services PMI fell from 52.9 to 51.2, below expected 53.2, reaching a 7-month low. Consequently, Composite PMI also declined from 53.0 to 51.7, hitting its lowest point in seven months.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, noted that the Flash PMI survey data for June signals a slowdown in the pace of economic growth, with GDP now growing at a “sluggish” quarterly rate of just over 0.1%. This slowdown is partly due to uncertainty in the business environment ahead of the general election, causing many firms to pause decision-making while awaiting clarity on future policies.

From an inflation perspective, the survey highlights persistent inflation in the service sector, which remains a significant barrier to lowering interest rates. This stubborn inflation is currently at a 5.7% pace but is expected to cool further in the coming months.

In summary, while the current economic slowdown may be temporary, contingent on business reactions to new government policies, the persistent underlying inflationary pressures above BoE’s target remain a concern.

UK retail sales volume grows 2.9% mom in May, vs exp 1.5% mom

UK retail sales volume rose 2.9% mom in May, above expectation of 1.5% mom. More broadly, sales volumes rose by 1.0% in the three months to May 2024 when compared with the previous three months. Over the year to May 2024, volumes rose by 1.3%, and were -0.5% below their pre-coronavirus (COVID-19) pandemic level in February 2020.

Japan’s CPI core accelerates to 2.5%, but core-core slows to 2.1%

Japan’s CPI core (ex-food) accelerated from 2.2% yoy to 2.5% yoy in May, slightly below the expected 2.6%. This marks the 26th consecutive month that core inflation has remained above BoJ’s 2% target. However, the increase was primarily driven by a significant 14.7% yoy rise in electricity prices.

In contrast, CPI core-core (ex-food and energy) slowed from 2.4% yoy to 2.1% yoy. Additionally, services inflation eased from 2.5% yoy to 2.2% yoy. Headline CPI also rose from 2.5% to 2.8% yoy, marking its ninth consecutive month of deceleration and the lowest reading since September 2022.

BoJ Governor Kazuo Ueda has repeatedly suggested that a July rate hike is a possibility. However, today’s report indicates that the inflation uptick is mainly due to cost-push factors, such as higher electricity prices, rather than increased demand. This might not provide a strong enough basis yet for BoJ to proceed with a rate hike at this time.

Japan’s PMI composite falls to 50, mixed economic signals with rising costs

Japan’s latest PMI data for June presents a mixed economic outlook. Manufacturing PMI slipped slightly from 50.4 to 50.1, falling short of expectations of 50.6. However, manufacturing output showed a positive shift, rising from 49.9 to 50.5, marking the first expansion in over a year. Conversely, Services PMI dropped sharply from 53.8 to 49.8, indicating fractional contraction for the first time since August 2022. As a result, Composite PMI fell from 52.6 to 50.0.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, commented that the private sector expansion has stalled midway through the year. The return of manufacturing output growth was overshadowed by a decline in services activity, partially due to labor constraints.

A notable concern is the “pressure on margins,” with average input costs rising at the fastest pace in over a year while output price inflation softened, particularly in the service sector. Anecdotal evidence pointed to the weak yen and increasing labor costs as significant factors driving up cost inflation.

Australia’s PMI composite falls to 50.6, slowing business expansion, manufacturing weakness

Australia’s PMI data for June indicates a slowdown in business expansion, with Manufacturing PMI falling from 49.7 to 47.5, Services PMI dropping from 52.5 to 51.0, and Composite PMI decreasing from 52.1 to 50.6, hitting a five-month low.

Warren Hogan, Chief Economic Advisor at Judo Bank, noted that while business activity continues to grow, the pace of expansion has slowed compared to the strong performance in the first half of 2024.

The manufacturing sector showed significant weakness, with PMI, output, and new orders declining towards the cyclical lows of 2023, all falling below the 50 threshold that separates expansion from contraction. In contrast, the services sector experienced a slight pullback but remained in expansionary territory.

The composite input price index dropped below 60 for the first time since January 2021, suggesting that business cost growth is easing. Final prices also decreased but still indicate above-target inflation. Service sector price indicators retreated in June, aligning with the view that inflation is gradually easing in 2024, yet they remain above RBA’s target range of 2-3%.

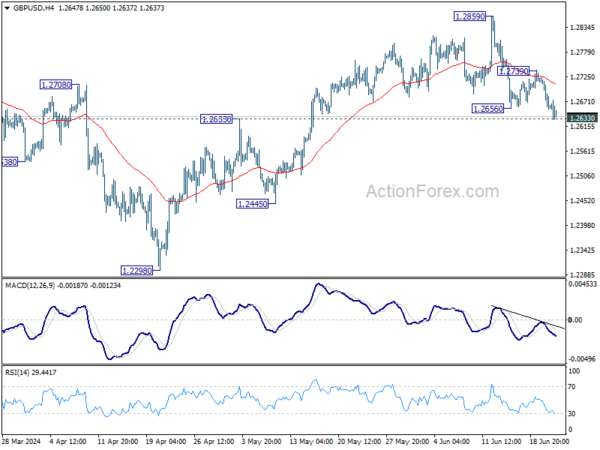

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2633; (P) 1.2679; (R1) 1.2704; More…

Intraday bias in GBP/USD is back on the downside as fall from 1.2859 resumed by breaking through 1.2656 temporary low. Firm break of 1.2633 resistance turned support will argue that whole rise from 1.2298 has completed, and target 1.2445 and below. For now, risk will stay on the downside as long as 1.2739 resistance holds, in case of recovery.

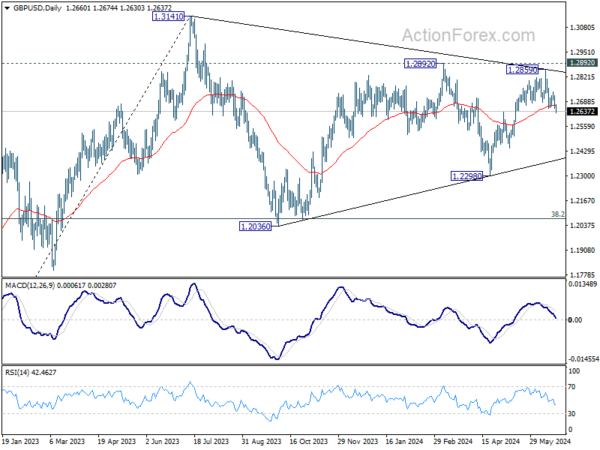

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern. Fall from 1.2892 is seen as the third leg which might have completed already. Break of 1.2892 resistance will argue that larger up trend from 1.0351(2022 low) is ready to resume through 1.3141. Meanwhile, break of 1.2445 support will extend the corrective pattern with another decline instead.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Jun P | 47.5 | 49.7 | ||

| 23:00 | AUD | Services PMI Jun P | 51 | 52.5 | ||

| 23:01 | GBP | GfK Consumer Confidence Jun | -14 | -16 | -17 | |

| 23:30 | JPY | National CPI Y/Y May | 2.80% | 2.50% | ||

| 23:30 | JPY | National CPI ex Fresh Food Y/Y May | 2.50% | 2.60% | 2.20% | |

| 23:30 | JPY | National CPI ex Food Energy Y/Y May | 2.10% | 2.40% | ||

| 00:30 | JPY | Manufacturing PMI Jun P | 50.1 | 50.6 | 50.4 | |

| 00:30 | JPY | Services PMI Jun P | 49.8 | 53.8 | ||

| 06:00 | GBP | Retail Sales M/M May | 2.90% | 1.50% | -2.30% | -1.80% |

| 06:00 | GBP | Public Sector Net Borrowing (GBP) May | 14.1B | 14.8B | 19.6B | 17.5B |

| 07:15 | EUR | France Manufacturing PMI Jun P | 45.3 | 46.8 | 46.4 | |

| 07:15 | EUR | France Services PMI Jun P | 48.8 | 50 | 49.3 | |

| 07:30 | EUR | Germany Manufacturing PMI Jun P | 43.4 | 46.4 | 45.4 | |

| 07:30 | EUR | Germany Services PMI Jun P | 53.5 | 54.4 | 54.2 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jun P | 45.6 | 48 | 47.3 | |

| 08:00 | EUR | Eurozone Services PMI Jun P | 52.6 | 53.5 | 53.2 | |

| 08:30 | GBP | Manufacturing PMI Jun P | 51.4 | 51 | 51.2 | |

| 08:30 | GBP | Services PMI Jun P | 51.2 | 53.2 | 52.9 | |

| 12:30 | CAD | Industrial Product Price M/M May | 0.00% | 0.40% | 1.50% | 1.40% |

| 12:30 | CAD | Raw Material Price Index May | -1.00% | -0.60% | 5.50% | 5.30% |

| 12:30 | CAD | Retail Sales M/M Apr | 0.70% | 0.70% | -0.20% | -0.30% |

| 12:30 | CAD | Retail Sales ex Autos M/M Apr | 1.80% | 0.50% | -0.60% | -0.80% |

| 13:45 | USD | Manufacturing PMI Jun P | 51 | 51.3 | ||

| 13:45 | USD | Services PMI Jun P | 53.5 | 54.8 | ||

| 14:00 | USD | Existing Home Sales May | 4.10M | 4.14M | ||

| 14:30 | USD | Natural Gas Storage | 69B | 74B |